The London Fish Exchange

Data / Market Insight / News

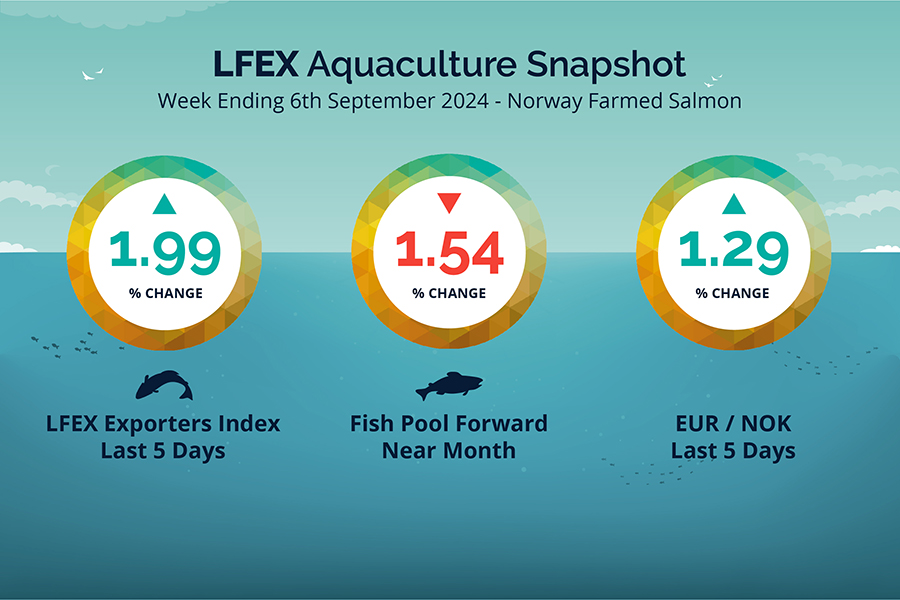

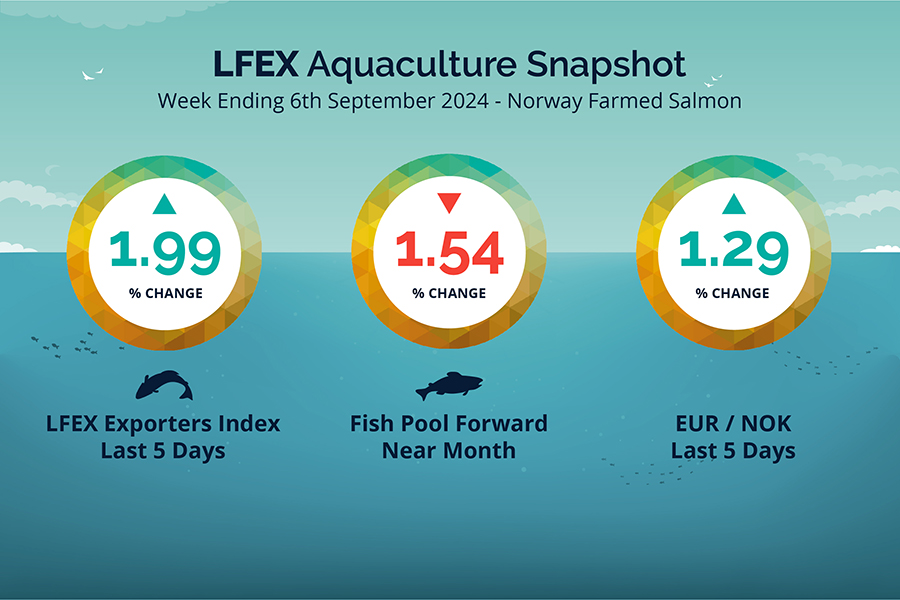

LFEX European Aquaculture Snapshot to 6th September, 2024

|

|

Published: 6th September 2024 This Article was Written by: John Ersser |

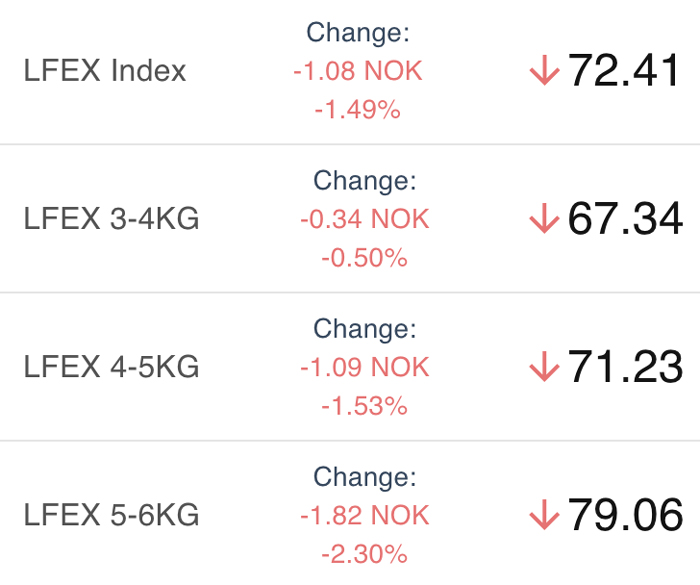

The LFEX Norwegian Exporters Index for Week 36 2024 ended the week up +1.41 