The London Fish Exchange

Data / Market Insight / News

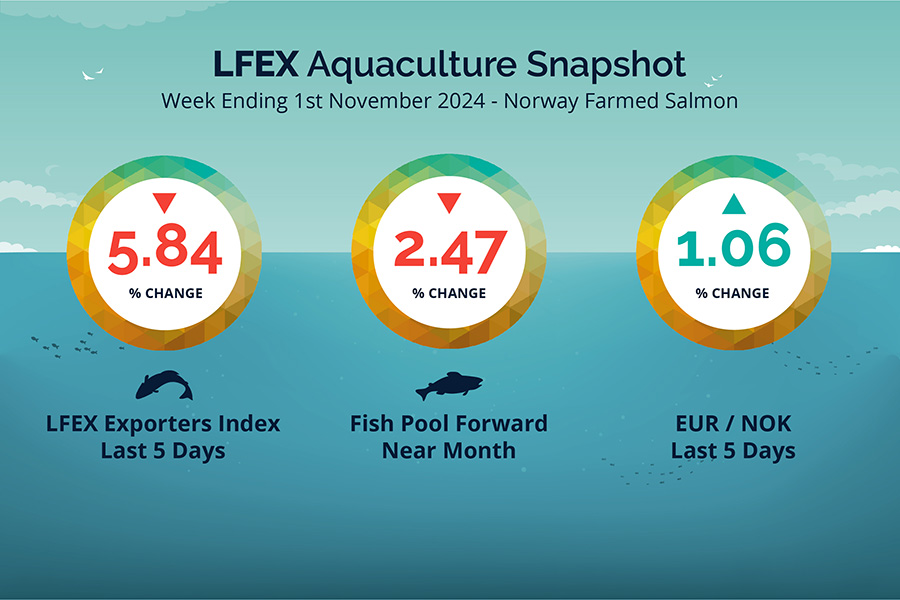

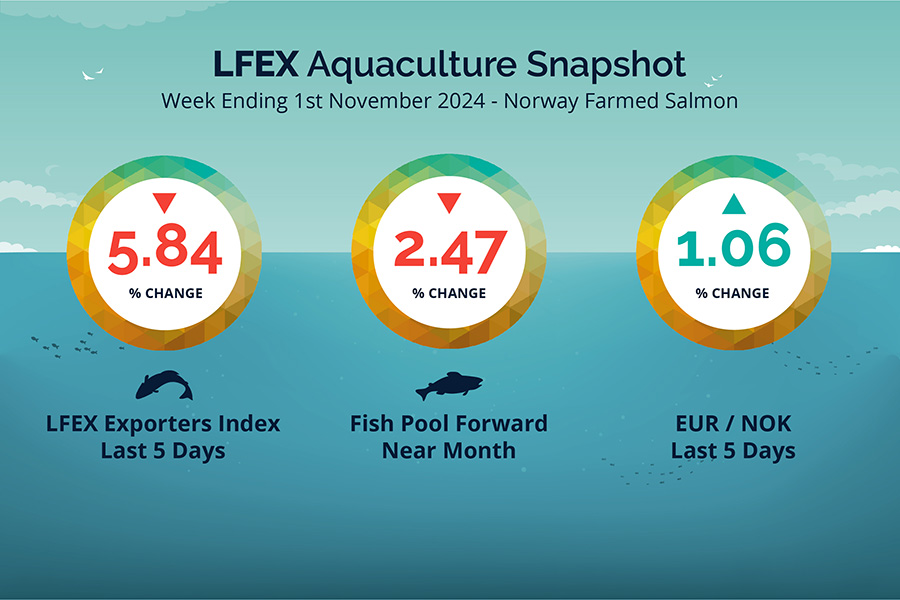

LFEX European Aquaculture Snapshot to 1st November, 2024

|

|

Published: 1st November 2024 This Article was Written by: John Ersser |

