The London Fish Exchange

Data / Market Insight / News

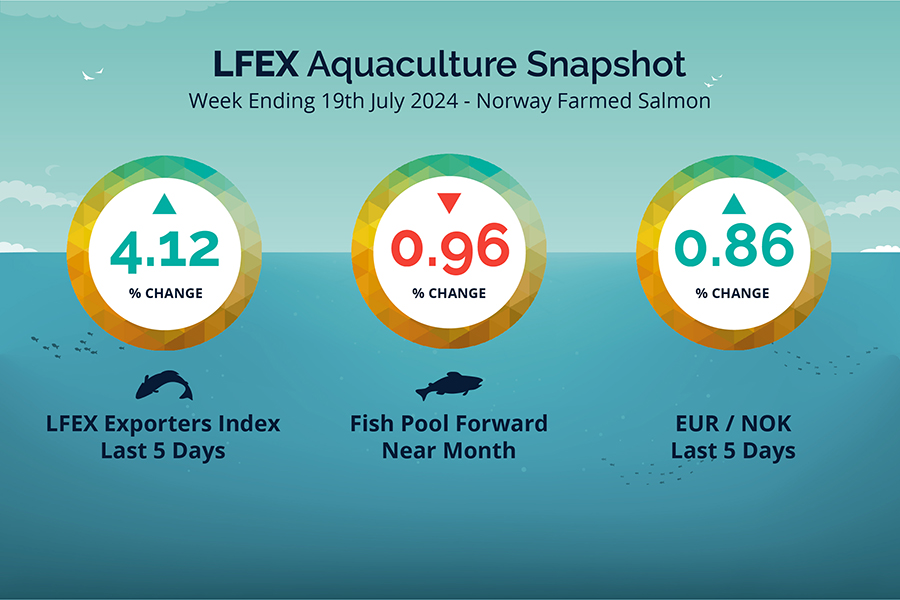

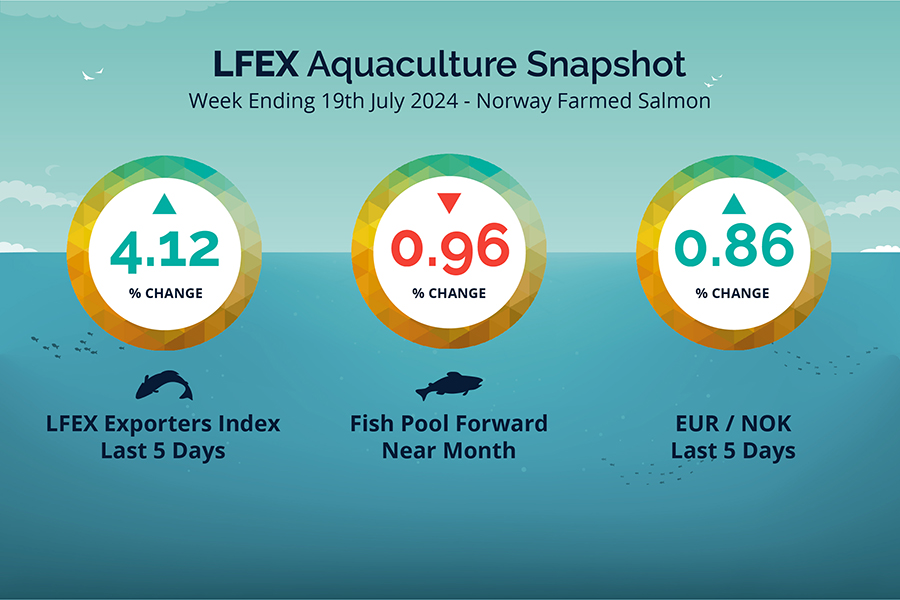

LFEX European Aquaculture Snapshot to 19th July, 2024

|

|

Published: 19th July 2024 This Article was Written by: John Ersser |

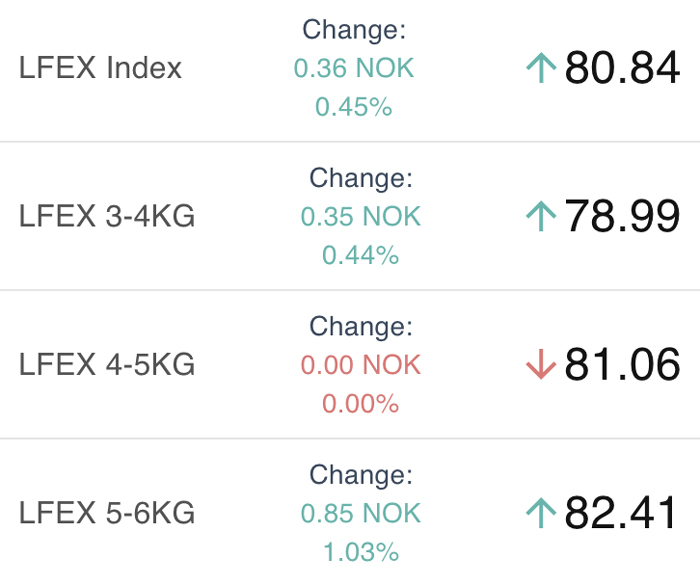

The LFEX Norwegian Exporters Index for Week 29 2024 ended the week up +4.12%, +3.20 NOK to stand at 80.84 NOK (in EUR terms 6.87 / + 0.22 / +3.24%) FCA Oslo Week ending Thursday vs previous Thursday.

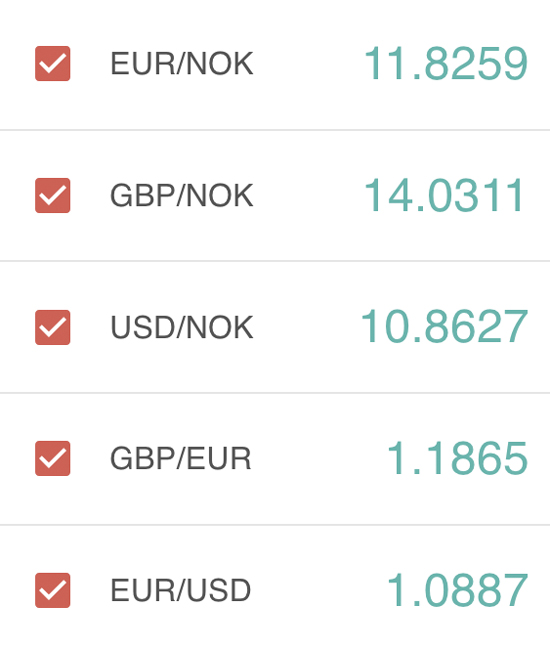

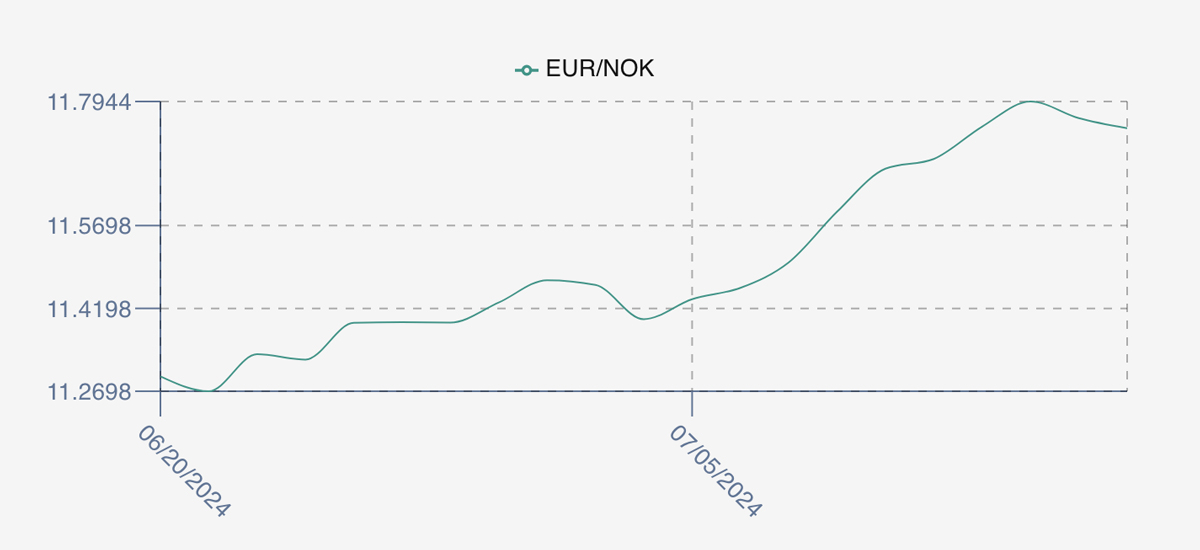

The NOK rate ended up, at 11.77 to the Euro over the period Thursday to Thursday +0.10 NOK or +0.86%. The Fish Pool future July was reported down – 0.75, -0.96% at 77.15 NOK.

