The London Fish Exchange

Data / Market Insight / News

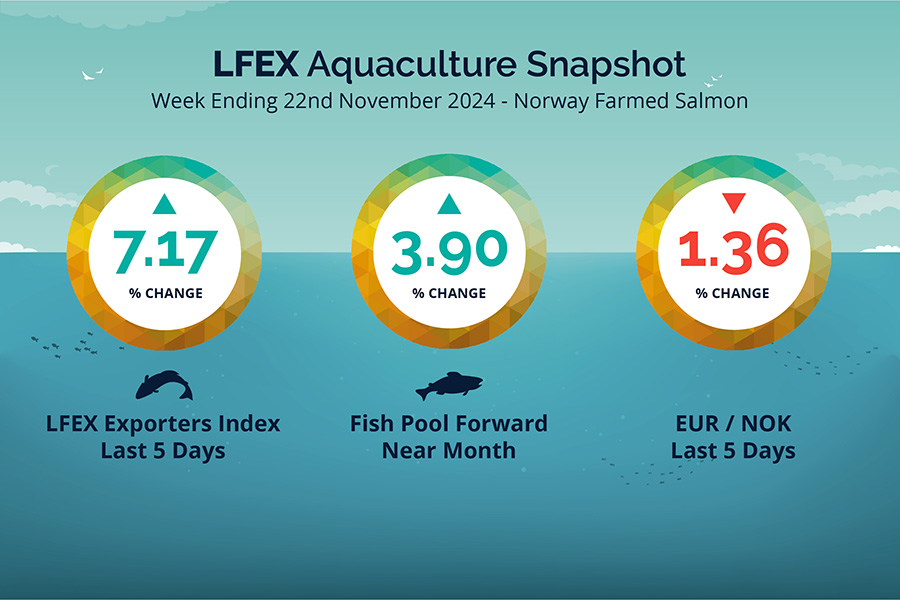

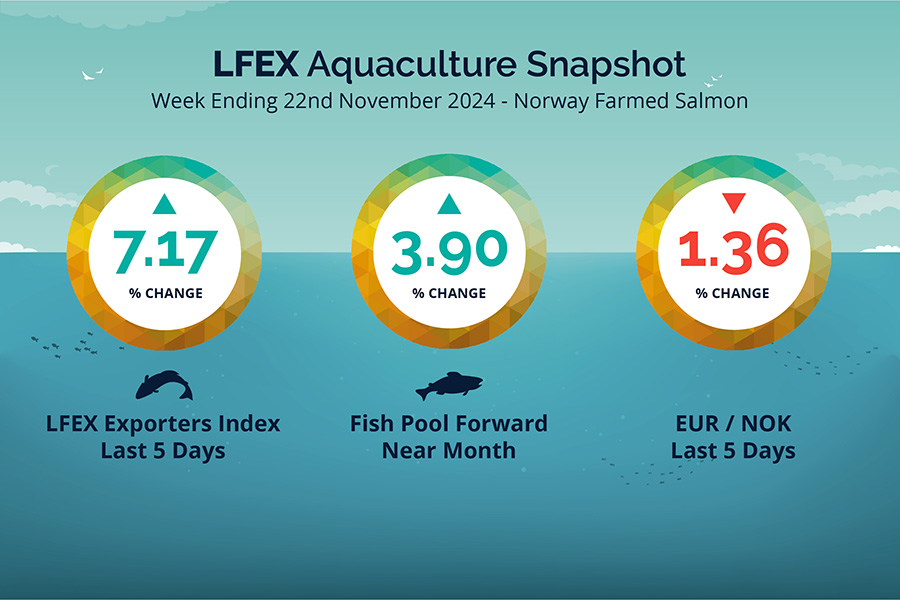

LFEX European Aquaculture Snapshot to 22nd November, 2024

|

|

Published: 22nd November 2024 This Article was Written by: John Ersser |

