The London Fish Exchange

Data / Market Insight / News

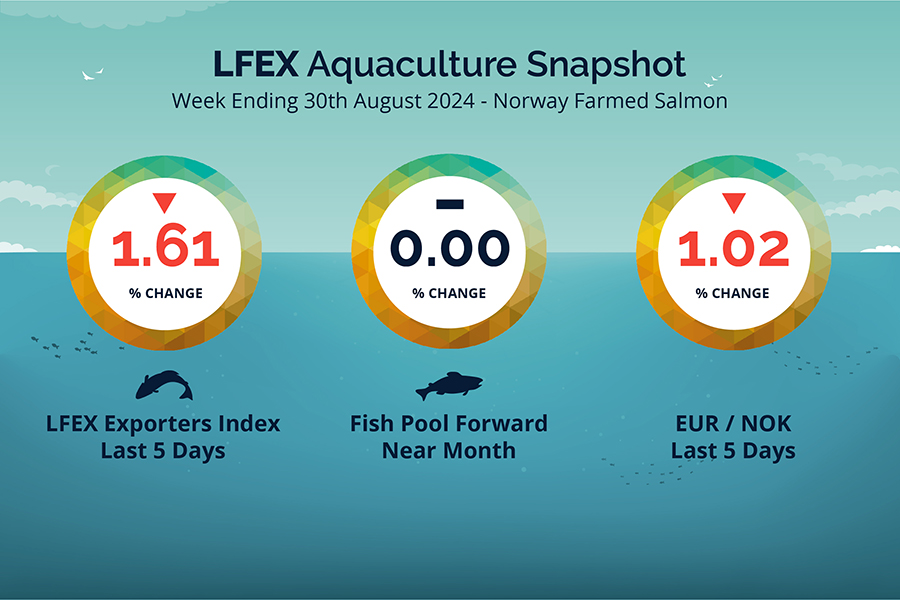

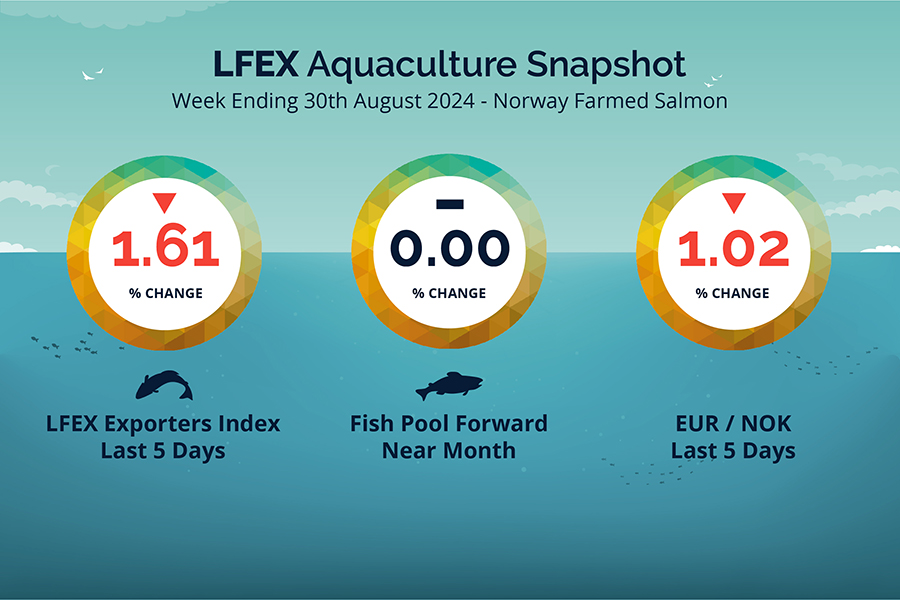

LFEX European Aquaculture Snapshot to 30th August, 2024

|

|

Published: 30th August 2024 This Article was Written by: John Ersser |

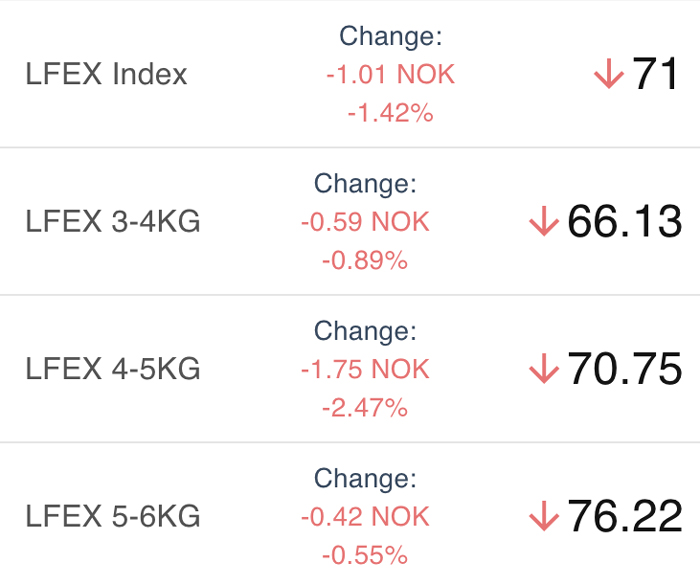

The LFEX Norwegian Exporters Index for Week 35 2024 ended the week down -1.16 NOK / -1.61% to