The London Fish Exchange

Data / Market Insight / News

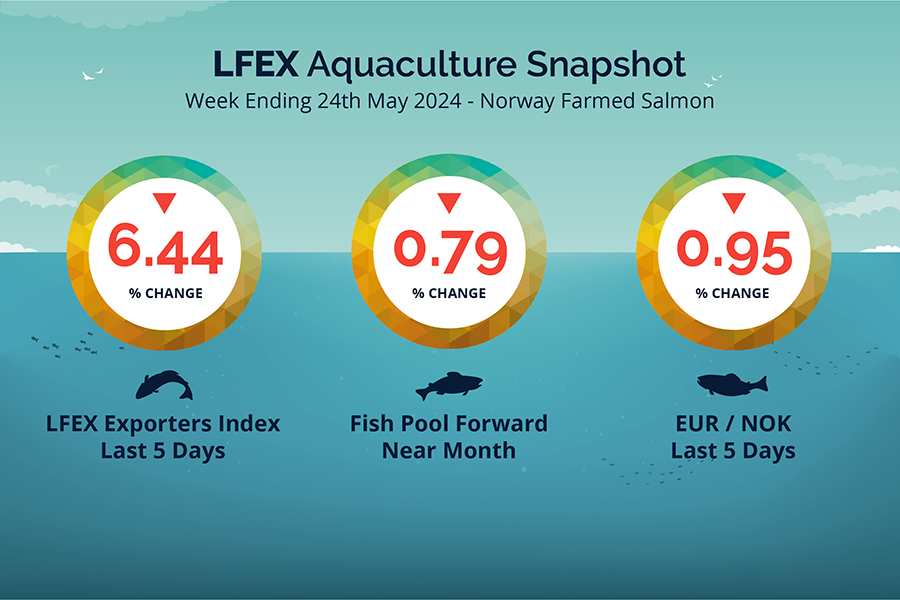

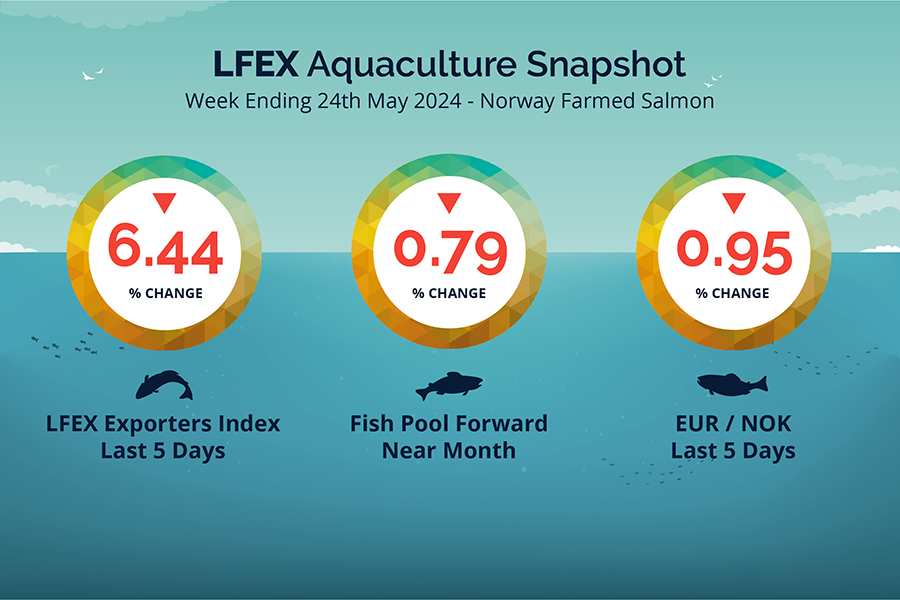

LFEX European Aquaculture Snapshot to 24th May, 2024

|

|

Published: 24th May 2024 This Article was Written by: John Ersser |

