The London Fish Exchange

Data / Market Insight / News

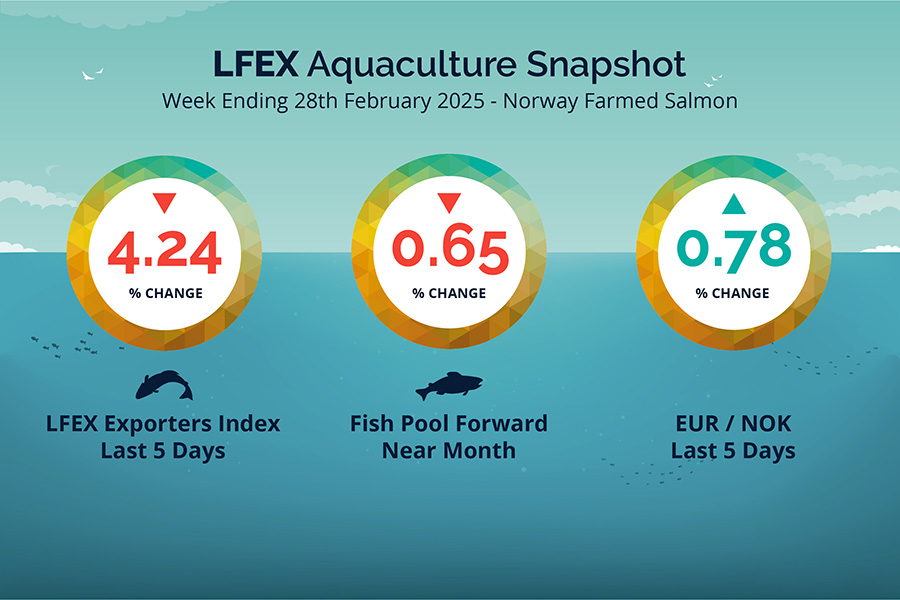

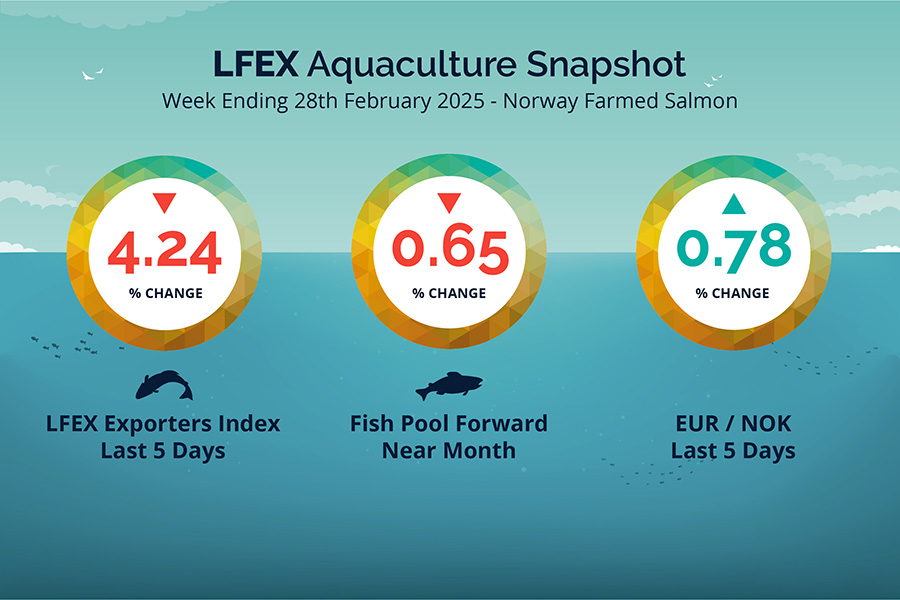

LFEX European Aquaculture Snapshot to 28th February, 2025

|

|

Published: 28th February 2025 This Article was Written by: John Ersser |

