The London Fish Exchange

Data / Market Insight / News

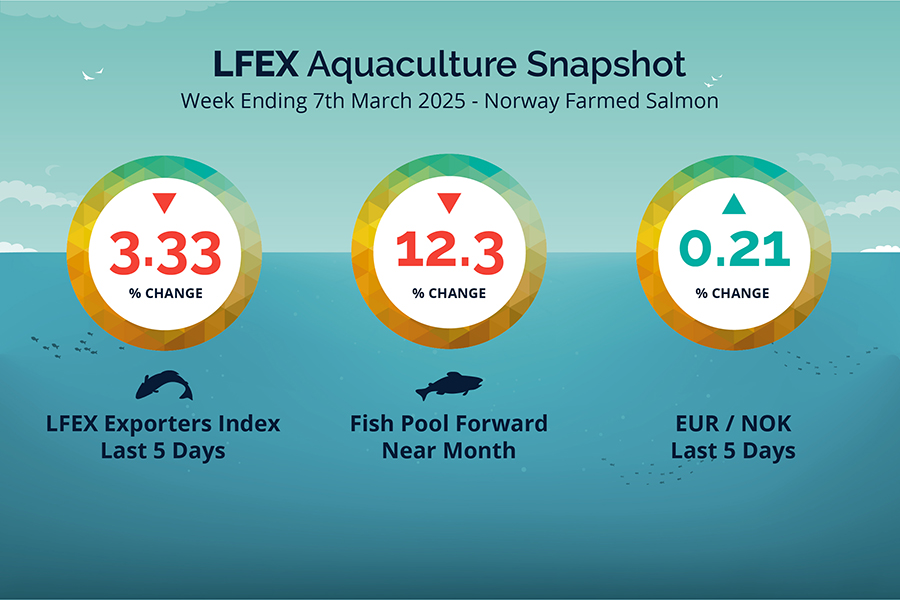

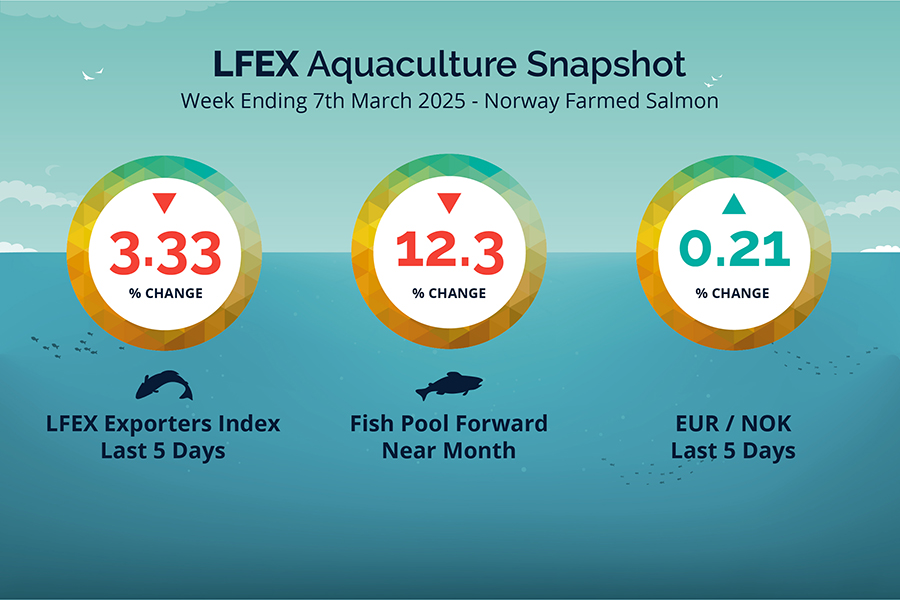

LFEX European Aquaculture Snapshot to 7th March, 2025

|

|

Published: 7th March 2025 This Article was Written by: John Ersser |

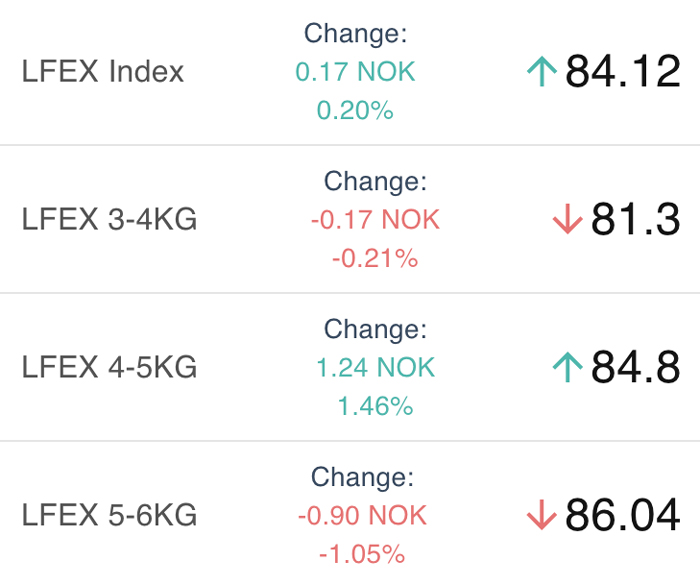

The LFEX Norwegian Exporters Index for Week 10 2025 ended the week down -2.90 NOK /-3.33% to stand at 84.12 NOK (in EUR terms 7.17 / -0.26 / -3.54%) FCA Oslo Week ending Thursday vs previous Thursday.

