The London Fish Exchange

Data / Market Insight / News

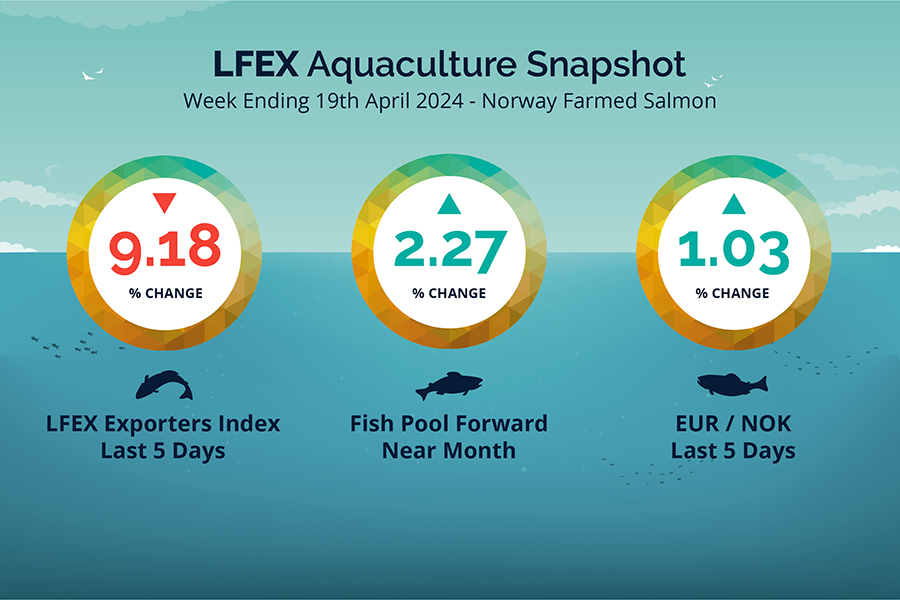

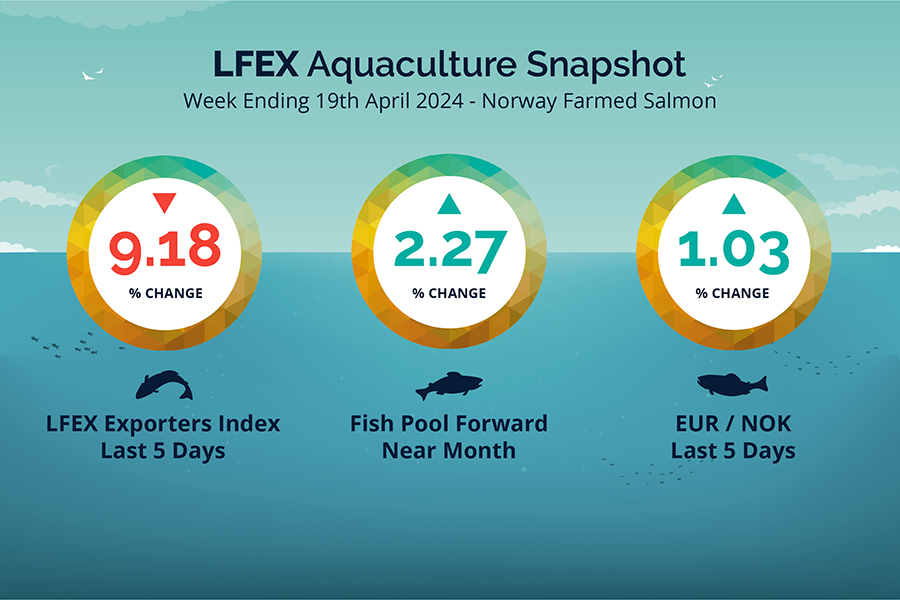

LFEX European Aquaculture Snapshot to 19th April, 2024

|

|

Published: 19th April 2024 This Article was Written by: John Ersser |

The LFEX Norwegian Exporters Index for Week 16 2024 ended the week down -9.18%, -12.59 NOK to stand at 124.54 NOK (in EUR terms 10.62 / -1.19 / -10.11%) FCA Oslo Week ending Thursday vs previous Thursday.

The NOK rate ended up at 11.73 to the Euro over the period Thursday to Thursday +0.12 NOK or +1.03%. The Fish Pool future April was reported up +2.9 NOK, +2.27% at 130.50 NOK.

Another full trading week this week with prices starting to come off from their recent record highs. The market opened lower on Friday at 131.28 a fall of around 5% on the prior weeks close and maintained this level through Monday as spreads compressed a little between sizes. Tuesday saw a notch down to 127.93, with Wednesday further weakness 126.57 and finally closing out at 124.54 for a not insignificant drop of over 9% on the week and over 10% in Euro terms as the NOK weakened further.

Volume figures for week 15 were up on the prior week at 13,015 versus 11,675 tons the week prior. Week 15 2023 saw exports at 15,265 – which was a big jump on the prior week. So, volumes are still down.

Next week prices are coming down further. There is left over supply in the system which is being pushed through at cheaper prices. Barcelona is on peoples minds and sellers are keen to clear the decks for next week. However, buyers aren’t biting in volume, which means more selling activity next week. Harvest volumes are looking flat but more superiors in the mix. Early indications on the index around 119 / 120 NOK going in to next week.

By comparison week 17 2023 prices ended at 112.89 NOK down 5% on the week. The EURONOK rate was 11.79 similar to current.

David Nye’s technical analysis report will be published on Monday.

Market Data (Click Each to Expand)

| LFEX Prices | FX Rates | LFEX Indicative Exporter Prices (4 Week) | EUR / NOK FX Rate (4 Week) |

|

Prices Ending 19th April, 2024 For Friday's Price For Next Week, Offers & Trading Please Register |

Did You Know?

You can place orders / make offers (or RFQ’s) on the system for any period you want. So if you want to make an offer for a limited period, or offer a firm price you are prepared to buy at over a short period you can do that. In fact you can define any time period you want from minutes to weeks, allowing you to match your orders with your business demands.

It also means you can for example put out offers for available frozen inventory, and update prices as often as you want against this without having to constantly resend offers.

FAQ’s

Q. I get confused having to track multiple communication channels, is there a better way?

A. By becoming a central focus point for a market, it is much easier to direct all communications into one channel which is secure, trusted and private. We know that companies often have to juggle 6 or 7 different solutions which becomes unworkable and unreliable as a process. LFEX chat is available 24/7 with all history accessible and auditable on web and mobile with alerts meaning you never miss that important message, order or price or conversation.