The London Fish Exchange

Data / Market Insight / News

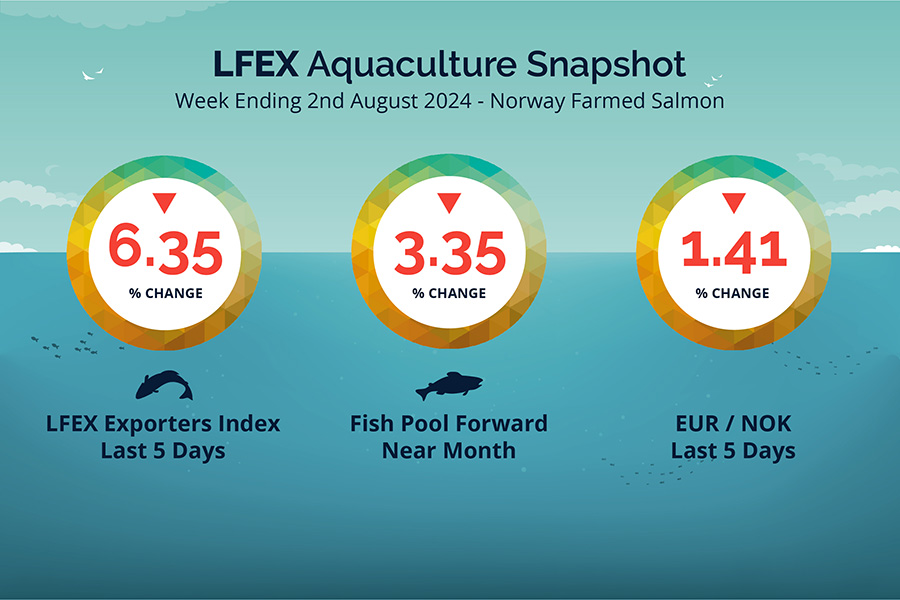

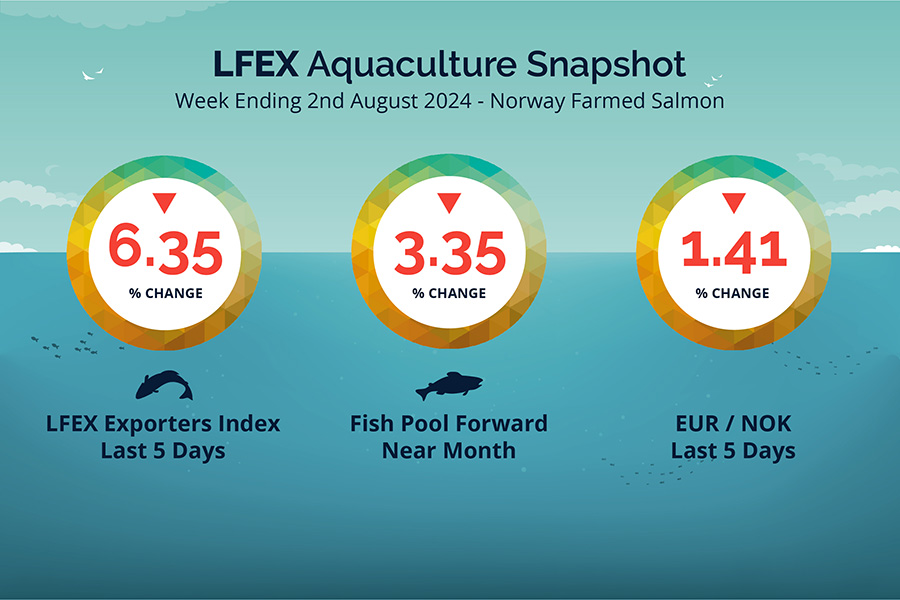

LFEX European Aquaculture Snapshot to 2nd August, 2024

|

|

Published: 2nd August 2024 This Article was Written by: John Ersser |

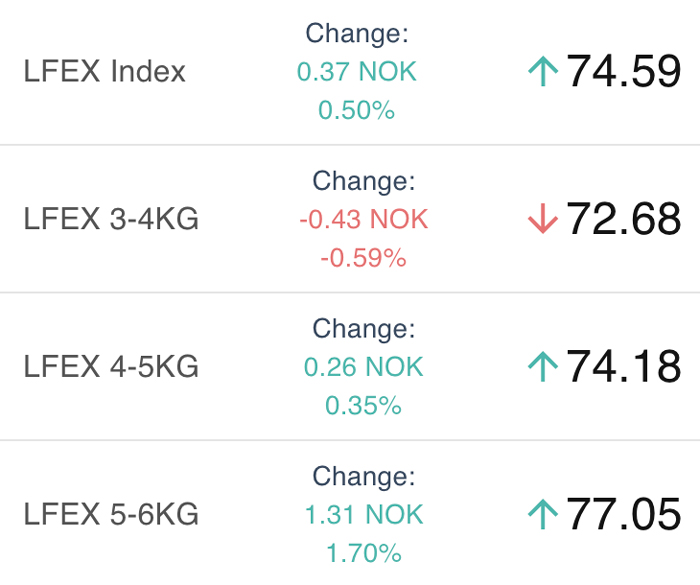

The LFEX Norwegian Exporters Index for Week 31 2024 ended the week down -6.35%, -5.03 NOK to stand at 74.22 NOK (in EUR terms 6.23 / – 0.33 / -5.01%) FCA Oslo Week ending Thursday vs previous Thursday.

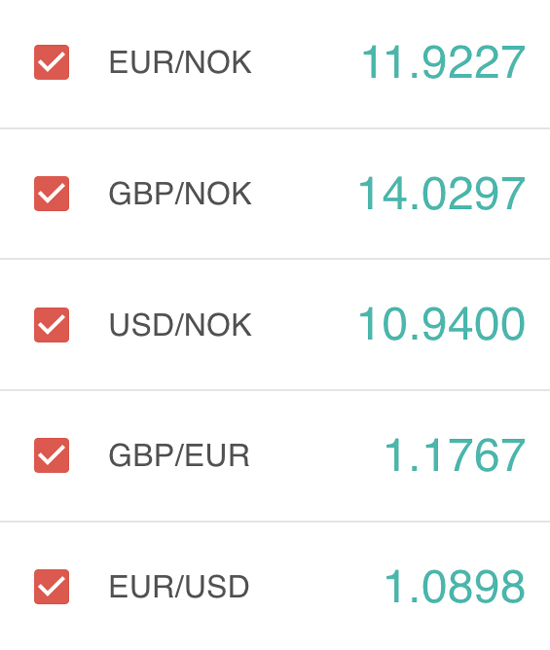

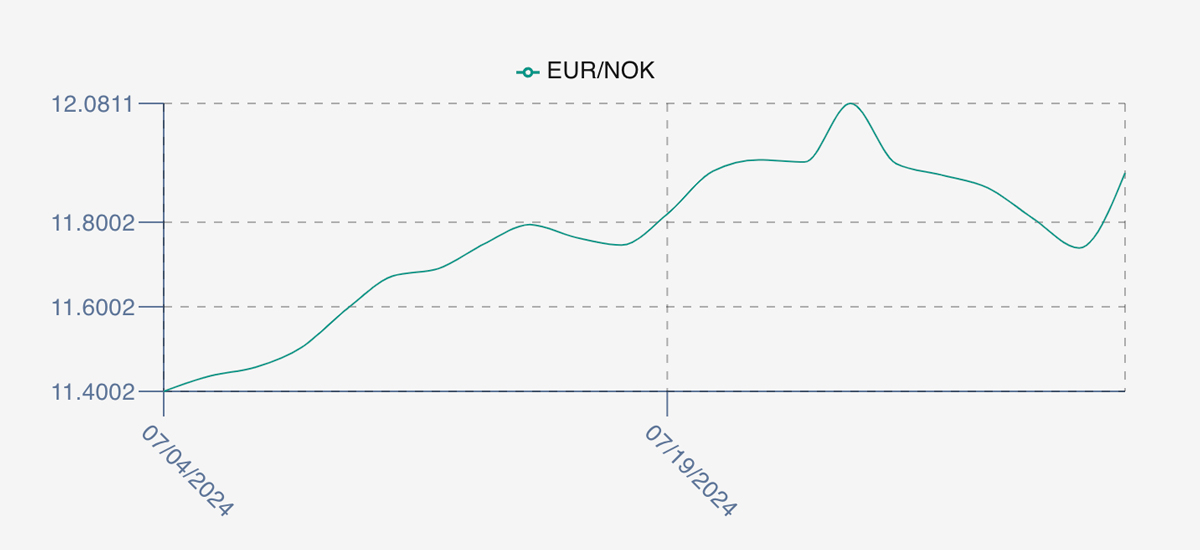

The NOK rate ended down, at 11.91 to the Euro over the period Thursday to Thursday -0.17 NOK or -1.41%. The Fish Pool future August was reported down – 2.70, -3.35% at 78.00 NOK.