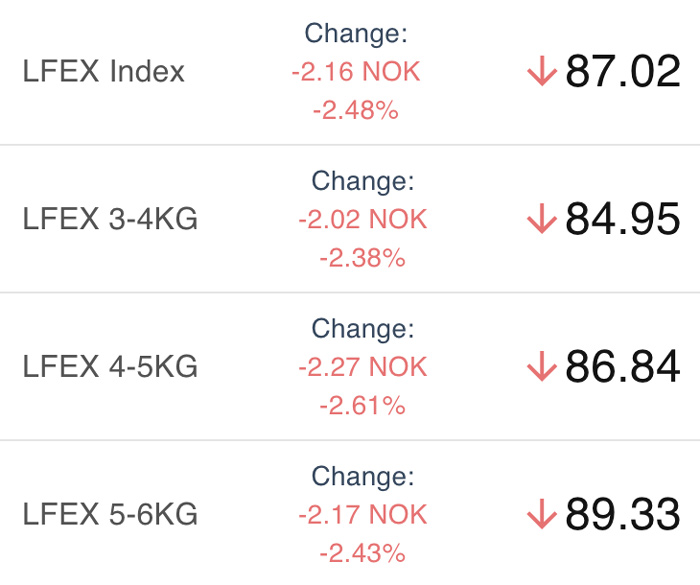

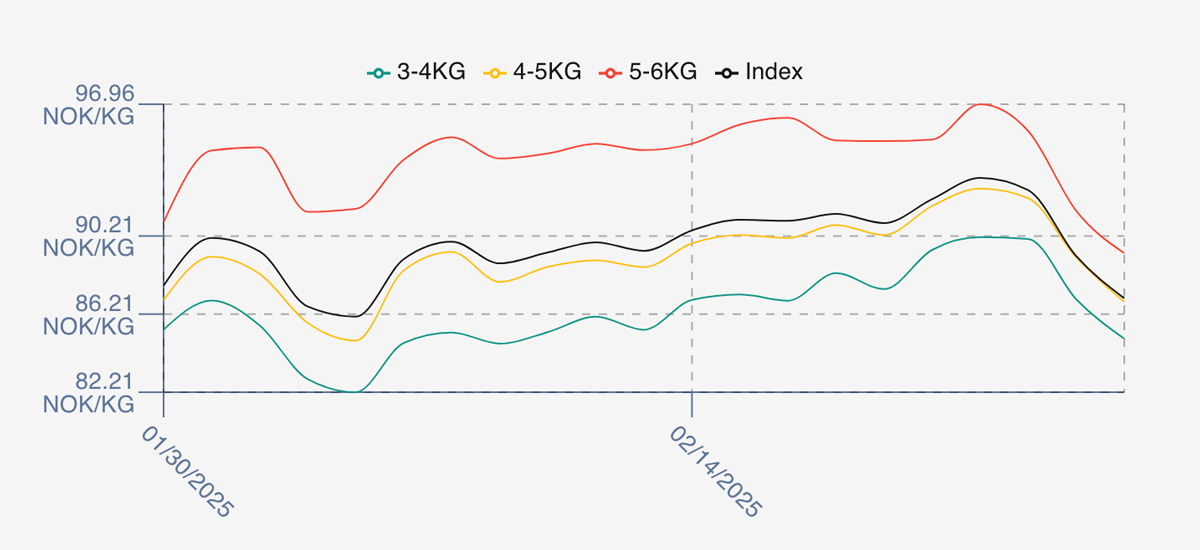

The LFEX Norwegian Exporters Index for Week 9 2025 ended the week down -3.85 NOK / -4.24% to stand at 87.02 NOK (in EUR terms 7.44 / -0.39 / -4.97%) FCA Oslo Week ending Thursday vs previous Thursday.