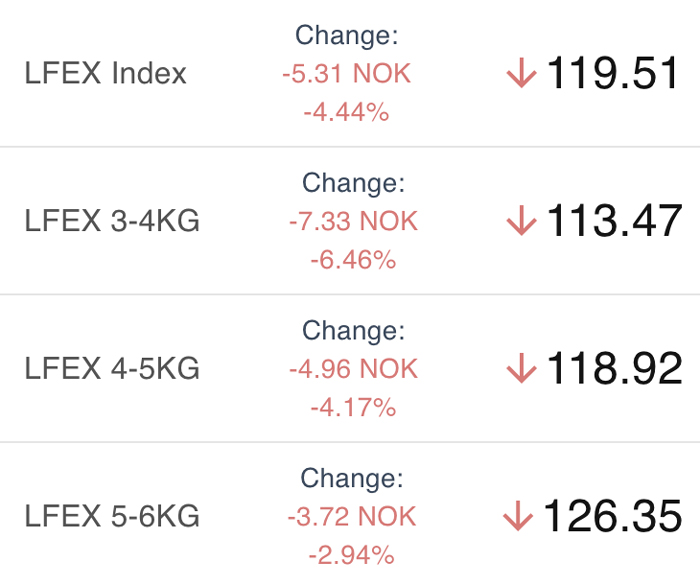

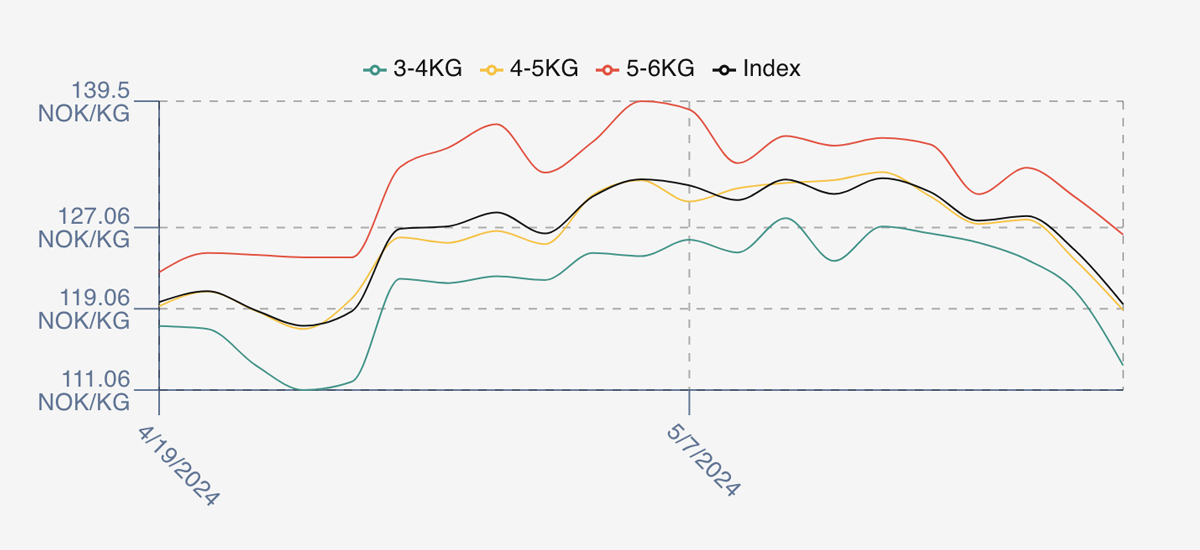

The LFEX Norwegian Exporters Index for Week 21 2024 ended the week down -6.44%, -8.23 NOK to stand at 119.51 NOK (in EUR terms 10.37 / -0.61 / -5.55%) FCA Oslo Week ending Thursday vs previous Thursday.

