The London Fish Exchange

Data / Market Insight / News

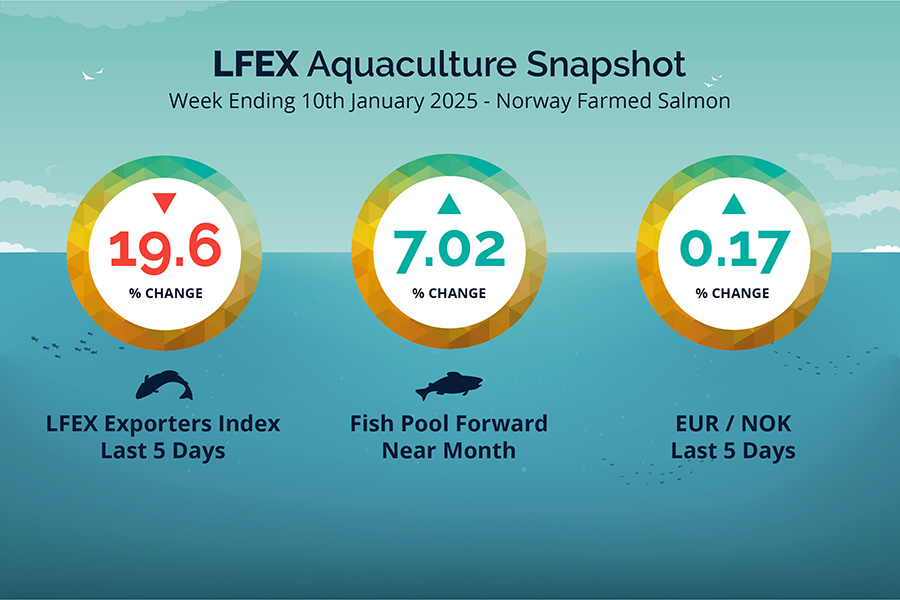

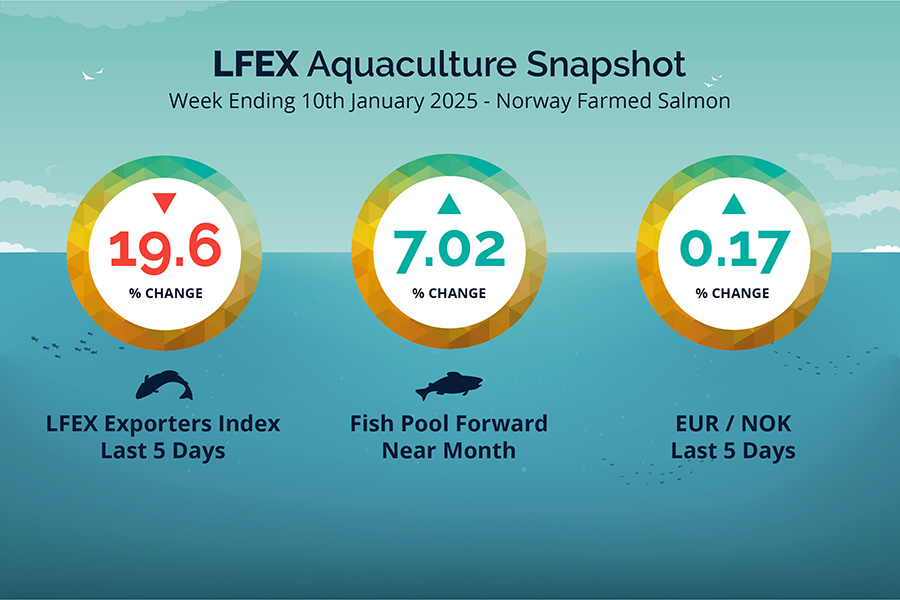

LFEX European Aquaculture Snapshot to 10th January, 2025

|

|

Published: 10th January 2025 This Article was Written by: John Ersser |

