The London Fish Exchange

Data / Market Insight / News

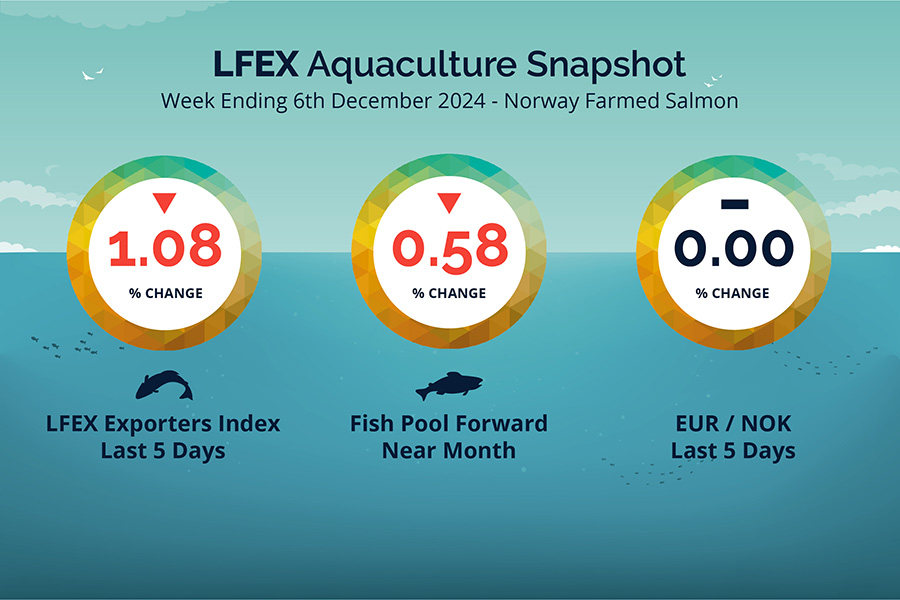

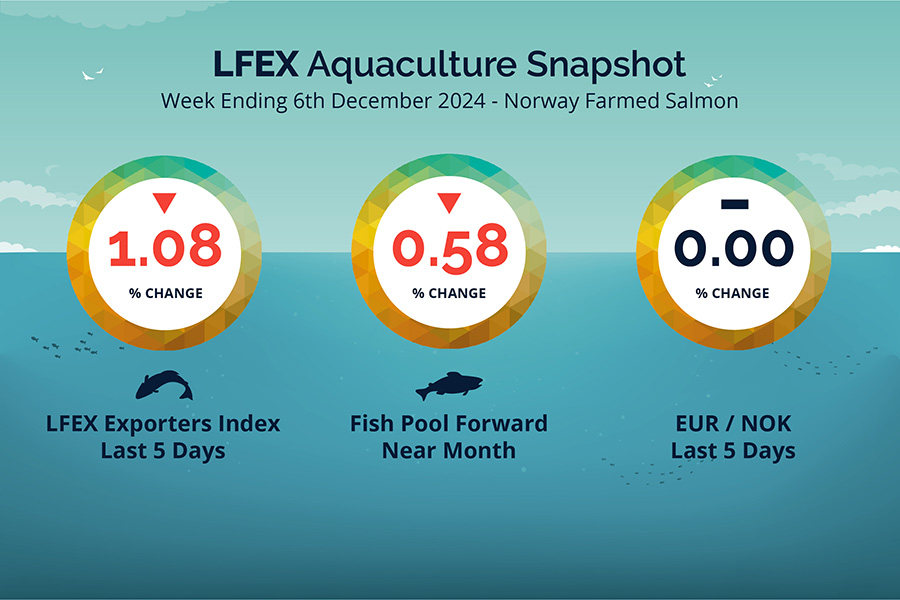

LFEX European Aquaculture Snapshot to 6th December, 2024

|

|

Published: 6th December 2024 This Article was Written by: John Ersser |

