The London Fish Exchange

Data / Market Insight / News

LFEX European Aquaculture Snapshot to 3rd January, 2025

|

|

Published: 3rd January 2025 This Article was Written by: John Ersser |

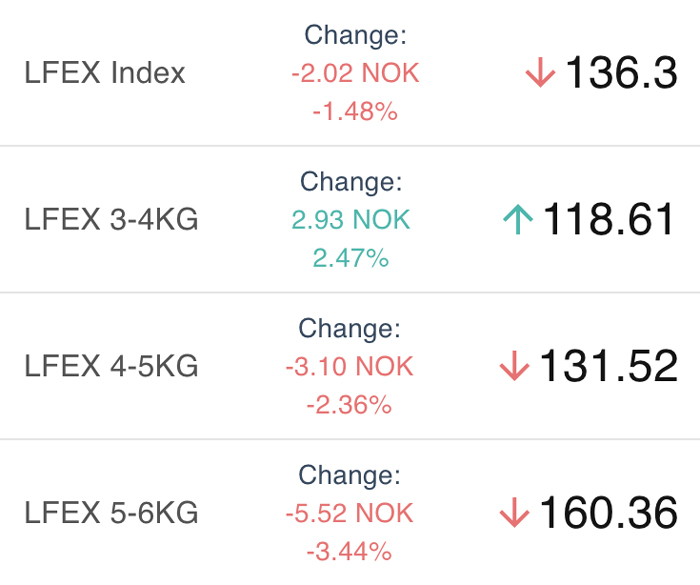

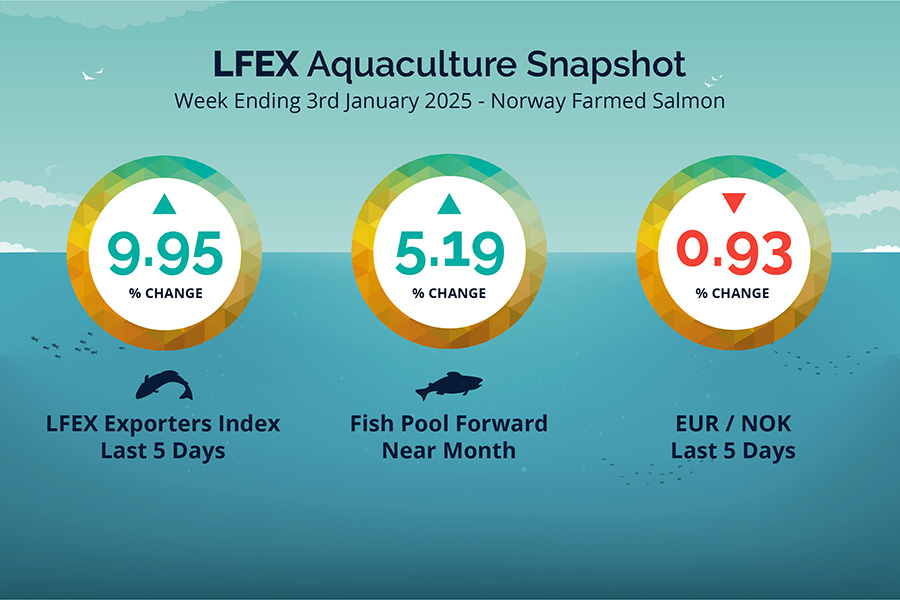

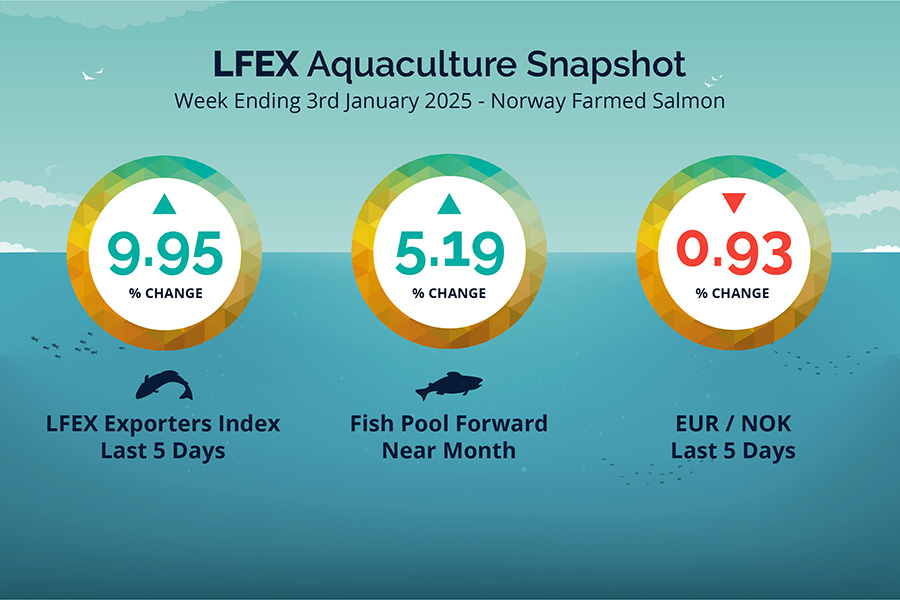

The LFEX Norwegian Exporters Index for Week 1 2025 ended the week up +12.34 NOK / +9.95% to