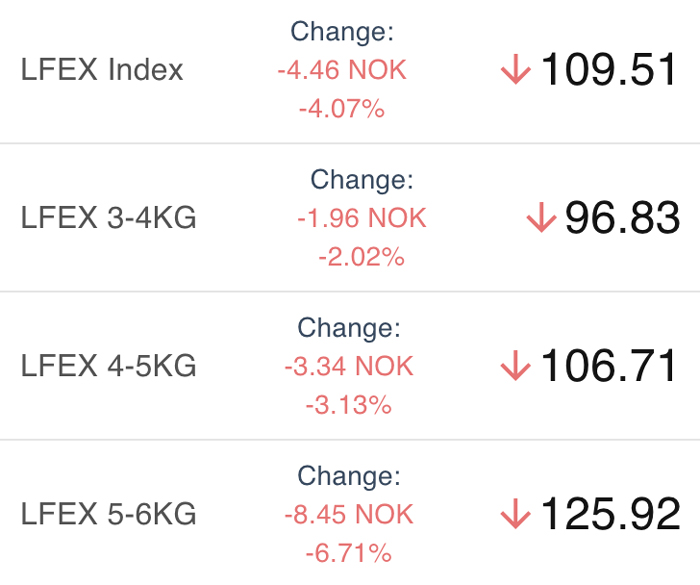

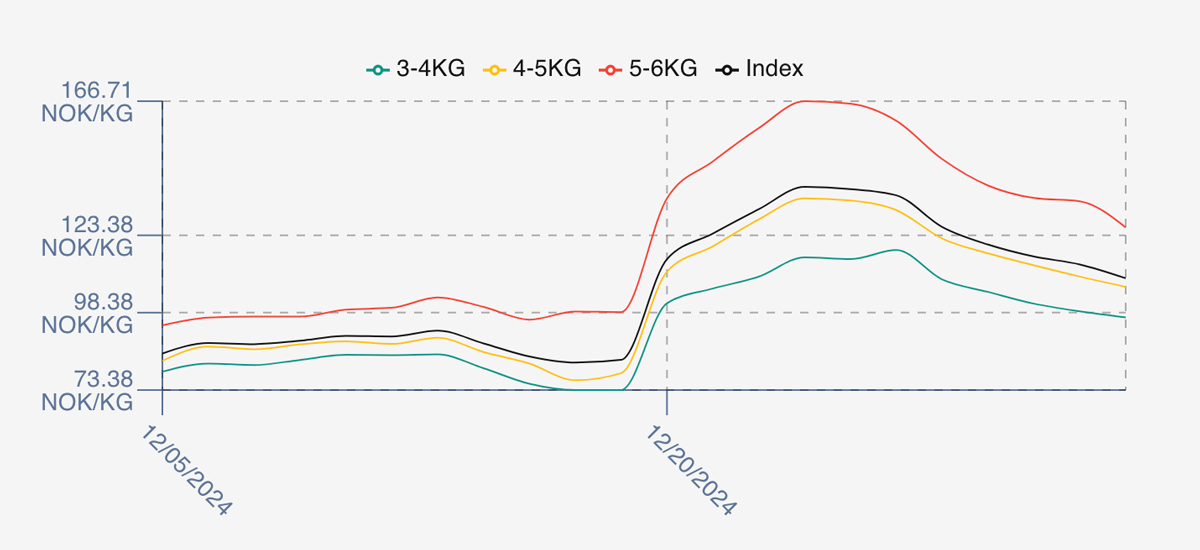

The LFEX Norwegian Exporters Index for Week 2 2025 ended the week down -26.79 NOK / -19.66% to stand at 109.51 NOK (in EUR terms 9.32 / -2.30 /-19.79%) FCA Oslo Week ending Thursday 9th vs previous Thursday.