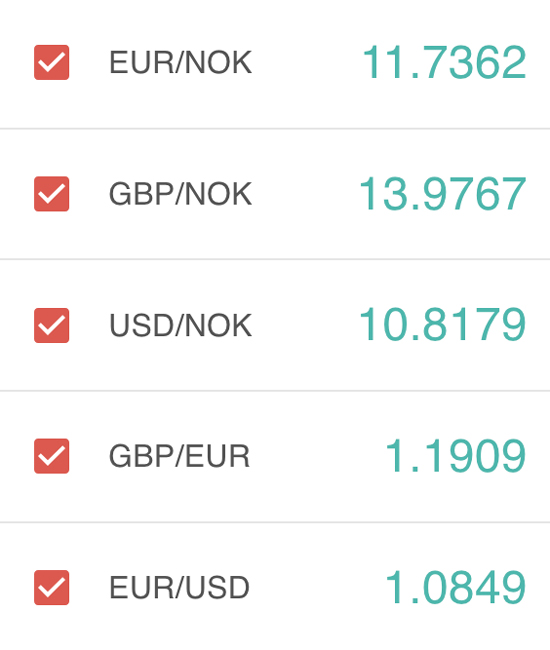

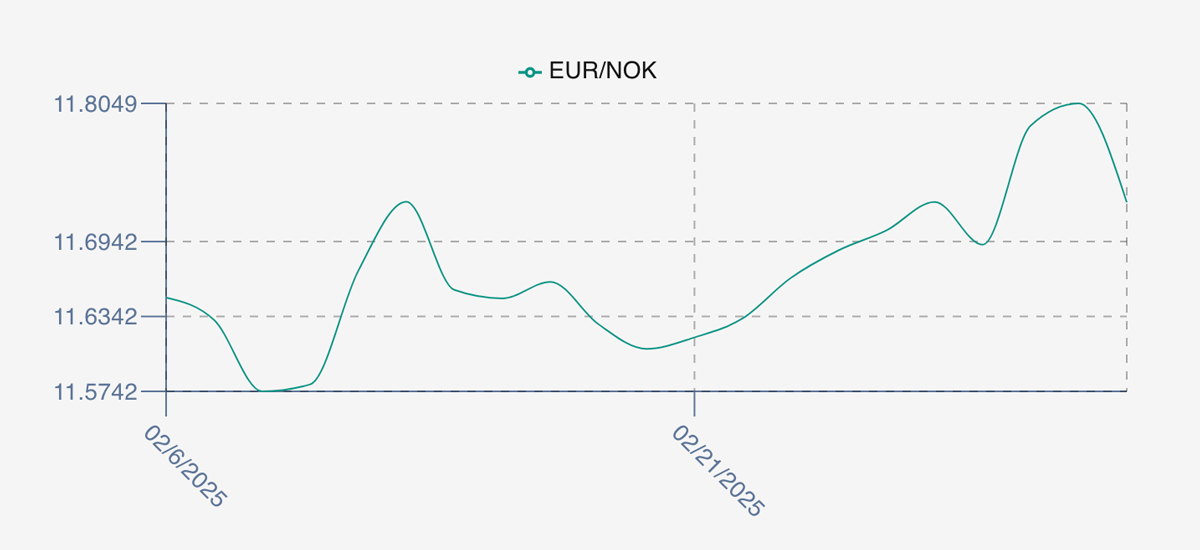

The NOK rate ended up +0.03 NOK / +0.21% at 11.73 to the Euro over the period Thursday to Thursday. The Fish Pool Euronext future April was reported down Thursday to Thursday – 10.00 EUR / -12.35% at 7.10 EUR which equates to approximately 83.28 NOK.

