The London Fish Exchange

Data / Market Insight / News

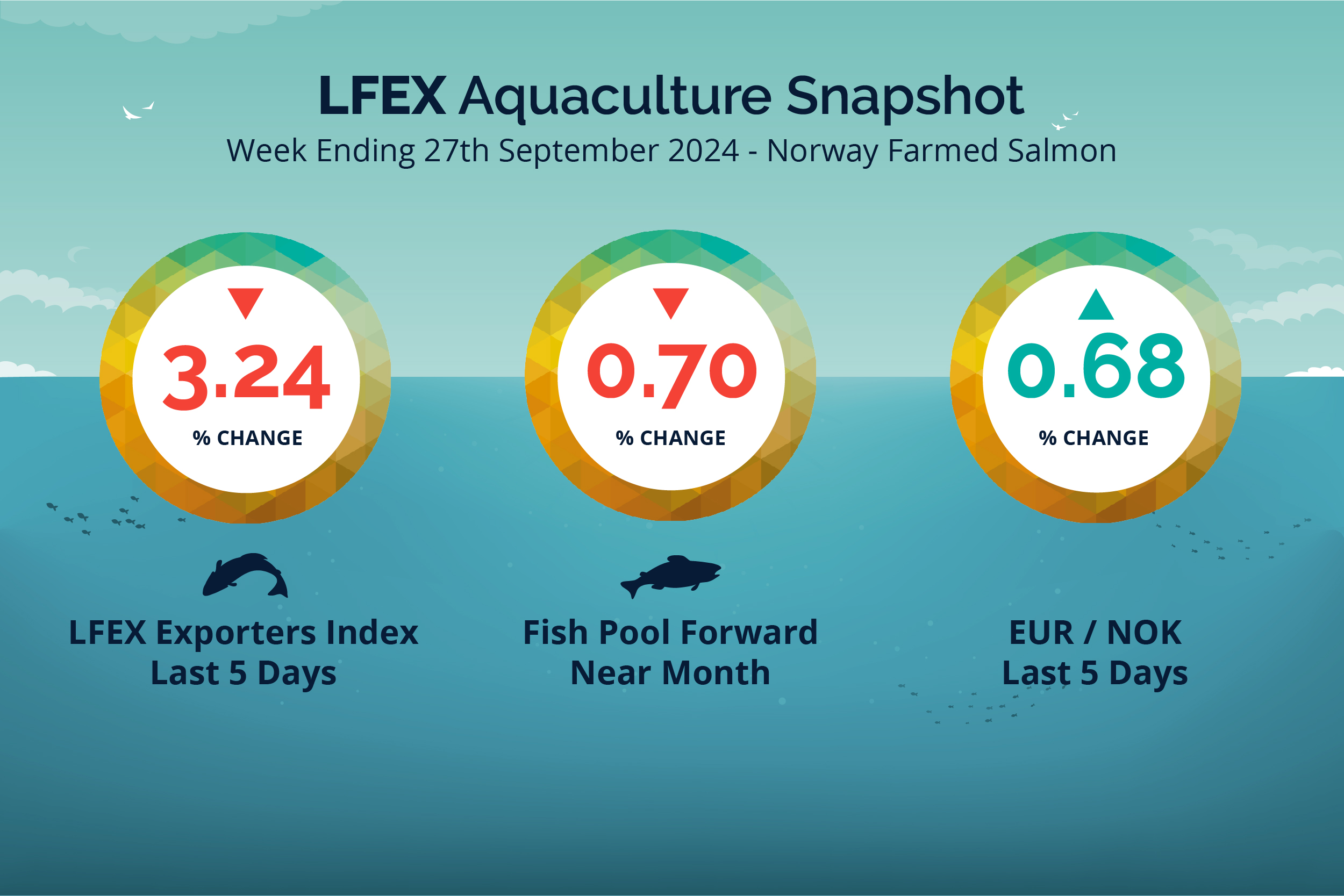

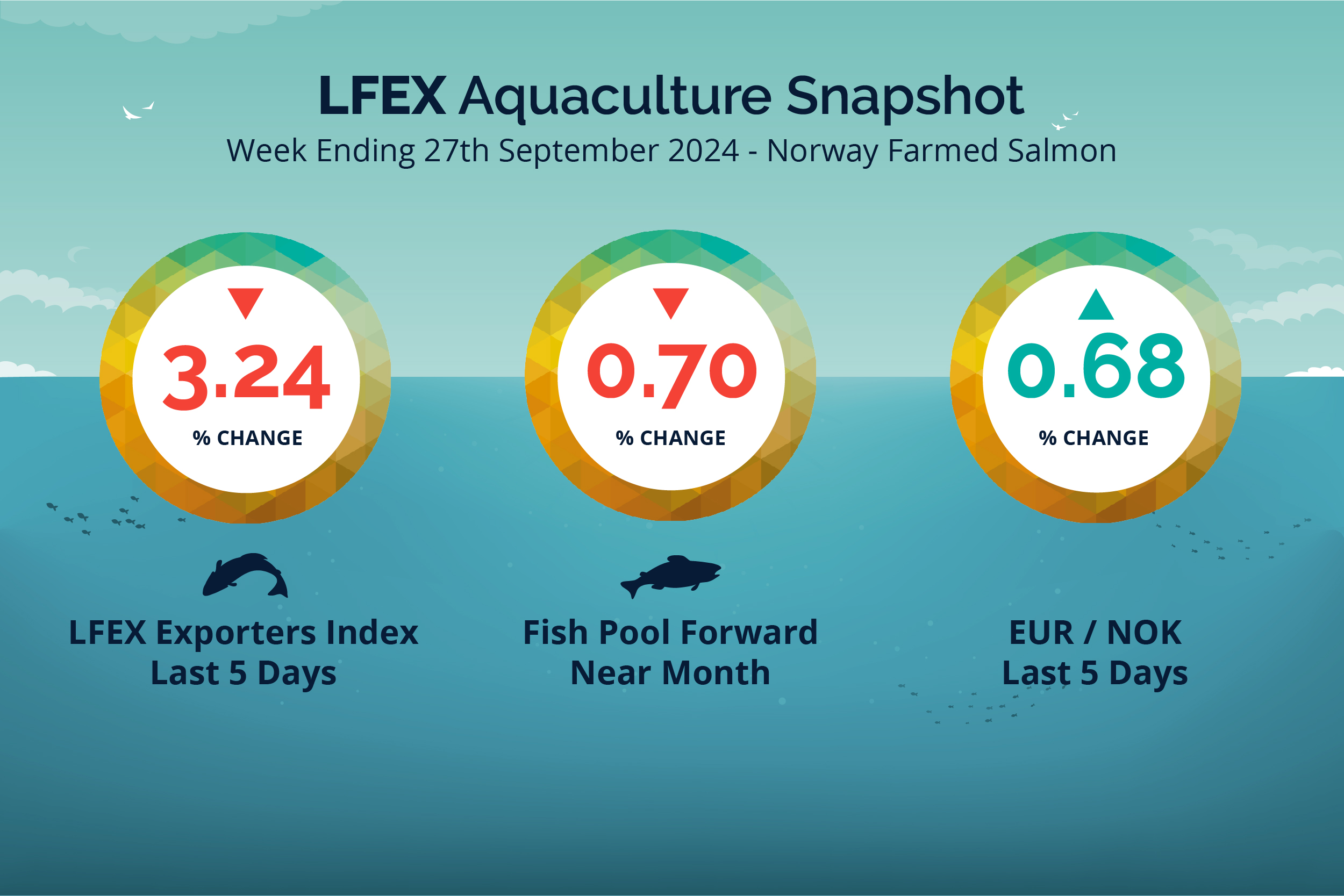

LFEX European Aquaculture Snapshot to 27th September, 2024

