The London Fish Exchange

Data / Market Insight / News

LFEX European Aquaculture Snapshot to 15th February, 2024

|

|

Published: 16th February 2024 This Article was Written by: John Ersser |

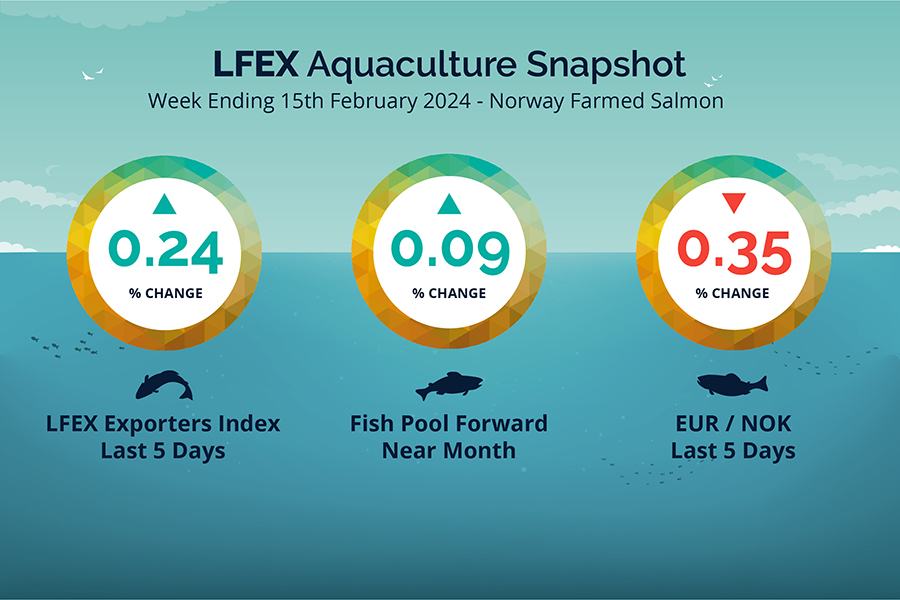

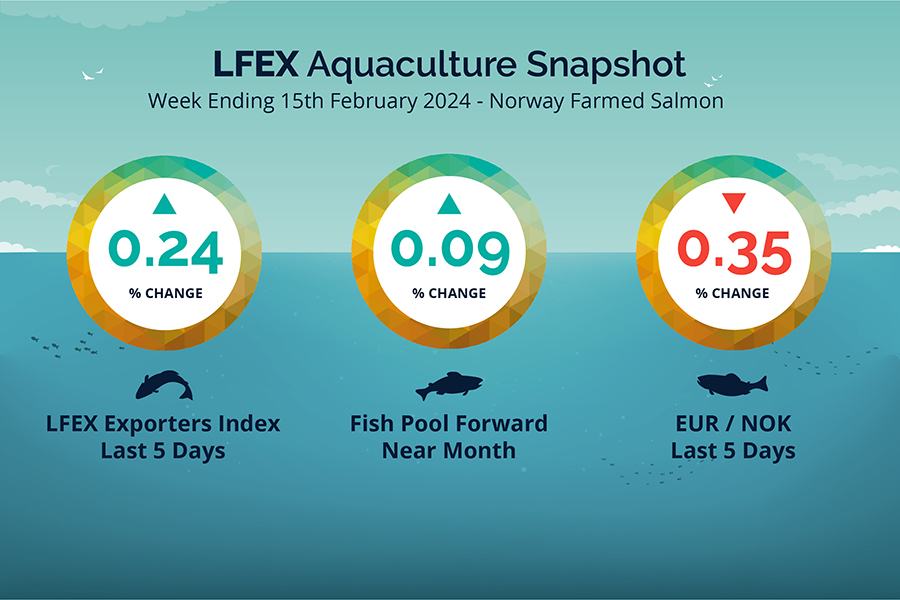

The LFEX Norwegian Exporters Index for Week 7 2024 ended the week up +0.24%, +0.26 NOK to stand at 109.46 NOK (in EUR terms 9.64 / +0.06 / +0.59%) FCA Oslo Week ending Thursday vs previous Thursday.

The NOK rate ended down at 11.36 to the Euro over the period Thursday to Thursday -0.04 NOK or -0.35%. The Fish Pool future February was reported up +0.10 NOK, +0.09% at 109.60 NOK.

The index opened up small last Friday +1.18% at 110.5 as prices held onto their previous closing levels (109.20). Monday saw a further rise to 111.39, and Tuesday 112.16 the peak for the week. Expectation was that prices would fall back later in the week which they did, with the week ending marginally higher at 109.46. Euro prices showing a little more at 9.64 as the NOK put on a 1/3 of a percent. Larger fish 5/6s showing a more marked decrease Wed/Thurs bring the index down and the spread between 3/4s and 5/6s down to around 15 NOK (from 21 the week prior). Prices were pretty stable on low volumes.

Next week is a difficult one to call. Price discovery is hard in early market. There is the expectation that volumes will be further restricted for week 8, forcing offered prices up maybe 9 – 10 NOK. Whether customers will buy anything other than the bare minimum they require is questionable at these levels, given that they have been quiet at week 7 levels.

By Comparison – pricing for Week 8 last year was a strong week ending up at 119.7 as low harvest volumes squeezed supply.

David Nye’s technical analysis report will be published later next week.

Market Data (Click Each to Expand)

| LFEX Prices | FX Rates | LFEX Indicative Exporter Prices (4 Week) | EUR / NOK FX Rate (4 Week) |

|

Prices Ending 15th February, 2024 For Friday's Price For Next Week, Offers & Trading Please Register |

Did You Know?

LFEX has significant experience in building and running internal trading, middle and back-office systems?

This means our experience and systems used to run and operate markets, also provides the basis for internal technology solutions for producers / sales organisations and also buyside companies. Feel free to contact us to discuss your internal technology requirements and how it can be a bespoke and unique solution for your local and global business operations and needs.

FAQ’s

Q. Can I as a buyer enter a price that I am prepared to trade on?

A. 100% yes. Buyers can not only make specific requests based on their own requirements, they can also include a price that they are prepared to buy at. Sellers can accept this price and trade with you, or counter with their own price(s). Buyers can amend their prices, or withdraw them at any time, and are in complete control of the prices they want to show and to whom they want to show them.

This is a great way of building an understanding of a market where there are both sellers prices and buyers prices are visible.