The London Fish Exchange

Data / Market Insight / News

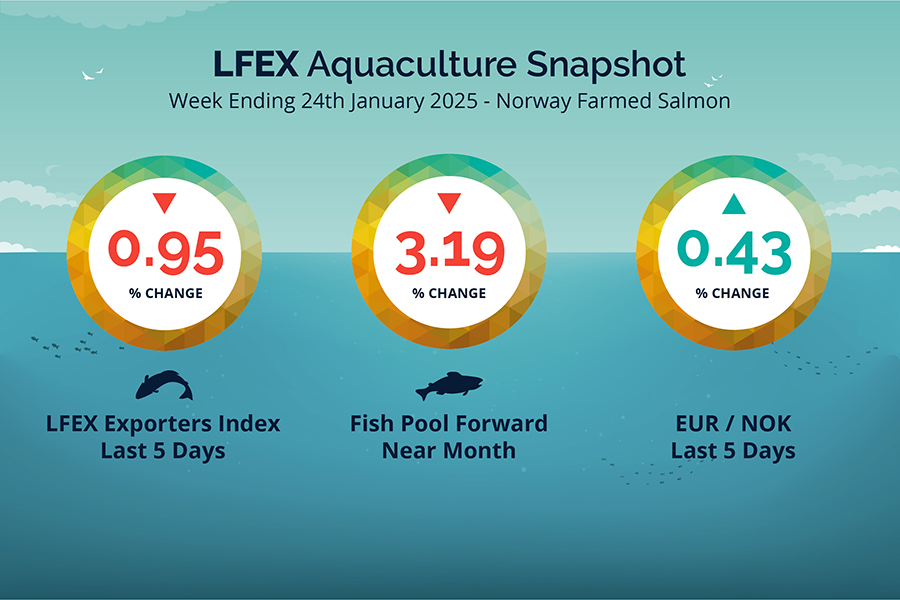

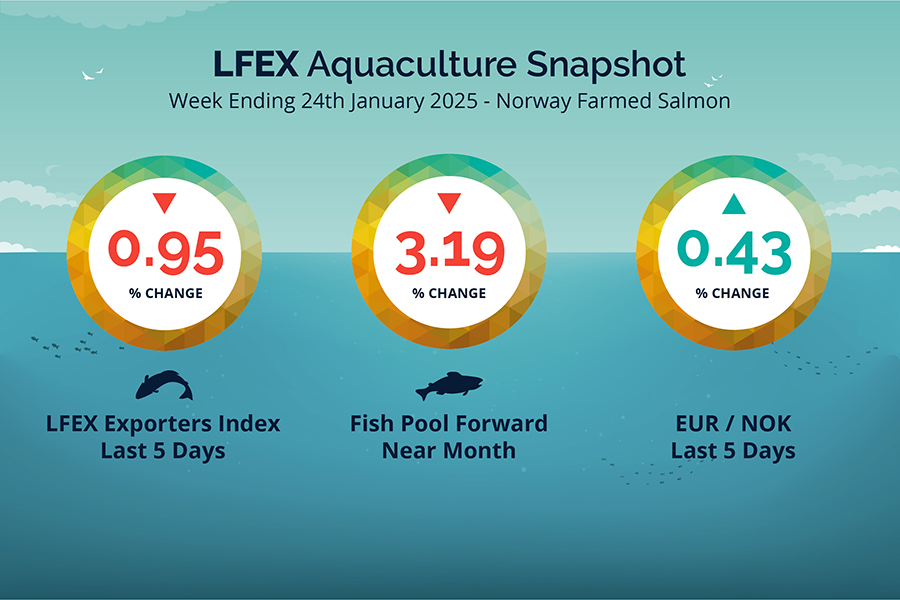

LFEX European Aquaculture Snapshot to 24th January, 2025

|

|

Published: 24th January 2025 This Article was Written by: John Ersser |

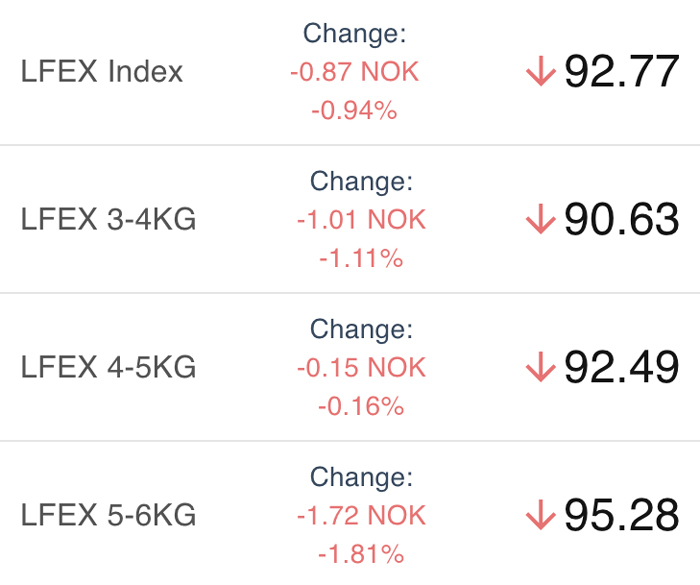

The LFEX Norwegian Exporters Index for Week 4 2025 ended the week down -0.89 NOK / -0.95% to stand at 92.77 NOK (in EUR terms 7.90 / -0.11 / -1.37%) FCA Oslo Week ending Thursday vs previous Thursday.

