The London Fish Exchange

Data / Market Insight / News

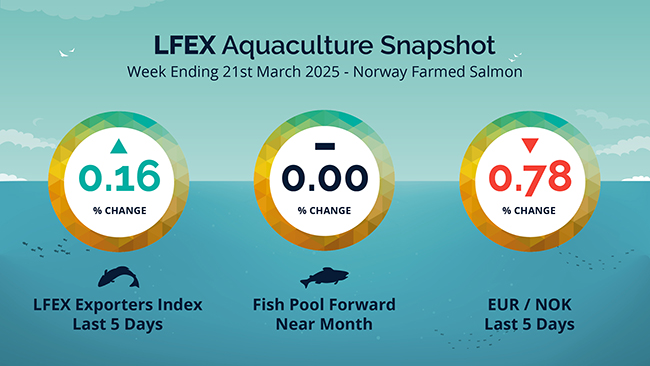

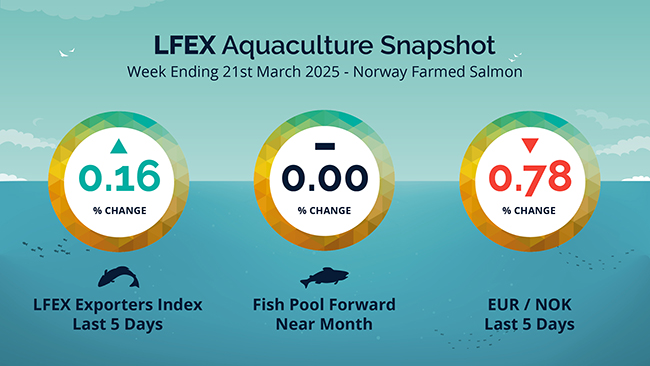

LFEX European Aquaculture Snapshot to 21st March, 2025

|

|

Published: 22nd March 2025 This Article was Written by: John Ersser |

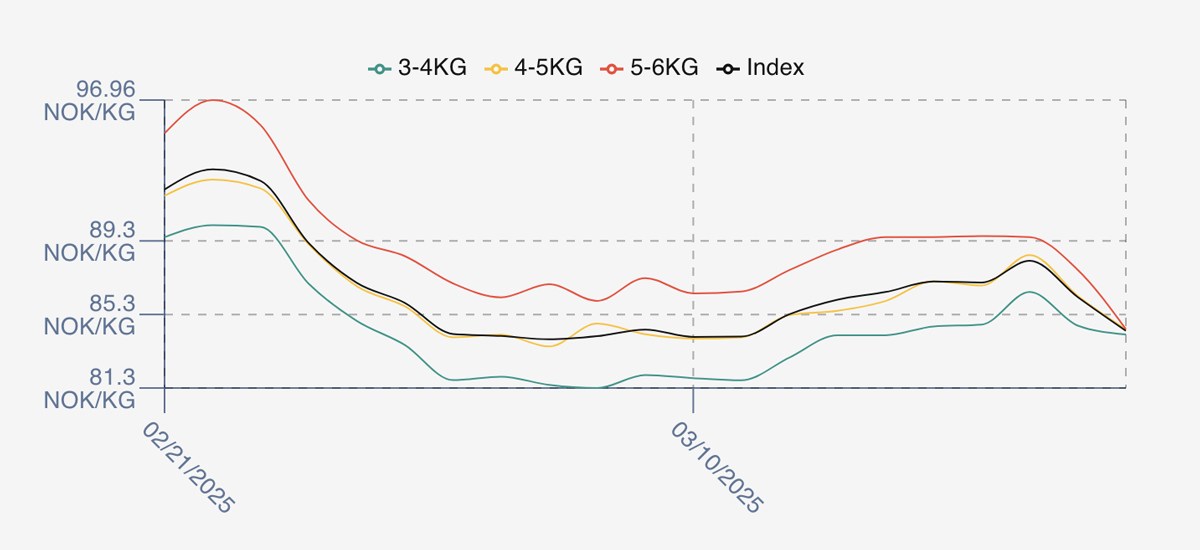

The LFEX Norwegian Exporters Index for Week 12 2025 ended the week UP +0.14 NOK / +0.16% to stand at 86.24 NOK (in EUR terms 7.49 / +0.07 / +0.95%) FCA Oslo Week ending Thursday vs previous Thursday.