stand at 71.00 NOK (in EUR terms 6.10 / – 0.04 / -0.59%) FCA Oslo Week ending Thursday vs previous Thursday.

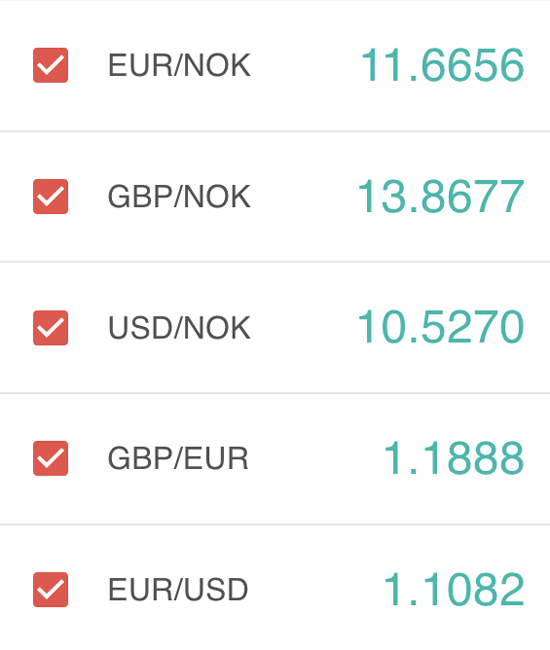

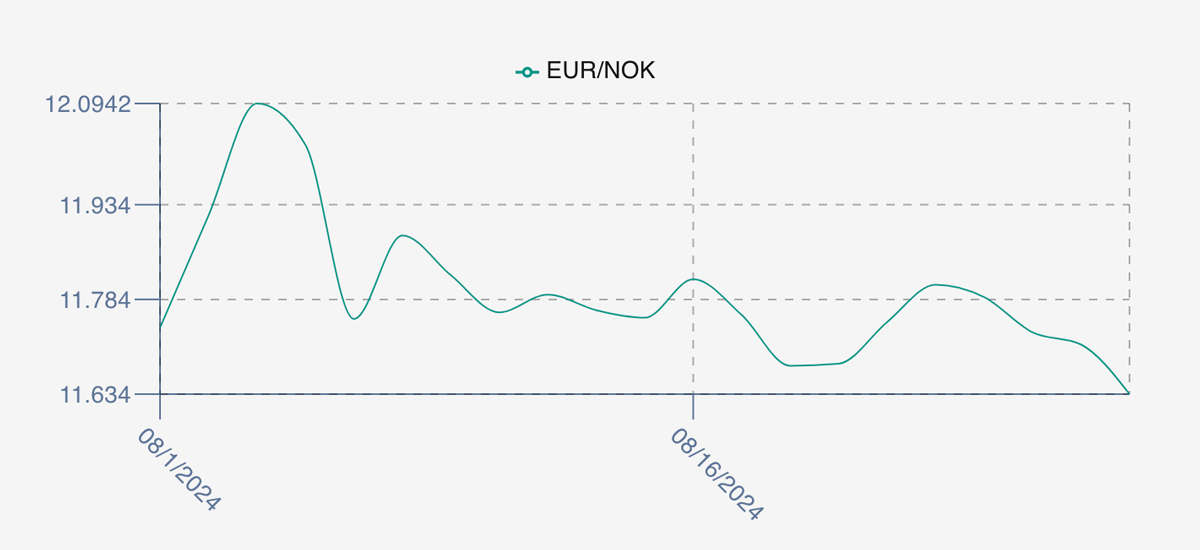

The NOK rate ended lower at 11.63 to the Euro over the period Thursday to Thursday -0.12 NOK or -1.02%. The Fish Pool future August was reported flat at 72.00 NOK with September showing 71.50 down 1.00 NOK.

