The London Fish Exchange

Data / Market Insight / News

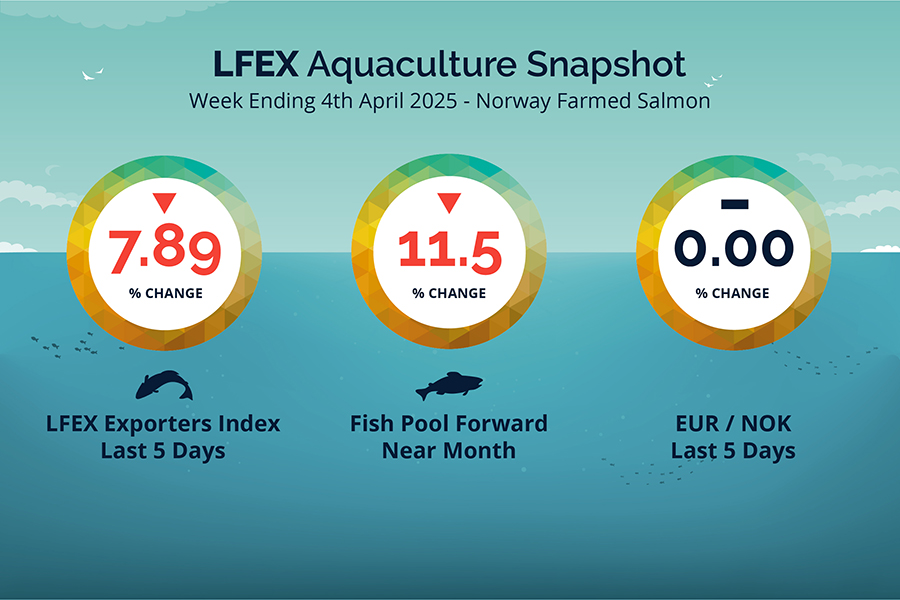

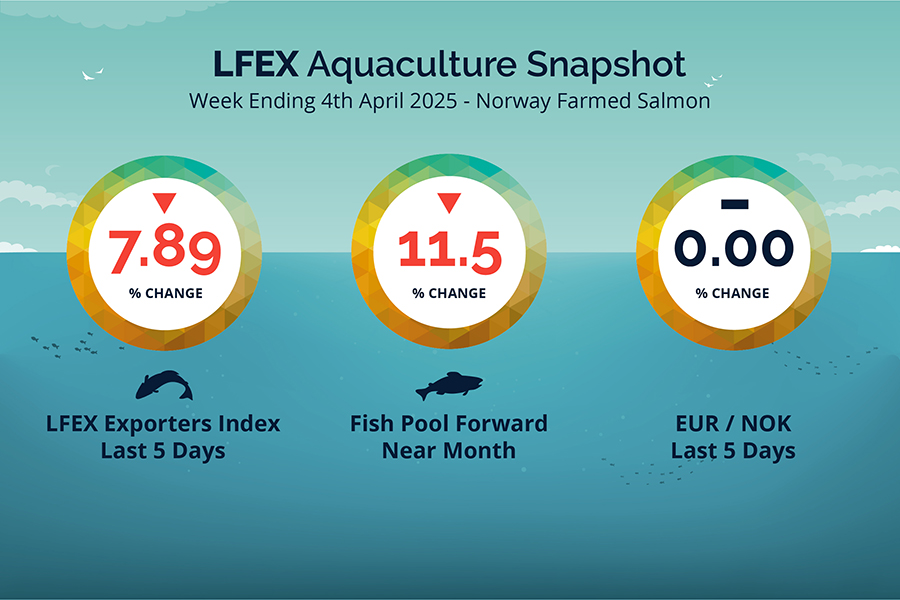

LFEX European Aquaculture Snapshot to 4th April, 2025

|

|

Published: 4th April 2025 This Article was Written by: John Ersser |

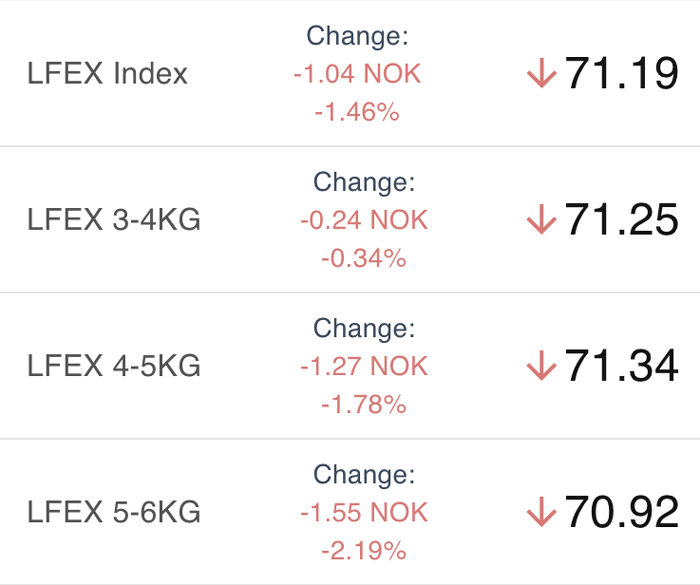

The LFEX Norwegian Exporters Index for Week 14 2025 ended the week DOWN -6.10 NOK / -7.89% to stand at 71.19 NOK (in EUR terms 6.27 / -0.54 / -7.89%) FCA Oslo Week ending Thursday vs previous Thursday.

