The London Fish Exchange

Data / Market Insight / News

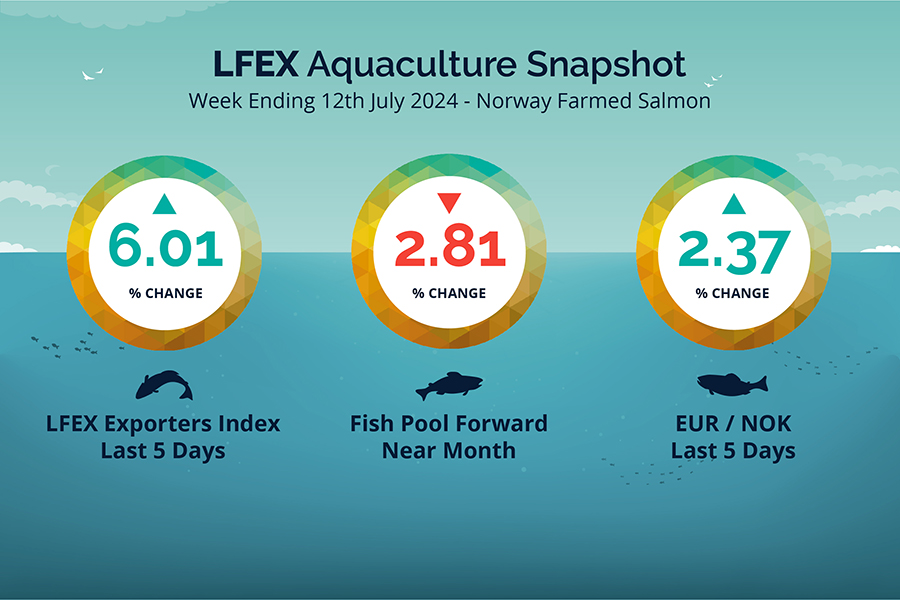

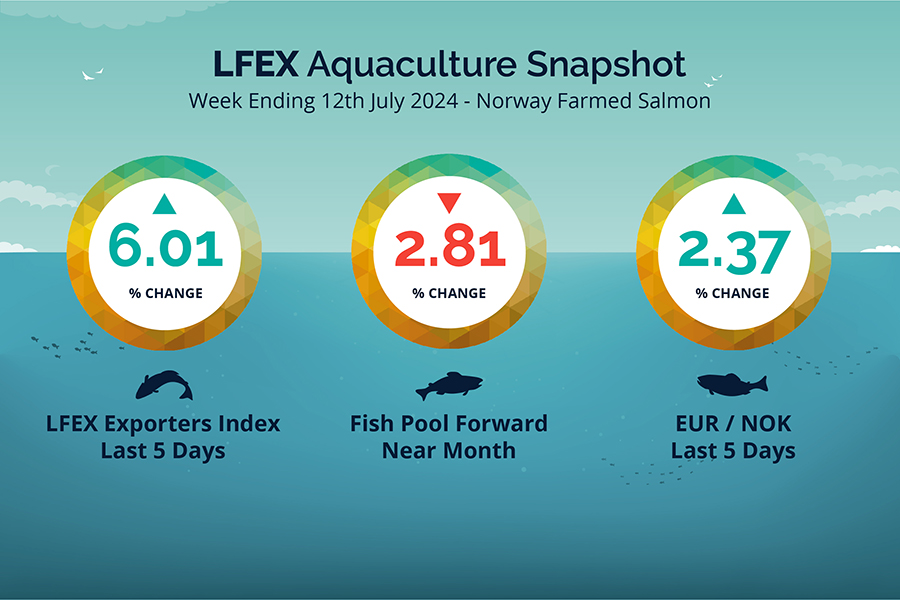

LFEX European Aquaculture Snapshot to 12th July, 2024

|

|

Published: 12th July 2024 This Article was Written by: John Ersser |

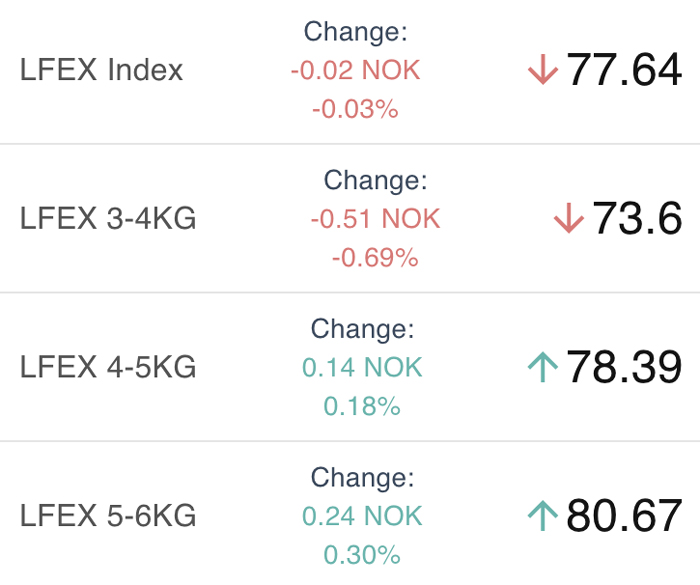

The LFEX Norwegian Exporters Index for Week 28 2024 ended the week up +6.01%, +4.40 NOK to stand at 77.64 NOK (in EUR terms 6.65 / + 0.23 / +3.65%) FCA Oslo Week ending Thursday vs previous Thursday.

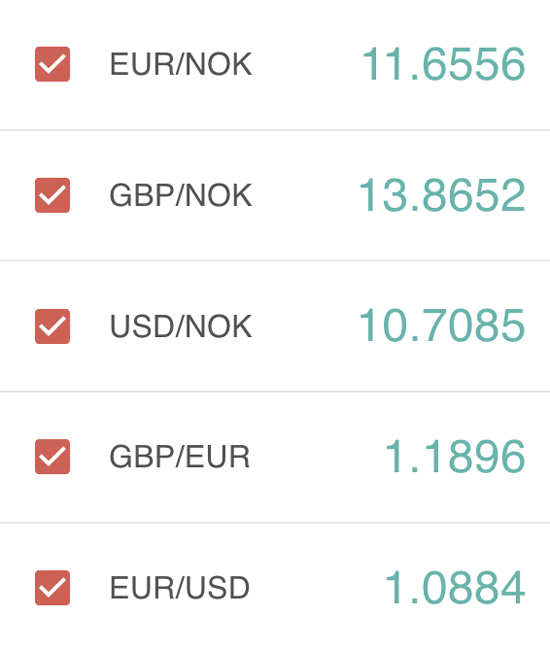

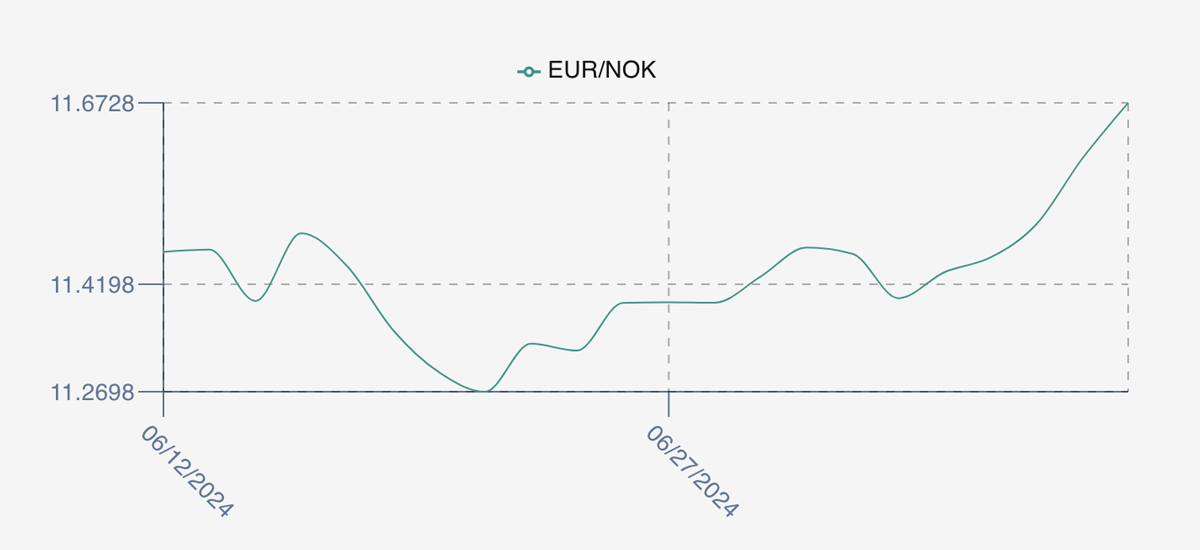

The NOK rate ended up, at 11.67 to the Euro over the period Thursday to Thursday +0.27 NOK or +2.37%. The Fish Pool future July was reported down – 2.25, -2.81% at 77.9 NOK.