Last Week

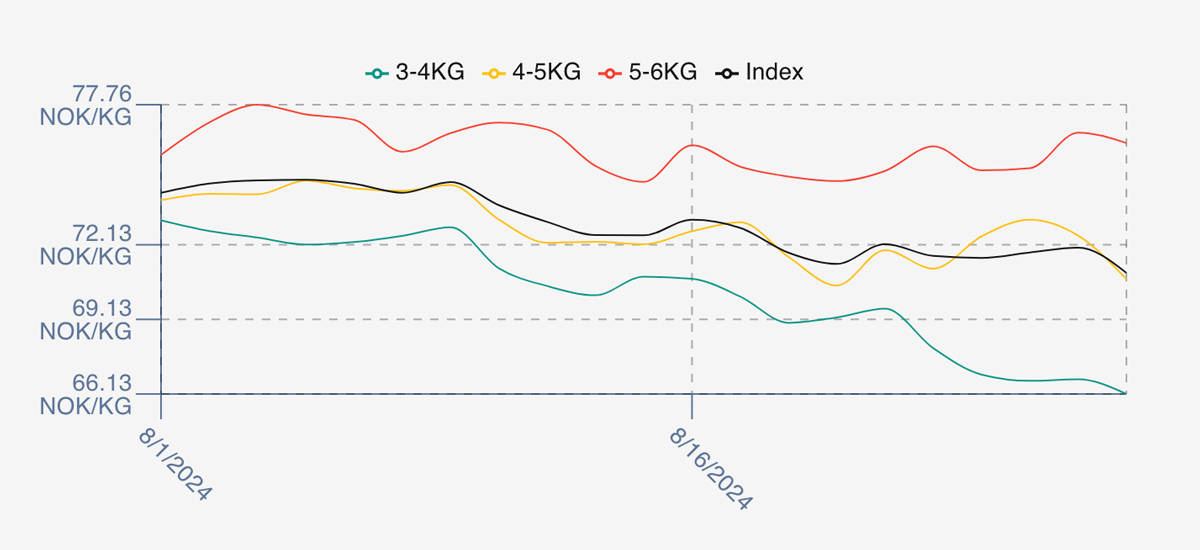

When a flat market isn’t flat ! Last week the index was pretty flat. Pricing opened lower -0.67%, -0.48 NOK at 71.68 as compared to the prior weeks close on Thursday as we indicated it would. Monday unchanged at 71.6, Tuesday 71.82 and Wednesday 72.01, with the index down a touch on Thursday at 71.00. However, the story is in the pricing gap that has opened up between 3-4s, 4-5s and 5-6s. If you were trading bigger fish, you would have seen prices stable with a slight rise come Thursday. 3-4s continued their falling trend ending at 66 offered while middle of the range fish managed to both climb midweek before falling off to close 70.75 offered 1 NOK softer for the week.

Spread gradually widened over the week from 5.5 NOK close last week to close out over 10 NOK wide approximately 76 – 66 offered.

The FX rate ended lower with a steady gentle fall across the week from a start at 11.75 down to 11.63, making the Euro price 6.10 down 0.6% or 4 cents.

Next Week

Early opening indications from sellers for week 36 is coming in lower than last week’s close. This means we see an indicative starting level for the index at around the 70 NOK levels. Again, good supply especially in smaller sizes although the price of 3-4s is similar to yesterday around 66 offered. Both 4-5s and 5-6s are down however. Spread around 8 – 9 NOK difference.

Volumes

Volume figures for week 34 (2024) were 24,242 tons versus a lower 24,089 in 2023. Volumes for weeks 35 and 36 (2023) were 25,260 and 25,523 respectively for comparison.

Historical Price Guidance for Next Week

A year ago, Week 36 2023 was up +1.85%, +1.34 NOK to stand at 73.87 NOK FCA (approximately 6.43 EUR) the Euro stood at 11.48 and Fishpool future September was reported up +1.00 NOK, +1.00 NOK at 70.75 NOK.

David Nye’s technical analysis report will be published on Monday.

Market Data (Click Each to Expand)

| LFEX Prices | FX Rates | LFEX Indicative Exporter Prices (4 Week) | EUR / NOK FX Rate (4 Week) |

|

Prices Ending 30th August, 2024 For Friday's Price For Next Week, Offers & Trading Please Register |

Did You Know?

The London Fish Exchange works 365 days, 24/7!

Let the LFEX work for you. It never needs an afternoon off, or a day off, or holiday (although you can access it on your vacation). It can help your company buy or sell efficiently and in a cost effective manner. Make offers or requests 24 hours a day. Let the LFEX be a key member of your team.

FAQ’s

Q. How flexible is the system if my specifications are complex?

A. This is a great question, and the answer is ultimately infinitely flexible. Every week we get feedback from users and we can add new features or parameters to the system to ensure that users demands are met. Data capture and communication are key. The system also offers multiple ways of communicating in addition to the core order/trading functions, including order commentary and chat to ensure that you can always communicate clearly with counterparties.