The London Fish Exchange

Data / Market Insight / News

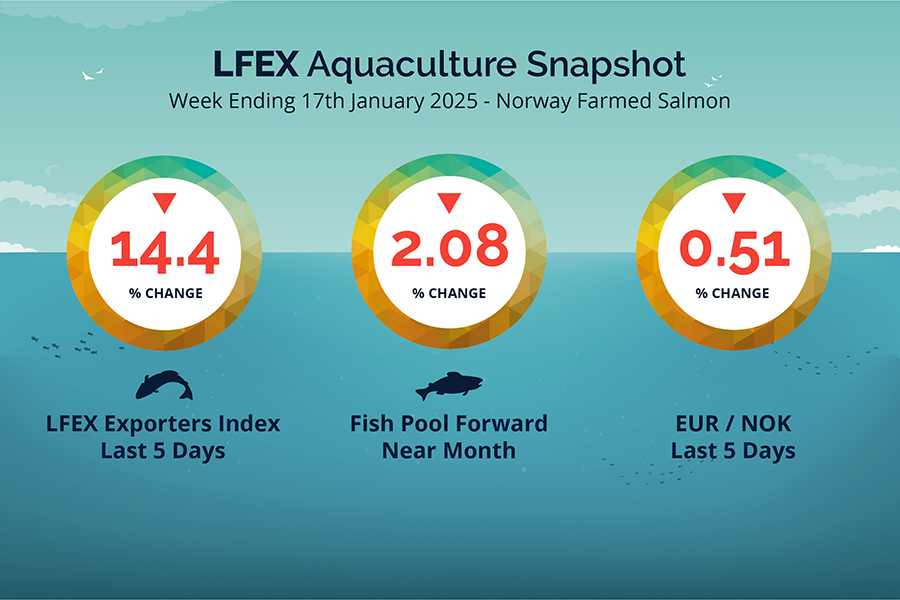

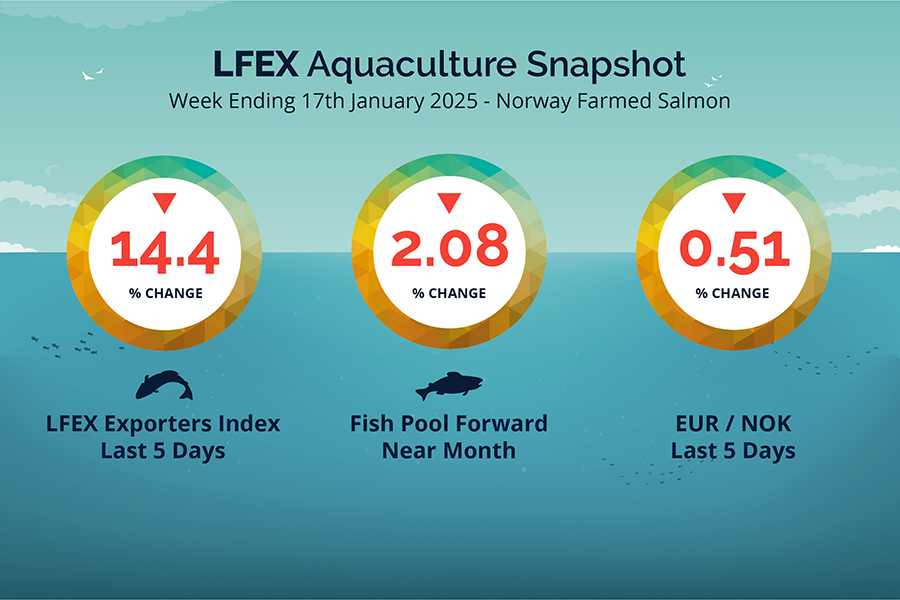

LFEX European Aquaculture Snapshot to 17th January, 2025

|

|

Published: 17th January 2025 This Article was Written by: John Ersser |