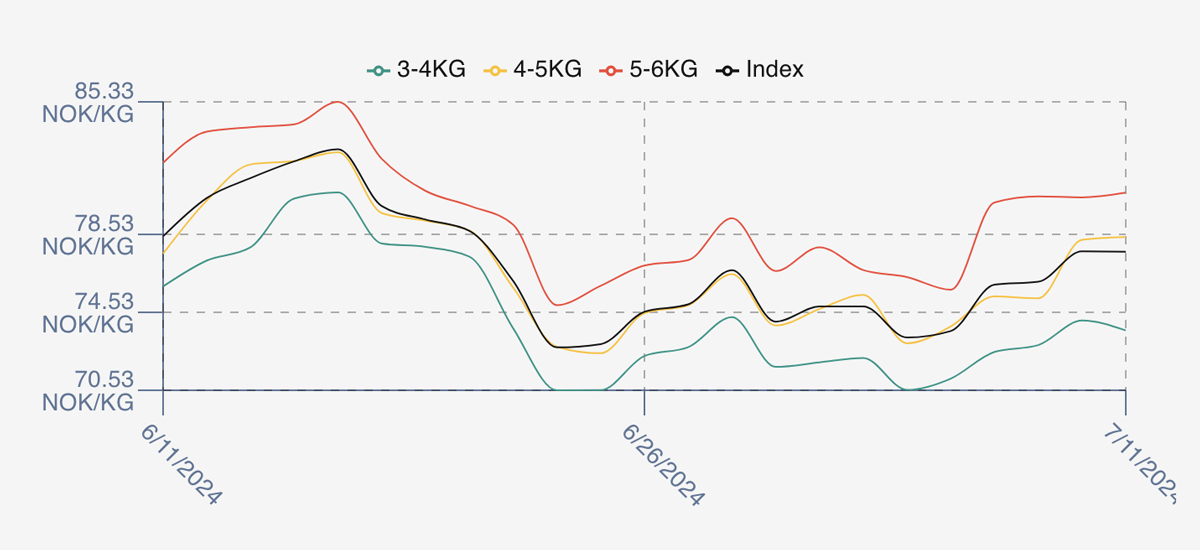

Pricing opened up flat / marginally stronger at 73.57 as compared to the prior weeks close as we indicated last week. There was a feeling that some of the chunky volume had gone through early which meant that sellers weren’t as stressed. This seems to have borne out in the pricing levels as the market ticked up this week. Monday put on 2.5 NOK. Tuesday was flat and prices then ratchetted up a further 1.5 NOK Wednesday and this held for Thursday. Overall, a 6% gain from the prior week’s closing. The end of week weakness did not materialise as was suggested.

Spread was around 7 NOK 3/4s – 5/6s. NOK weakness this week of over 2% meant that EUR prices ended 3.56% higher at 6.65. The market therefore managed a rally this week and just broke through the 76.75 nearest support level.

Pricing for next week looks relatively stable again. Early indications are for a small increase over where we left off last week. This would suggest an offered index level of around / just under 79 NOK to open with similar volumes to last week expected to come through.

Volumes

Volume figures for week 28 (2024) were 19,201 tons versus a very similar 19,220 in 2023.

Historical Price Guidance

A year ago, Week 29 2023 prices ended down -7.90 NOK on the week at 86.88 NOK a fall of 8.34%. The EURNOK rate was lower at 11.16 a 0.89% drop. A volatile week where larger fish drove pricing higher and then pushed lower.

David Nye’s technical analysis report will be published on Monday.

Market Data (Click Each to Expand)

| LFEX Prices | FX Rates | LFEX Indicative Exporter Prices (4 Week) | EUR / NOK FX Rate (4 Week) |

|

Prices Ending 12th July, 2024 For Friday's Price For Next Week, Offers & Trading Please Register |

Did You Know?

The LFEX RFQ allows users to make offers and requests for forward orders not just the current week?

If a customer has a specific need for inventory at a specific day / week in the near future this request can be put up – for example a short-term campaign. Likewise, if a seller wants to secure some early sales (especially in a falling market) they can put up offers for that date / following week. The system also offers contracts trading for multi-leg orders.

FAQ’s

Q. With pricing volatility I am concerned about getting caught selling too much at the wrong level – how can you help?

A. There are a number of ways we enable business to protect their offers / orders to give users comfort that they won’t be exposed. Primarily a specific amount of inventory can be offered to a group of buyers – the system won’t let you over trade. You can change available volumes and pricing instantly, as well as suspending pricing or cancelling offered prices or cancelling the offer completely as examples of some of the protection functionality we offer.