The London Fish Exchange

Data / Market Insight / News

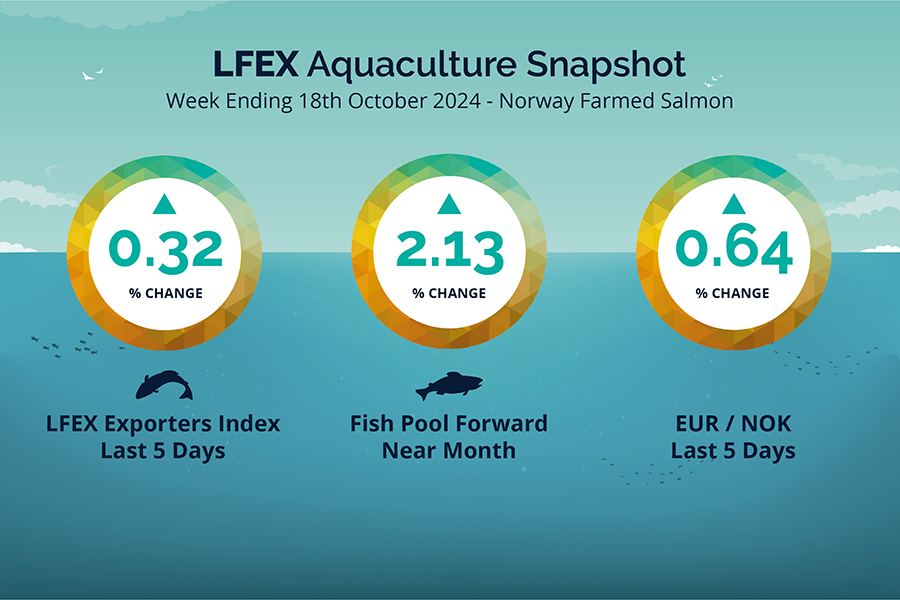

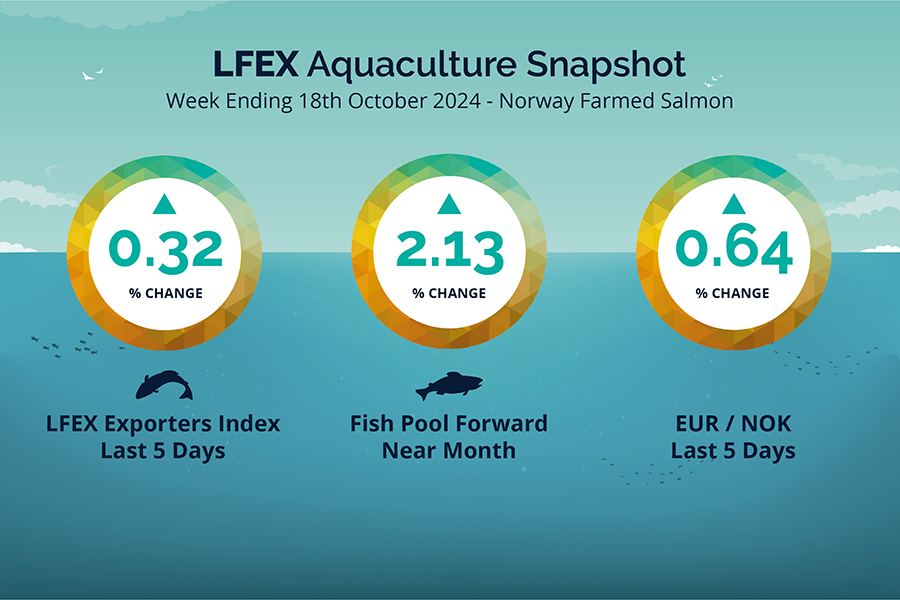

LFEX European Aquaculture Snapshot to 18th October, 2024

|

|

Published: 18th October 2024 This Article was Written by: John Ersser |