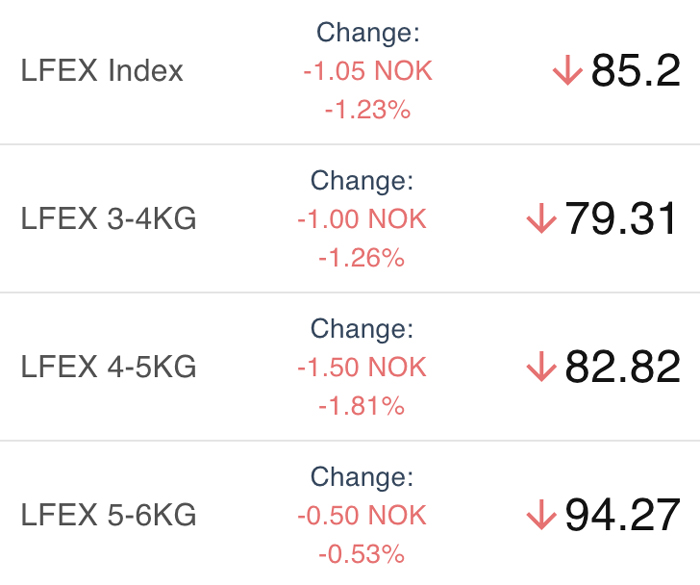

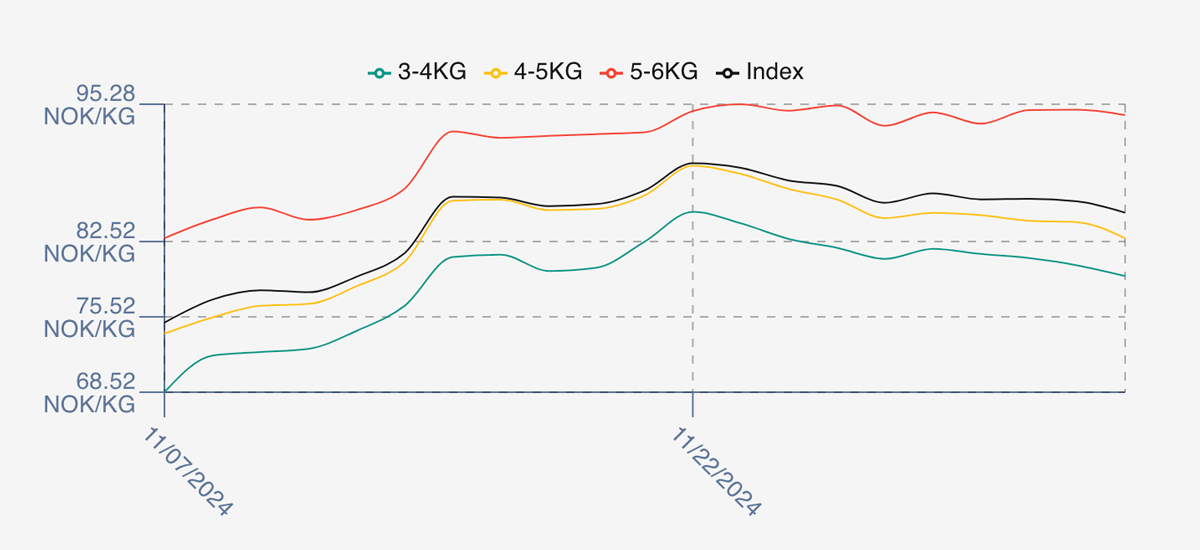

The LFEX Norwegian Exporters Index for Week 49 2024 ended the week down -0.93 NOK / -1.08% to stand at 85.20 NOK (in EUR terms 7.31 / -0.08 / -1.09%) FCA Oslo Week ending Thursday vs previous Thursday.