|

|

Published: 27th September 2024 This Article was Written by: John Ersser |

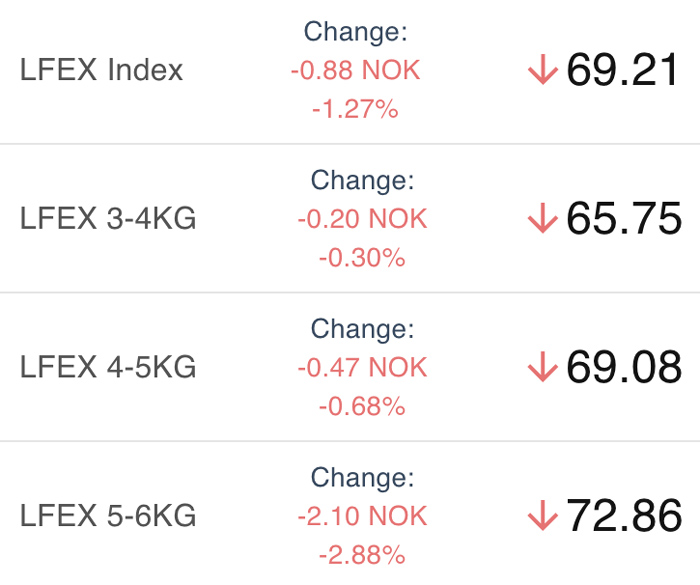

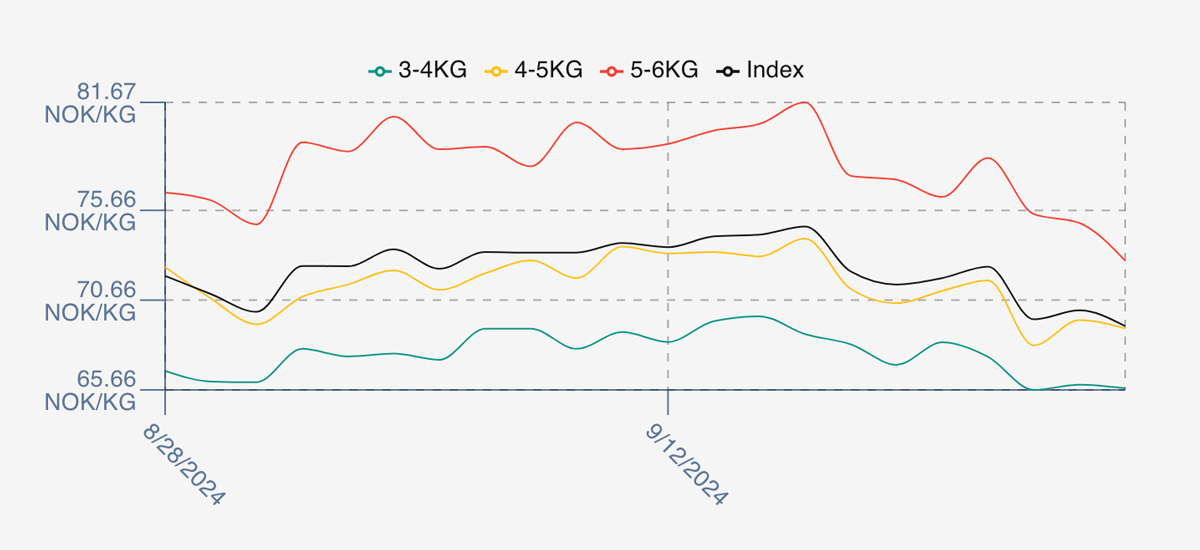

The LFEX Norwegian Exporters Index for Week 39 2024 ended the week down -2.32 NOK / -3.24% to stand at 69.21 NOK (in EUR terms 5.88 / – 0.24 / -3.90%) FCA Oslo Week ending Thursday vs previous Thursday.