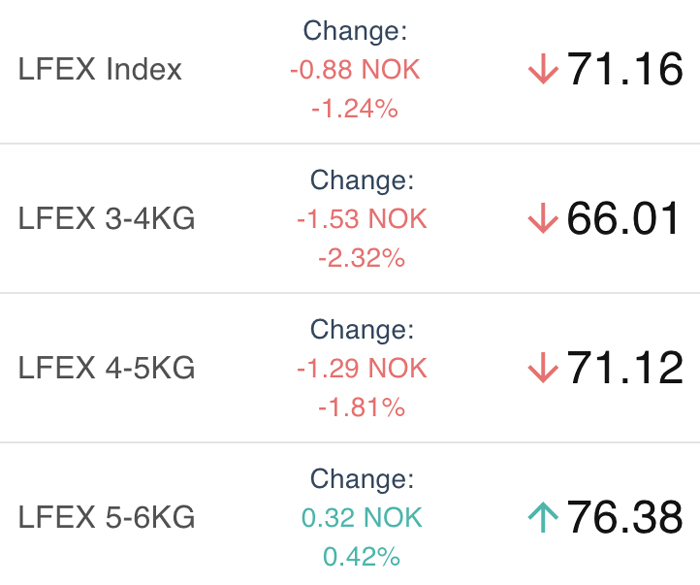

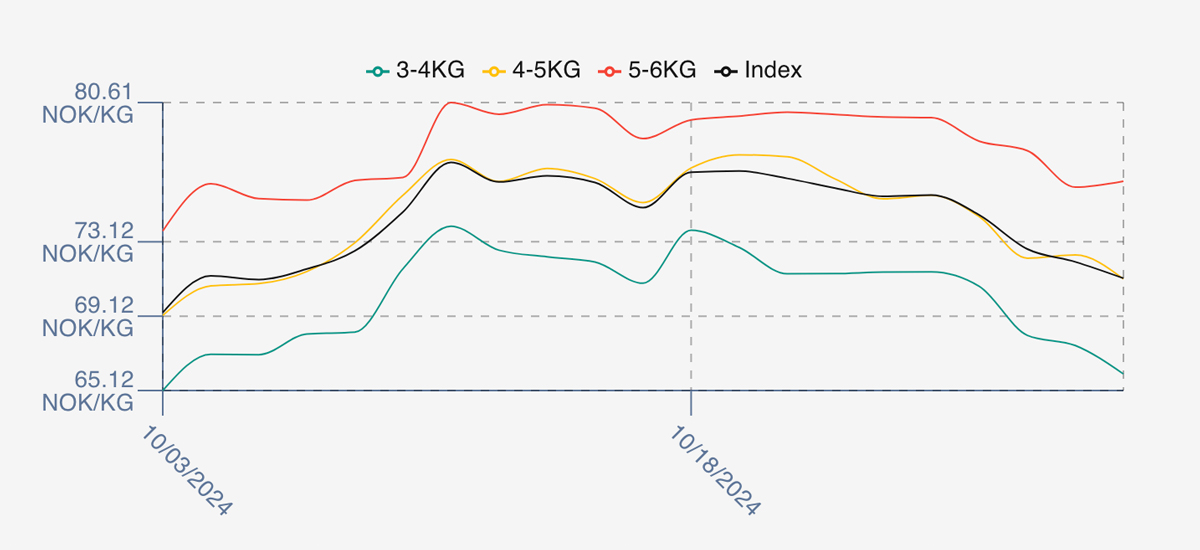

The LFEX Norwegian Exporters Index for Week 44 2024 ended the week down -4.41 NOK / +0.81% to stand at 71.16 NOK (in EUR terms 5.96 / + 0.44 / +6.82%) FCA Oslo Week ending Thursday vs previous Thursday.

