The London Fish Exchange

Data / Market Insight / News

LFEX European Aquaculture Snapshot to 4th October, 2024

|

|

Published: 4th October 2024 This Article was Written by: John Ersser |

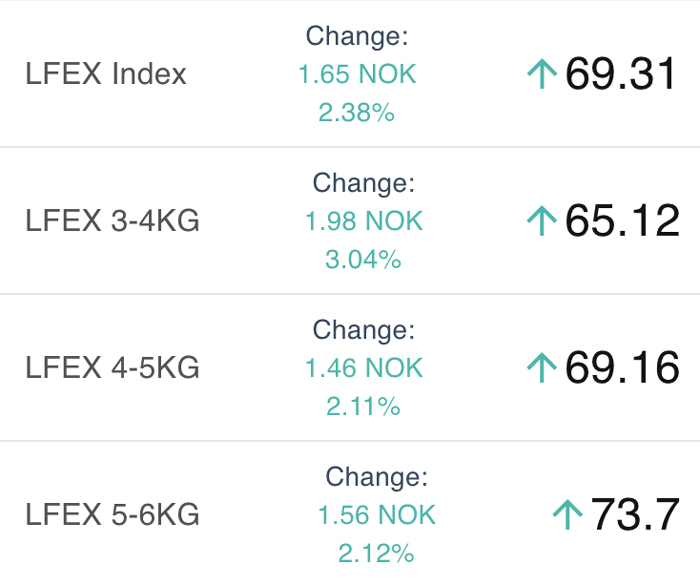

The LFEX Norwegian Exporters Index for Week 40 2024 ended the week up +0.10 NOK / +0.14% to stand at 69.31 NOK (in EUR terms 5.91 / + 0.03 / +0.57%) FCA Oslo Week ending Thursday vs previous Thursday.

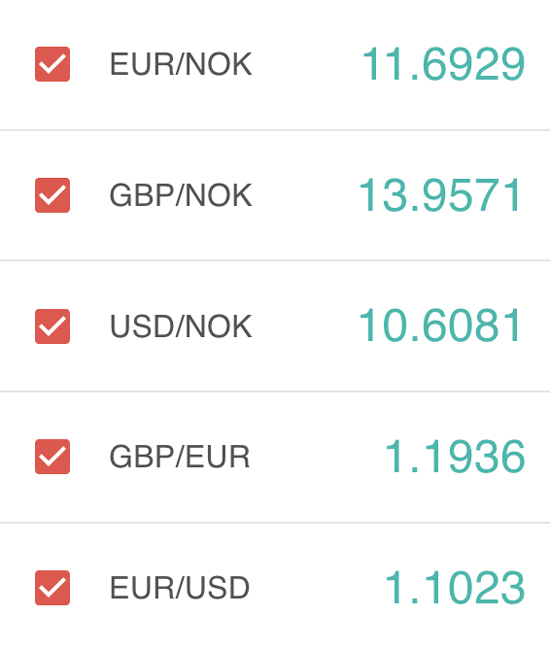

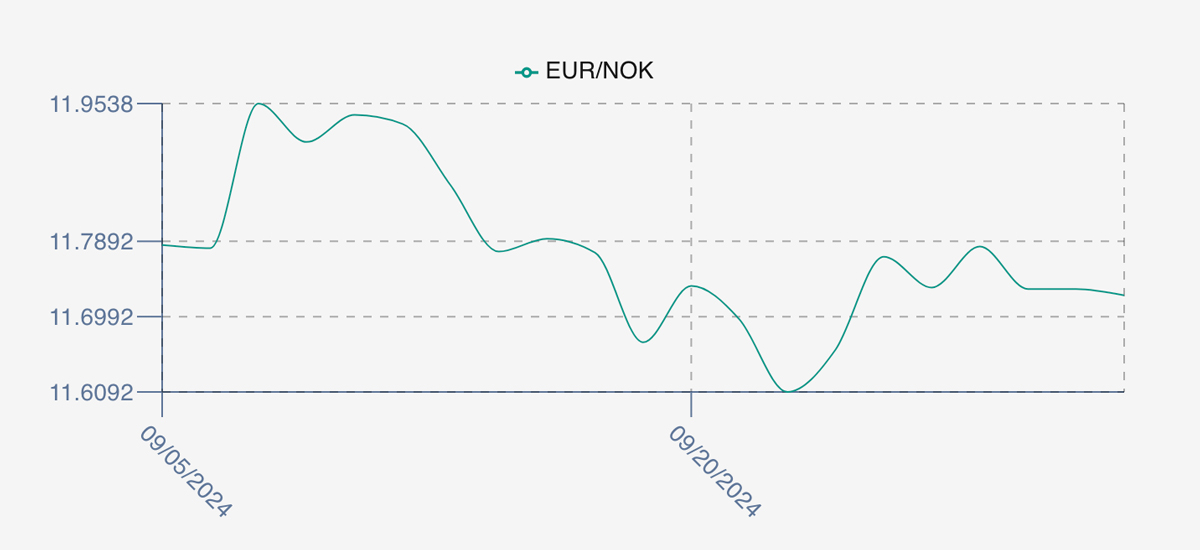

The NOK rate ended lower at 11.72 to the Euro over the period Thursday to Thursday -0.05 NOK or -0.42%. The Fish Pool future October was reported down Wednesday to Thursday -1.50 NOK / -2.09% at 70.2 NOK.

