The London Fish Exchange

Data / Market Insight / News

LFEX European Aquaculture Snapshot to 27th December, 2024

|

|

Published: 27th December 2024 This Article was Written by: John Ersser |

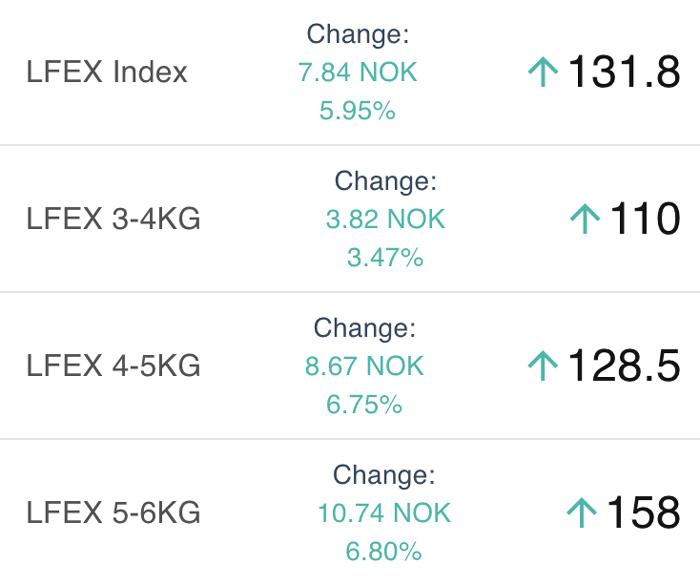

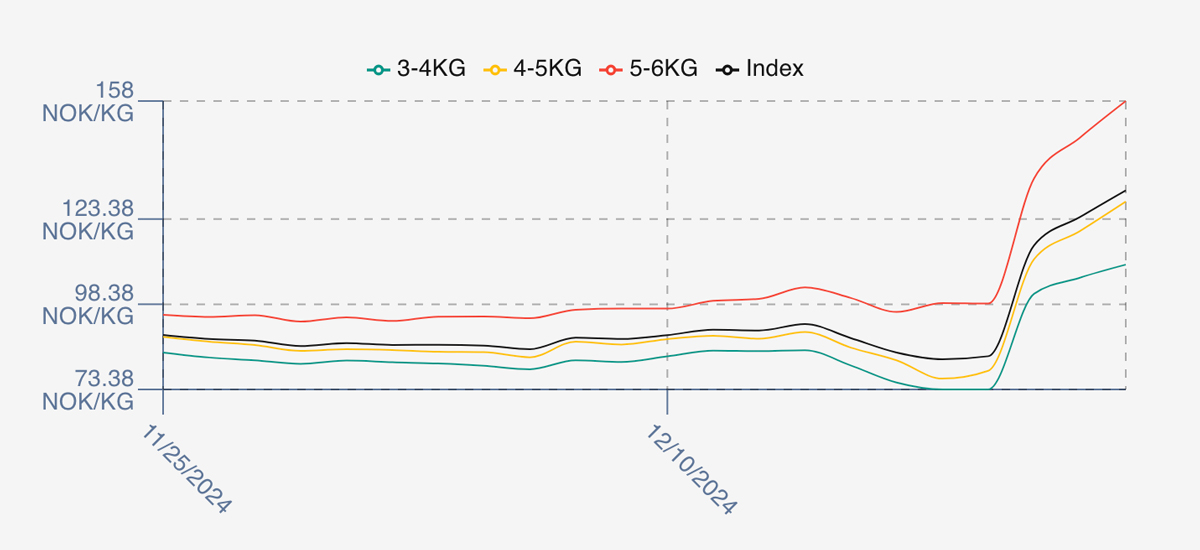

