The London Fish Exchange

Data / Market Insight / News

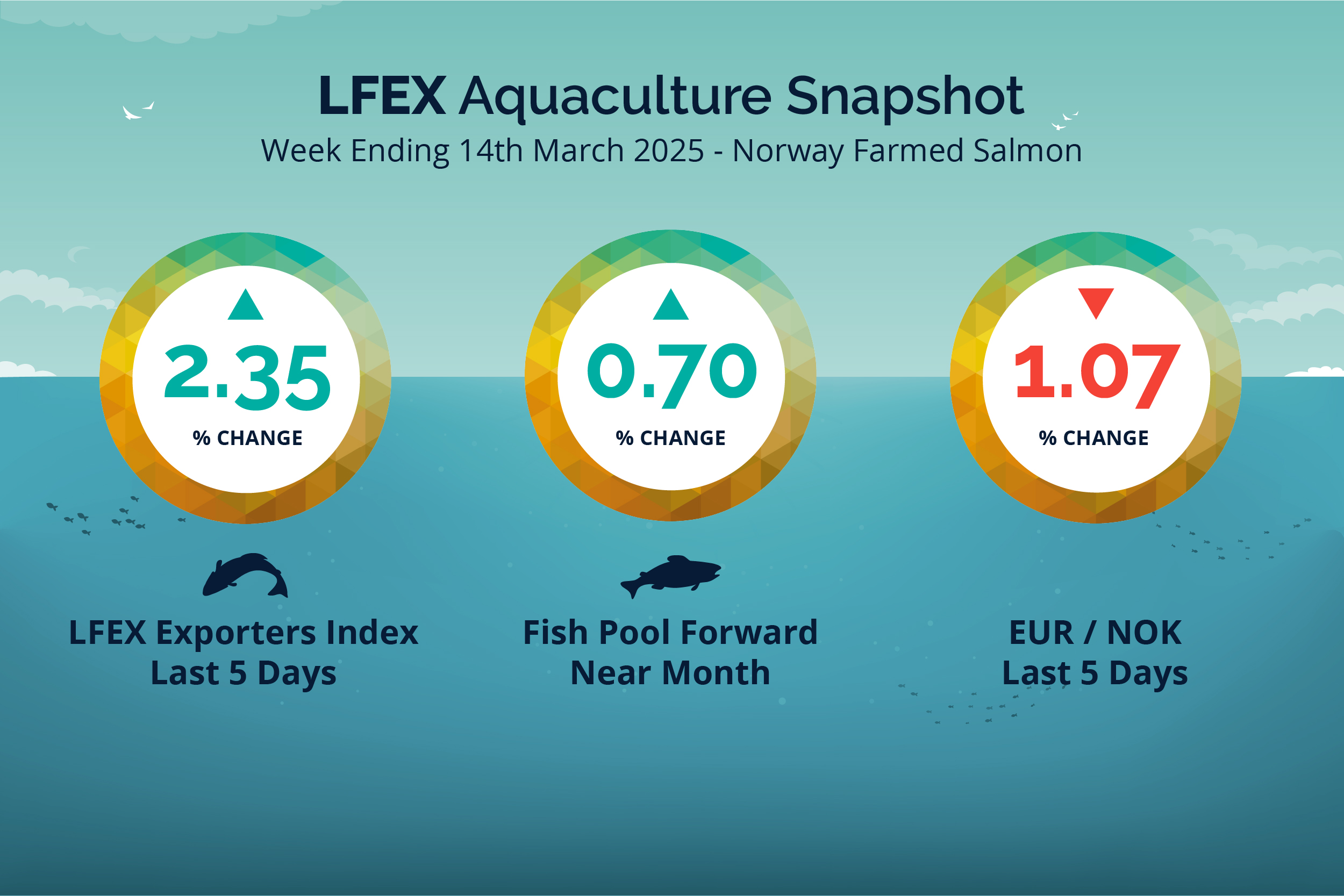

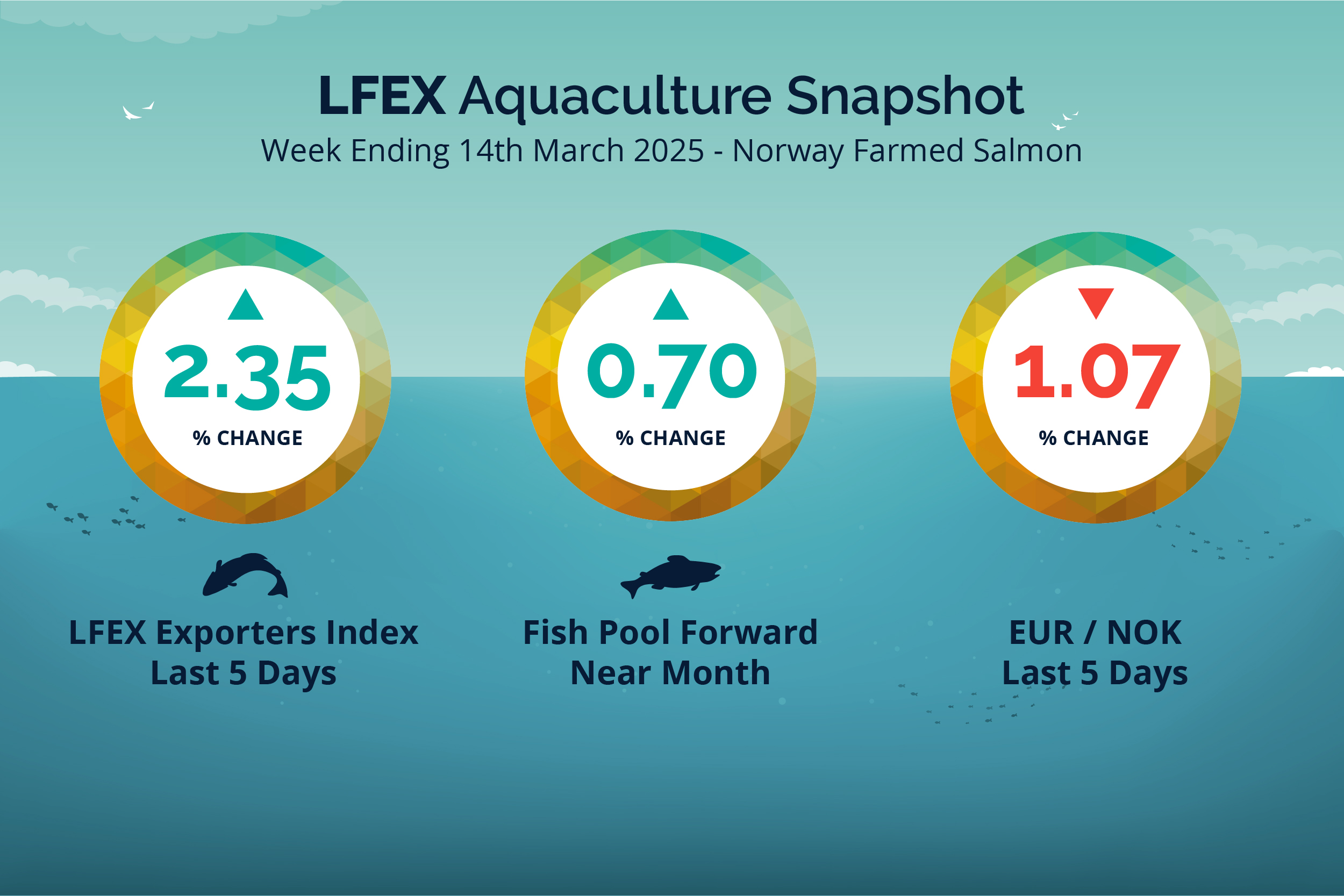

LFEX European Aquaculture Snapshot to 14th March, 2025