NOK / +1.99% to stand at 72.41 NOK (in EUR terms 6.145 / + 0.04 / -0.69%) FCA Oslo Week ending Thursday vs previous Thursday.

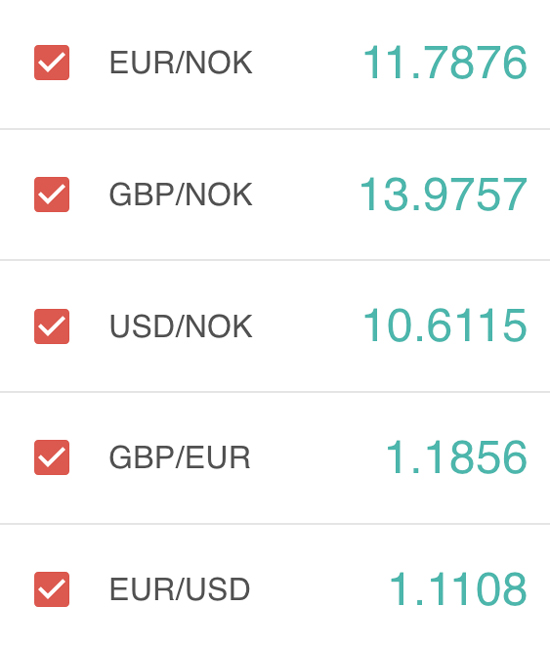

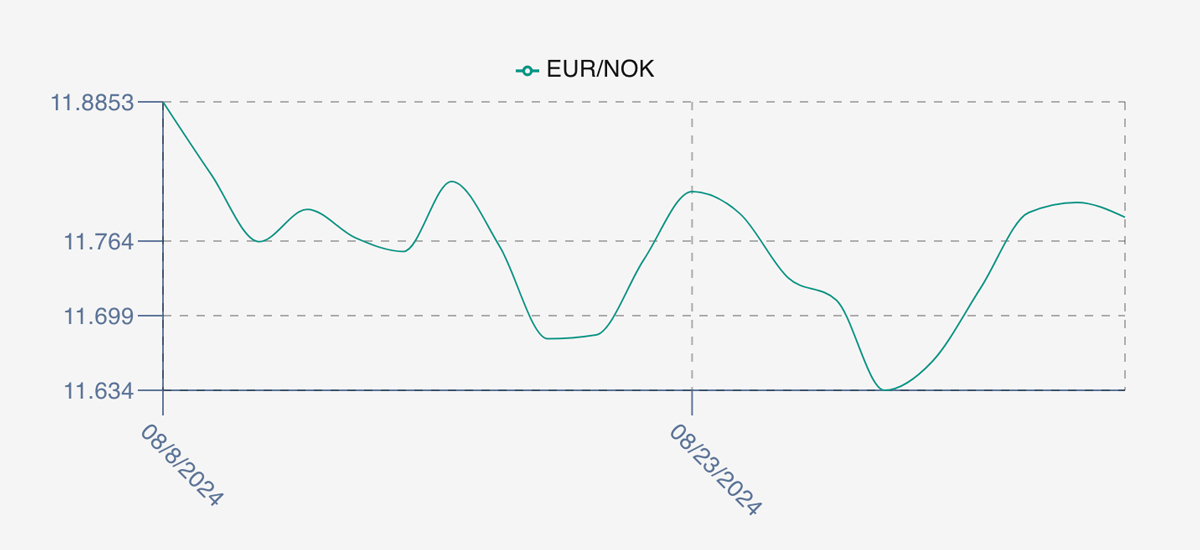

The NOK rate ended higher at 11.78 to the Euro over the period Thursday to Thursday +0.15 NOK or +1.29%. The Fish Pool future September was reported down -1.10 NOK / – 1.54% at 70.4 NOK.

