The London Fish Exchange

Data / Market Insight / News

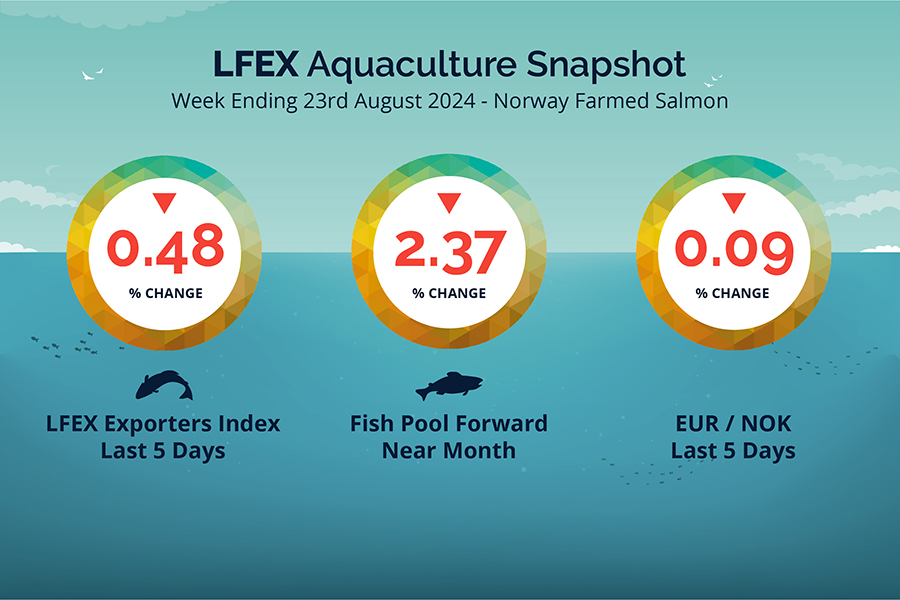

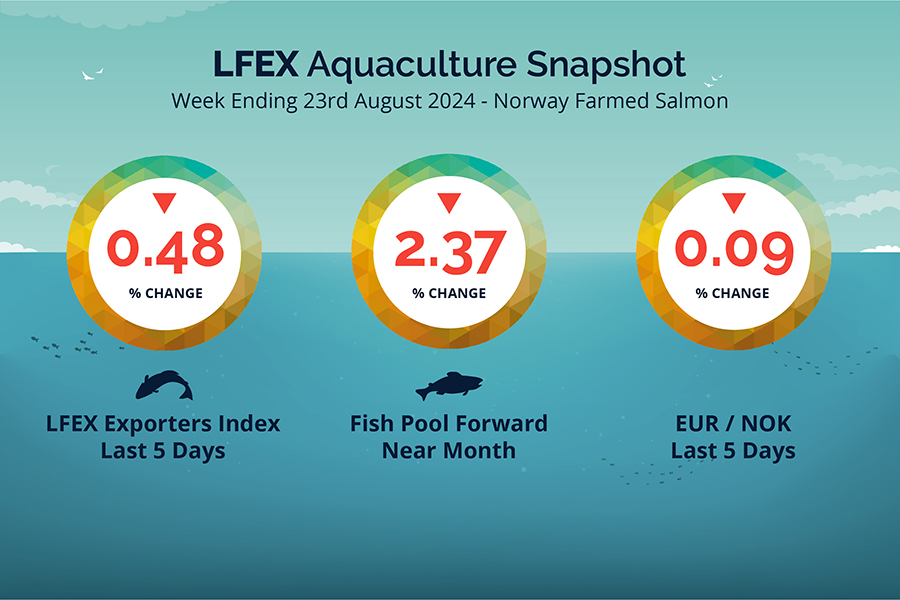

LFEX European Aquaculture Snapshot to 23rd August, 2024

|

|

Published: 23rd August 2024 This Article was Written by: John Ersser |

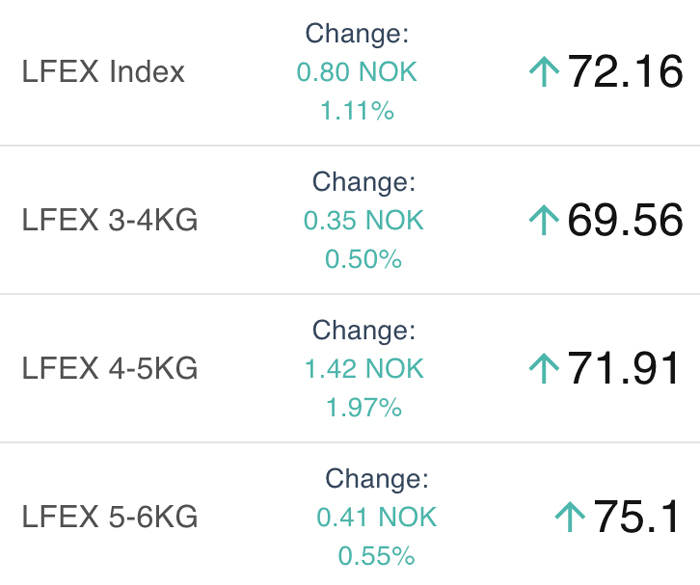

The LFEX Norwegian Exporters Index for Week 34 2024 ended the week down -0.35 NOK / 0.48% to