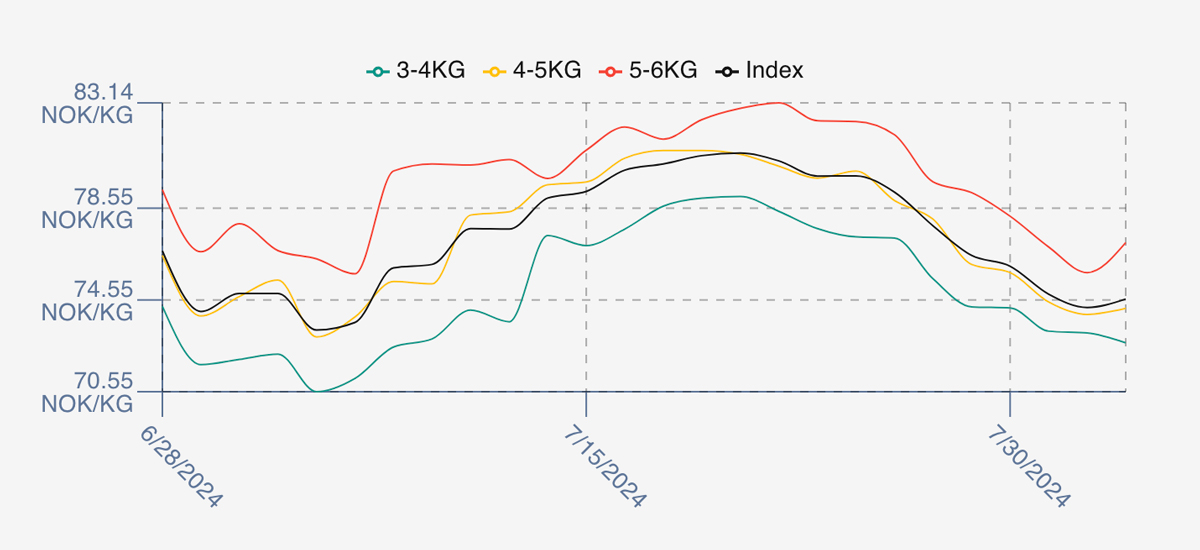

Last Week

Pricing opened down -1.85%, -1.47 NOK at 79.25 as compared to the prior weeks close in what was to be the high of the week. There was talk early on of good availability and the market reflected the sentiment as pricing weakened across the week. Monday gave up another Nok and a bit to 76.49, Tuesday 76.02 and Wednesday dropping off for 74.80 and prices finally sinking to close out at 74.22.

Summer volatility has returned. The FX rate by comparison provided the Nok with a little strength clawing back to 11.91 over the period and set the Euro price 5% lower over the week as a consequence.

Spread showing around 2.5 NOK 3/4s – 5/6s. Price falls are expected this time of year as volumes come through. The low for 2023 was 69.9 NOK on the 22nd August for reference.

Next Week

After the drop off in pricing this week, early opening indications from sellers are to try and stabilise pricing for the start of the week – hence we see early offered level indications to start around the 74.5 NOK levels. However….a lot of fish around, summer holidays and fish left over will all put pressure on prices this week. Larger fish pricing maybe more settled. Remember these are offered prices and we expect traded prices to naturally go through ultimately at lower levels as part of the negotiation process. We capture intraweek volatility well and track the NASDAQ price less a margin closely when we look back and compare.

Volumes

Volume figures for week 30 (2024) were 21,986 tons versus a lower 19,604 in 2023. Volumes for weeks 31 and 32 (2023) were 20,649 and 21060 respectively for comparison.

Historical Price Guidance

A year ago, Week 32 2023 prices ended down -4.25%, -3.37 NOK to stand at 75.99 NOK FCA Oslo while the Euro stood at 11.19 and Fishpool August showed 74.0 as prices continued their summer slide as volumes continued to build.

David Nye’s technical analysis report will be published on Monday.

Market Data (Click Each to Expand)

| LFEX Prices | FX Rates | LFEX Indicative Exporter Prices (4 Week) | EUR / NOK FX Rate (4 Week) |

|

Prices Ending 2nd August, 2024 For Friday's Price For Next Week, Offers & Trading Please Register |

Did You Know?

As a seller you can offer the same trucks to multiple buyers and then negotiate with each of them?

You can set-up an offer and send it to multiple counterparties at the same time. You can negotiate and manage this volume between the counterparties and sell full or part of this inventory. Importantly the system won’t let you over-sell inventory you don’t want to offer / don’t have. At times of high volume it helps to be showing volume to as many customers a possible to get orders.

FAQ’s

Q. Can I communicate in a different language on the platform?

A. The chat service supports multilanguage / characters meaning as long as users have the necessary input keyboard they can communicate in any language they chose – including helpful emojis.