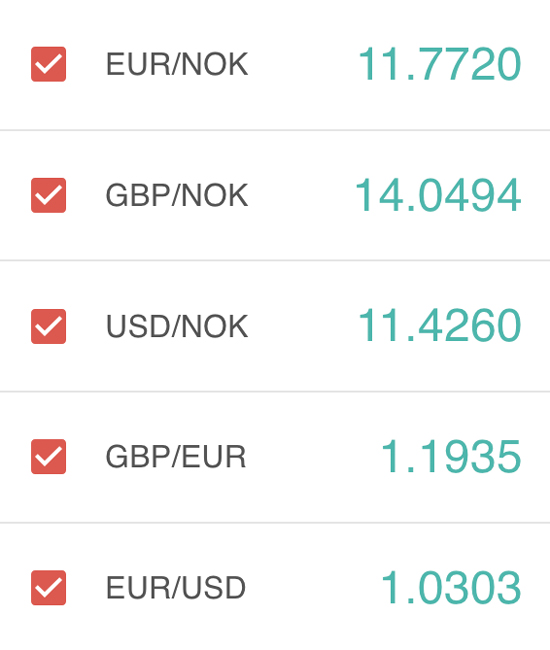

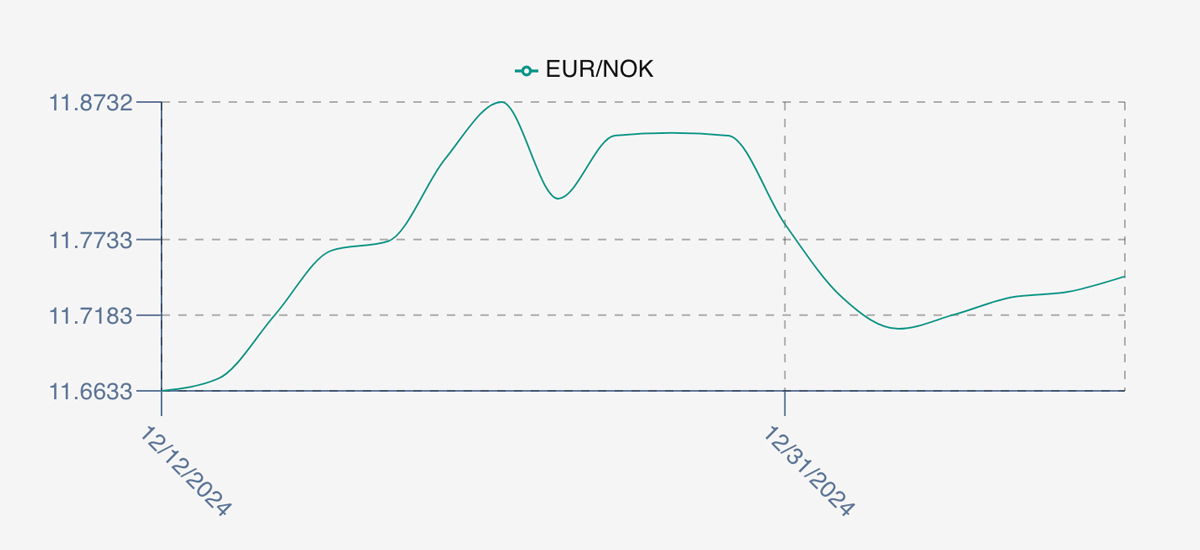

The NOK rate ended up +0.02 NOK /+0.17% at 11.75 to the Euro over the period Thursday to Thursday. The Fish Pool Euronext future February was reported up Thursday to Thursday 0.63 EUR / +7.02% at 9.60 EUR which equates to approximately 112.81 NOK.

The Last Week

This week we saw the correction in prices that had been expected after the recent seasonal run-up. Although the market opened lower on the Friday with the index indicating a 126 level, a correction of 10 NOK sellers were keen to holdout on pricing on Friday until volumes became clearer for the next week. Monday saw another 6 NOK chipped away to 120.37, a further 4 NOK on Tuesday to 116.5. Wednesday the index reduction was tempered by some bigger fish holding their own, 113.07 indicated while Thursday saw 109.51 as the price capitulation was complete – 26 NOK in the week as unsold fish pushed prices lower.

Spreads between sizes have increased a little and coming in around 29 NOK during the week.

The EURNOK FX rate increased marginally to 11.75 NOK giving a comparable Euro index price of 9.32 Euro.

Next Week

Early pricing indications from sellers for next week are coming around the 106.5 NOK level offered for the index – a further fall of around 3 NOK from yesterday’s close. Buyers are hoping for falls with volume available but, it’s unsure at the moment which way the week will end up. 5/6s have dropped around 10 NOK bringing the spread in, to 21ish NOK.

EUR NOK FX rate started the day at 11.75 and has fallen this afternoon to the 11.72 levels. This would give an indicative Euro index price around 9.08 on levels later Friday.

Volumes – Fresh Export

Volume figures for week 1 (2025) was 11,364 tons down – 741 tons as compared to 12,105 in 2024. Volumes for week 2 and week 3 (2024) were 16,016 and 14,622 respectively for comparison.

Historical Price Guidance for Next Week

The LFEX Norwegian Exporters Index for Week 3 2024 ended the week up +4.76%, +4.5 NOK to stand at 99.0 NOK (in EUR 8.65 FCA Oslo. The NOK rate ended up at 11.44. The Fish Pool future January was reported down -0.90 NOK, -0.84% at 106.1 NOK.

David Nye’s technical analysis report will be published this Monday.

Market Data (Click Each to Expand)

| LFEX Prices | FX Rates | LFEX Indicative Exporter Prices (4 Week) | EUR / NOK FX Rate (4 Week) |

|

Prices Ending 10th January, 2025 For Friday's Price For Next Week, Offers & Trading Please Register |

Did You Know?

The LFEX platform helps sellers manage and distribute multiple prices to different customers in real-time on the system.

Customers are different and have different demands, whether it is sizes, classifications, certifications, currencies or INCO terms. The platform allows sellers to manage this process, getting bespoke pricing out to a universe of customers quickly and easily allowing buyers more immediate access to offers to see and react to.

FAQ’s

Q. How does your weekly pricing change work?

A. The index is a useful tool for overall pricing as well as tracking intra week volatility and we calculate and publish the index every day. We report the weekly change based on the change from the previous Thursday – effectively that week’s close to the Thursday of that following week. This gives an accurate measure of the actual change week on week, especially useful when pricing has gapped between the Thursday close and Friday pricing. The index will show how it changed during that week, capturing the opening levels as prices and sales are pushed at the start of the week and where it ends up, and is a useful indication of intra week sentiment.