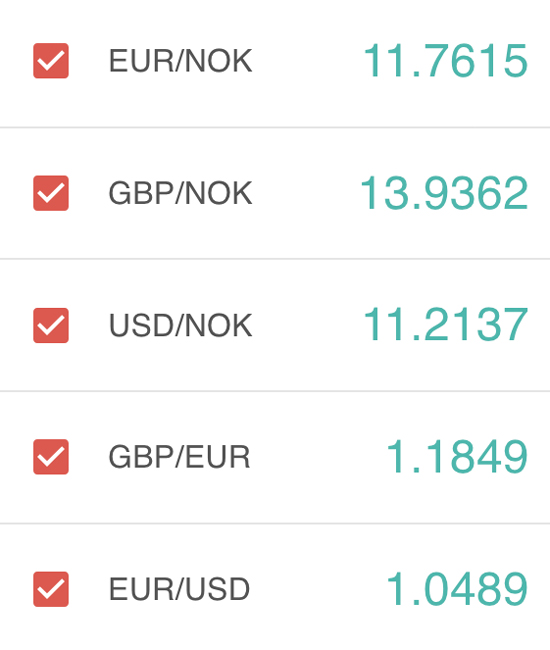

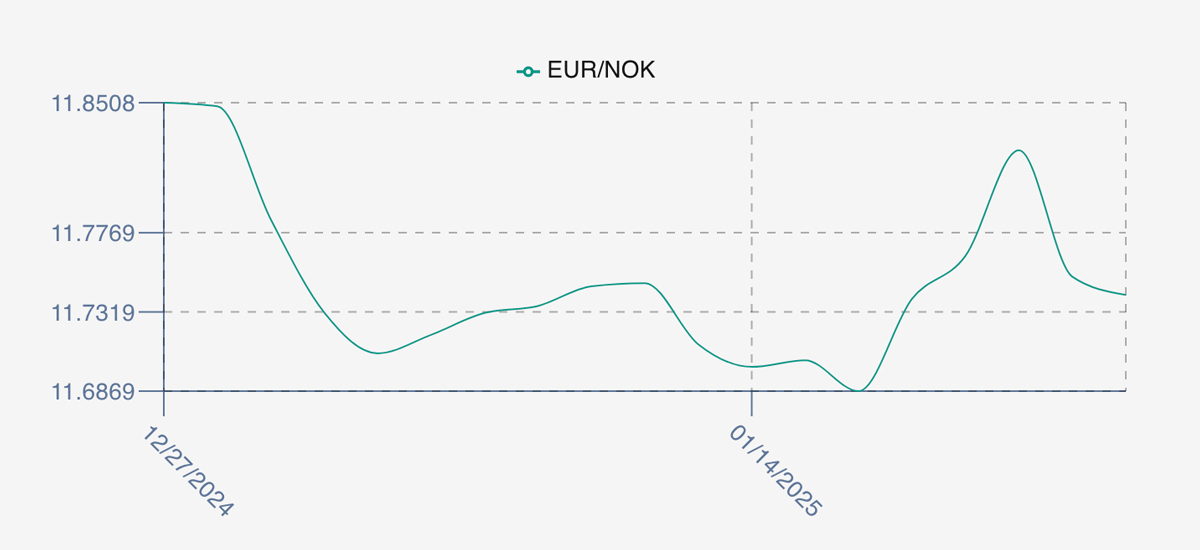

The NOK rate ended up +0.05 NOK /+0.43% at 11.74 to the Euro over the period Thursday to Thursday. The Fish Pool Euronext future February was reported down Thursday to Thursday – 0.3 EUR / -3.19% at 9.10 EUR which equates to approximately 106.83 NOK with March showing 9.40.