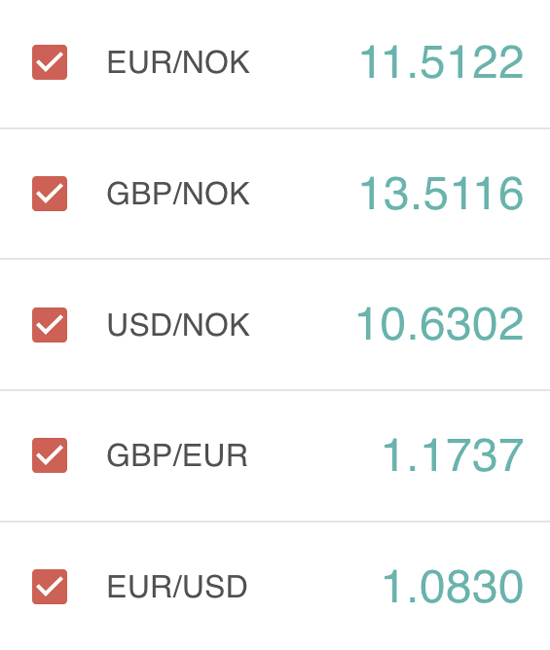

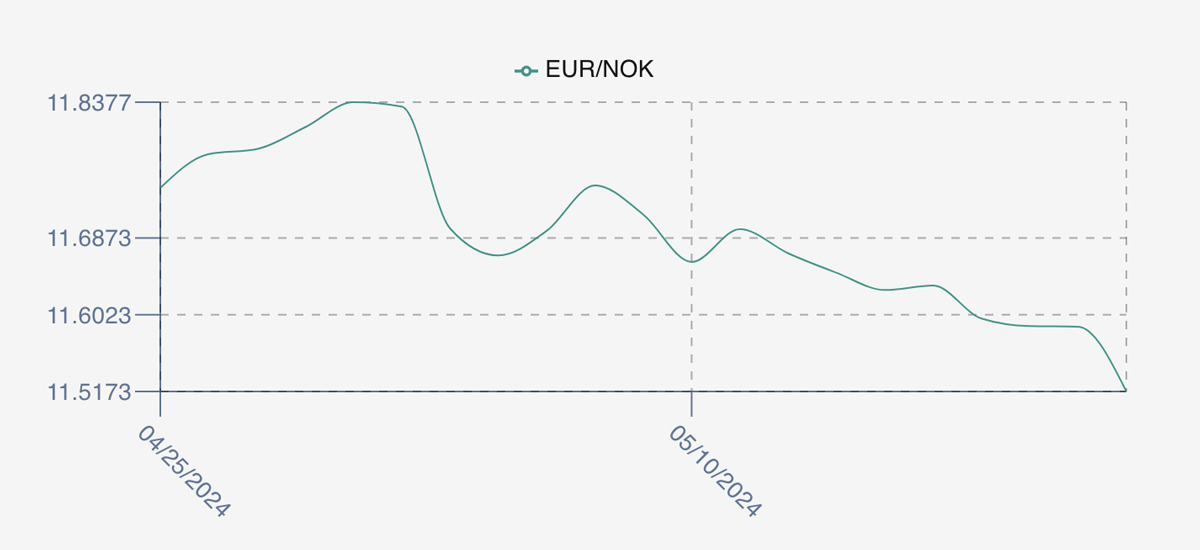

The NOK rate ended down at 11.52 to the Euro over the period Thursday to Thursday -0.11 NOK or -0.95%. The Fish Pool future May was reported down – 1.00, -0.79% at 125.50 NOK.

This week was interrupted by the long Constitution and Whitsun bank holidays. Pricing leading into the weekend remained strong at 127.74 on the Thursday. Having time off the market returned with renewed vigour as prices not only held but even snuck up a little to 128.19 to ‘start’ the week on Tuesday. However, Wednesday saw some softening to 124.82 and Thursday closed the week at 119.51 as prices started to drop off more dramatically than the usual end of week sell off. If there was some good news for the sellers, it was that the Nok continues to appreciate against the Euro, nearly 1% this week bring the Euro price in at 10.37 at the close.

No more short weeks until Christmas and volume picking up will be the story going forwards. For next week, week 22 pricing is looking to take a significant dip. Early indications are around 108 NOK for the index, which would be an 11 NOK drop from Thursday for next week deliveries. Why – well signs of more harvest is coming through, although not huge volumes more and less industrial fish means pressure on pricing. Demand remains weak however, although buyers are starting to show signs of interest.

Volume figures for week 20 were similar to the same time last year at 11,698 vs 11,512. Volumes in week 21 2023 were 15,492 and 15,666 for week 22 to give some comparison guidance.

A year ago, Week 22 2023 prices ended up at 116.49 NOK an increase of 4.04%. The EURNOK rate was higher at 11.95.

David Nye’s technical analysis report will be published on Tuesday.

Market Data (Click Each to Expand)

| LFEX Prices | FX Rates | LFEX Indicative Exporter Prices (4 Week) | EUR / NOK FX Rate (4 Week) |

|

Prices Ending 24th May, 2024 For Friday's Price For Next Week, Offers & Trading Please Register |

Did You Know?

Price volatility is an issue in many markets? Just following the US tech market will give you a good idea of potential price swings.

We saw a large drop in salmon prices in week 24 last year with a 17.7% fall, and this wasn’t a complete anomaly. In July 22 we saw a 17.27% drop in a week and in May 22 we saw a 14.84% drop. The problem is accessing prices during very volatile periods – or price discovery. This is where electronic platforms are very powerful, enabling second by second price updates for market participants in a very efficient manner, allowing both sides of the market a much clearer picture, and the ability to read market direction and react accordingly. One of the many ways technology creates efficiencies for markets.

FAQ’s

Q. Can my colleagues see / participate in my activity and / or communications on the LFEX platform?

A. The platform will allow ‘internal’ users to share / access information on the platform, and therefore users will be able to see offered prices by colleagues as well as trades and history. It allows you to handle customers when colleagues are away from the desk / office and tracks and records each users activities, meaning your business will never miss an order or sale. The same is also true for larger buying organisations, with real-time access across departments.