The London Fish Exchange

Data / Market Insight / News

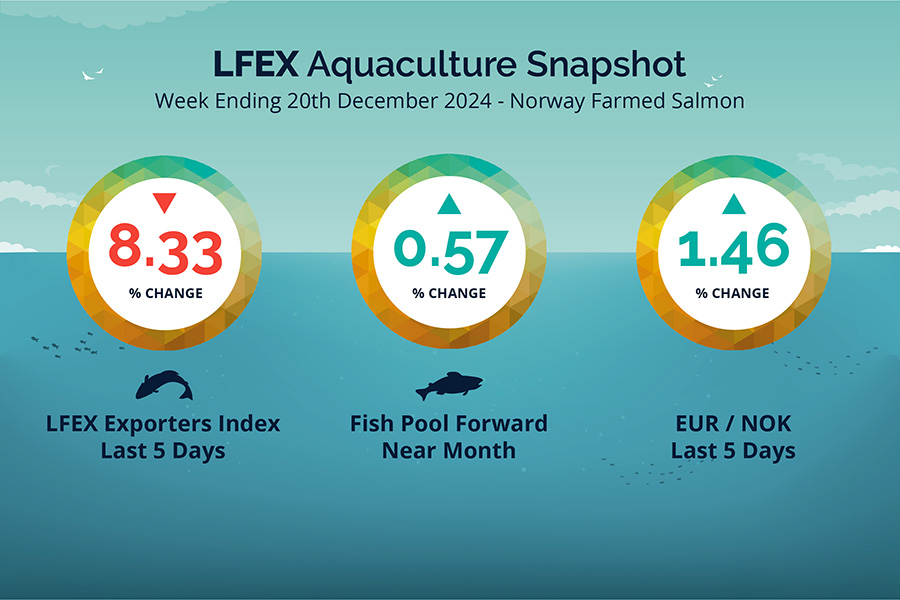

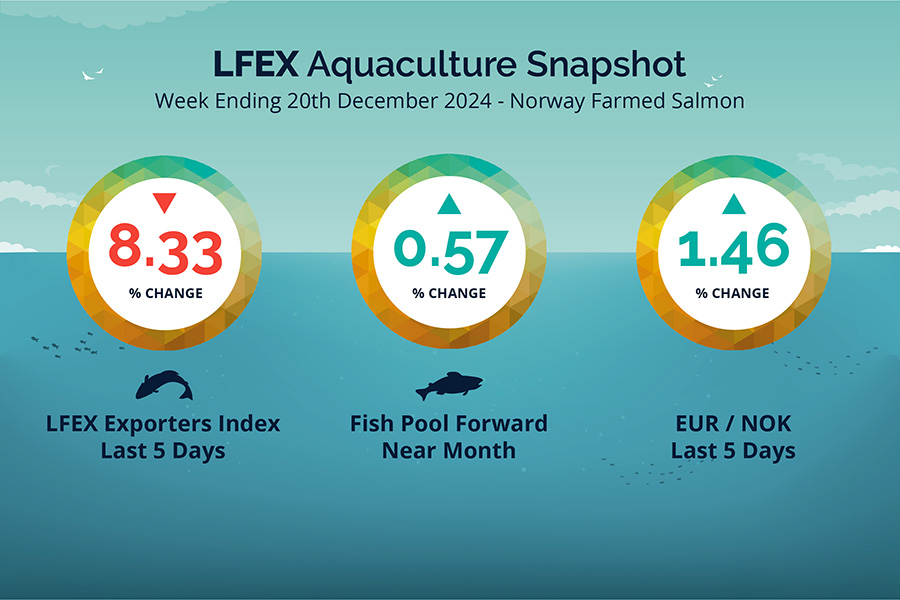

LFEX European Aquaculture Snapshot to 20th December, 2024

|

|

Published: 21st December 2024 This Article was Written by: John Ersser |

The LFEX Norwegian Exporters Index for Week 51 2024 ended the week down -7.55 NOK / -8.33% to stand at 83.13 NOK (in EUR terms 7.03 / -0.75 / -9.64%) FCA Oslo Week ending Thursday vs previous Thursday.