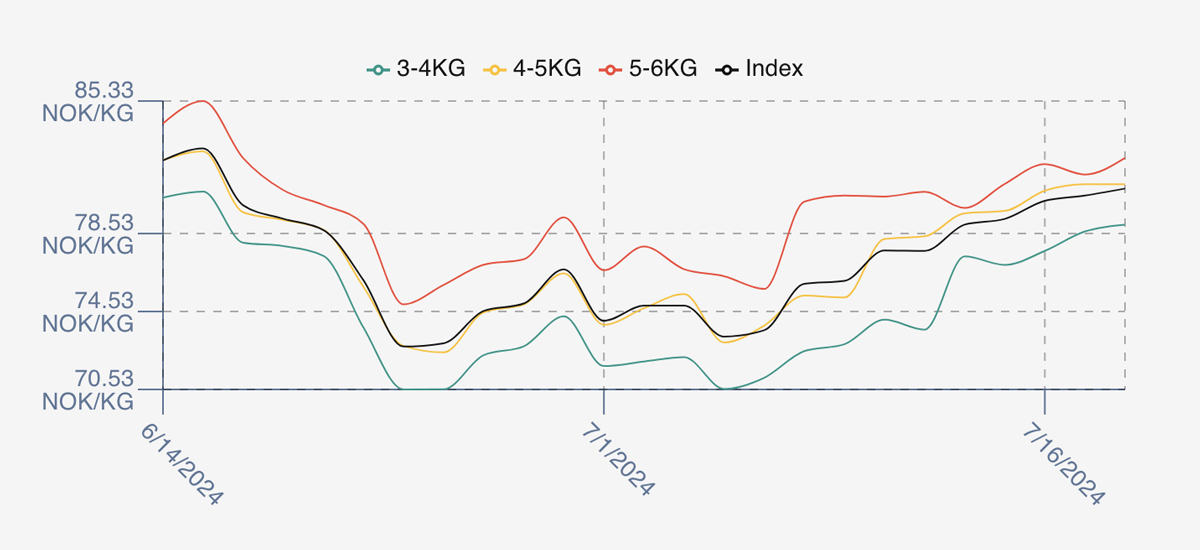

Pricing opened up +1.35 NOK / 1.75% at 78.99 as compared to the prior weeks close to set the tone for week 29 trading. The week provided stable pricing again with no large volatility swings. Prices crept up on Monday to 79.28 and in fact the week experienced a gentle appreciation with Tuesday at 80.12, Wednesday at 80.48 and closed on the high of the week at 80.84.

Spread have come in to around 3.5 NOK 3/4s – 5/6s. The NOK weakness continued this week with another 1% softening. Arguably good for farmers / exporters in NOK and buyers in EUR.

Pricing for next week is a little thin but looks like we are kicking off from where we left off last week which would put the offered rate at around 80 again on similar volumes. No great volatility expected at the moment but given the excitement of earlier in the year this stability is helpful.

Volumes

Volume figures for week 28 (2024) were 18,421 tons versus a lower 17,844 in 2023. Volumes for weeks 29 and 30 (2023) were 17,898 and 19,604 respectively.

Historical Price Guidance

A year ago, Week 30 2023 prices ended down -4.42%, -3.84 NOK to stand at 83.04 NOK FCA Oslo while the Euro stood at 11.14 and Fishpool July showed 88.75.

David Nye’s technical analysis report will be published on Monday.

Market Data (Click Each to Expand)

| LFEX Prices | FX Rates | LFEX Indicative Exporter Prices (4 Week) | EUR / NOK FX Rate (4 Week) |

|

Prices Ending 19th July, 2024 For Friday's Price For Next Week, Offers & Trading Please Register |

Did You Know?

You can find historical weekly reports and data from LFEX going back over 3 years.

We collect manage and maintain all data to allow the market the ability to use and interpret information they find useful. With 3 years of unique high quality daily data it is the only place you can access pricing trends at such a granular level.

FAQ’s

Q. Can I manage a sub-set of my client list to show prices or specific requests for prices?

A. Yes the LFEX system flexibility allows users to show interest to one counterpart, all counterparties or a specific group of counterparties that you chose. The system is built to be as flexible as possible, replicating real world processes, but automating them making it much more efficient. So if you want to quote/target a sub-set of users because of geography / currency / inco terms etc it is easy to do.