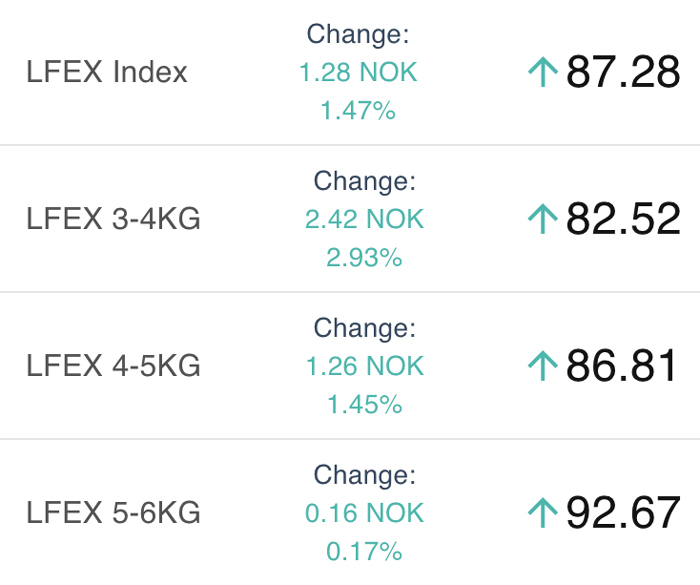

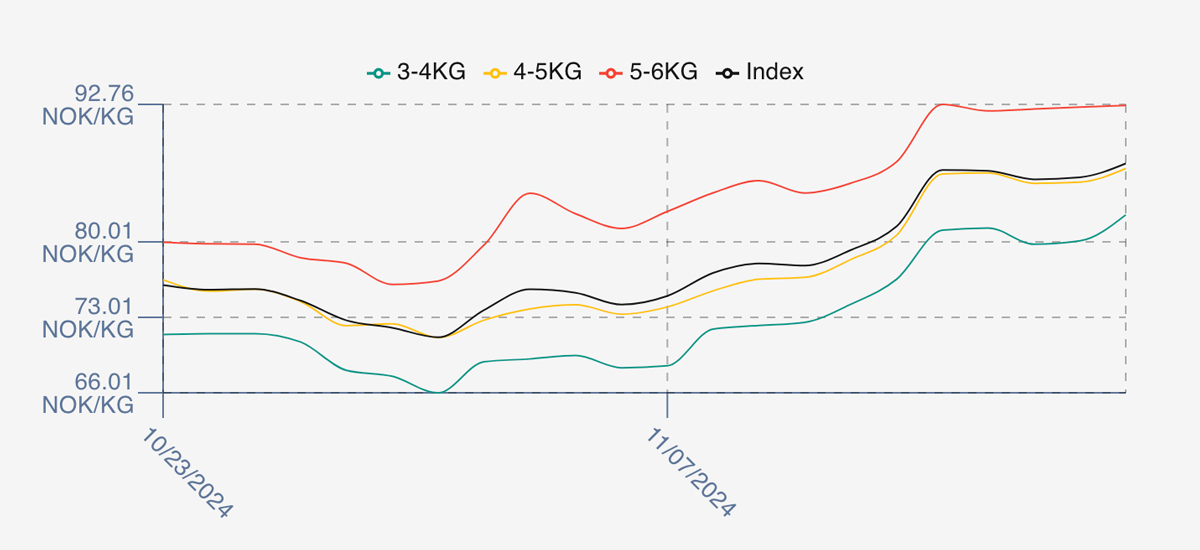

The LFEX Norwegian Exporters Index for Week 47 2024 ended the week up +5.84 NOK / +7.17% to stand at 87.28 NOK (in EUR terms 7.52 / + 0.60 / +8.65%) FCA Oslo Week ending Thursday vs previous Thursday.

