The London Fish Exchange

Data / Market Insight / News

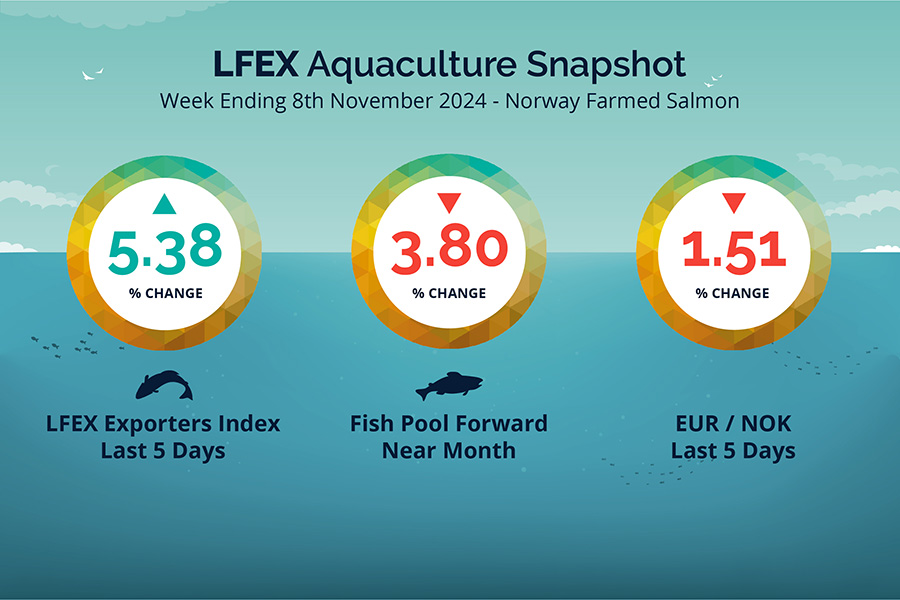

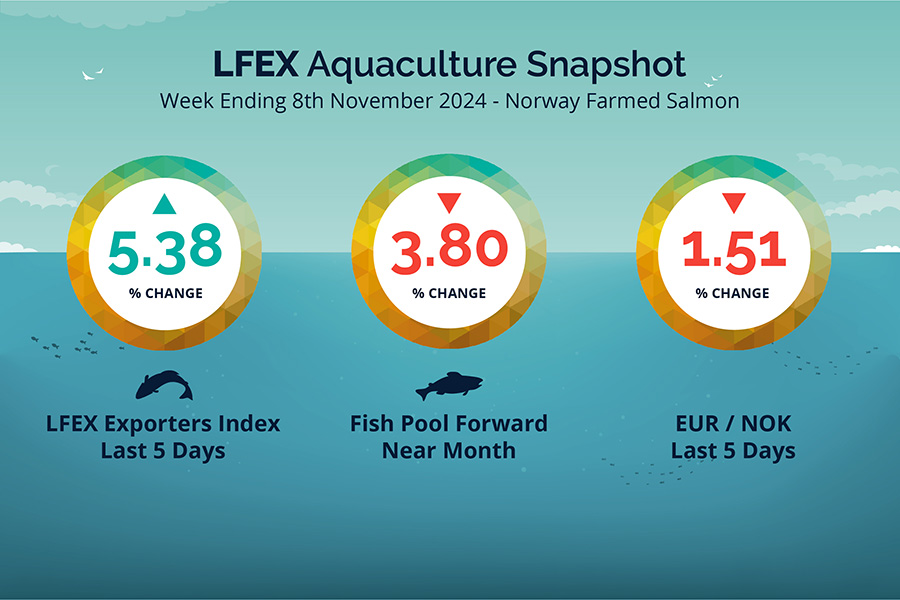

LFEX European Aquaculture Snapshot to 8th November, 2024

|

|

Published: 8th November 2024 This Article was Written by: John Ersser |

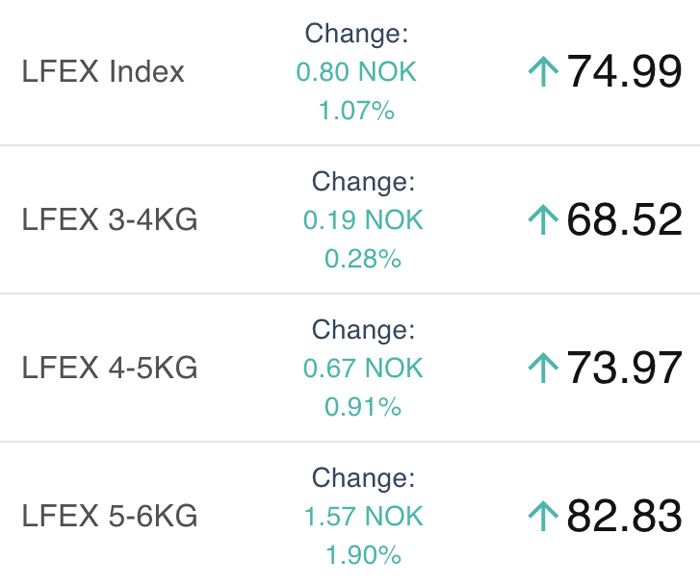

The LFEX Norwegian Exporters Index for Week 45 2024 ended the week up +3.83 NOK / +5.38% to stand at 74.99 NOK (in EUR terms 6.38 / + 0.42 / +7.00%) FCA Oslo Week ending Thursday vs previous Thursday.

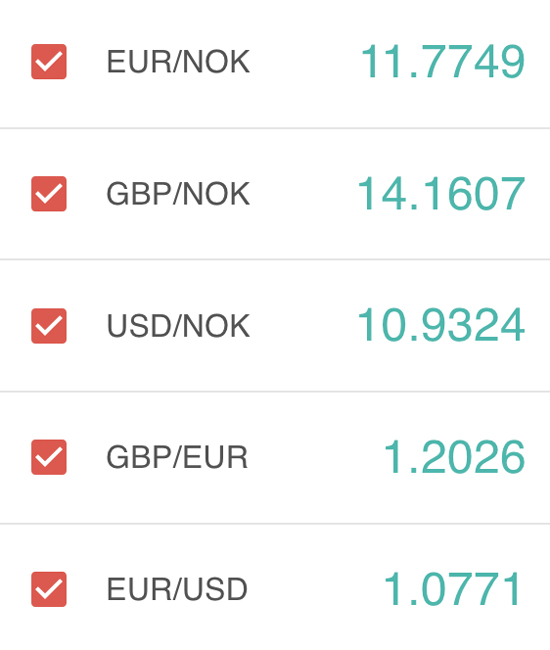

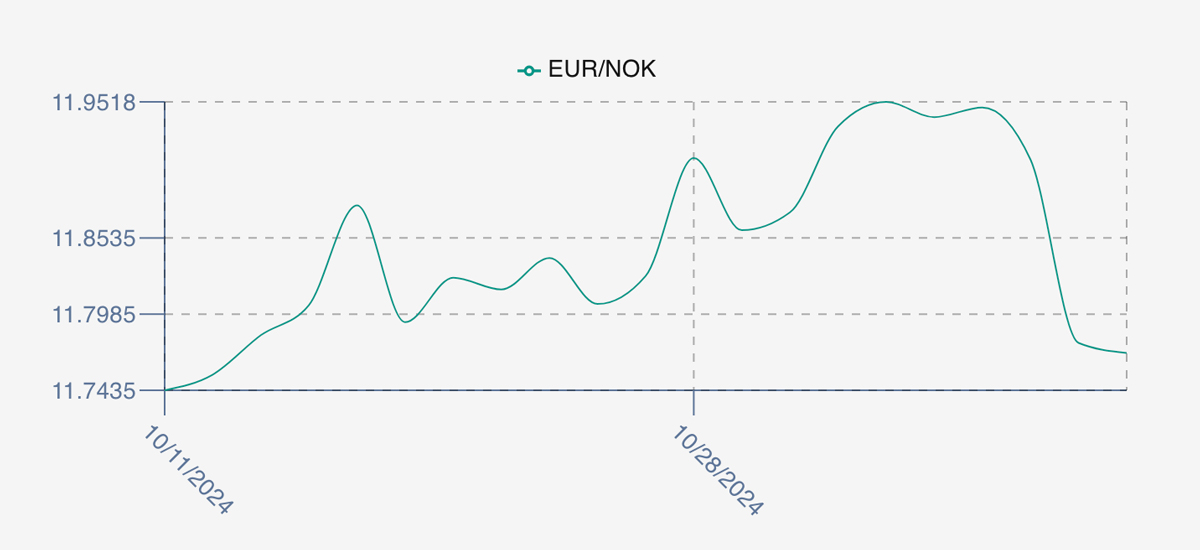

The NOK rate ended down at 11.75 to the Euro over the period Thursday to Thursday -0.18 NOK or -1.51%. The Fish Pool future November was reported up Thursday to Thursday -3.00 NOK / -3.80% at 76.0 NOK.