|

|

Published: 14th March 2025 This Article was Written by: John Ersser |

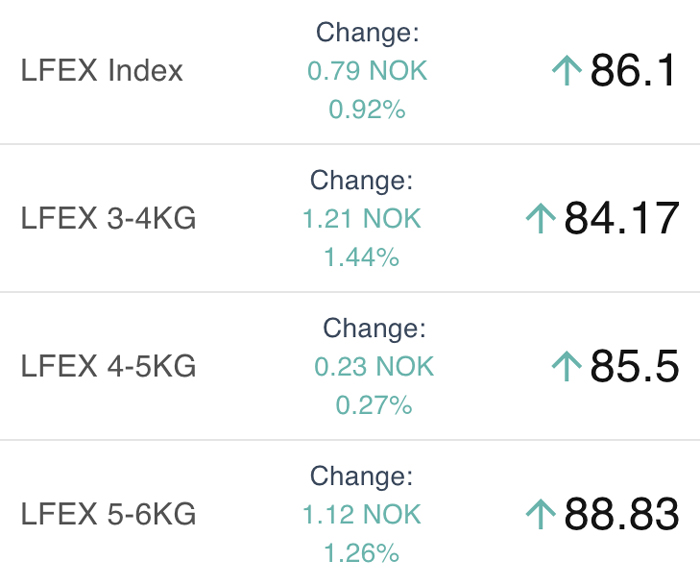

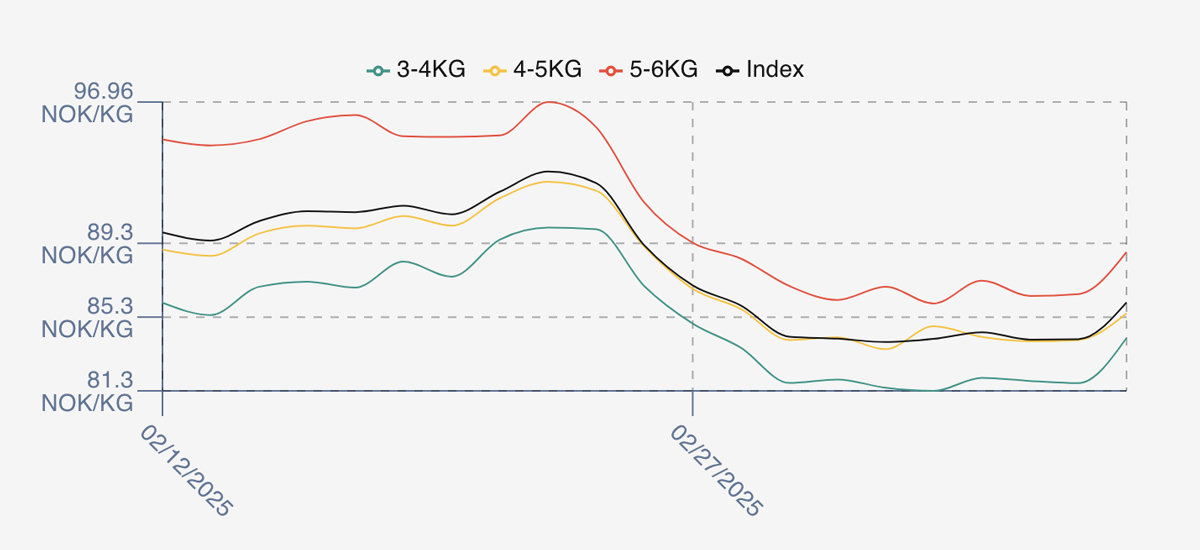

The LFEX Norwegian Exporters Index for Week 11 2025 ended the week UP +1.98 NOK / +2.35% to stand at 86.10 NOK (in EUR terms 7.42 / +0.25 / +3.46%) FCA Oslo Week ending Thursday vs previous Thursday.

