The London Fish Exchange

Data / Market Insight / News

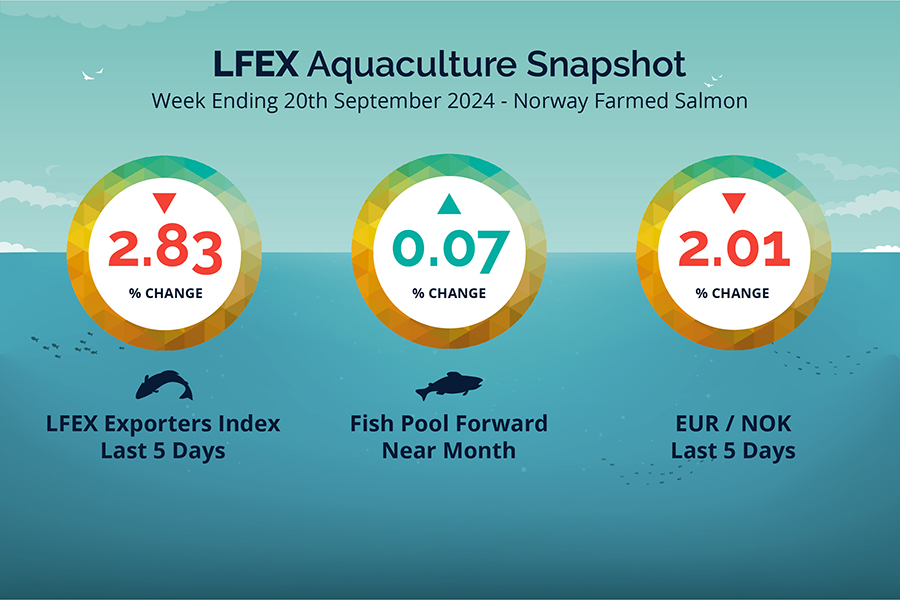

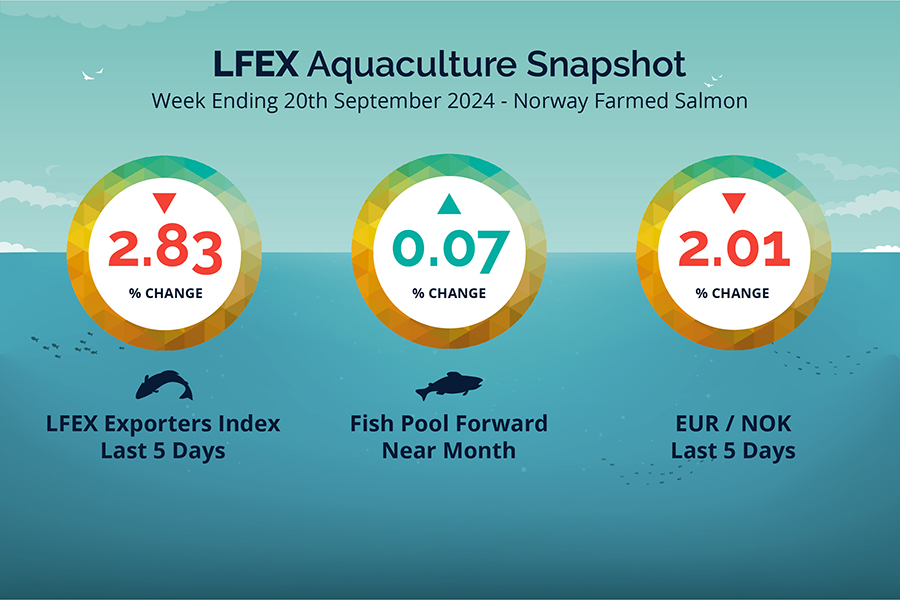

LFEX European Aquaculture Snapshot to 20th September, 2024

|

|

Published: 20th September 2024 This Article was Written by: John Ersser |