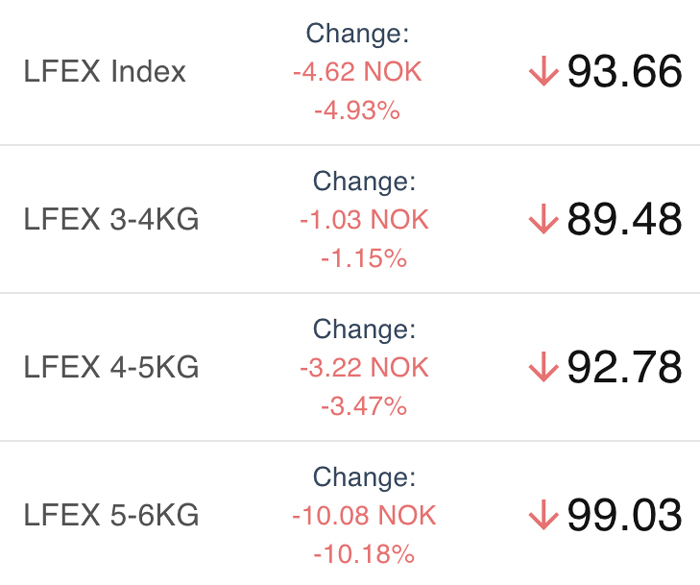

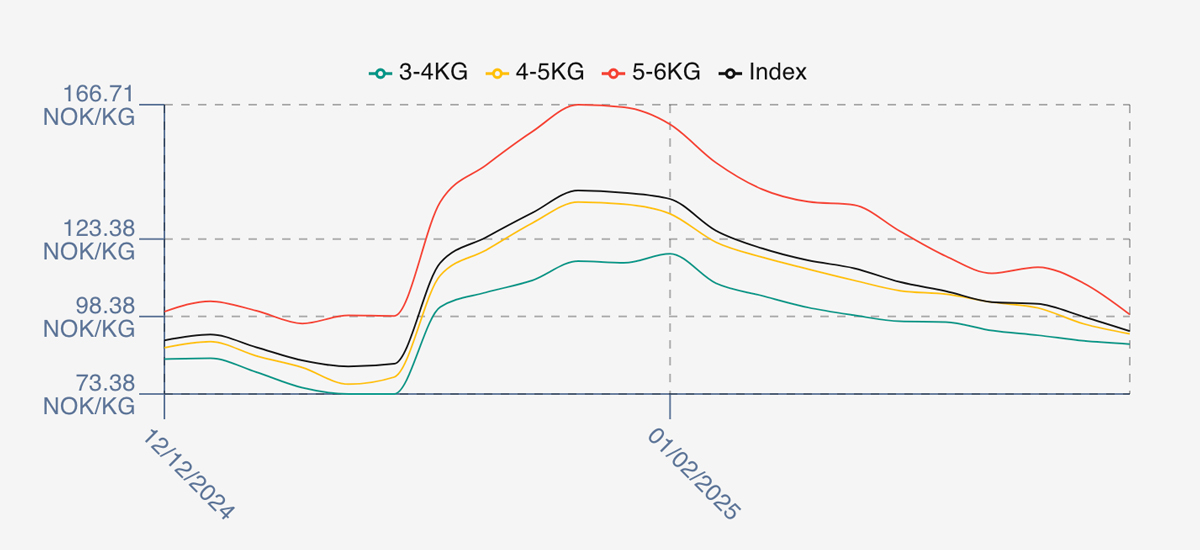

The LFEX Norwegian Exporters Index for Week 3 2025 ended the week down -15.85 NOK / -14.47% to stand at 93.66 NOK (in EUR terms 8.01/ -1.31 /-14.03%) FCA Oslo Week ending Thursday 9th vs previous Thursday.

