The London Fish Exchange

Data / Market Insight / News

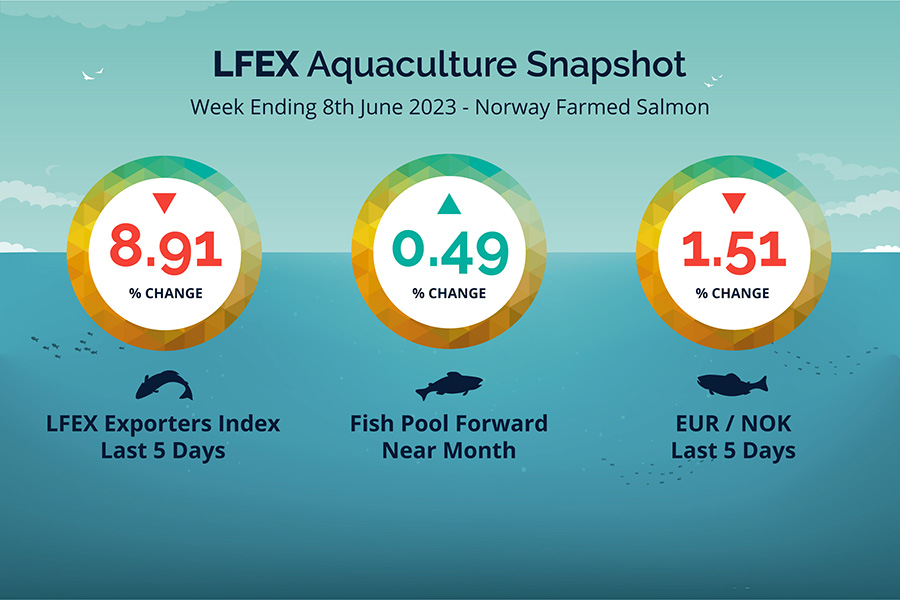

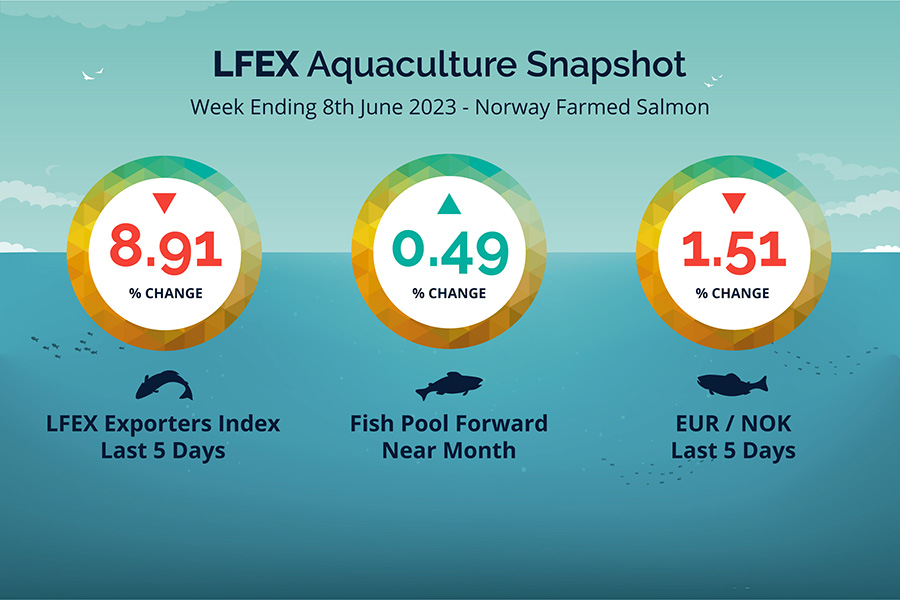

LFEX European Aquaculture Snapshot to 8th June, 2023

|

|

Published: 9th June 2023 This Article was Written by: John Ersser |

The LFEX Norwegian Exporters Index for Week 23 2023 was in the end down -8.91%, -10.38 NOK to stand at 106.11 NOK FCA Oslo Week ending Thursday vs previous Thursday.

The NOK rate was down at 11.77 to the Euro over the period Thursday to Thursday -0.18 NOK or -1.51%. The Fish Pool future June was reported higher at 102.5 NOK up +0.5 NOK or +0.49%.

A roller coaster week. For a kick-off prices opened firmer, against expectations, with a +2.1 NOK / 1.8% increase on the Friday and continued to strengthen on Monday to 121.86 NOK. Tuesday brought it back to level compared the to previous weeks close at 116.53, and Wednesday ticked down to 113.92 NOK where prices were felt to have been. Thursday however registered a 7.81 NOK drop to close out at 106.11, a roller coaster week with a top to bottom range of 15,75 NOK / 12.9%. Poland was closed, but some there were still purchasing from there, and the fish that would have been processed would have been bought the prior week – i.e. it shouldn’t necessarily have impacted Thursdays price. The higher prices didn’t help the drop, there were fish around but not enough to explain the fall, so more likely a general drop in prices. Next week is hard to gauge after volatility like this. As of Thursday evening thoughts were of a stronger open for the week. To get Fridays actual index price login to the platform this afternoon. We shall see.

David Nye’s technical analysis report will be published on Monday.

Market Data (Click Each to Expand)

| LFEX Prices | FX Rates | LFEX Indicative Exporter Prices (4 Week) | EUR / NOK FX Rate (4 Week) |

|

Prices Ending 8th June, 2023 For Friday's Price For Next Week, Offers & Trading Please Register |

Did You Know?

Electronic platforms perform many roles for markets and market participants.

By bringing a community together you get a much better view of available inventory (liquidity), access to more participants, more opportunity for price discovery, ability to track market pricing electronically in real-time, pre-trade checking and secure and robust confirmations between parties. They throw off mountains of data that can be used to analyse pricing, trading patterns, counterparty performance etc.

Further, they can provide a single point of connectivity for settlement and documentation and an independent and verified record of truth. They provide huge efficiencies in process, less errors, automation of orders / trading / settlement processes. They give participants the ability to access the right price for any given market condition, and free up staff time to focus on optimising business and relationships.

FAQ’s

Q. I am concerned about beginning the transition from manual to electronic transacting. Is it acceptable to do both?

A. The short answer is of course yes. In fact we recommend that this is how people start. By dipping your toes you learn about the system, what you see and what to expect. You can then build confidence and proactively use the system to get the maximum benefit from it. You can download the orders from the system if you need to into a CSV file, or input data into your existing system in the same way you do a manual trade.