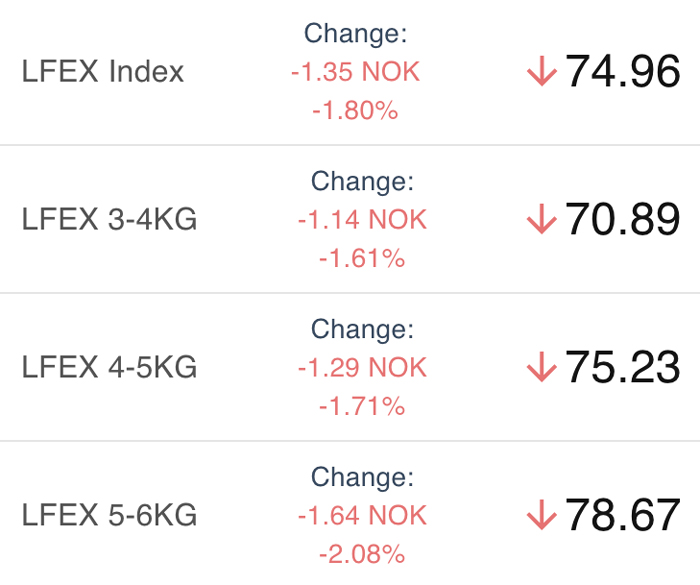

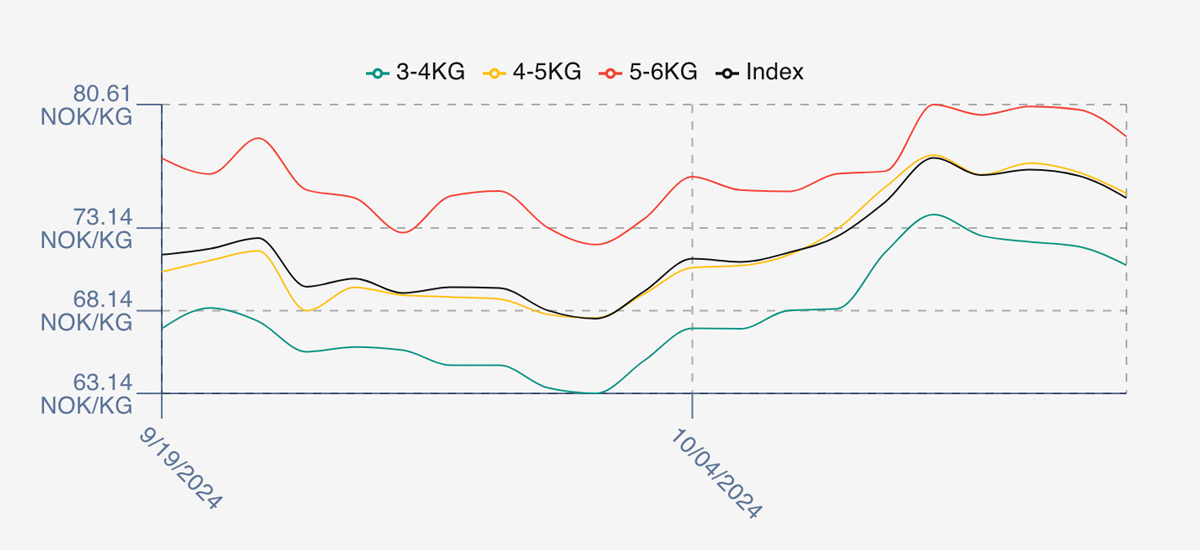

The LFEX Norwegian Exporters Index for Week 42 2024 ended the week up +0.24 NOK / +0.32% to stand at 74.96 NOK (in EUR terms 6.31 / – 0.02 / -0.31%) FCA Oslo Week ending Thursday vs previous Thursday.