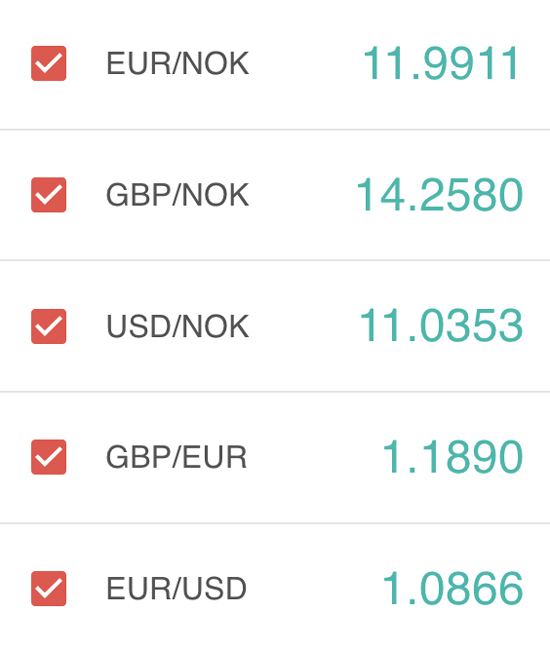

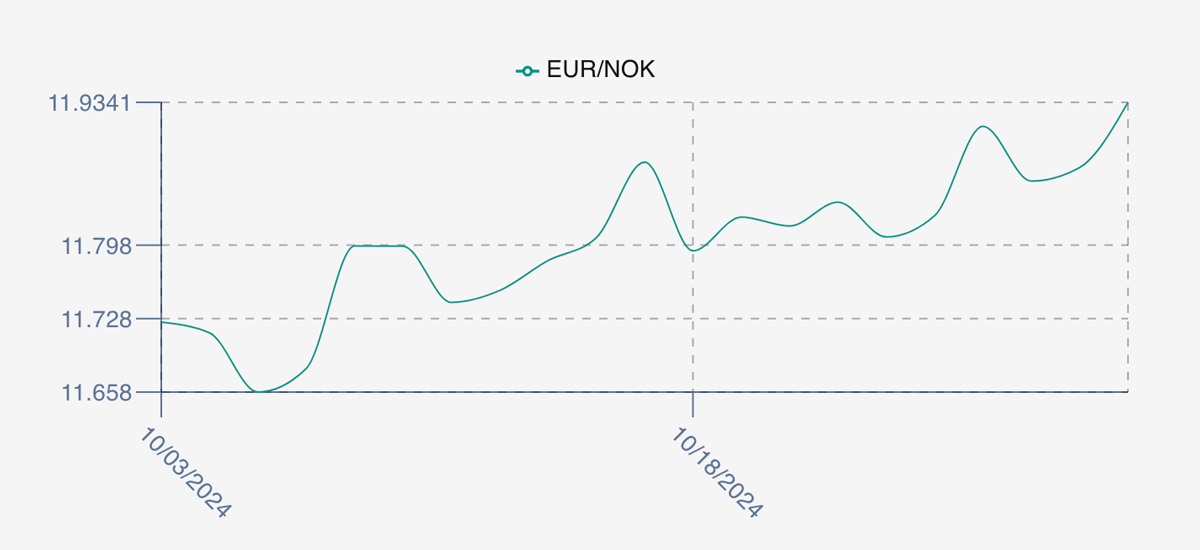

The NOK rate ended up at 11.93 to the Euro over the period Thursday to Thursday +0.13 NOK or +1.06%. The Fish Pool future November was reported up Thursday to Thursday -2.00 NOK / -2.47% at 79.0 NOK.

The Last Week

Last week the overall balance felt on Friday meant prices coming into the new week were flat at 75.64 NOK for the index (+0.07NOK). However, this was to be short lived with Monday showing weakness down a NOK and a bit at 74.56, with further falls on Tuesday 72.73 and Wednesday 72.04 before finishing the week at the low 71.16 and puts us back to levels we saw earlier in September. Smaller and midsized fish have dragged the index lower, while 5/6s are off slightly.

Spreads as a consequence widened and ended the week around 10.00 NOK between 3-4s and 5-6s.

The EURNOK FX pair opened on Friday up small at 11.82, and overall trended upwards to the high 11.93 by the weeks’ end. Better news for EUR buyers as prices fell nearly 7% over the week.

Next Week

Early pricing indications from sellers for week 45 are coming in at around 73 NOK as sellers push prices. There is recognition that prices came off 5 NOK over the last week, and this represents a bit of a bounce back up. It is All Saints bank holiday in parts of Europe today including Poland which means less selling activity today and less demand, and we need to see how things progress on Monday. On smaller sizes there is some price pressure and spreads remain around 10 NOK.

Volumes – Fresh Export

Volume figures for week 43 (2024) was 24,910 tons as compared to 26,459 in 2023. Volumes for weeks 44 and 45 (2023) were 24,437 and 23,852 respectively for comparison.

Historical Price Guidance for Next Week

The LFEX Norwegian Exporters Index for Week 45 2023 ended the week down -4.35%, -3.45 NOK to stand at 75.81 NOK (approximately 6.35 EUR) FCA Oslo. The NOK rate was 11.94 and the Fish Pool future November was reported at 78.0 NOK.

David Nye’s technical analysis report will be published on Monday.

Market Data (Click Each to Expand)

| LFEX Prices | FX Rates | LFEX Indicative Exporter Prices (4 Week) | EUR / NOK FX Rate (4 Week) |

|

Prices Ending 1st November, 2024 For Friday's Price For Next Week, Offers & Trading Please Register |

Did You Know?

LFEX has significant experience in building and running internal trading, middle and back-office systems as well as data solutions?

This means our experience and systems used to run and operate markets, also provides the basis for internal technology solutions for producers / sales organisations and also buyside companies. We know in many industries companies fail to prioritise internal / supply chain technology which can provide multiple efficiencies within an organisation and further deliver high quality data that can be used to further improve operational activity. Feel free to contact us to discuss your internal technology requirements and how it can be a bespoke and unique solution for your local and global business operations and needs.

FAQ’s

Q. What other views can I get on pricing?

A. We publish technical analysis every week from David Nye – the only company to do so using daily pricing data. It provides a further view on pricing trends and helps add colour to the short-term pricing picture. Even when markets are running flat it can provide useful commentary to highlight market pricing, as we did last week. “I still believe the Oslo FoB Index is making its seasonal lows for the year. In October of each year, in the available history the Oslo FoB Index, the Oslo FoB Index does appear to have a modest pull back in price after its first initial rally from its seasonal lows. This trend has continued until mid-November of each year. It’s very possible this is what are now experiencing in the Oslo FoB Index.”