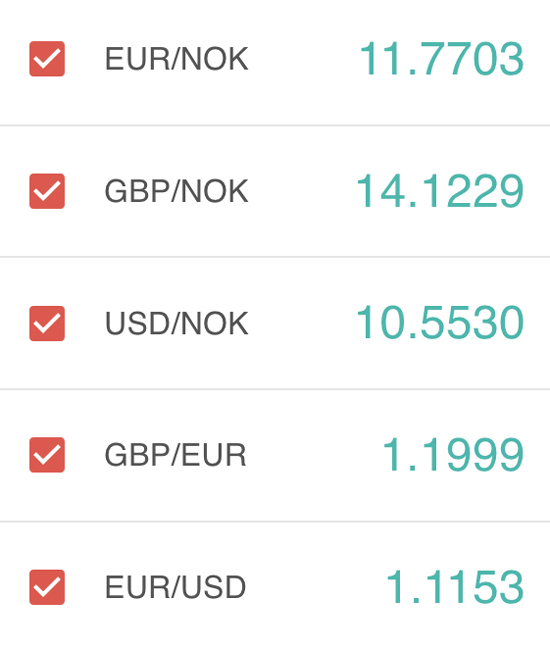

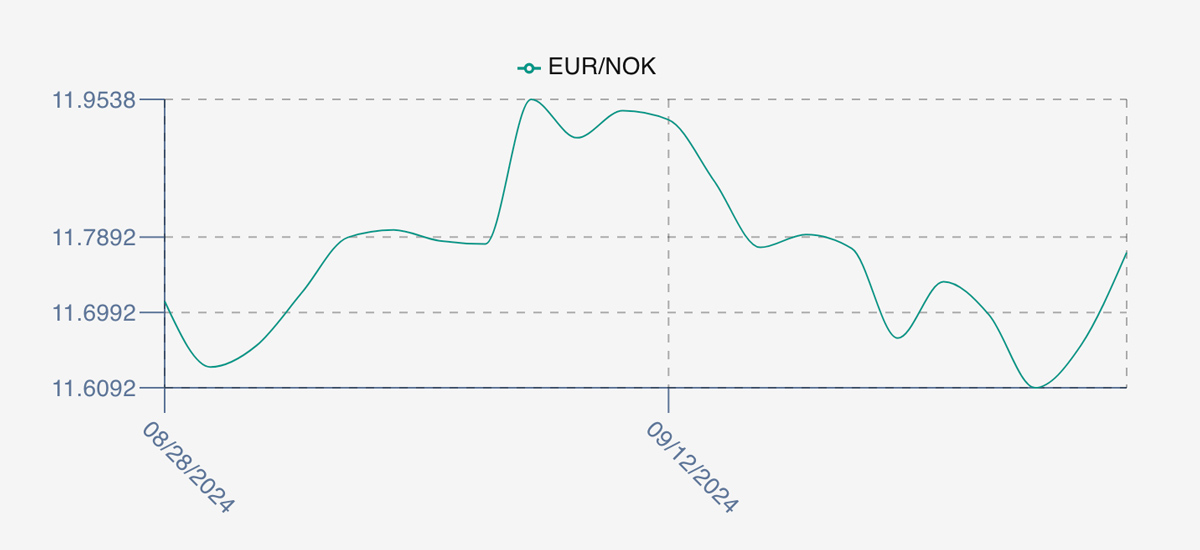

The NOK rate ended higher at 11.77 to the Euro over the period Thursday to Thursday +0.08 NOK or +0.68%. The Fish Pool future September was reported down -0.24 NOK / -0.70% at 70.25 NOK with October showing 70.71.

Last Week

Despite the record volumes coming through, prices ticked up at the beginning of the week. We saw the index start the week at the 71.89 levels, slightly ahead of where we thought it might be, and this pushed on through Monday to the high of 72.53 NOK as larger fish pushed the index higher. However, come Tuesday the larger sizes dropped 3 NOK each and the 3-4s 2.5NOK as the index fell to 69.59 and the first time it has dropped below 70 this year. Wednesday edged above 70 but the this was short lived as we ended the week on a low of 69.21. An intraweek top to bottom fall of 3.32 NOK or 4.3%.

Spreads have come in this week as the larger fish prices have come down, with the week closing out at 7 NOK – see chart.

The FX rate has been volatile but within a trading range between 11.60 and 11.95 the last few weeks. This week was an up week for the rate +0.08 NOK / +0.68% at 11.77. This made the Euro price 5.88 down -3.90% by comparison.

Next Week

Early opening indications from sellers for week 40 are coming in at around the 69 NOK level offered for the index. A similar pattern to last week where prices have been coming down from Wednesday and a similar story in the market of record volumes coming through especially on the small fish – the 2-3s pricing has been gapping down, putting pressure on all sides.

Volumes – Fresh Export

Volume figures for week 38 (2024) was 28,673 tons nearly matching the previous week record and versus 24,851 tons in 2023. Volumes for weeks 39 and 40 (2023) were 24,952 and 25,979 respectively for comparison.

Historical Price Guidance for Next Week.

The LFEX Norwegian Exporters Index for Week 40 2023 was down -2.47%, -2.00 NOK to stand at 79.13 NOK (approximately 6.83 EUR) FCA Oslo Week ending Thursday vs previous Thursday. The NOK rate was jumped back to 11.58 to the Euro over the period Thursday to Thursday +0.26 NOK or +2.30%. The Fish Pool future October was reported up +4.00 NOK, +5.41% at 78 NOK.

David Nye’s technical analysis report will be published on Monday.

Market Data (Click Each to Expand)

| LFEX Prices | FX Rates | LFEX Indicative Exporter Prices (4 Week) | EUR / NOK FX Rate (4 Week) |

|

Prices Ending 27th September, 2024 For Friday's Price For Next Week, Offers & Trading Please Register |

Did You Know?

The LFEX platform has been designed to allow you to manage your business in real-time from a single application.

It means not only is key information available at your fingertips to allow you to make the trading decisions you need to make, it allows you to act on those decisions effectively and efficiently. As a tool it matches systems found in financial markets where time and money are critical.

FAQ’s

Q. How do electronic markets work?

A. Electronic platforms perform many roles for markets and market participants.

By bringing a community together you get a much better view of available inventory (liquidity), access to more participants, more opportunity for price discovery, ability to track market pricing electronically in real-time, pre-trade checking and secure and robust confirmations between parties. They throw off mountains of data that can be used to analyse pricing, trading patterns, counterparty performance etc.

Further, they can provide a single point of connectivity for settlement and documentation and an independent and verified record of truth. They provide huge efficiencies in process, less errors, automation of orders / trading / settlement processes. They give participants the ability to access the right price for any given market condition, and free up staff time to focus on optimising business and relationships.