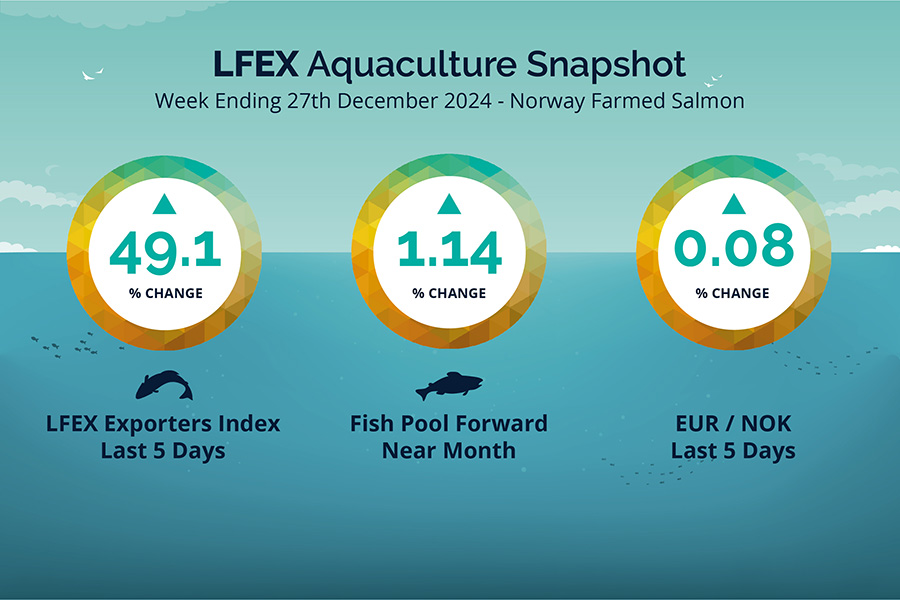

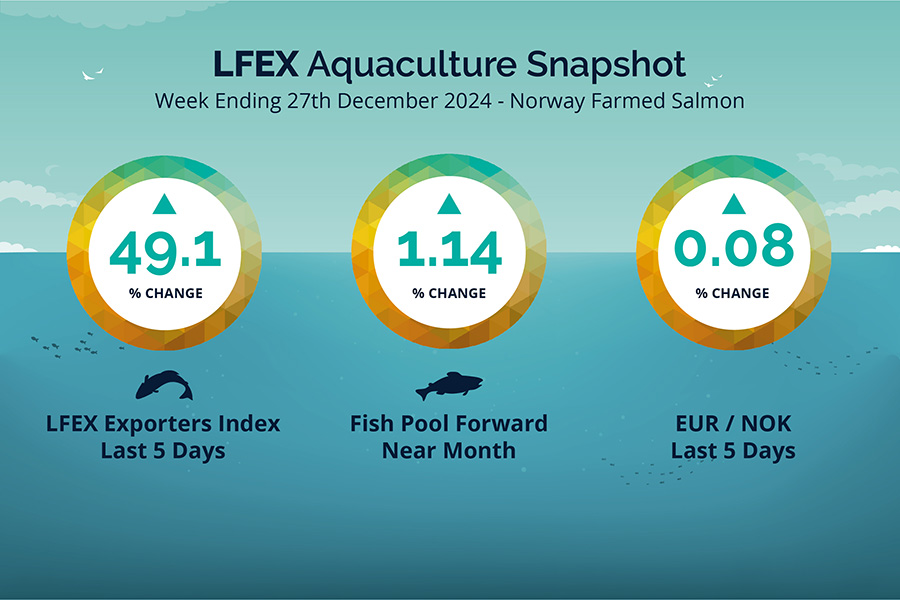

The LFEX Norwegian Exporters Index for Week 52 2024 ended the week up +40.83 NOK / +49.12% to stand at 123.96 NOK (in EUR terms 10.47 / +3.44 / +48.99%) FCA Oslo Week ending Monday 23rd December vs previous Thursday 19th December.

