The London Fish Exchange

Data / Market Insight / News

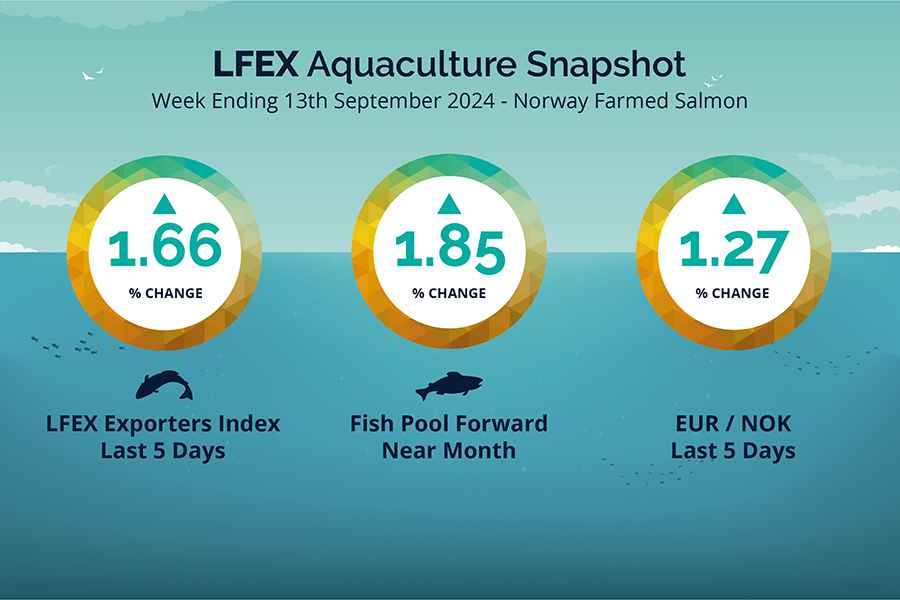

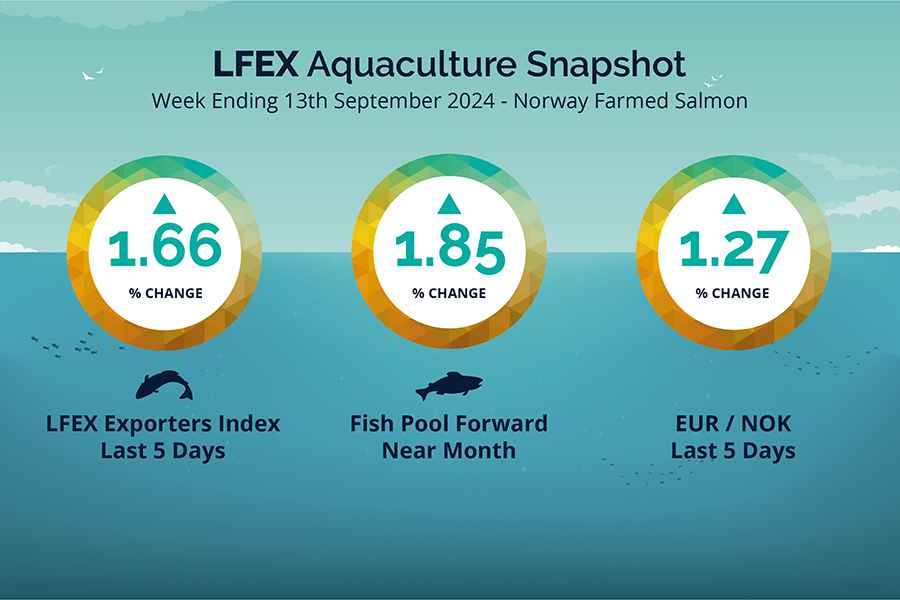

LFEX European Aquaculture Snapshot to 13th September, 2024

|

|

Published: 13th September 2024 This Article was Written by: John Ersser |