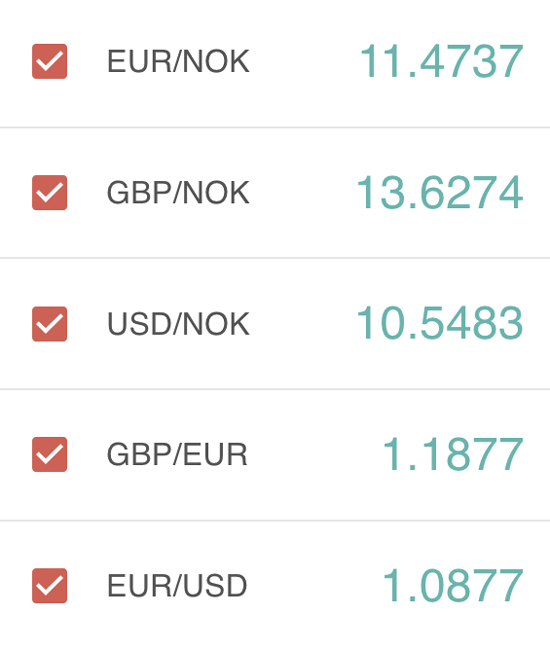

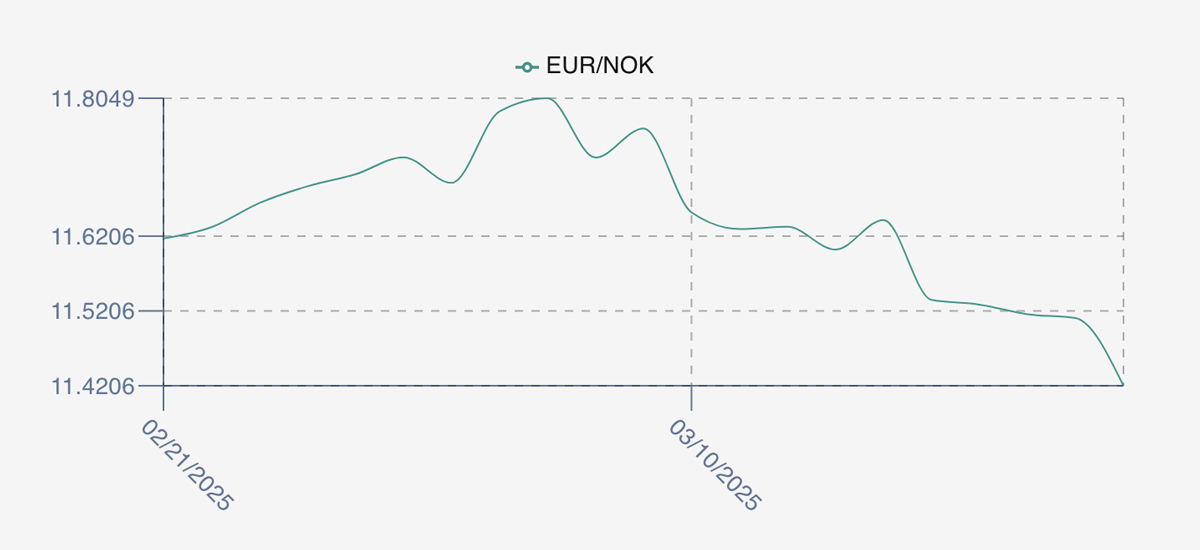

The NOK rate ended down -0.09 NOK / -0.78% at 11.51 to the Euro over the period Thursday to Thursday. The Fish Pool Euronext future April was reported flat Thursday to Thursday at 7.15 EUR which equates to approximately 82.30 NOK.

The Last Week

Last week was fairly modest in terms of price movement. The week kicked off with a smal rise +0.42NOK or o.5%. Sentiment was positive for the week and this was reflected in slighly stonger pricing through the week. Monday saw 87.09, Tuesday flat whilst Wednesday edged up a further NOK to 88.22. Unfortunately Thursday gave it all back (as unsold fish remained) to close out at a barely changed 86.24.