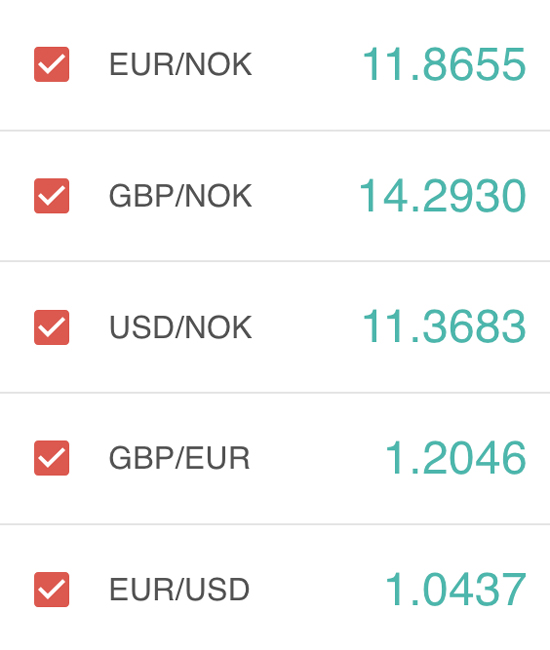

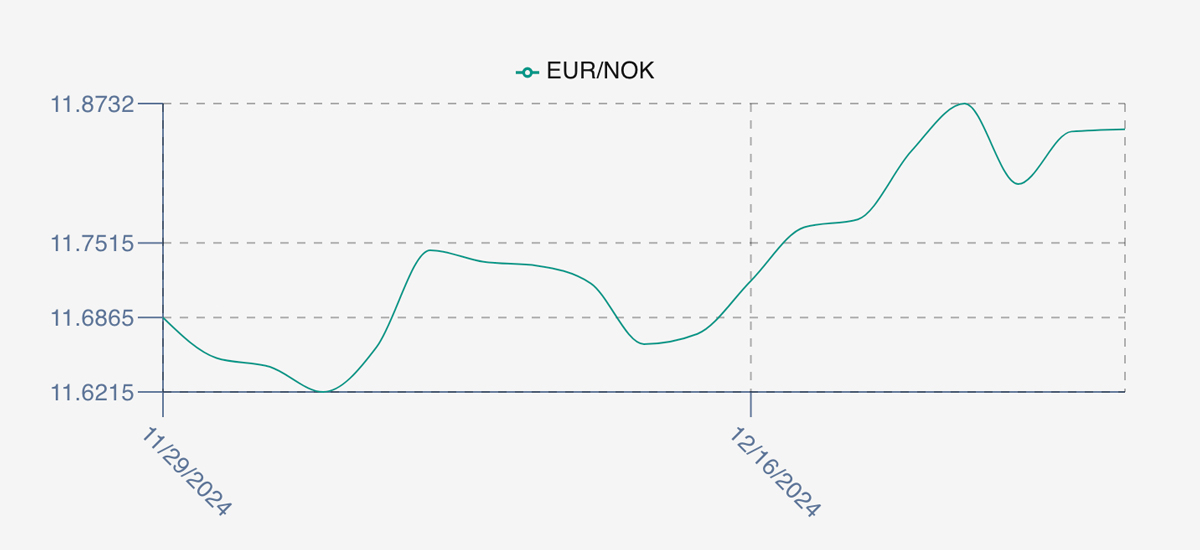

The NOK rate ended up +0.01 NOK / +0.08% at 11.84 to the Euro over the period Thursday to Thursday. The Fish Pool future December was reported up Thursday to Tuesday 24th +1.00 NOK / +1.14% at 89.00 NOK which equates to 7.52 Euro with January showing 7.70 Euro.

The Last Week

The numbers are always dramatic over this period as the prices fall off in week 51 due to buyers having bought for Christmas, only for them to rebound massively as limited stock is chased by buyers for the new year in a short trading window. Last week overall the index price moved sharply upwards in the 2 trading days (Friday and Monday) the index was calculated. On Friday the index mounted a surge to 115.67 which continued through on Monday with another 8 NOK added to a level of 123.96.

Spreads between sizes gapped further again even as prices jumped. We saw over 40 NOK spread on Monday as the smaller fish climbed to 106 NOK, while the further limited supply 5/6s showed 147 NOK offered.

The EURNOK FX pair was flat at 11.84 NOK giving a comparable Euro index price at 10.47 Euro.

Next Week

Early pricing indications from sellers for next week are coming around the 130 NOK level offered for the index – a further jump in prices. Limited production days mean limited supply, and producers are able to call the tune when it comes to pricing coming into the following week. A nearing 45 point spread between 3/4s and 5/6s with 5/6s over 150 NOK being offered for those in need.

EUR NOK FX rate is marginally up at 11.85 which would give an indicative Euro index price around 10.97 on levels later Friday.

We wish everyone a very Happy New year.

Volumes – Fresh Export

Volume figures for week 51 (2024) was 22,450 tons up +3,970 tons as compared to 18,480 in 2023. Volumes for week 52 and week 1 (2023/4) were 10,440 and 12,105 respectively for comparison.

Historical Price Guidance for Next Week

The LFEX Norwegian Exporters Index for Week 1 2024 ended the week up +9.21%, +9.92 NOK to stand at 117.61 NOK (in EUR terms 10.44) FCA Oslo. The NOK rate ended flat at 11.27. The Fish Pool future January was reported up + 1.80 at 107.0 NOK.

David Nye’s technical analysis report will be published this Monday.

Market Data (Click Each to Expand)

| LFEX Prices | FX Rates | LFEX Indicative Exporter Prices (4 Week) | EUR / NOK FX Rate (4 Week) |

|

Prices Ending 27th December, 2024 For Friday's Price For Next Week, Offers & Trading Please Register |

Did You Know?

Many buyers have repeat business, week in week out. This can be systematised creating efficiencies into your daily operations.

The beauty of a professional and well thought through mature technology is that we can provide users these benefits. The system will remember your last RFQ order and auto populate if you are not a heavy user. You can also set-up your own default RFQ’s meaning your whole order profile is literally available at the click of 1 button. Within 5 seconds you can get your perfect RFQ out to as many sellers as you want, week in week out.

FAQ’s

Q. I am concerned about beginning the transition from manual to electronic transacting. Is it acceptable to do both?

A. The short answer is of course yes. In fact, we recommend that this is how people start. By dipping your toes you learn about the system, what you see and what to expect. You can then build confidence and proactively use the system to get the maximum benefit from it. You can download the orders from the system if you need to into a CSV file, or input data into your existing system in the same way you do a manual trade. For more advanced users we can connect via the LFEX API.