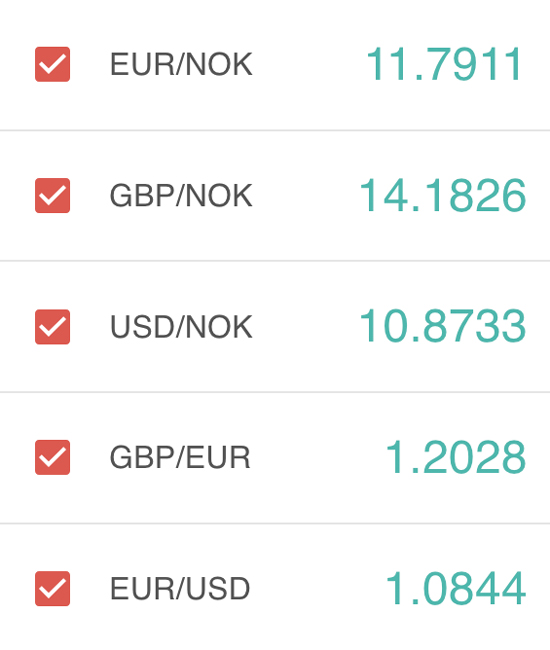

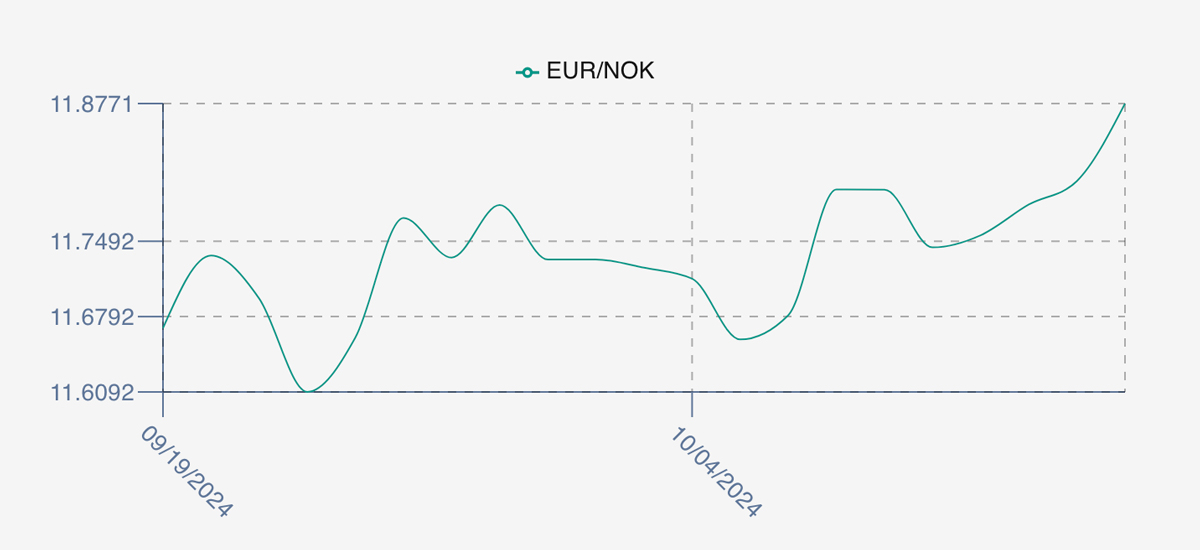

The NOK rate ended higher at 11.875 to the Euro over the period Thursday to Thursday +0.07 NOK or +0.64%. The Fish Pool future October was reported up Thursday to Thursday +1.50 NOK / +2.13% at 72.0 NOK.

The Last Week

We saw a significant jump in prices on market open Friday after the previous weeks’ gains. The index opened at a level of 77.39 NOK, a 2.67 NOK / 3.57% gain on the Thursday close for deliveries in week 42. There seemed to be some shock as prices were pushed higher by the producers based on reducing volumes of fish. No one was sure how the buyers would react, but pricing settled back 1 NOK on the Monday to 76.34 and remained at this level Tuesday 76.67 and Wednesday 76.31. By Thursday however, the market had given up the gains with unsold fish and back to the 74.96 level for a marginal overall increase over the week.

Spreads widened a little from Tuesday and ended the week around 7.5NOK between 3-4s and 5-6s with all 3 sizes falling in unison on the Thursday.

The EURNOK FX pair was one way traffic this week. Starting at 11.74 and peaking on the Thursday at 11.875.

Next Week

Early pricing indications from sellers for week 43 are coming at a level around 76.5 NOK, which represents a lift from Thursday, but similar pricing midweek in week 41 by way of comparison. There is less abundance of smaller fish which means their pricing (2-3s) has firmed a little, and is bring the spread in to nearer 6 NOK.

Volumes – Fresh Export

Volume figures for week 41 (2024) was 25,180 tons as compared to 24,679 in 2023. Volumes for weeks 42 and 43 (2023) were 24,609 and 26,459 respectively for comparison.

Historical Price Guidance for Next Week.

The LFEX Norwegian Exporters Index for Week 43 2023 ended the week down -5.88%, -4.83 NOK to stand at 77.34 NOK (approximately 6.52 EUR) FCA Oslo. The NOK rate was 11.86 and the Fish Pool future October was reported 81.75 NOK.

David Nye’s technical analysis report will be published on Monday.

Market Data (Click Each to Expand)

| LFEX Prices | FX Rates | LFEX Indicative Exporter Prices (4 Week) | EUR / NOK FX Rate (4 Week) |

|

Prices Ending 18th October, 2024 For Friday's Price For Next Week, Offers & Trading Please Register |

Did You Know?

Even when you are not in the office you can keeping a proper track on everything you do?

The system is designed to be there for you 24 x 7, no matter where you are or what time zone you are in you will be able to access the platform and communicate, place orders or make offers or execute trades. You can log in remotely and securely from any location, see the most recent data and offers. The system has been designed to ensure you never miss an opportunity and sends notifications to users (SMS and Email) of events affecting you even when not logged in. We also provide access to the LFEX Mobile APP should you not have access to a computer or WiFi, and real-time LFEX Chat services. Whether you are away from the desk, office or country, at an Expo or on holiday you will always have everything you need to optimise your business.

FAQ’s

Q. I want to lock in some volume for the next few weeks – can I do this?

A. Yes you can. The system will allow you to make requests (RFQ’s) to as many counterparties as you want. You can choose an immediate spot date for the current / following week, or forward dates for future deliveries. You can separate these trades out and negotiate and trade them separately (with different counterparties), or as a contract with a specific counterparty.