The London Fish Exchange

Data / Market Insight / News

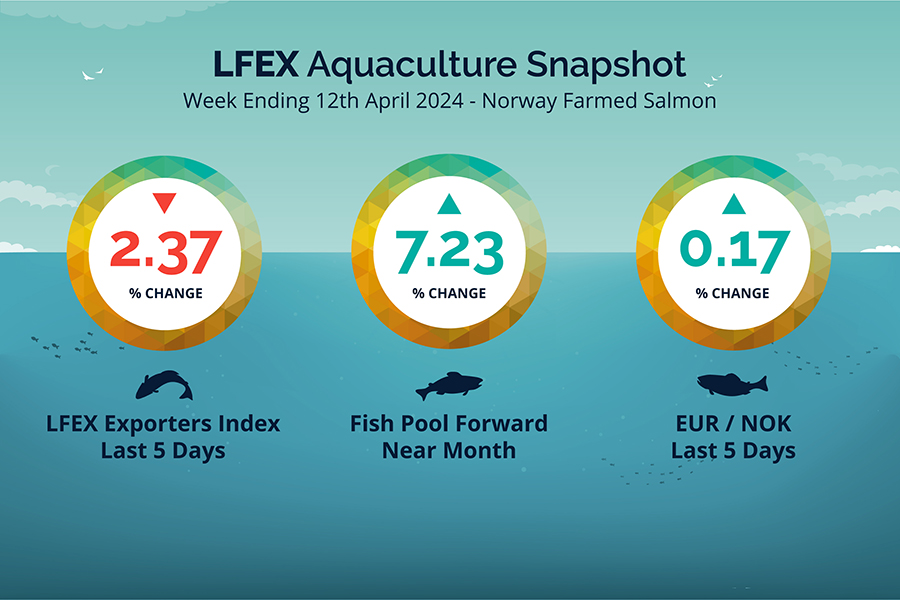

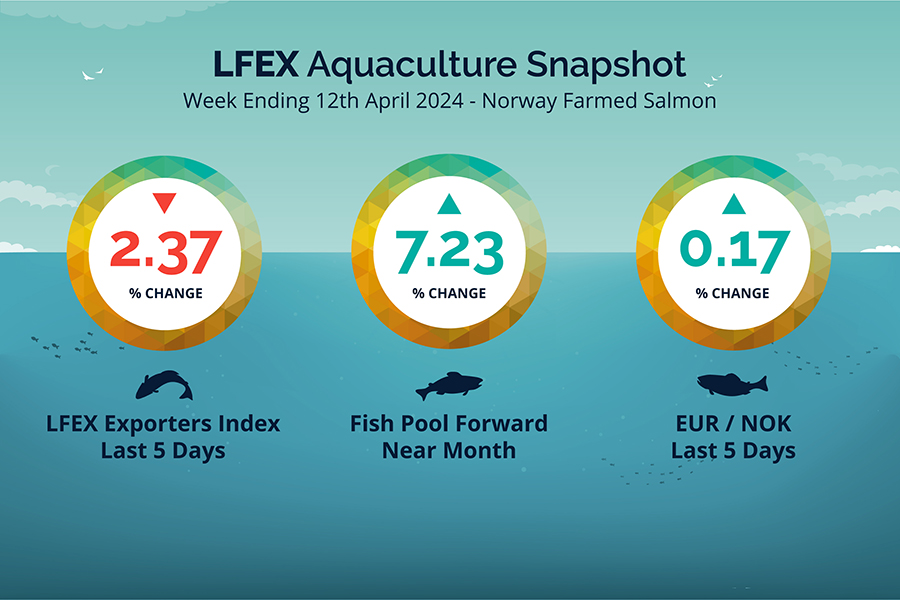

LFEX European Aquaculture Snapshot to 12th April, 2024

|

|

Published: 12th April 2024 This Article was Written by: John Ersser |

The LFEX Norwegian Exporters Index for Week 15 2024 ended the week down -2.77%, -3.33 NOK to stand at 137.13 NOK (in EUR terms 11.81 / -0.31 / -2.61%) FCA Oslo Week ending Thursday vs previous Thursday.

The NOK rate ended up at 11.61 to the Euro over the period Thursday to Thursday +0.02 NOK or +0.17%. The Fish Pool future April was reported up +8.60 NOK, +7.23% at 127.60 NOK.

A full trading week this week with prices maintaining their record levels. Kicking off on Friday the market edged up a little further on continued supply weakness, to register 141.50, and a similar level at 141.54 for Monday trading. If buyers were hoping for a drop this week they would have been disappointed as levels remained static, Tuesday recording 140.83 and Wednesday 140.42. A minor respite on Thursday as prices softened slightly down 3 NOK to close out at the 137 NOK level with not everything was sold, pushing pricing down.

Volume figures for week 14 were up on the prior week at 11,675 versus 9512 tons. It is worth noting week 14 2023 saw exports at 11,722 – so very comparable. The NOK was pretty flat not giving or taking much for Euro buyers.

Next week there is still a limited supply of superior, but expectation of a little more fish and cheaper fish hanging around from last week. Bigger fish 6+ values will fall as supply is available. Production fillets used to trade at a larger discount, but the spread has come in on these distorting the market. Indications for the index will start around 131 NOK on Friday for next week deliveries. Prices may soften further over the week depending on the volumes available.

By comparison week 16 2023 prices ended at 119 NOK. The EURONOK rates was 11.60 same as current.

David Nye’s technical analysis report will be published on Monday.

Market Data (Click Each to Expand)

| LFEX Prices | FX Rates | LFEX Indicative Exporter Prices (4 Week) | EUR / NOK FX Rate (4 Week) |

|

Prices Ending 12th April, 2024 For Friday's Price For Next Week, Offers & Trading Please Register |

Did You Know?

The salmon market trades fundamentally like every other commodity market? We have seen and continue to see significant volatility in many agricultural commodities.

Markets and platforms help both buyers and sellers, in periods of high or low volumes find price levels and trading partners, and provide the mechanism to connect, engage, and execute. Because markets are fluid and supply and demand ebb and flow it pays to be connected, present and involved. The more activity placed on an electronic market, the better and more useful data can be produced, with improved and accessible transparency helping you and your business.

FAQ’s

Q. I go to conferences and seminars and travel a lot. How do I keep up to date?

A. The system is there for you 24 x 7, no matter where you are or what time zone you are in you will be able to access the platform and communicate, place orders or make offers, execute trades, chat and access all the usual functions and data you would do normally. If you really invest time in setting up and using the system, you can continue to work as normal anywhere, anytime.