stand at 72.16 NOK (in EUR terms 6.14 / – 0.02 / -0.40%) FCA Oslo Week ending Thursday vs previous Thursday.

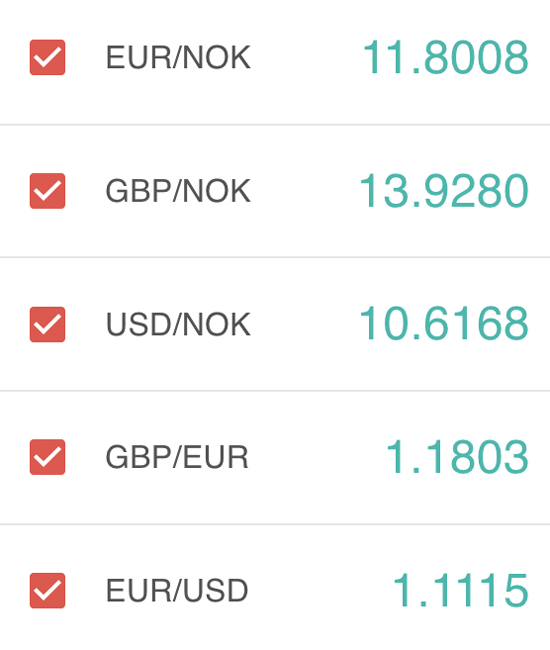

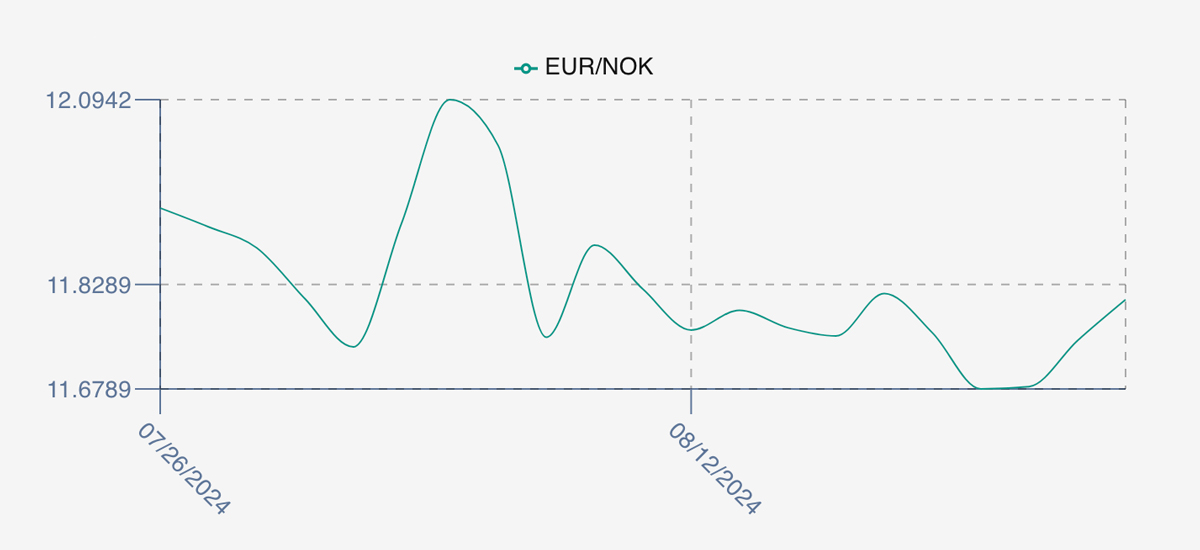

The NOK rate ended flat, at 11.75 to the Euro over the period Thursday to Thursday -0.01 NOK or -0.09%. The Fish Pool future August was reported down – 1.75, -2.37% at 72.00 NOK with September showing 72.50.