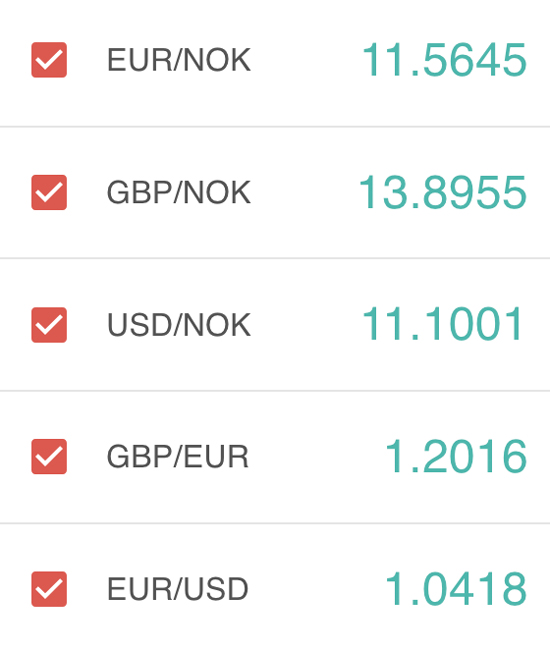

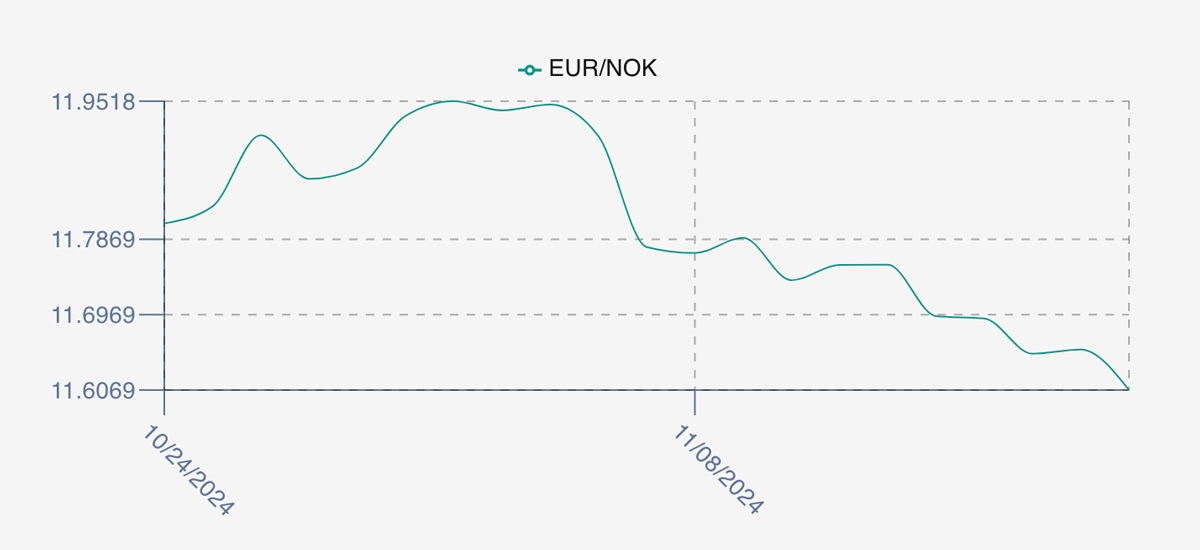

The NOK rate ended down at 11.60 to the Euro over the period Thursday to Thursday -0.16 NOK or -1.36%. The Fish Pool future November was reported up Thursday to Thursday 3.00 NOK / +3.90% at 80.0 NOK with Dec showing 84.

David Nye’s technical analysis report will be published on Monday.

The Last Week

Last week prices again opened stronger off the bat versus week 46, with the index showing a positive +5.24 NOK / +6.43% increase over the prior Thursday close for delivery week 47 at 86.68. The poorer weather / lice and reduced supply pushed prices to these levels and that’s where it stayed. There was early talk of prices giving back a little given the price bump but this did not materialise. In fact, the market remained flat for the week around the 86 mark, save for Thursday where the index was inched up a bit mainly as the 3-4s gained a little ground.

The chart shows a flat trajectory save for Thursday where the index and smaller fish increased, which had the effect of compressing the spread between sizes to just under 10 NOK.

The EURNOK FX pair took a step down last Friday to 11.695 and continued stepping down during the week to end at 11.60, bringing the comparable Euro index price higher at 7.52.

Next Week

Early pricing indications from sellers for week 48 are coming in at around 89 NOK level for the index, which represents a further increase of over Thursdays close. While there has been commentary more recently around weather, slaughter for lice and even jelly fish problems, however it seems prices are just stronger this week.

EUR NOK FX rate has reduced a little this afternoon around 11.56, off 0.04 NOK which would give an indicative Euro index price around 7.69 levels later Friday.

Volumes – Fresh Export

Volume figures for week 46 (2024) was 22,825 tons as compared to 24,833 in 2023. Volumes for weeks 47 and 48 (2023) were 22,141 and 22,910 respectively for comparison.

Historical Price Guidance for Next Week

The LFEX Norwegian Exporters Index for Week 48 2023 ended the week up +3.78%, +3.04 NOK to stand at 83.48 NOK (approximately 7.12 in EUR) FCA Oslo. The NOK rate ended up at 11.73. The Fish Pool future November was reported at 79.0 NOK with Dec showing 85.5.

David Nye’s technical analysis report will be published this Monday.

Market Data (Click Each to Expand)

| LFEX Prices | FX Rates | LFEX Indicative Exporter Prices (4 Week) | EUR / NOK FX Rate (4 Week) |

|

Prices Ending 22nd November, 2024 For Friday's Price For Next Week, Offers & Trading Please Register |

Did You Know?

Getting confused having to track multiple communication channels, is there a better way?

By having a central focus point for a market, it is much easier to direct all communications into one channel which is secure, trusted and private. We know that companies often have to juggle 6 or 7 different solutions which becomes unworkable and unreliable as a process. LFEX chat is available 24/7 with all history accessible and auditable on web and mobile with alerts meaning you never miss that important message, order or price or conversation.

FAQ’s

Q. How do I know I’m getting the best price?

A. A good question. The best price might be described better as the right price, taking into account your volumes, delivery dates and specifications. The only clear way to achieve this is to have offers from as many companies as possible and co-ordinate this, to build up the price development picture and lastly to have a refence or benchmark price to provide guidance on the current market prices and activity. It’s called a market or an exchange and it is the only independent way you can secure and evidence the right price when you trade.