The Last Week

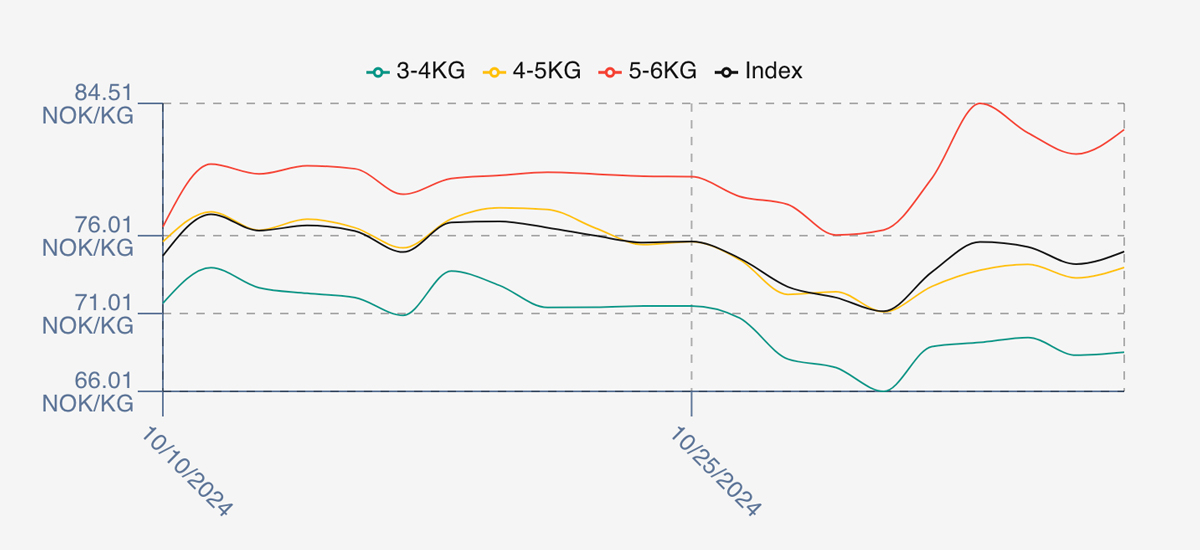

Last week prices opened stronger off of the declines in week 44 with the index showing a positive +2.52 NOK / +3.54% increase over the prior Thursday close for delivery week 45. With the All-Saints Day holiday on Friday there was less activity as sellers tried to find the level. Monday closed up at 75.61 as people came back into the market and 5/6s pulled the index up. Tuesday was steady at 75.29. The index softened slightly on Wednesday to 74.71 in reaction to the 5/6’s dropping off and we closed out at 74.99NOK, up on the weekly comparison and up 1.32 during the trading week.

A bit of intraweek volatility between sizes as the larger fish moved up sharply and then softened a little. However, all sizes showed the same direction of travel on Thursday – up small, with the spread having expanded to 14 NOK between smaller and larger fish.

The EURNOK FX pair opened on Friday up small at 11.95, and overall trended flat through Tuesday. However, the trend was broken on Wednesday and a sharp drop to 11.75 levels which would have made Euro purchases later in the week 1.5% greater on the currency swing.

Next Week

Early pricing indications from sellers for week 46 are coming in at around 77 NOK for the index, which represents a small increase over Thursdays close. There are holidays in France, Poland and Belgium on Monday which will disrupt the market a little. Smaller fish volumes are good but some of the larger sizes may struggle for availability. EUR NOK FX rates have come back a little this afternoon around 11.80 levels later Friday.

Volumes – Fresh Export

Volume figures for week 44 (2024) was 25,749 tons as compared to 24,437 in 2023. Volumes for weeks 45 and 46 (2023) were 23,852 and 24,833 respectively for comparison.

Historical Price Guidance for Next Week

The LFEX Norwegian Exporters Index for Week 46 2023 ended the week up +0.41%, +0.31 NOK to stand at 76.12 NOK (approximately 6.47 EUR) FCA Oslo. The NOK rate was 11.86 the Fish Pool future November was reported at 77.5 NOK.

David Nye’s technical analysis report will be published on Monday.

Market Data (Click Each to Expand)

| LFEX Prices | FX Rates | LFEX Indicative Exporter Prices (4 Week) | EUR / NOK FX Rate (4 Week) |

|

Prices Ending 8th November, 2024 For Friday's Price For Next Week, Offers & Trading Please Register |

Did You Know?

You can track the business you do with each specific counterparty?

The system saves all your and your counterparties activity on the system. We give you the tools to then sort and manage this data yourself. If you want to find trades with just one counterparty this is easily achieved, as well as any pricing/data, or documentation against these trades. It’s a super flexible real-time system to get you the information and data you need, when you need it.

FAQ’s

Q. Can multiple people from my company use the platform and see the same information?

A. The answer is yes, we can set the system up to be able to see all offers or trades going through the system and allow multiple users access to this information in real-time. This helps build a picture of sales/ purchases and pricing across the business and facilitates teams work and optimisation of the selling / buying process.