Last Week

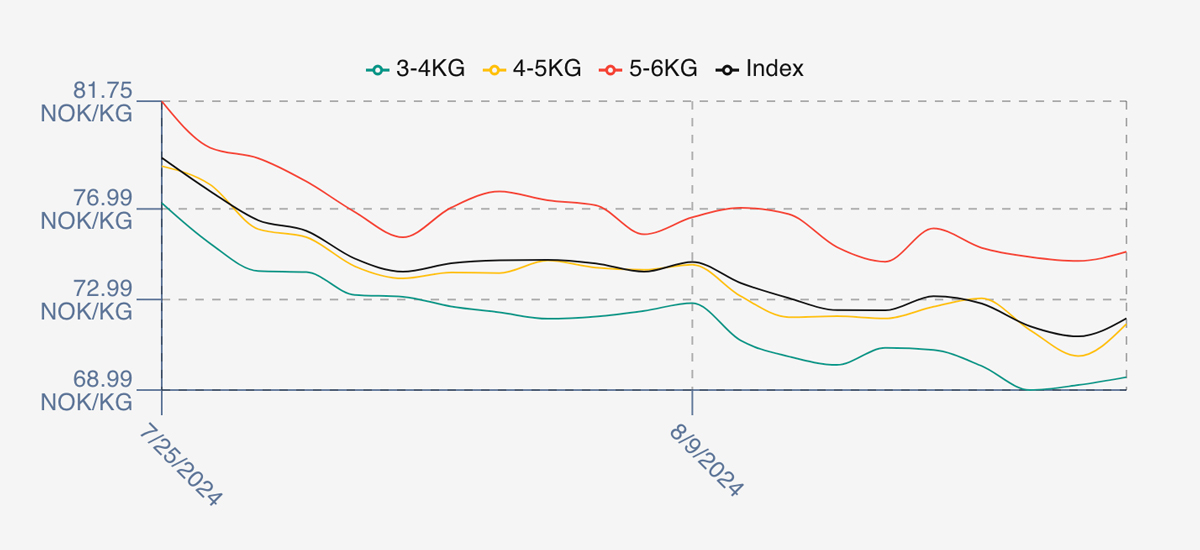

Last week was pretty flat for the index. Pricing opened up +0.87%, +0.63 NOK at 73.14 as compared to the prior weeks close on Thursday as we indicated it would. Monday held at 72.81 while we saw a drop on Tuesday of 1 NOK to 71.81 and Wednesday slipped to the low of the week at 71.63. Interestingly the market picked up marginally at the end of the week but recorded an overall fall.

Bigger sized fish held the index up with the 5-6s at the 74 levels offered during the week, whilst we saw 3-4s offered below 69. While all sizes increased on Thursday the biggest increase was in the 4-5s.

Spread widened a little during the week to 5 NOK and closed out a little higher showing around 5.5 NOK 3/4s – 5/6s.

The FX ended flat although experienced weaker levels last Friday at 11.82 before dropping 1.3% during the week to end at par for the week.

Next Week

Early opening indications from sellers for week 35 is coming in slightly lower than last week’s close. This means we see an indicative starting level for the index at around the 71 – 71.5 NOK levels. Good supply especially in smaller sizes and the price of 3-4s really dropping, whereas the 5-6s are if anything a little stronger as we go into the new week. Spread around 8 – 9 NOK difference.

Volumes

Volume figures for week 33 (2024) were 21,367 tons versus a higher 22,698 in 2023. Volumes for weeks 34 and 35 (2023) were 24,089 and 25,260 respectively for comparison.

Historical Price Guidance for Next Week

A year ago, Week 35 2023 was up +2.15%, +1.53 NOK to stand at 72.53 NOK FCA while the Euro stood at 11.58 and Fishpool August showed 73.50 with September showing 69.75.

David Nye’s technical analysis report will be published on Monday.

Market Data (Click Each to Expand)

| LFEX Prices | FX Rates | LFEX Indicative Exporter Prices (4 Week) | EUR / NOK FX Rate (4 Week) |

|

Prices Ending 23rd August, 2024 For Friday's Price For Next Week, Offers & Trading Please Register |

Did You Know?

As a manager you can get a snapshot in moments of the activity in your business.

You can see all order histories with ease on the platform. You can sort and search and see who are the biggest parties, discover who is buying / selling at optimal prices, and identify those companies to focus more on and reduce supply shock exposure by evaluating history. It’s all at your fingertips.

FAQ’s

Q. Can I as a buyer make my own prices that I am interested in and send them to Sellers?

A. Absolutely yes is the answer. Buyers have the same offering and trading capabilities as sellers. A balanced and ordered market should represent both sell side and buy side interest to facilitate price discovery and we would always encourage buyers to be part of this process. Buyers have as much ability to input prices and offers / orders, which in turn helps sellers get to the right price as well.