stand at 136.30 NOK (in EUR terms 11.62 / +1.15 / +11.00%) FCA Oslo Week ending Thursday 2nd January vs previous Monday 23rd December.

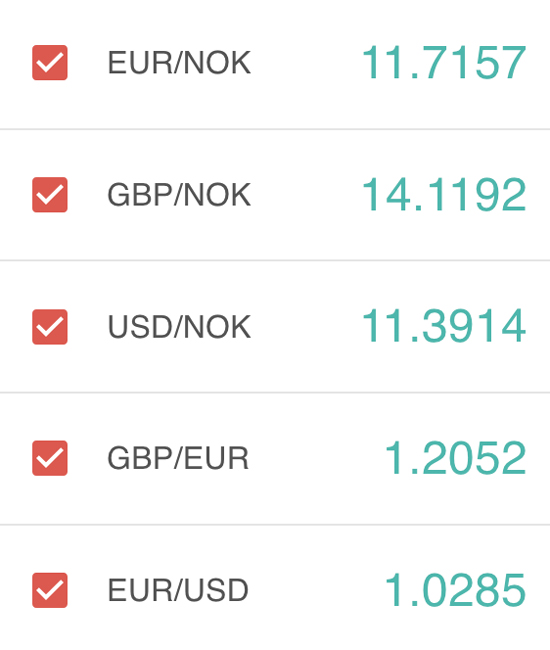

The NOK rate ended down -0.11 NOK / -0.93% at 11.73 to the Euro over the period Thursday to Thursday. The Fish Pool Euronext future January was reported up Thursday to Thursday +0.4 EUR / +5.19% at 8.10 EUR which equates to 95.01 NOK.