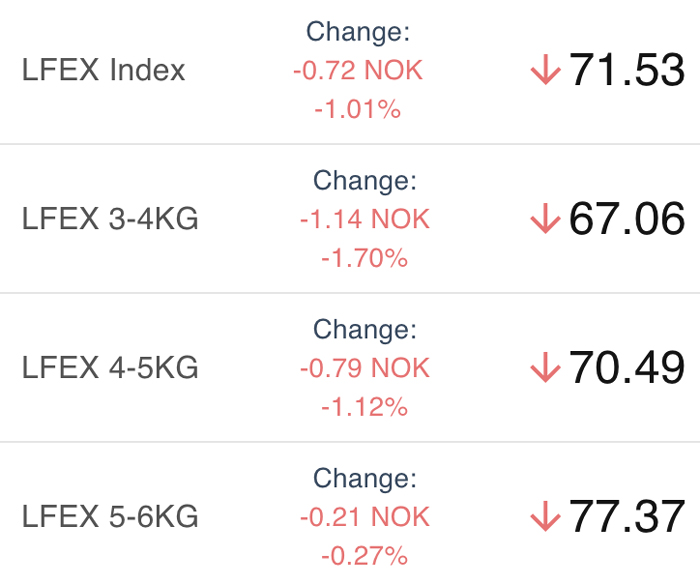

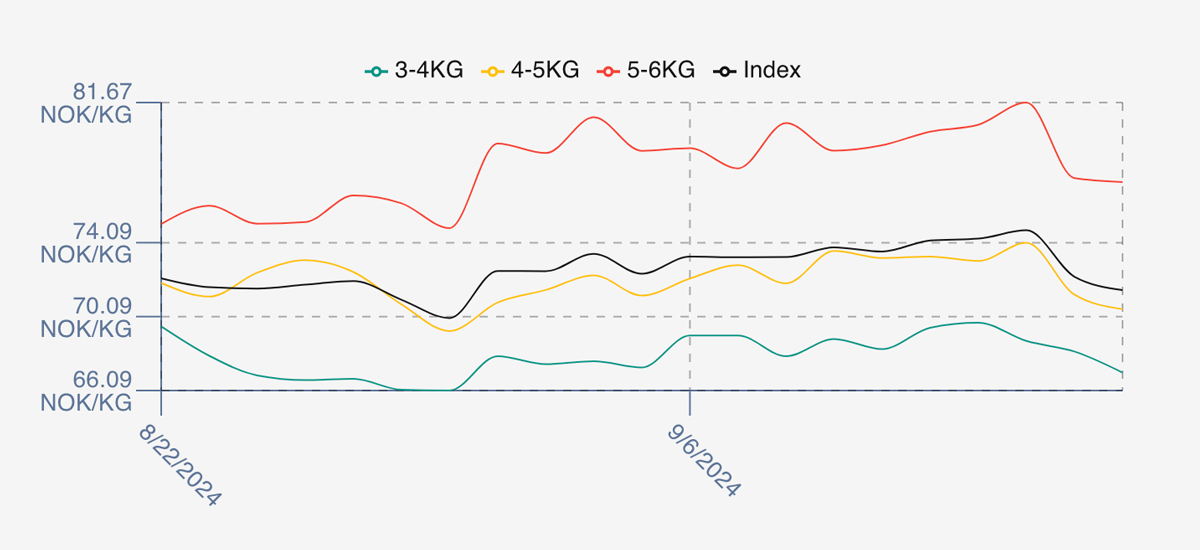

The LFEX Norwegian Exporters Index for Week 38 2024 ended the week down -2.08 NOK / -2.83% to stand at 71.53 NOK (in EUR terms 6.12 / – 0.05 / -0.83%) FCA Oslo Week ending Thursday vs previous Thursday.