The Last Week

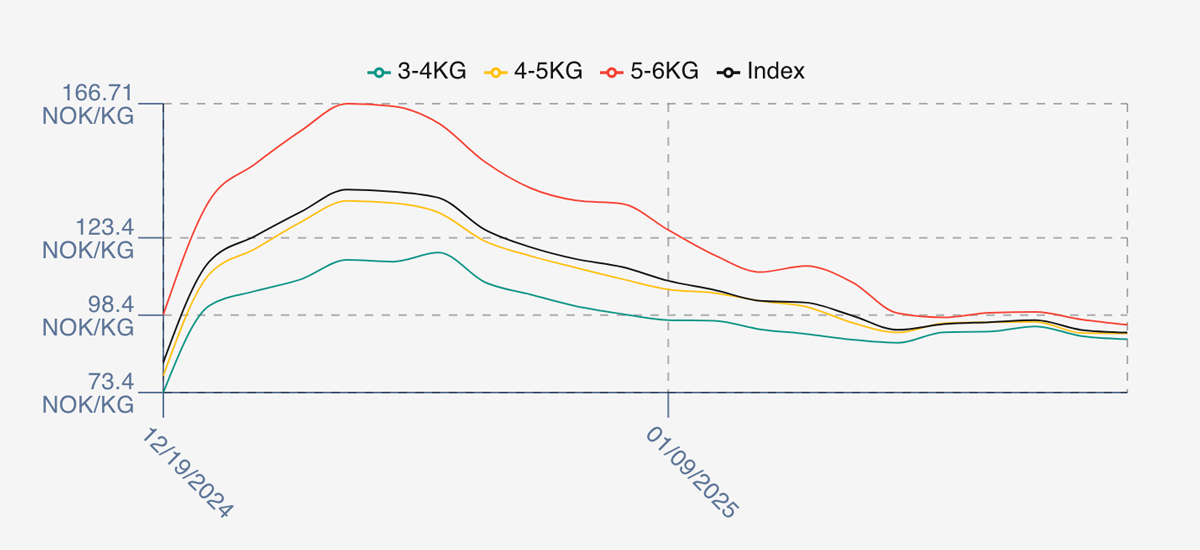

This week felt like there was overall more stability in the index. The week started Friday with the usual push up in prices meaning we saw 95.5 NOK open a 1.84 NOK / 1.96% rise from last weeks (Thursday) close. Spreads have massively compressed from the previous 2 / 3 weeks volatility. Monday prices edged up to 96.15 and Tuesday similar at 96.78 as all sizes ticked up a little in unison. However, midweek Wednesday gave up the weeks gains at 93.64 and we closed out at 92.77 as supply remained good at the end of the week, fish were unsold and an overall loss for the index for the week. Bigger fish have suffered the most as Chinese new year sales have been pretty much completed.

Spreads between sizes have crashed and now come in around 5 NOK evenly spread between sizes. The pricing graph for January is amazing showing the volatility people have been trading through.

The EURNOK FX rate increased to 11.74 NOK giving a comparable Euro index price of 7.90 Euro.

Next Week

Early pricing indications from sellers for next week are coming around the 92.9 NOK level offered for the index – so flat from Thursday’s levels. Chinese New Year as mentioned is pretty much over, but we still see a spread (2 NOK) between 4-5s and 5-6s.

EUR NOK FX rate is pretty much level at 11.75 this afternoon. This would give an indicative Euro index price around 7.90 on levels later Friday.

Volumes – Fresh Export

Volume figures for week 3 (2025) was 17,325 tons up 2,703 tons as compared to 14,622 in 2024. Volumes for week 4 and week 5 (2024) were 15,342 and 13,511 respectively for comparison.

Historical Price Guidance for Next Week

The LFEX Norwegian Exporters Index for Week 5 2024 ended the week up +8.24%, +8.51 NOK to stand at 111.76 NOK (in EUR terms 9.83) FCA Oslo. The NOK rate ended flat at 11.37. The Fish Pool future February was reported up +0.1 NOK, +0.09% at 107.2 NOK.

David Nye’s technical analysis report will be published this Monday.

Market Data (Click Each to Expand)

| LFEX Prices | FX Rates | LFEX Indicative Exporter Prices (4 Week) | EUR / NOK FX Rate (4 Week) |

|

Prices Ending 24th January, 2025 For Friday's Price For Next Week, Offers & Trading Please Register |

Did You Know?

Odd Lots – what does it mean, and can I trade them?

Odd Lots, or smaller orders and unusual one-off transactions are often the result of a surprise demand that needs to be facilitated by a buyer, or a smaller excess inventory from a seller. The use of a platform is ideal in this scenario allowing both sides to broadcast their Odd Lot requirement to multiple counterparties quickly and easily, and to source and mop up the requirement. It means the system can take the strain as opposed to chasing around for ultimately a low volume order.

FAQ’s

Q. If I use your chat service can anyone else see my messages?

A. LFEX Chat is available on both web and mobile devices and allows users to communicate in real-time with specific named individuals. Every user on the system is uniquely identified and this offers a secure, robust and private service. It is free to use as part of the LFEX service and puts all your business communications in one place, and your private data remains just that… private. It won’t keep glitching like skype and won’t frustratingly reinvent words as your mobile ‘auto-corrects’ to the wrong words.