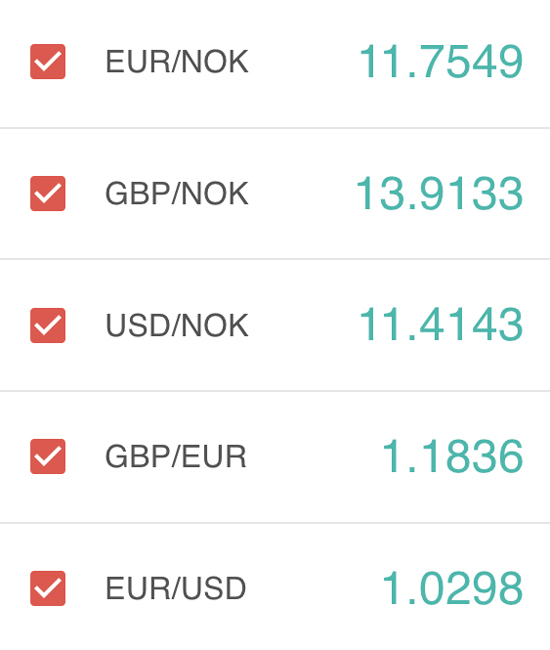

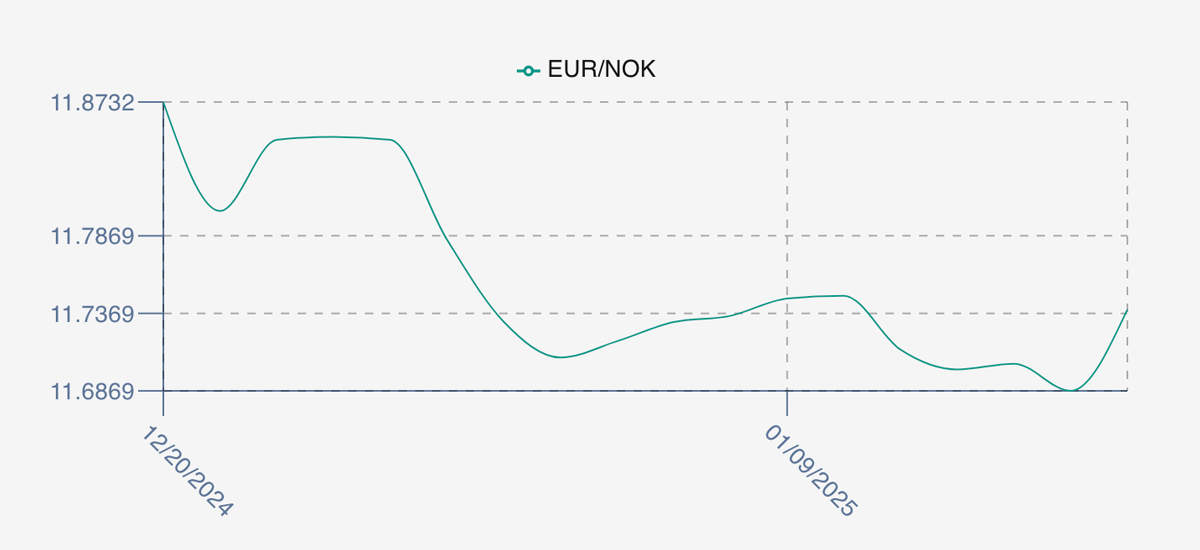

The NOK rate ended down -0.06 NOK /-0.51% at 11.69 to the Euro over the period Thursday to Thursday. The Fish Pool Euronext future February was reported down Thursday to Thursday -0.2 EUR / -2.08% at 9.40 EUR which equates to approximately 109.88 NOK.

The Last Week

This week we saw the continued correction in prices. There had been consideration on Friday that prices might start to hold as the index opened at 106.57, a 3 NOK drop from the Thursday pricing. Monday was similar down a further 3 NOK at 103.04 and Tuesday relatively stable at 102.46, but still softer. Wednesday took a 4 NOK chunk out of the index and Thursday near 5 NOK lower closing out at 93.66. The larger fish 5-6s took the brunt of the falls this week with an offered high at 114 and a close out low at 99 NOK. Supply was good and left over fish pushed the pricing down at the weeks end.

Spreads between sizes came in substantially showing less than 10 NOK and a serious compression as spreads become more normalised.

The EURNOK FX rate decreased to 11.69 NOK giving a comparable Euro index price of 8.01 Euro.

Next Week

Early pricing indications from sellers for next week are coming around the 99.5 NOK level offered for the index – a reasonable pick-up from Thursday lows. Chinese New Year is looming 29th January, but a sense demand expectation won’t have been met. Later in the week price movements are uncertain at this stage.

EUR NOK FX rate started the day at 11.70 levels and has increased this afternoon to the 11.75 levels. This would give an indicative Euro index price around 8.46 on levels later Friday.

Volumes – Fresh Export

Volume figures for week 2 (2025) was 15,939 tons down – 77 tons as compared to 16,016 in 2024. Volumes for week 3 and week 4 (2024) were 14,622 and 15,342 respectively for comparison.

Historical Price Guidance for Next Week

The LFEX Norwegian Exporters Index for Week 4 2024 ended the week up +4.29%, +4.25 NOK to stand at 103.25 NOK (in EUR terms 9.07) FCA Oslo. The NOK rate ended down at 11.38. The Fish Pool future January was reported up +0.40 NOK, +0.38% at 106.5 NOK.

David Nye’s technical analysis report will be published this Monday.

Market Data (Click Each to Expand)

| LFEX Prices | FX Rates | LFEX Indicative Exporter Prices (4 Week) | EUR / NOK FX Rate (4 Week) |

|

Prices Ending 17th January, 2025 For Friday's Price For Next Week, Offers & Trading Please Register |

Did You Know?

You can amend or add to orders transacting on LFEX?

The system allows you to very quickly put up offers / orders within the RFQ service and manage pricing in real-time. The system not only lets you manage order parameters during the sale/purchase process but by single or multiple counterparties. It has been built to replicate your business workflows, is highly flexible and captures your business activity / management perfectly.

FAQ’s

Q. How can I optimise my sales in weeks where there may be more volume coming through?

A. Active engagement with as many counterparties as possible will help with distribution. Widening global reach would also help with this, especially if the softness is within a particular market, and funnel volume elsewhere. Proactive updating of pricing and offers will create a sense of movement in the market and spur activity, as well as targeted pricing by clients or geography. Encourage engagement with dialogue on chat and market updates and even get buyers to put up bids to you help build a better market picture.