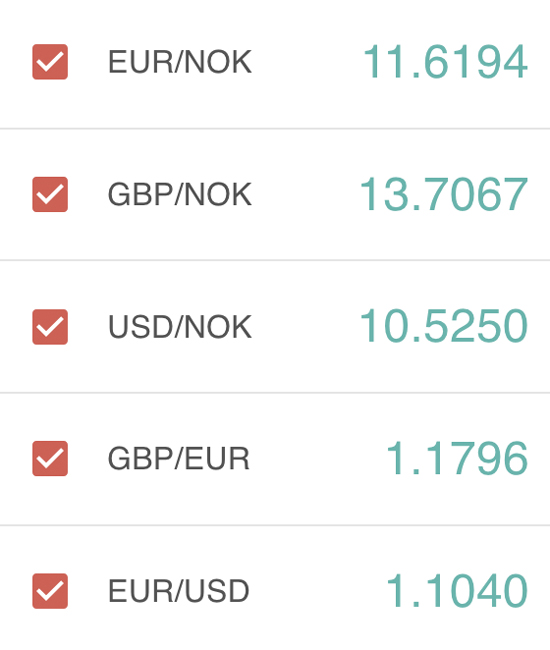

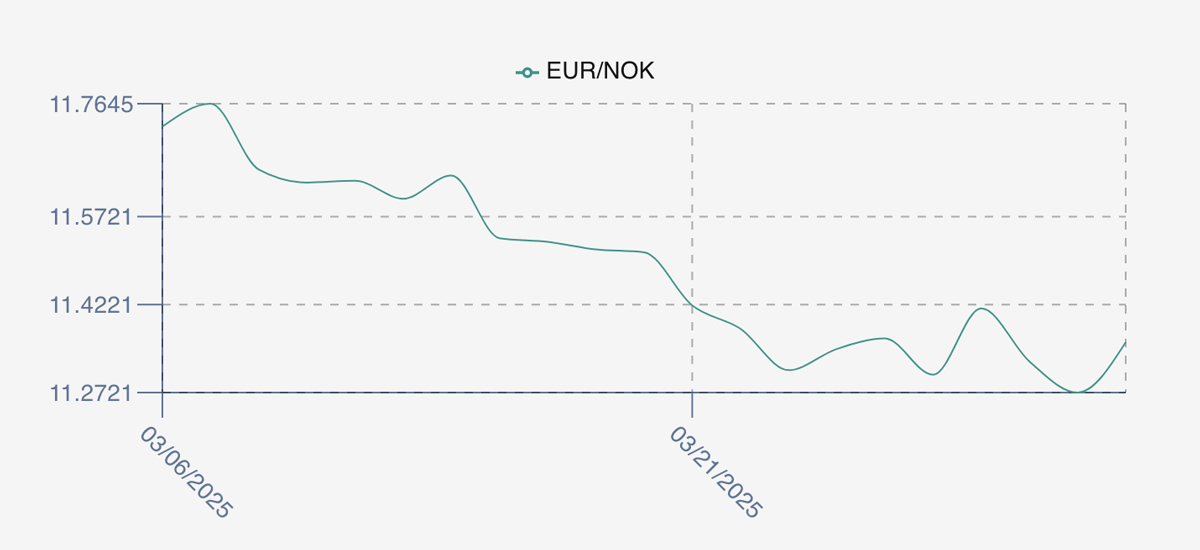

The NOK rate ended flat at 11.36 to the Euro over the period Thursday to Thursday. The Fish Pool Euronext future May was reported down Thursday to Thursday -0.90 / -11.54 % at 6.90 EUR, approximately 78.38 NOK.