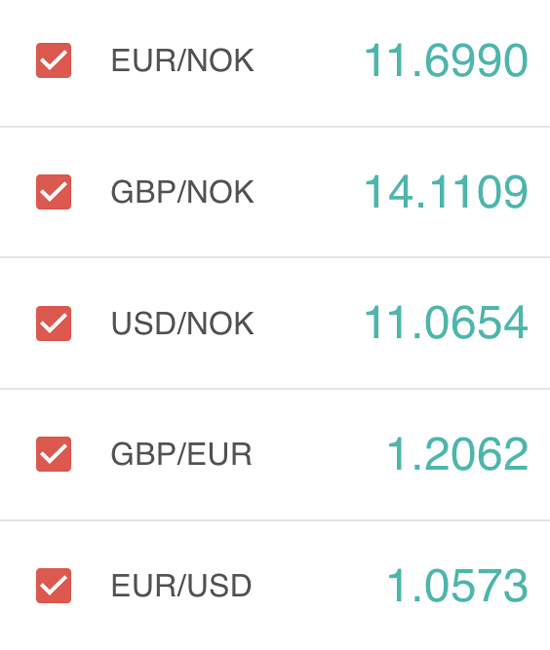

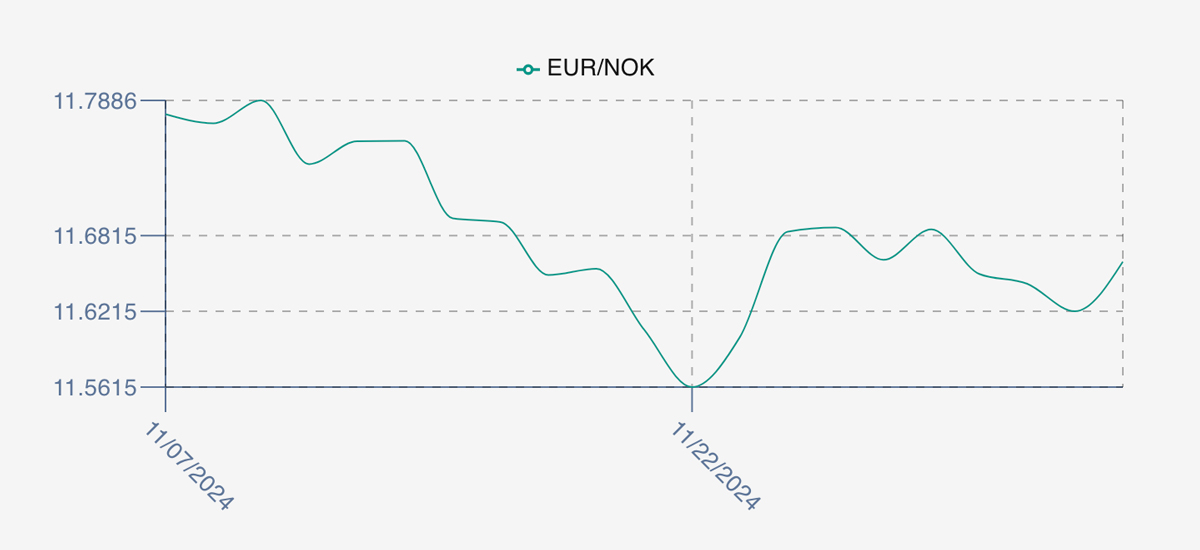

The NOK rate ended up where it started the week at 11.66 to the Euro over the period Thursday to Thursday. The Fish Pool future December was reported down Thursday to Thursday -0.50 NOK / -0.58% at 86.0 NOK.

The Last Week

Last week index prices broadly trod water. After the drop off the prior Thursday, index prices opened at 86.99, up 0.86 NOK or 1 % but still below prior week levels as sellers pushed sales for week 49. From an overall index perspective this was the right level as we continued with similar levels into Monday at 86.44, Tuesday at 86.49 and Wednesday at 86.25. Thursday saw the only material change as the index price dropped 1% to the closeout level 85.2. Volumes were again good.

This wasn’t the whole story as 5/6s held their own over the week at the 94 NOK and the index brought lower by both the 3/4s and 4/5s which both were off around 2 / 2.5 NOK reducing gently over the week.

The EURNOK FX pair was a non-event this week. It again reached the 11.68 level before settling back at 11.66 for a no overall change on the week, bringing the comparable Euro index price lower at 7.31 Eur.

Next Week

Early pricing indications from sellers for week 50 are coming around the 88.5 NOK level offered for the index, which represents a small lift over last week generally. Not too much buying activity today. Sometimes expectations are in unison for the following week, next week is not one of them; there is optimist for a Christmas lift for fresh while similar supply levels and availability is argued for stable pricing.

EUR NOK FX rate has picked up at 11.77 which would give an indicative Euro index price around 7.52 levels later Friday.

Volumes – Fresh Export

Volume figures for week 48 (2024) was 25,376 tons up +2,466 tons as compared to 22,910 in 2023. Volumes for weeks 49 and 50 (2023) were 22,243 and 24,551 respectively for comparison.

Historical Price Guidance for Next Week

The LFEX Norwegian Exporters Index for Week 50 2023 ended the week up +4.18%, +3.41 NOK to stand at 85.03 NOK (approximately 7.21 in Euro) FCA Oslo. The NOK rate ended up at 11.80. The Fish Pool future December was reported 84.0 NOK.

David Nye’s technical analysis report will be published this Monday.

Market Data (Click Each to Expand)

| LFEX Prices | FX Rates | LFEX Indicative Exporter Prices (4 Week) | EUR / NOK FX Rate (4 Week) |

|

Prices Ending 6th December, 2024 For Friday's Price For Next Week, Offers & Trading Please Register |

Did You Know?

If you have a certain amount of inventory and want to sell at a target price you can manage this on the system.

If you know how much you want to move, at what price and which potential customers you want to sell it to – you can configure this in seconds on the system. You can then manage this in real-time, chip away at the orders but always in control of where you are at. You can use the chat facility to engage with and encourage customers around your offer.

FAQ’s

Q. In my job I need information quickly – can the system help me?

A. The LFEX platform has been designed to allow you to manage your business in real-time from a single application. It means not only is key information available at your fingertips to allow you to make the trading decisions you need to make, it allows you to act on those decisions effectively and efficiently. As a tool it matches systems found in financial markets where time and money are critical. You want technology on your side to help make trading as efficient as possible.