Last Week

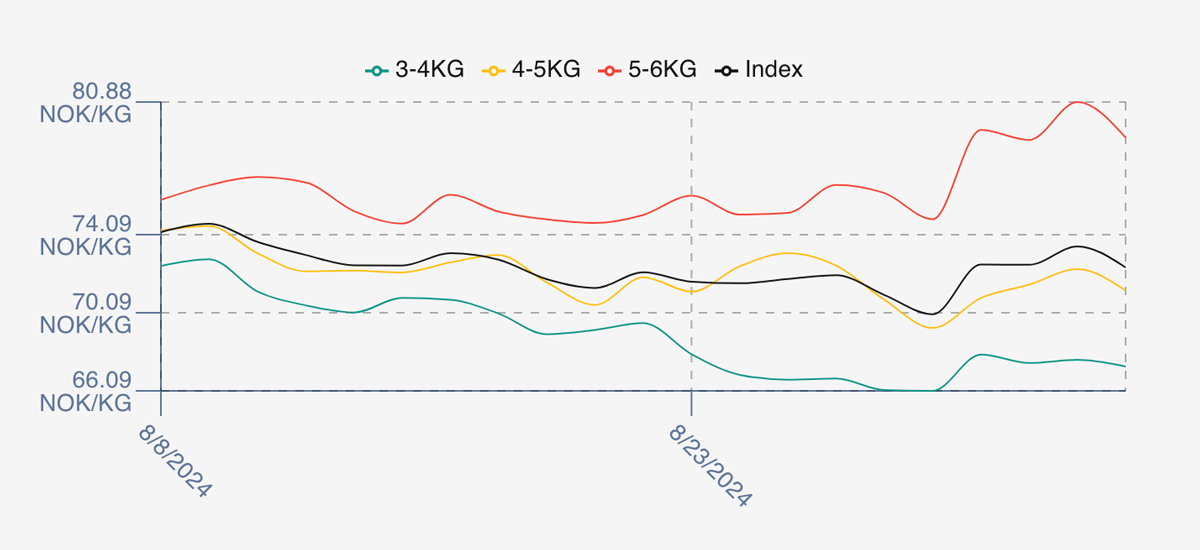

Interesting week last week as prices went up. While big volumes are going through the market we do experience the index average going up, and this happened this year and last year in week 36. The market opened 1 NOK lower / -1.39% as soft as pricing from the prior week played out. Monday saw a 2.5 NOK jump to 72.56 which set the level for Tuesday at 72.55 and the indexed pushed on to 73.49 by Wednesday, before settling back at the 72.41 level. Having said that, the detail is that the 3-4’s flat lined around 67 NOK offered as the larger fish pushed on during the week with the 5-6s hitting 80 offered on Wednesday.

Spread remain wide starting the week at approximately 10 NOK and closed last week to close out over 11.5 NOK wide approximately 79 – 67.5 offered.

The FX rate gave back its strength from last week, with the rate moving up 1.29% to 11.78. This made the Euro price 6.15 up only 0.69% by comparison.

Next Week

Early opening indications from sellers for week 37 are coming in at around the 73 NOK level offered for the index. This would put us a little above last weeks close. Similar conditions to last week where the larger fish are under pressure, but there remains good availability of smaller sizes. Pricing is a little erratic despite consensus that there is good volume available from most European geographies this week.

Volumes

Volume figures for week 35 (2024) were 25,506 tons versus a lower 25,260 in 2023. Volumes for weeks 36 and 37 (2023) were 25,523 and 25,480 respectively for comparison.

Historical Price Guidance for Next Week

A year ago, Week 37 2023 The LFEX Norwegian Exporters Index was up +0.89%, +0.66 NOK to stand at 74.53 NOK (approximately 6.48 EUR) FCA Oslo Week ending Thursday vs previous Thursday.

The NOK rate was pretty flat at 11.50 to the Euro over the period Thursday to Thursday +0.02 NOK or +0.17%. The Fish Pool future September was reported up +2.25 NOK, +3.18% at 73.00 NOK.

David Nye’s technical analysis report will be published on Monday.

Market Data (Click Each to Expand)

| LFEX Prices | FX Rates | LFEX Indicative Exporter Prices (4 Week) | EUR / NOK FX Rate (4 Week) |

|

Prices Ending 6th September, 2024 For Friday's Price For Next Week, Offers & Trading Please Register |

Did You Know?

Built by traders for traders.

For sophisticated users LFEX provides the ultimate in flexibility in setting up your screens the way you want to, to drive the system. People work differently and have different priorities in terms of functions or data. The system allows you to set-up as many of your own workspaces as you need, as well as spread over multiple monitors – ensuing you can track offers, orders and pricing quickly and easily.

FAQ’s

Q. How can I know where my fish are from?

A. Provenance and specifications documentation are supported order by order.

As provenance and certifications become more important to buyers, it is imperative that the supporting documentation can be made available down to the individual order/trade level. The system supports Fish CV’s, certification documentation and detailed product specifications to ensure that you have all the required documentation and can evidence these materials for counterparty auditing, internal reporting and third-party auditing – all instantly available within your organisation.