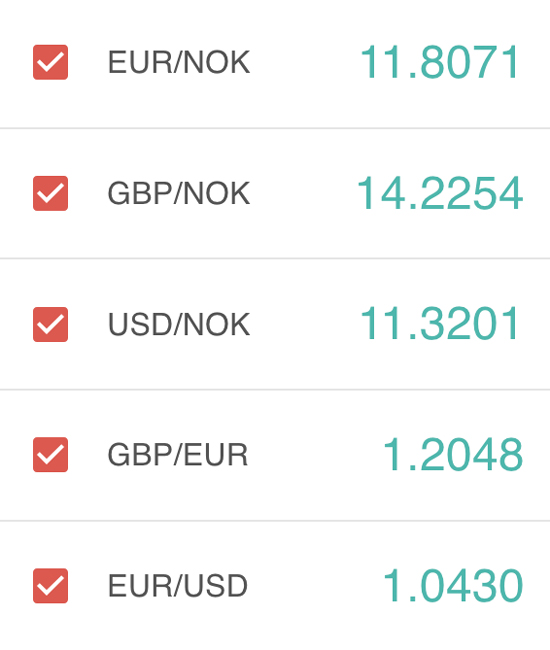

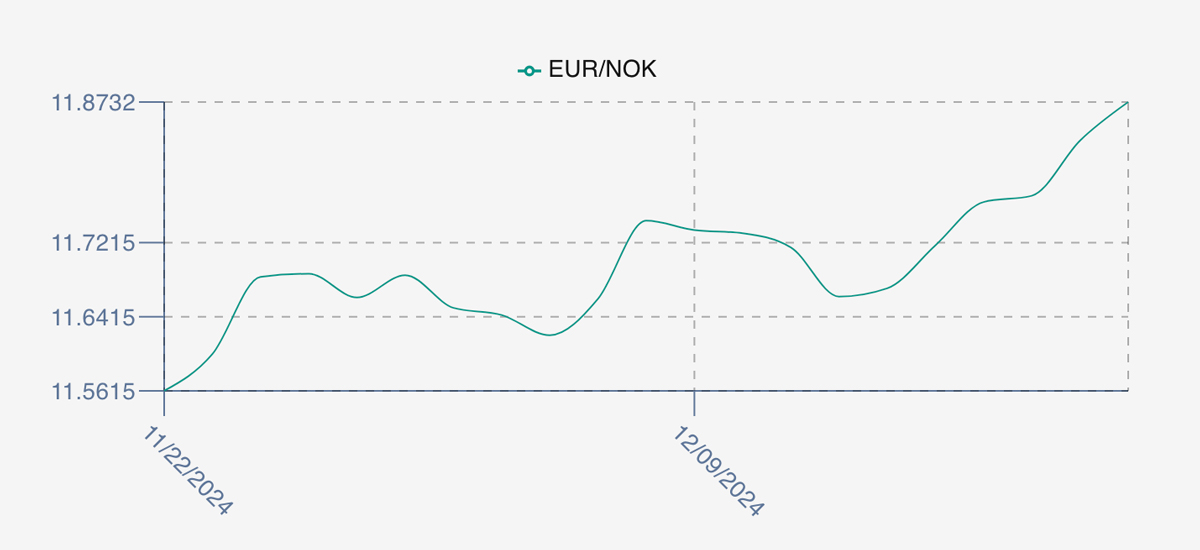

The NOK rate ended up +0.17 NOK / +1.46% k at 11.83 to the Euro over the period Thursday to Thursday. The Fish Pool future December was reported up Thursday to Thursday +0.50 NOK / +0.57% at 88.00 NOK which equates to 7.44 Euro with January showing 7.53 Euro.

The Last Week

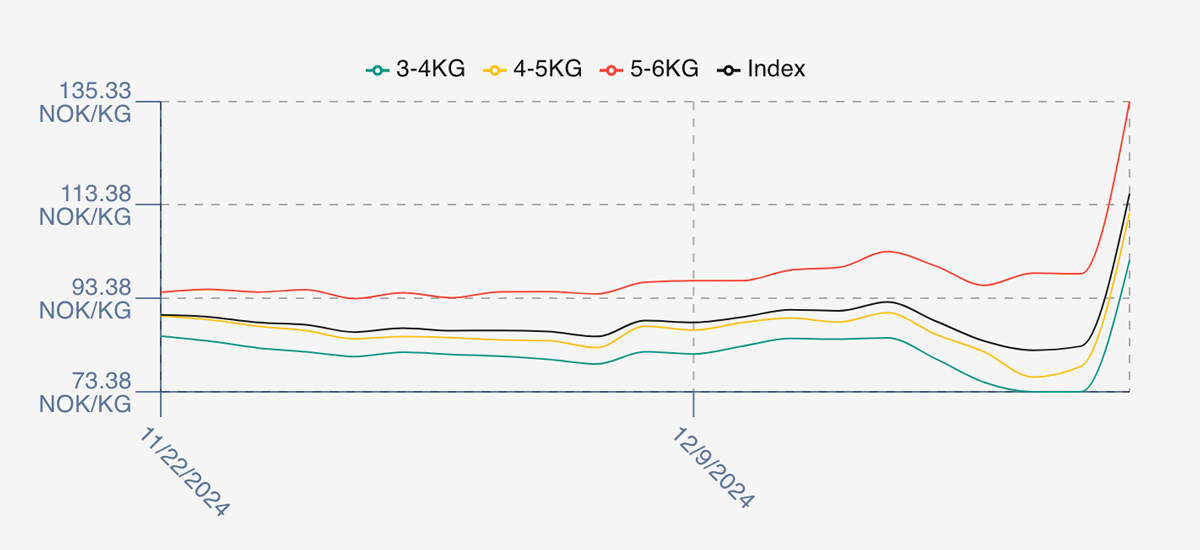

Last week overall the index price moved sharply downwards in the last full production week before Christmas. Friday open was strong as sellers eked out a further 1.88 NOK, +2.07% to open the week at 92.56. This wasn’t expected to last, and prices fell on a fairly even trajectory over the week as demand started its seasonal reduction. Monday lost 4 NOK at 88.46, Tuesday a further 4 NOK at 84.22 and Wednesday saw 82.25 NOK. Thursday was a slight surprise as the index edged up fractionally to close at 83.13.