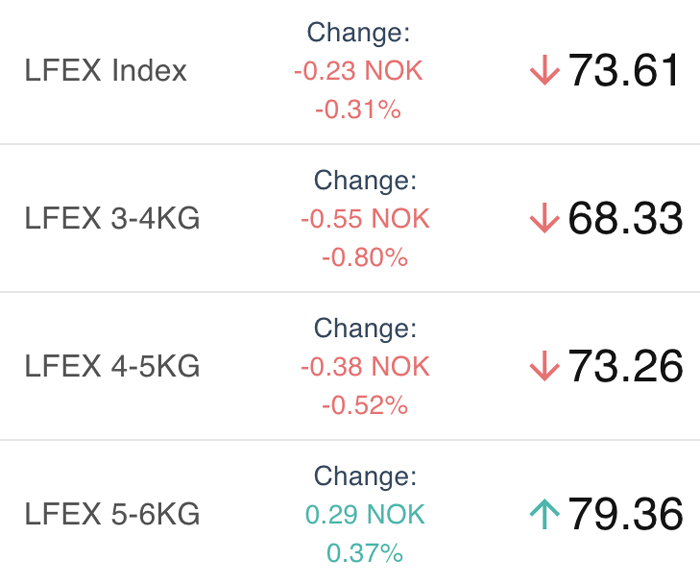

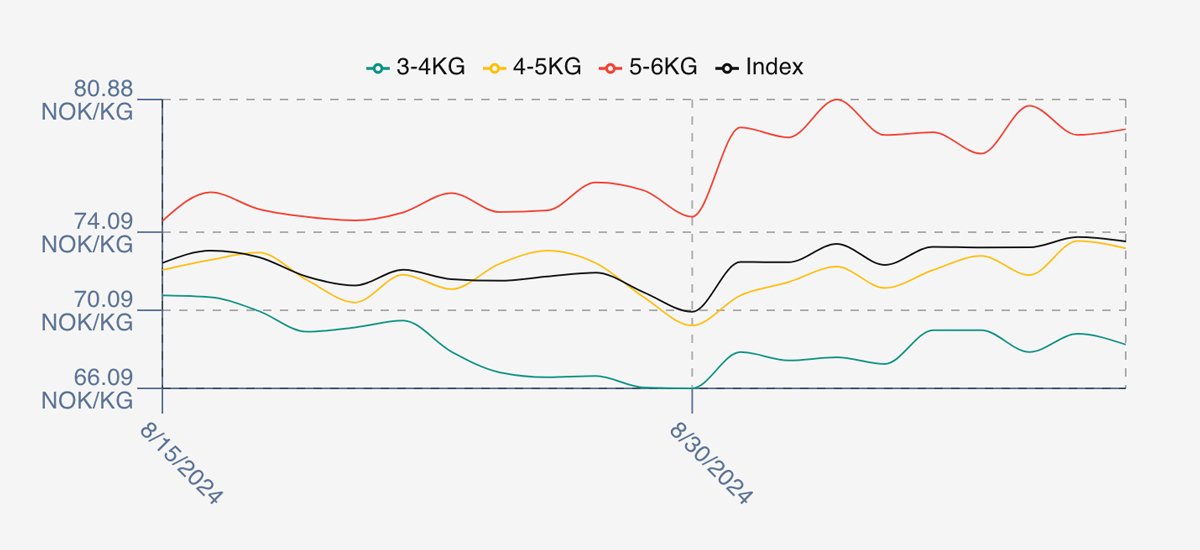

The LFEX Norwegian Exporters Index for Week 37 2024 ended the week up +1.20 NOK / +1.66% to stand at 73.61 NOK (in EUR terms 6.17 / + 0.02 / +0.38%) FCA Oslo Week ending Thursday vs previous Thursday.