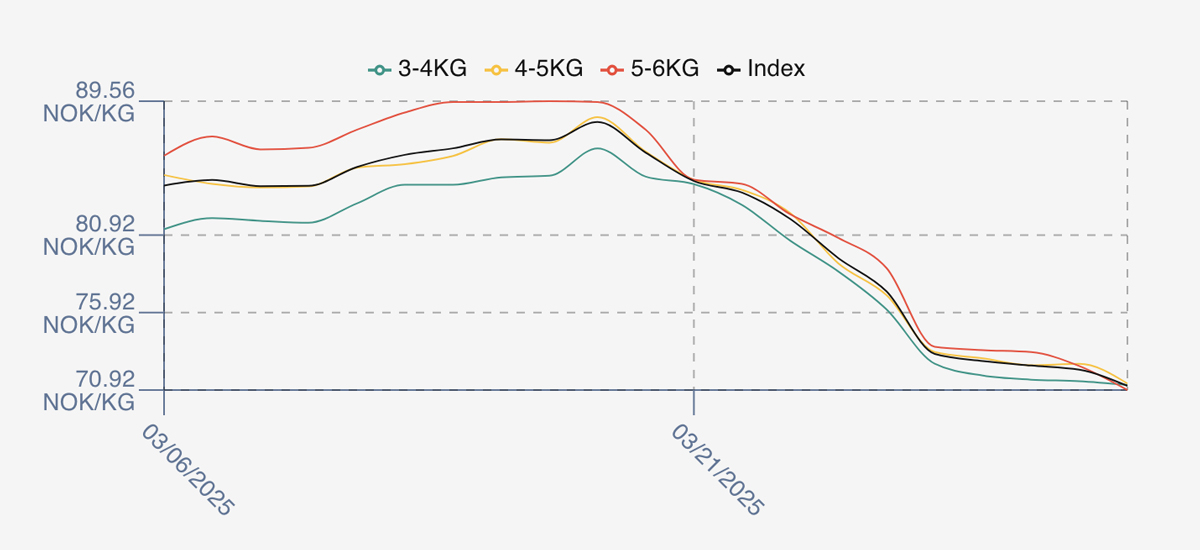

The Last Week

No respite from weaker prices this week. Friday extended the prior week falls with a further drop of over 4 NOK on the opening trading day for week 14, to bring the offered index level down to the 73.25 levels. Monday saw the index 0.5 NOK softer as prices edged down, and this weakness set the tone for the rest of the week. Tuesday losing 0.3 at 72.5 and Wednesday at 72.33. End of the trading week and pricing was again stressed with unsold fish helping the index to close at the low of the week at 71.19 NOK. A lot of fish being harvested and not easily finding a home. Sentiment not helped by US tariffs and the tragic earthquake in Myanmar and Thailand.

Total spreads have again compressed at the end of the week to 1 NOK between sizes 3/4s and 5/6s.

The EURNOK FX rate was volatile all week, peaking and troughing between the 11.27 and 11.41 levels whilst end fairly neutrally.

Next Week

Early pricing indications from exporters for next week are coming around the 76.5 NOK level offered for the index. This is up around 5 NOKs from Thursdays low close. Mixed messaging from the market, prices seem stable today at this level but next week isn’t an easy call. Good volumes available and more big fish. Spreads remain compressed at the 1 NOK level.

EUR NOK FX rate has had a big move up 11.67 currently and expected to continue to move up from these levels. This would give an indicative Euro index price around 6.56 on levels later Friday.

Volumes – Fresh Export

Volume figure for week 13 (2025) was 18,828 tons up 9,316 as compared to 9,512 in 2024 nearly doubling volumes. Volumes for week 14 and week 15 (2024) were 11,675 and 13,015 respectively for comparison.

Historical Price Guidance for Next Week

The LFEX Norwegian Exporters Index for Week 15 2024 ended the week down -2.77%, -3.33 NOK to stand at 137.13 NOK (in EUR terms 11.81) FCA Oslo. The NOK rate ended up at 11.61 to the Euro. The Fish Pool future April was reported up +8.60 NOK, +7.23% at 127.60 NOK.

David Nye’s technical analysis report will be published this Monday.

Market Data (Click Each to Expand)

| LFEX Prices | FX Rates | LFEX Indicative Exporter Prices (4 Week) | EUR / NOK FX Rate (4 Week) |

|

Prices Ending 4th April, 2025 For Friday's Price For Next Week, Offers & Trading Please Register |

Did You Know?

You can let different people from your company use the platform and share information?

The system is set-up to be able to show all your offers or trades going through the system and allow multiple users in your company access to this information in real-time. This helps build a picture of sales / purchases and pricing across the business and facilitates teams work and optimisation of the selling / buying process, as well as giving logistics and finance real-time information. This data is private and only available to your organisation.

FAQ’s

Q. How do electronic markets work?

A. Electronic platforms perform many roles for markets and market participants.

By bringing a community together you get a much better view of available inventory (liquidity), access to more participants, more opportunity for price discovery, ability to track market pricing electronically in real-time, pre-trade checking and secure and robust confirmations between parties. They throw off mountains of data that can be used to analyse pricing, trading patterns, counterparty performance etc.

Further, they can provide a single point of connectivity for settlement and documentation and an independent and verified record of truth. They provide huge efficiencies in process, less errors, automation of orders / trading / settlement processes. They give participants the ability to access the right price for any given market condition, and free up staff time to focus on optimising business and relationships especially in times of stress.