Spreads between sizes gapped massively this week as the larger fish supply remained tight. Friday 5/6s peaked at 103, while dropping Monday and Tuesday down to 96 before popping up a further 2.5 NOK to 98.5 for Wednesday and Thursday. The smaller sized 3/4s meanwhile tanked from 84.9 down to 73.4 at the close -11.5 NOK / -13.5% on the week. 4/5s followed them down but also corrected on Thursday finishing at 78.8 offered. The total spread at the end of the week 25.4 NOK.

The EURNOK FX pair saw NOK weakness as the rate climbed steadily over the week to 11.83 or 1.46% giving a comparable Euro index price at 7.03 Euro, a not inconsiderable -9.64% drop over the week.

Next Week

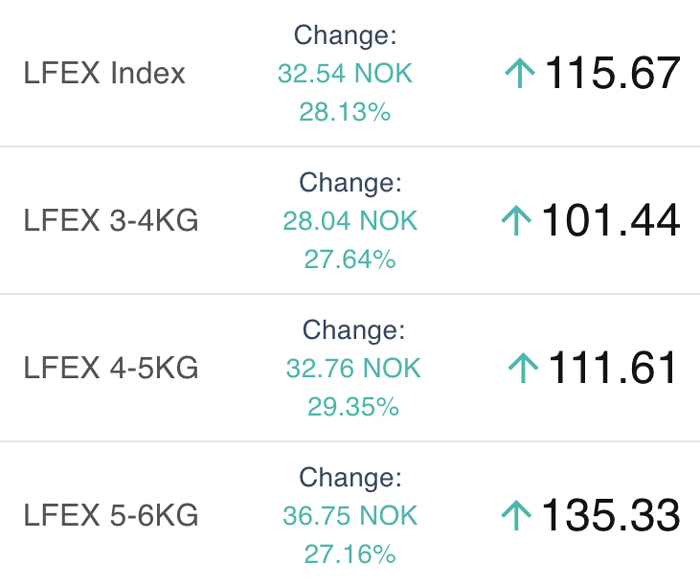

Early pricing indications from sellers for week 52 are coming around the 115 NOK level offered for the index – a huge jump from where we left off last week as prices reach for the stars. However, this is not abnormal pricing behaviour for this week of the year (see comment below). There are 2 production days next week and small volumes squeezing prices which buyers have to chase. All sizes (3-6) have increased around 28% – 29% and the spread remains around 25NOK.

EUR NOK FX rate has picked up slightly at 11.84 which would give an indicative Euro index price around 9.77 on levels later Friday.

We wish everyone a very Happy Christmas and compliments of the season.

Volumes – Fresh Export

Volume figures for week 50 (2024) was 25,658 tons up +1,107 tons as compared to 24,551 in 2023. Volumes for weeks 51 and 52 (2023) were 18,480 and 10,440 respectively for comparison.

Historical Price Guidance for Next Week

The LFEX Norwegian Exporters Index for Week 52 2023 ended the week up +27.85%, +23.46 NOK to stand at 107.69 NOK (in EUR terms 9.56) FCA Oslo. The NOK rate ended down at 11.26. The Fish Pool future December was reported up + 3.00 NOK, +3.53% at 88.0 NOK with January showing 105.2.

David Nye’s technical analysis report will be published this Monday.

Market Data (Click Each to Expand)

| LFEX Prices | FX Rates | LFEX Indicative Exporter Prices (4 Week) | EUR / NOK FX Rate (4 Week) |

|

Prices Ending 20th December, 2024 For Friday's Price For Next Week, Offers & Trading Please Register |

Did You Know?

After you have executed transactions on the platform you can access documentation from this order?

By executing on the platform, you have a confirmed transaction between you and your counterparty – a fully electronically documented record of your transaction with all associated details contained in this. These details are immediately available in real-time to both parties and can be accessed whenever required. All history is maintained within the system. Further, a full suite of documentation can then be attached to these records whether it is invoices, specifications, logistics etc making all relevant trade documentation available to both parties the instant they are uploaded / updated.

FAQ’s

Q. When is LFEX open?

A. Like the city, the platform never sleeps. It is available for use 24 x 7 x 365. The nature of aquaculture trading is global with sellers and buyers from all corners of the planet. It is the perfect tool to manage orders 24 hours a day. It allows users to put up offers and requests when counterparties are asleep, knowing when they wake up and are available the system will have notified them of any new offers or orders they need to react to. Or perhaps just a morning chat or end of day round-up to keep building that relationship.