Total spreads between sizes 3/4s and 5/6s has compressed to the 3 NOK level evenly spread to 4/5s.

The EURNOK FX rate again saw volatility popping to a high of 11.64 early doors and then dropping to a week ending low of 11.51 on Thursday down 0.78% in the week.

Next Week

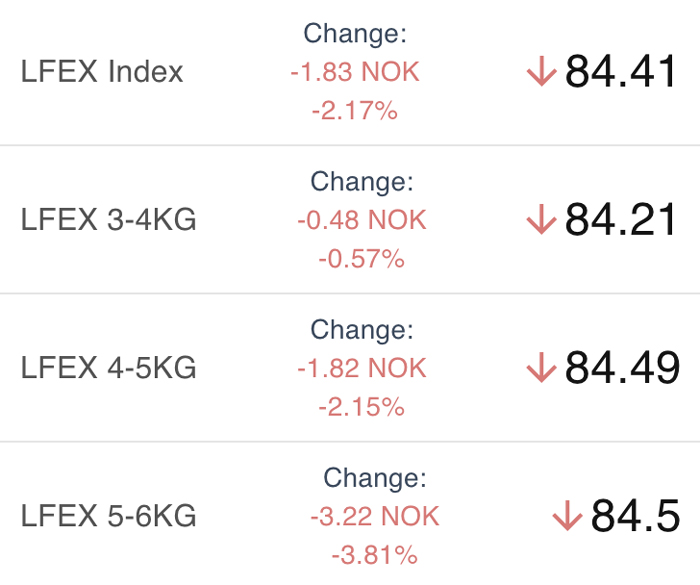

Early pricing indications from exporters for next week are coming around the 84.41 NOK level offered for the index. This is down over 2 NOKs from Thursdays close and around 4 NOK lower than Wednesday. Prices were starting to fall end of last week, but the fire that has put Heathrow airport out of action has had a further negative impact on pricing. 6+ fish need to find a home and will struggle to get a decent price. There are good volumes coming through generally.

Spreads have completely compressed. 3-6s are broadly the same price going into the new week.

EUR NOK FX rate has tanked to 11.41 this afternoon, although off the bottom at 11.39 earlier. This would give an indicative Euro index price around 7.39 on levels later Friday.

Volumes – Fresh Export

Volume figure for week 11 (2025) was 17,467 tons up 2,848 tons as compared to 14,619 in 2024. Volumes for week 12 and week 13 (2024) were 13,493 and 9,512 respectively for comparison.

Historical Price Guidance for Next Week

The LFEX Norwegian Exporters Index for Week 13 2024 ended the week up +19.12%, +22.07 NOK to stand at 137.49 NOK (in EUR terms 11.77 FCA Oslo. The NOK rate ended up at 11.68 to the Euro. The Fish Pool future March was reported up +2.20 NOK, +1.98% at 113.2 NOK with April showing 116.50.

David Nye’s technical analysis report will be published this Monday.

Market Data (Click Each to Expand)

| LFEX Prices | FX Rates | LFEX Indicative Exporter Prices (4 Week) | EUR / NOK FX Rate (4 Week) |

|

Prices Ending 21st March, 2025 For Friday's Price For Next Week, Offers & Trading Please Register |

Did You Know?

As a manager you can get a snapshot in moments of the activity in your business.

You can see all order histories with ease on the platform. You can sort and search and see who are the biggest parties, discover who is buying / selling at optimal prices, and identify those companies to focus more on and reduce supply shock exposure by evaluating history. It’s all at your fingertips.

FAQ’s

Q. How flexible is the system if my specifications are complex?

A. This is a great question, and the answer is ultimately infinitely flexible. Every week we get feedback from users and we can add new features or parameters to the system to ensure that users demands are met. Data capture and communication are key. The system also offers multiple ways of communicating in addition to the core order/trading functions, including order commentary and chat to ensure that you can always communicate clearly with counterparties.