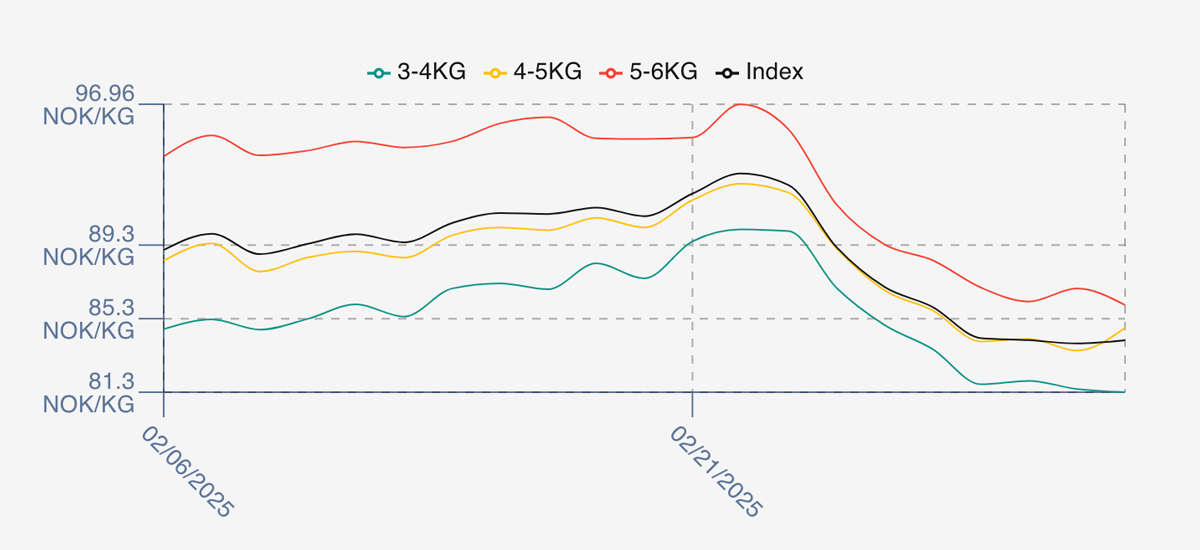

The Last Week

We saw continued price weakness last week as suggested. Friday opened down on the prior week (Thursday) close, off 1.09 NOK or 1.25% at 85.93 as available volume and weaker demand put pressure on prices. Monday didn’t improve things with a further 1.5 NOK lower, and while pricing stabilised this wasn’t the low with Tuesday and Wednesday edging lower. The index week bottomed at 83.95 on Wednesday. Thursday index values were helped by 4/5s showing some strength on the day, otherwise we would have seen a sub 84 NOK index close out.

Total spreads between sizes 3/4s and 5/6s remain around the 5 NOK level, with 4/5s nearer to 5/6s close of week.

The EURNOK FX rate saw significant volatility this week, from a low of 11.69 on Monday to 11.805 Wednesday, before settling back at 11.725 levels end of week. Financial markets themselves have seen significant swings as the 47th US Presidents’ pronouncements continue to rock markets.

Next Week

Early pricing indications from exporters for next week are coming around the 84.5 NOK level offered for the index, which puts us flat / up small from Thursday close – and -1.5 NOK off of last Friday. There continues to be a significant amount of fish coming through and unsure there is enough demand. Feels like prices will probably soften a little further before they stabilise. Spreads showing around 5 NOK at the moment.

EUR NOK FX rate is showing 11.74 this afternoon. This would give an indicative Euro index price around

7.1975 on levels later Friday.

Volumes – Fresh Export

Volume figure for week 9 (2025) was 18,067 tons up 5,108 tons as compared to 12,959 in 2024. Volumes for week 10 and week 11 (2024) were 14,487 and 14,619 respectively for comparison.

Historical Price Guidance for Next Week

The LFEX Norwegian Exporters Index for Week 11 2024 ended the week down -5.11%, -5.78 NOK to stand at 107.31 NOK (in EUR terms 9.36) FCA Oslo. The NOK rate ended at 11.46 +0.06 NOK or +0.53%. The Fish Pool future March was reported down -2.50 NOK at 110.5 NOK.

David Nye’s technical analysis report will be published this Monday.

Market Data (Click Each to Expand)

| LFEX Prices | FX Rates | LFEX Indicative Exporter Prices (4 Week) | EUR / NOK FX Rate (4 Week) |

|

Prices Ending 7th March, 2025 For Friday's Price For Next Week, Offers & Trading Please Register |

Did You Know?

LFEX delivers secure and trusted connectivity with counterparties globally for order routing, price discovery and transactions.

If you have a group of customers in Asia, you are a processor in northern Europe or a retailer in the US, we provide in a single, real-time, seamlessly integrated technology platform including pre and post trade services and data to support industry operations.

FAQ’s

Q. Microsoft has announced Skype messaging will be switched off in May. Can you help?

A. The LFEX platform offers secure chat services built into the platform. You can communicate securely and privately with individual users on the platform – so whether it is getting market intelligence or a social interaction you can maintain a private conversation with the person. All chats are securely stored for review or audit should you need, and it supports different language input which can be translated. Better still, using the systems order routing / negotiation / trading capabilities means every detail of a transaction is held digitally – much better than a random thumbs up skype message.