The Last Week

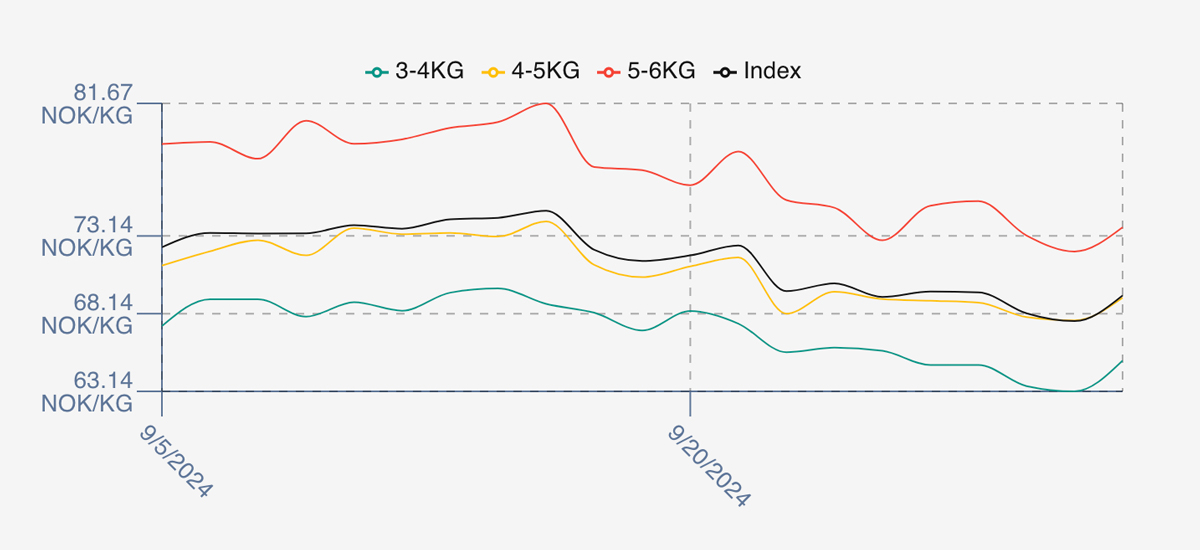

Prices at the end of the prior week 39 were pushed down on the heavy volumes, so no surprise the exporters pushed the prices slightly higher on the open at 69.56 last Friday up a tad at 0.35NOK or 0.5%. The price settled here for Monday at 69.51, but we saw weakness begin to creep in on Tuesday at 68.16 and Wednesday down at 67.66 NOK. The low of the week – and the year so far – was this the bottom? Thursday found strength popping back up to 69.31 which left the overall change for the week pretty flat, but again doesn’t tell the whole story.

Spreads remained fairly constant with sizes moving in unison, with approximately 4 NOK between classes and therefore 8 NOK overall.

Intraweek FX volatility has been subdued in the past week with the EURNOK pair trading range between 11.78 and 11.725, closing on the low. This made the Euro price 5.91 up +0.57% by comparison.

Next Week

Early opening indications from sellers for week 41 are coming in with prices popping up at around the 71 NOK level offered for the index. Still a lot of fish around and these prices are not expected to hold as the week progresses.

Volumes – Fresh Export

Volume figures for week 39 (2024) was 29,238 tons a record week and 17% over the same time period as last year of 24,952 tons according to SSB. Volumes for weeks 40 and 41 (2023) were 25,979 and 24,679 respectively for comparison.

Historical Price Guidance for Next Week.

The LFEX Norwegian Exporters Index for Week 41 2023 was up +7.43%, +5.88 NOK to stand at 85.01 NOK (approximately 7.38 EUR) FCA Oslo. The NOK rate ended at 11.52 and the Fish Pool future October 23 was reported up + 2.00 NOK at 80.0 NOK

David Nye’s technical analysis report will be published on Monday.

Market Data (Click Each to Expand)

| LFEX Prices | FX Rates | LFEX Indicative Exporter Prices (4 Week) | EUR / NOK FX Rate (4 Week) |

|

Prices Ending 4th October, 2024 For Friday's Price For Next Week, Offers & Trading Please Register |

Did You Know?

The technical analysis we publish weekly adds colour and thought to the near term (and longer term) price movements.

Last week we published the following conclusion – ‘In summary, I still believe the Oslo FoB Index is searching for a seasonal price low. Notice there is still a bullish divergence signal between the Composite Index and the RSI while the Oslo FoB Index is testing a support zone backed up three separate methods. Represented by the purple downward sloping trendline on the Composite Index and the upward sloping black trendline on the RSI. Can the Oslo FoB Index continue to lower prices? Absolutely. The next couple of weeks should be interesting for the Oslo FoB Index.’

FAQ’s

Q. Who can see my prices?

The answer is you can choose, it’s 100% in your control. Although you can connect to different counterparties simultaneously, the system maintains a 1-2-1 relationship between you and the seller / buyer you connected with. It securely brings your relationships onto the platform and you decide who can see your prices and offers / requests and all actions and activity are secure and private.