The London Fish Exchange

Data / Market Insight / News

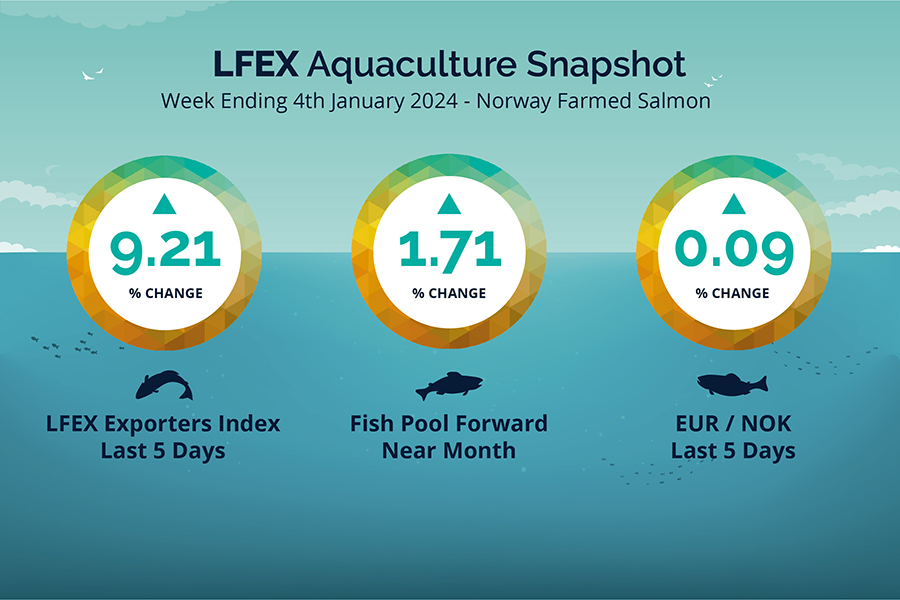

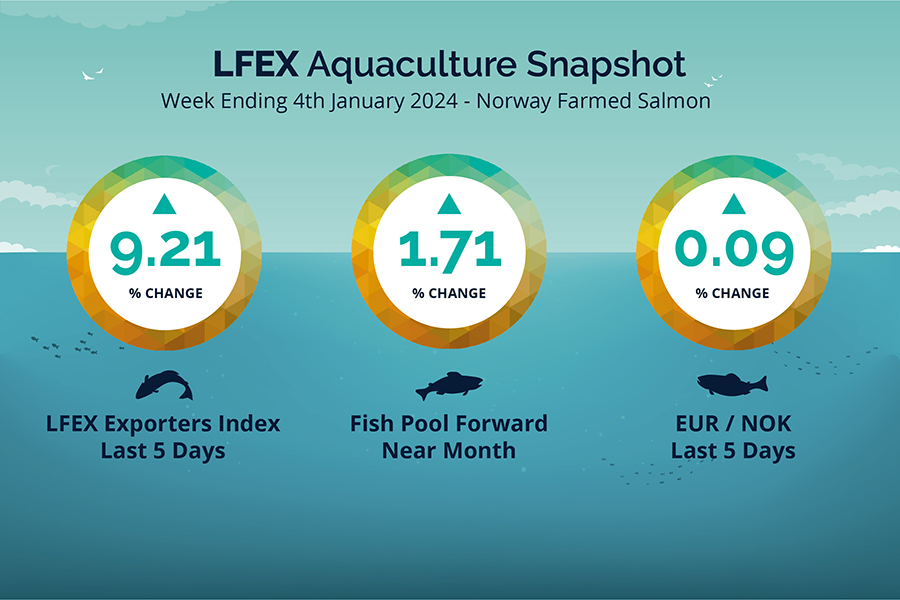

LFEX European Aquaculture Snapshot to 4th January, 2024

|

|

Published: 5th January 2024 This Article was Written by: John Ersser |

The LFEX Norwegian Exporters Index for Week 1 2024 ended the week up +9.21%, +9.92 NOK to stand at 117.61 NOK (in EUR terms 10.44 / +0.87/ +9.11%) FCA Oslo Week ending Thursday vs previous Thursday.

The NOK rate ended flat at 11.27 to the Euro over the period Thursday to Thursday +0.01 NOK or +0.09%. The Fish Pool future January was reported up + 1.80 NOK, +1.71% at 107.0 NOK.

Another week of impressive gains for the offered prices index as prices continued north peaking on Wednesday at 122.37, with Thursday showing a fall off to 117 NOK. Prices are higher this year than in the same period as compared to previous years.

What is the reason for higher prices?

A lot of different factors some specific and some generic. Consensus around low biomass growth and low harvesting as usual this time of year puts pricing under pressure. Combine this with poor weather affecting what harvesting was planned in the last 3 weeks and throw in the prior problems of pearl string jelly fish meaning farmers have had to emergency slaughter smaller fish in Q4 (that would normally be available later now and later in the year) leaving little incentive to harvest small slow growing fish stocks. Add in some winter wounds reducing export volumes and premium pricing for 5+ fish pulling the market up and the scenario for the significant price inflation is created.

Next week pricing levels remain elevated. Expect an index level around 120 with 5/6s expensive (137s) pushing the index up and a significant spread (30 NOK) between smaller and larger fish.

This time last year

As a comparison week 2 ’23 – last year – saw the price end of week close at 97.67 an 8.62% rise. However Chinese New Year was earlier (22nd January) which reflected demand (followed by a significant drop in week 3). This year it is 10th February. The FP future for January 23 was showing 93.4.

David Nye’s technical analysis report will be published later next week.

Market Data (Click Each to Expand)

| LFEX Prices | FX Rates | LFEX Indicative Exporter Prices (4 Week) | EUR / NOK FX Rate (4 Week) |

|

Prices Ending 4th January, 2024 For Friday's Price For Next Week, Offers & Trading Please Register |

Did You Know?

LFEX delivers secure and trusted connectivity with counterparties globally for order routing, price discovery and transactions.

We deliver unique market data for the industry to help support price discovery and risk management, and we offer pre and post trade services and data to support industry operations – all in a single, real-time, seamlessly integrated technology platform.

FAQ’s

Q. I want to lock in some volume for the next few weeks – can I do this?

A. Yes you can. The system will allow you to make requests (RFQ’s) to as many counterparties as you want. You can choose an immediate spot date for the following week, or forward dates for future deliveries. You can separate these trades out and negotiate and trade them separately (with different counterparties), or as a contract with a specific counterparty.