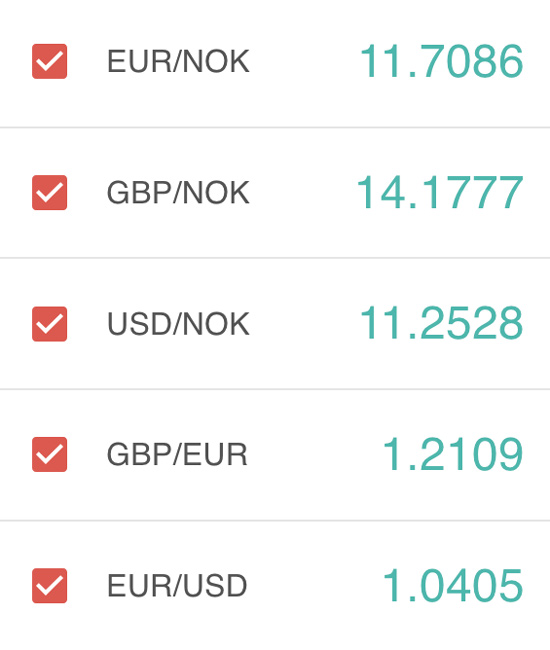

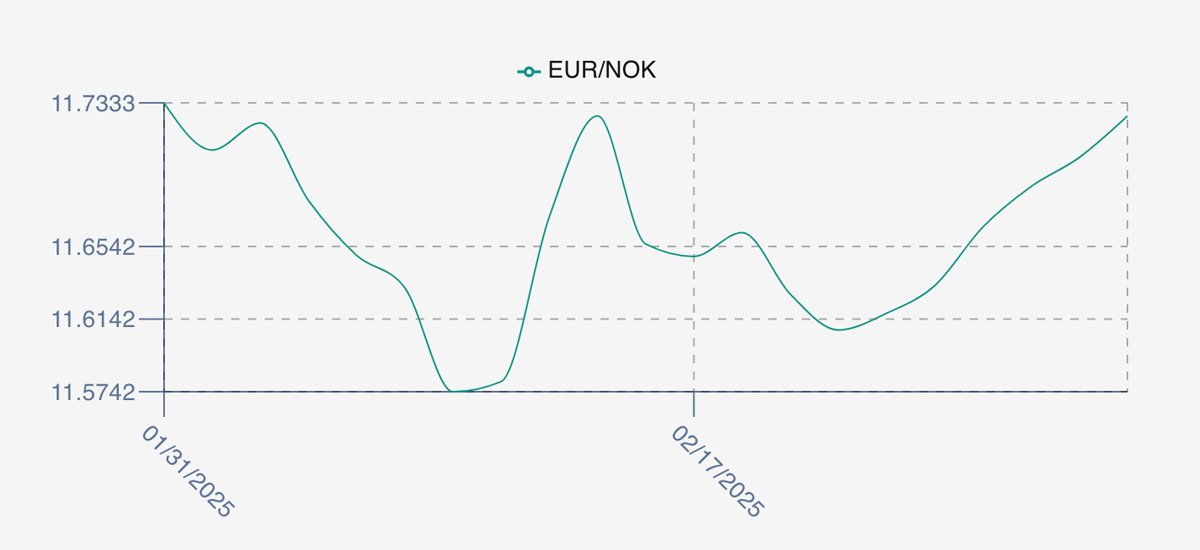

The NOK rate ended up +0.09 NOK / +0.78% at 11.70 to the Euro over the period Thursday to Thursday. The Fish Pool Euronext future March was reported down Thursday to Thursday – 0.50 EUR / -0.65% at 7.60 EUR which equates to approximately 88.92 NOK with April showing 8.10 EUR.

The Last Week

Things looked a little different in the end this week. It started going to plan, opening with a modest rise on last Thursdays price at 92.1 / +1.35% as sales were pushed. This continued to Monday at 93.19 NOK and held for Tuesday at 92.56. However, we started to see weakness on Wednesday as prices came off 3.5 NOK to 89.18 and further weakness Thursday to close out on the low at 87.02, top to bottom drop intraweek of over 6 NOK. Availability was good but lack of matching demand pushed prices down meaning fish remained unsold come the end of the week. Pricing and volumes compared to this time last year look quite different.

Total spreads between sizes 3/4s and 5/6s have compressed further and sit around 4.35 NOK, as the larger fish have come down further.

The EURNOK FX rate bounced off of last Thursdays low of 11.61 to finish the week at 11.70, giving a comparable Euro index price of 7.44 Euro.

Next Week

Early pricing indications from sellers for next week are coming around the 85.9 NOK level offered for the index, which puts us down about 1.10 NOK from Thursdays close – but 7 NOK off of last Friday.

There is a significant amount of fish coming through which started pushing pricing down last Wednesday and continue to exert pressure on pricing for week 10. Combined with fish left over from last week prices are soft. Pricing is difficult in this environment. Spreads showing around 5 NOK at the moment.

EUR NOK FX rate is showing 11.72 this afternoon. This would give an indicative Euro index price around

7.33 on levels later Friday.

Volumes – Fresh Export

Volume figure for week 8 (2025) was 15,536 tons up 4,849 tons as compared to 10,687 in 2024. Volumes for week 9 and week 10 (2024) were 12,959 and 14,487 respectively for comparison.

Historical Price Guidance for Next Week

The LFEX Norwegian Exporters Index for Week 10 2024 ended the week up +0.25%, +0.28 NOK to stand at 113.09 NOK (in EUR terms 9.92 / +0.11 / +1.13%) FCA Oslo. The NOK rate ended down at 11.40 to the Euro. The Fish Pool future March was showing up +0.30 NOK, +0.27% at 113.00 NOK.

David Nye’s technical analysis report will be published this Monday.

Market Data (Click Each to Expand)

| LFEX Prices | FX Rates | LFEX Indicative Exporter Prices (4 Week) | EUR / NOK FX Rate (4 Week) |

|

Prices Ending 28th February, 2025 For Friday's Price For Next Week, Offers & Trading Please Register |

Did You Know?

You can find historical weekly reports and data from LFEX going back over 3.5 years.

We collect manage and maintain all data to allow the market the ability to use and interpret information they find useful. With 3.5 years of unique high quality daily data it is the only place you can access pricing trends at such a granular level.

FAQ’s

Q. As a seller how can I manage my inventory as efficiently as possible?

A. You can set-up an offer and send it to multiple counterparties at the same time. You can negotiate and manage this volume between the counterparties and sell full or part of this inventory. Importantly the system won’t let you over-sell inventory you don’t want to offer / don’t have. At times of stress it helps to be showing volume to as many customers a possible to get orders.