The Last Week

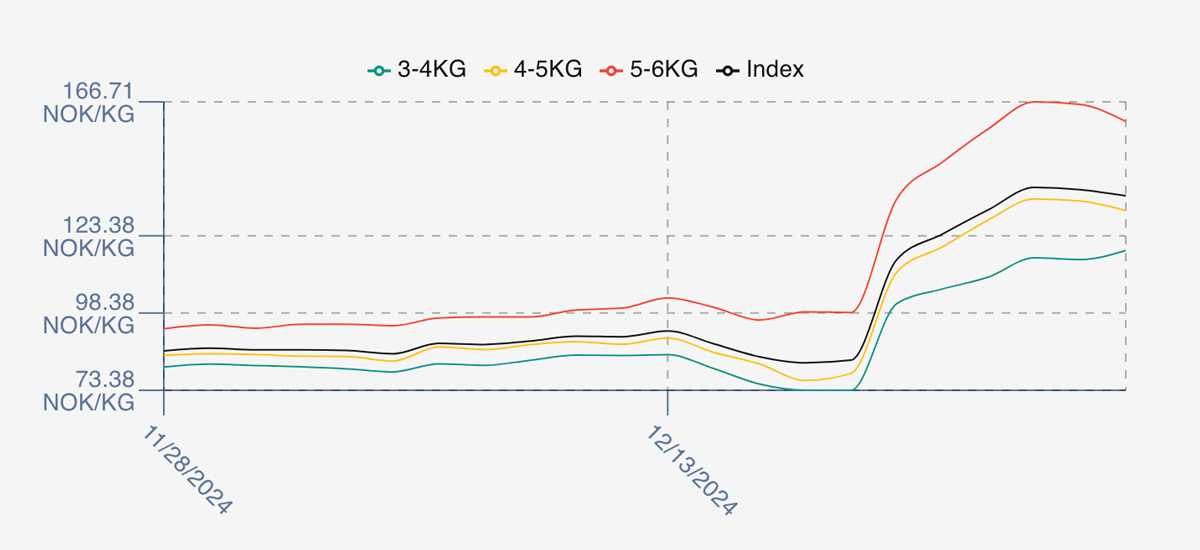

Small volumes over the Christmas / New Year week means high prices and poor price discovery. Index prices continued their upward trajectory last Friday opening at 131.8 NOK an increase of 7.84 NOK as 5/6 inventory remained low pushing the average higher. Monday 30th Dec more of the same as 5/6s peaked bringing the index to 139.01 and the high of the week. Tuesday saw little available inventory or pricing which remained just off the weekly high. After the New Year 4/5s and 5/6s both started to soften, while 3/4s showed strength all week. The index closing out off the highs at 136.30.

Spreads between sizes started to come in, especially as the larger fish dropped and 3/4s climbed, with spreads showing around 18 NOK by Friday.

The EURNOK FX rate fell to 11.73 NOK giving a comparable Euro index price of 11.62 Euro.

Next Week

Early pricing indications from sellers for next week are coming around the 126 NOK level offered for the index – a fall of around 10 NOK from last week. Expectation from buyers is that the price should be dropping further after the huge holiday jumps. However, volumes for the coming week aren’t clear at the moment and sellers are holding back on more reductions until the picture becomes clearer.

EUR NOK FX rate is ranging between 11.70 and 11.72 – so slightly off. This would give an indicative Euro index price around 10.76 on levels later Friday.

Volumes – Fresh Export

Volume figures for week 52 (2024) was 9,134 tons down – 1,306 tons as compared to 10,440 in 2023. Volumes for week 1 and week 2 (2024) were 12,105 and 16,016 respectively for comparison.

Historical Price Guidance for Next Week

The LFEX Norwegian Exporters Index for Week 2 2024 ended the week down -19.65%, -23.11 NOK to stand at 94.50 NOK (in EUR terms 8.35) FCA Oslo. The NOK rate ended up small at 11.32. The Fish Pool future January was reported no change at 107.0 NOK.

David Nye’s technical analysis report will be published this Monday.

Market Data (Click Each to Expand)

| LFEX Prices | FX Rates | LFEX Indicative Exporter Prices (4 Week) | EUR / NOK FX Rate (4 Week) |

|

Prices Ending 3rd January, 2025 For Friday's Price For Next Week, Offers & Trading Please Register |

Did You Know?

The LFEX RFQ allows users to make offers and requests for forward orders not just the current week?

If a customer has a specific need for inventory at a specific day / week in the near future this request can be put up – for example a short-term campaign. Likewise, if a seller wants to secure some early sales (especially in a falling market) they can put up offers for that date / following week. The system also offers contracts trading for multi-leg orders.

FAQ’s

Q. After I have bought on the platform do I get a confirmation?

A. When executing on the platform you and your counterparty both receive an instantaneous confirmation of the transaction between you. The system creates a fully electronic documented record of your transaction with all associated details contained in this. These same details are immediately available in real-time to both parties and can be accessed whenever required. All history is maintained within the system and can be searched by any parameter of the trade.