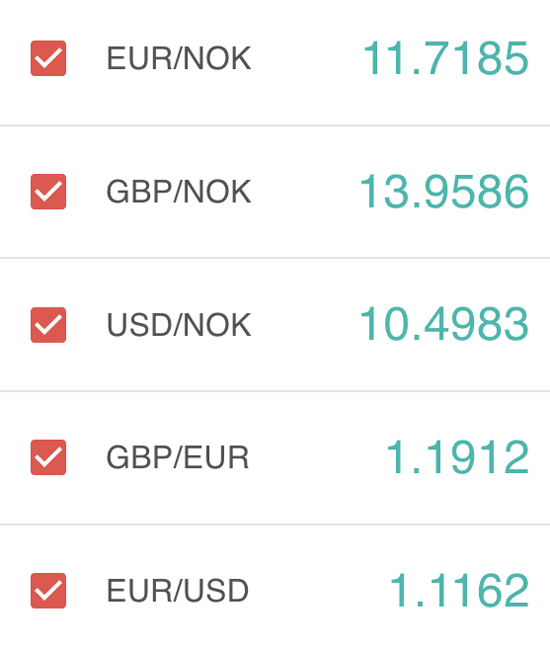

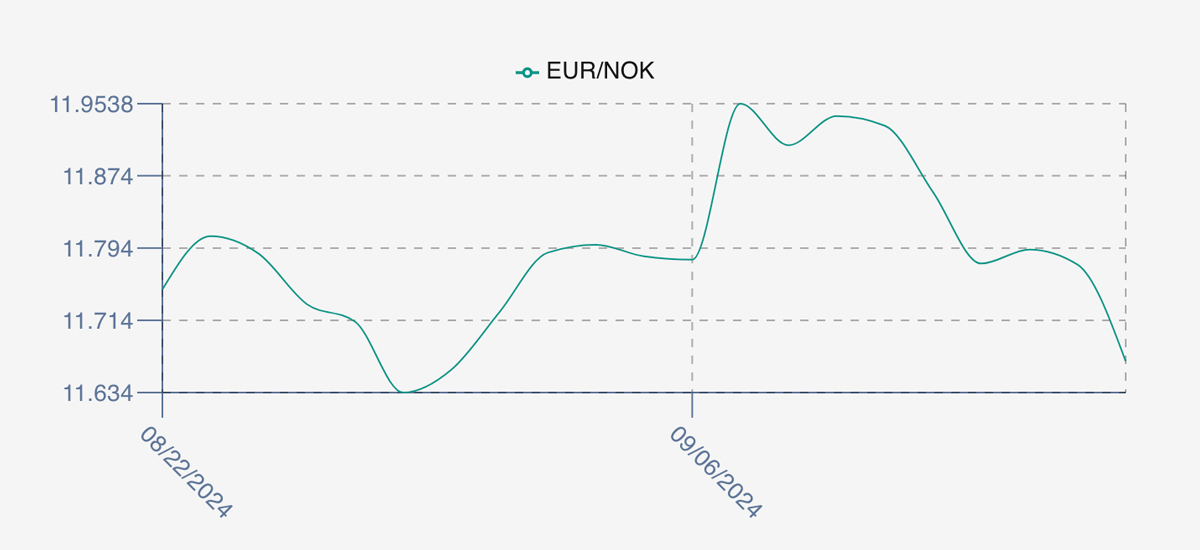

The NOK rate ended lower at 11.69 to the Euro over the period Thursday to Thursday -0.24 NOK or -2.01%. The Fish Pool future September was reported up +0.05 NOK / +0.07% at 71.75 NOK.

Last Week

A tale of two halves. Pricing opened a little stronger following the recent trajectory of slightly higher prices, with the offered index showing a 0.6 NOK raise to open at 74.21 versus last Thursday close. Overall prices were flat for the first 3 days but the average pushed on to 74.31 on Monday and 74.76 on Tuesday, the high for the week. 5-6s reached 81 offered on Tuesday, whilst smaller fish 3-4s followed a similar pattern. Wednesday saw a change of fortune as the bigger fish dropped off 4 NOK, 4-5s dropped 3 NOK and the weakness continued into Thursday at 71.53 to close out.

Spreads remain wide with the week closing out at 10 NOK, as an abundance of smaller sizes remained available.

The FX rate faced a reversal of fortune this week dropping 0.24 NOK lower / -2.01% at 11.69. This made the Euro price 6.12 down -0.83% by comparison and better news for NOK sellers.

Next Week

Early opening indications from sellers for week 39 are coming in at around the 71 NOK level offered for the index. Prices have been coming down from Wednesday last week, with unsold fish at the end of a record week for volumes. That said pricing is down across the board. Lice problems adding to good volumes generally and putting pressure on smaller sized fish. Logistics are under pressure adding to delivered costs.

Volumes

Volume figures for week 37 (2024) was (a record) 28,799 tons versus a lower 25,480 in 2023. Volumes for weeks 38 and 39 (2023) were 24,851 and 24,952 respectively for comparison.

Historical Price Guidance for Next Week

The LFEX Norwegian Exporters Index for Week 39 2023 was up +6.14%, +4.69 NOK to stand at 81.13 NOK (approximately 7.17 EUR) FCA Oslo. The NOK rate was fell to 11.32 to the Euro and the Fish Pool future September was reported up +0.5 NOK, +0.68% at 74.5 NOK with October showing 74.

David Nye’s technical analysis report will be published on Monday.

Market Data (Click Each to Expand)

| LFEX Prices | FX Rates | LFEX Indicative Exporter Prices (4 Week) | EUR / NOK FX Rate (4 Week) |

|

Prices Ending 20th September, 2024 For Friday's Price For Next Week, Offers & Trading Please Register |

Did You Know?

You can manage sales inventory to target customers.

If you know how much you want to move, at what price and which potential customers you want to sell it to – you can configure this in seconds on the system. You can then manage this in real-time, chip away at the orders but always in control of where you are at. You can use the chat facility to engage with and encourage customers around your offer.

FAQ’s

Q. Can I communicate in a different language on the platform?

A. The good news is that the chat service supports multilanguage / characters meaning as long as users have the necessary input keyboard, they can communicate in any language they choose. This includes Chinese characters – for which you can use Google translate to …translate, as well as the ever-helpful emojis.