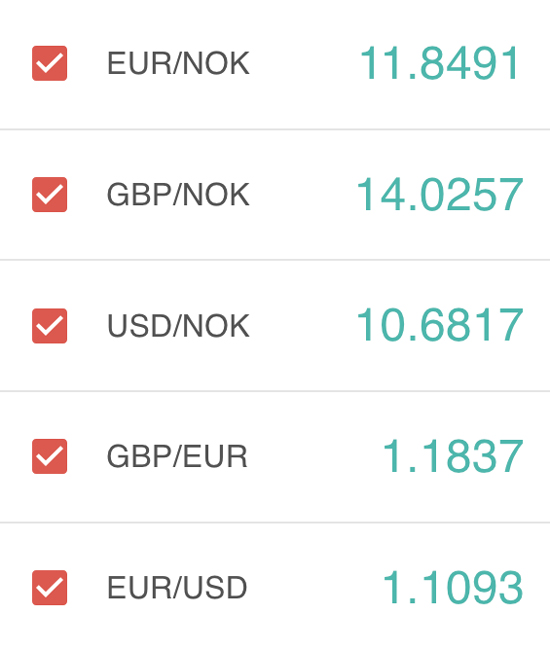

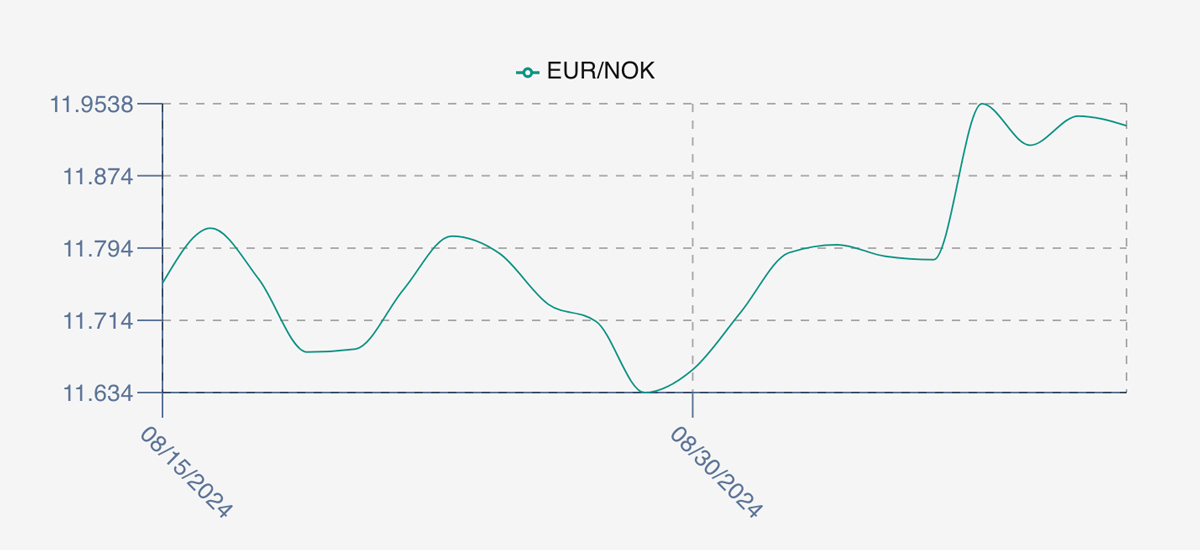

The NOK rate ended higher at 11.93 to the Euro over the period Thursday to Thursday +0.15 NOK or +1.27%. The Fish Pool future September was reported up +1.30 NOK / +1.85% at 71.7 NOK.

Last Week

Pricing was a little stronger this week, and if you tracked a daily chart the very slight overall direction of travel was also slightly higher during the week. Pricing opened up +0.93 NOK at 73.34 or 1.28%, although the index had already picked up increasing prices from the week prior – which doesn’t always get picked up on weekly pricing intervals. Monday and Tuesday were flat, Wednesday tickled up very small to 73.84 and the week closed out at 73.61. Bigger fish were more expensive, with 5/6s peaking at 80.5 offered on Tuesday. Spreads remain elevated at 11 NOK as an abundance of smaller sizes remain available.

The FX rate continued it trudge upwards 0.15 NOK higher / 1.27% at 1.93. This made the Euro price 6.17 up only 0.38% by comparison and better news for Euro buyers.

Next Week

Early opening indications from sellers for week 38 are coming in at around the 74 NOK level offered for the index. This would put us a little above last weeks close. Similar conditions to last week where the larger fish are under pressure, but there remains good availability of smaller sizes. Concerns over lice / potential lice in the north creating more slaughtered volume, counter with potentially smaller volumes out of Chile, giving sellers to those markets a potential fillip.

Volumes

Volume figures for week 36 (2024) were 26,416 tons versus a lower 25,523 in 2023. Volumes for weeks 37 and 38 (2023) were 25,480 and 24,851 respectively for comparison.

Historical Price Guidance for Next Week

A year ago, Week 38 2023 The LFEX Norwegian Exporters Index was up +2.56%, +1.91 NOK to stand at 76.44 NOK (approximately 6.64 EUR) FCA Oslo. The NOK rate was pretty flat at 11.51 to the Euro and the Fish Pool future September was reported up +1.00 NOK, +1.37% at 74.00 NOK.

David Nye’s technical analysis report will be published on Monday.

Market Data (Click Each to Expand)

| LFEX Prices | FX Rates | LFEX Indicative Exporter Prices (4 Week) | EUR / NOK FX Rate (4 Week) |

|

Prices Ending 13th September, 2024 For Friday's Price For Next Week, Offers & Trading Please Register |

Did You Know?

You can let different people from your company use the platform and share information?

The system is set-up to be able to show all your offers or trades going through the system and allow multiple users in your company access to this information in real-time. This helps build a picture of sales / purchases and pricing across the business and facilitates teams work and optimisation of the selling / buying process, as well as giving logistics and finance real-time information. This data is private and only available to your organisation.

FAQ’s

Q. How can I find completed trades on the system?

A. The system captures all pricing, orders and trading activity in real-time for users. You have immediate access to all your data including trades and trade related data, and the ability to search and sort this in the way you want to view it.