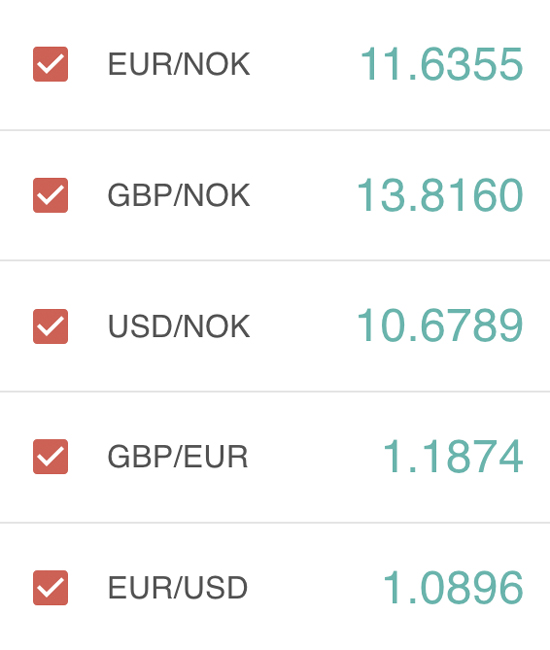

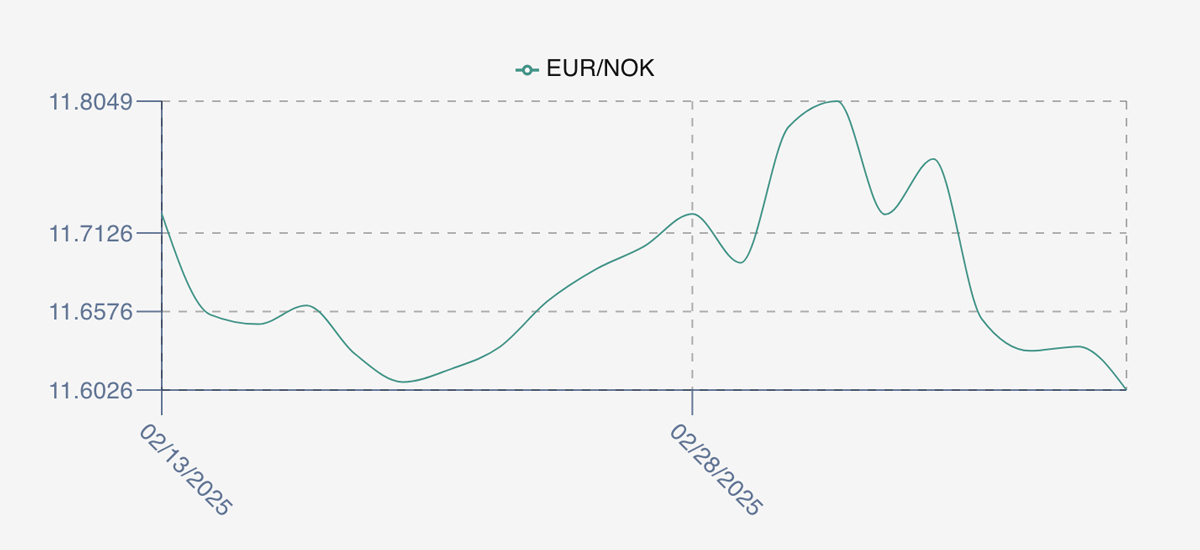

The NOK rate ended down -0.13 NOK / -1.07% at 11.60 to the Euro over the period Thursday to Thursday. The Fish Pool Euronext future April was reported up Thursday to Thursday +0.05 EUR / +0.70% at 7.15 EUR which equates to approximately 82.94 NOK.

The Last Week

Last week played out as suggested. We saw initial relative softness going into the week. The index climbed small on Friday open as sellers pushed the new week, the index showing 84.48, before falling back to the 84.1 levels Monday and Tuesday similar to the prior week close level. However, by Wednesday we had picked up a NOK and this continued into Thursday with a further 1 NOK added. The week finding overall strength and closing out on a high at 86.1 NOK.

Total spreads between sizes 3/4s and 5/6s remain around the 4.5 NOK level. 3/4s rebounded better and closed nearer the 4/5s around 1.5 NOK between them.

The EURNOK FX rate again saw a significant drop this week, from a high of 11.7650 on Friday dropping to a week ending low of 11.60 on Thursday down 1.4% in the week.

Next Week

Early pricing indications from exporters for next week are coming around the 86.5 NOK level offered for the index, which puts us up a little from Thursday close and a couple of NOK up on the prior week overall. General sentiment is positive for pricing and volumes. Many people are departing for the Boston show which sometimes makes connecting today difficult. Spreads showing around 5 NOK at the moment.

EUR NOK FX rate is showing 11.59 this afternoon. This would give an indicative Euro index price around

7.46 on levels later Friday.

Volumes – Fresh Export

Volume figure for week 10 (2025) was 17,116 tons up 2,629 tons as compared to 14,487 in 2024. Volumes for week 11 and week 12 (2024) were 14,619 and 13,493 respectively for comparison.

Historical Price Guidance for Next Week

The LFEX Norwegian Exporters Index for Week 12 2024 ended the week up + 7.56%, +8.11 NOK to stand at 115.42 NOK (in EUR terms 10.01) FCA Oslo. The NOK rate ended up at 11.53 to the Euro. The Fish Pool future March was reported up +0.50 NOK, +0.45% at 111.0 NOK.

David Nye’s technical analysis report will be published this Monday.

Market Data (Click Each to Expand)

| LFEX Prices | FX Rates | LFEX Indicative Exporter Prices (4 Week) | EUR / NOK FX Rate (4 Week) |

|

Prices Ending 14th March, 2025 For Friday's Price For Next Week, Offers & Trading Please Register |

Did You Know?

The LFEX system is secure and private? Whether you are a buyer or seller putting up prices you are in complete control of to whom and where you send your prices.

The system is configured to the counterparties you are prepared to see prices / offers from and within this you can configure who sees what price, all manageable and updateable in real-time. Each price between a seller and buyer is secure and private, and no one else has access to this.

FAQ’s

Q. I tend to trade the same order specifications each week, how can I do this efficiently?

A. No problem. The RFQ is configurable and saved by user. This means that you can set it up perfectly for what you want to trade with your own parameters and at a single click have your own fully populated orders ready to go week in week out. We understand that different users have different requirements, and the system has been designed to cater for everyone’s different choices. We also allow users to configure their LFEX Web workspaces to reflect how they want to operate and use the platform with bespoke and default layouts.