The London Fish Exchange

Data / Market Insight / News

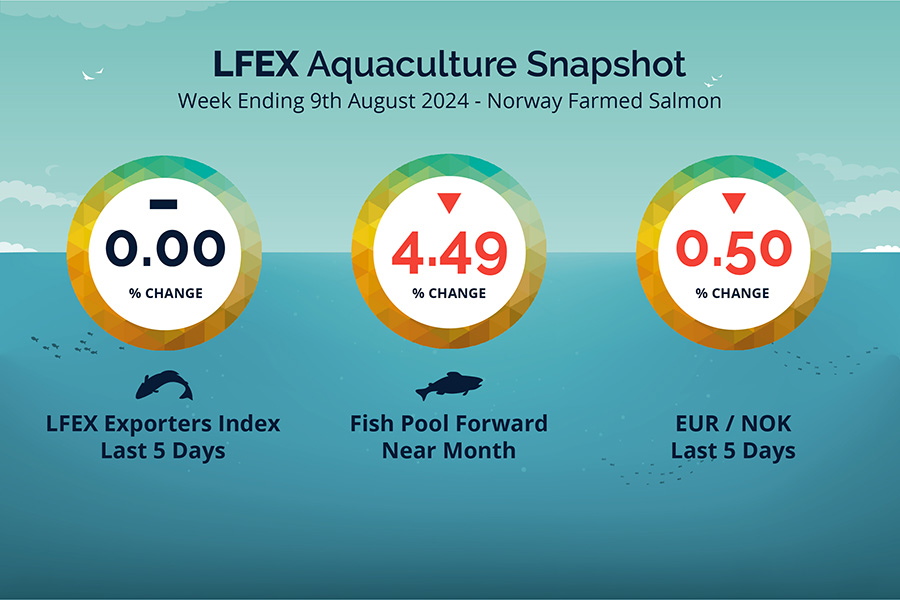

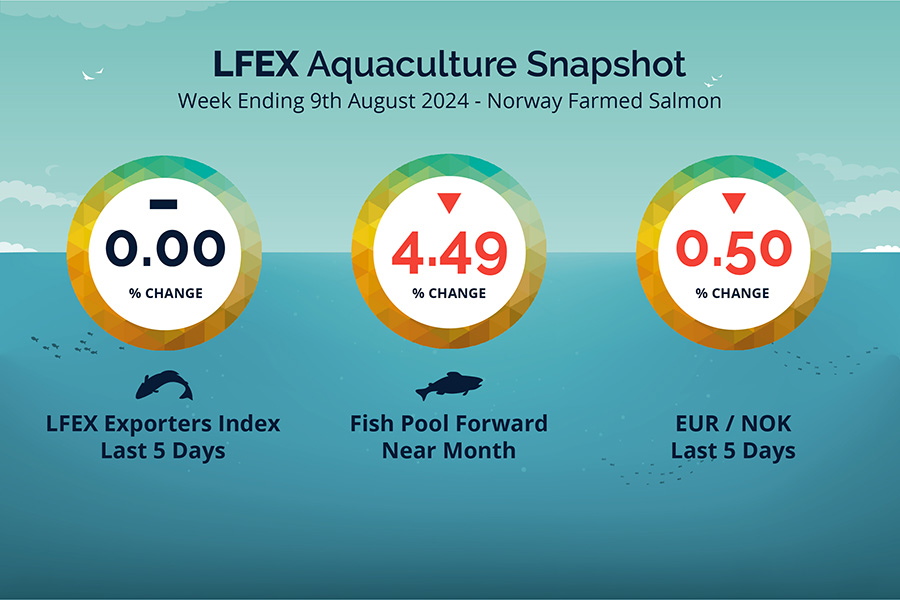

LFEX European Aquaculture Snapshot to 9th August, 2024

|

|

Published: 9th August 2024 This Article was Written by: John Ersser |

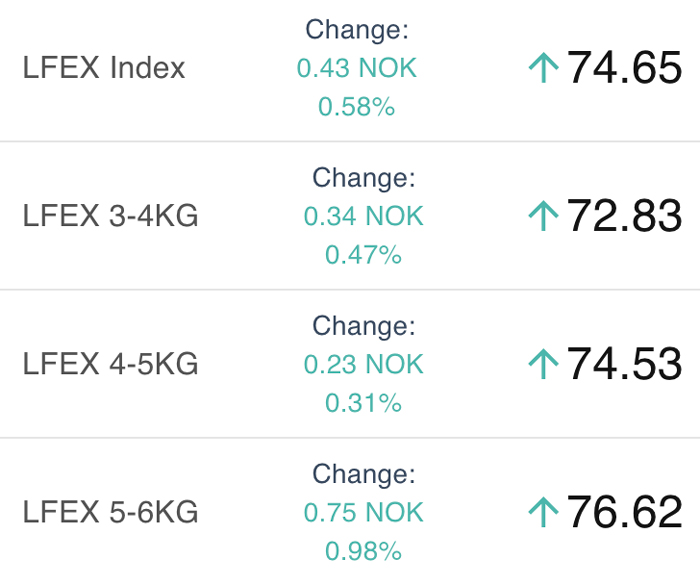

The LFEX Norwegian Exporters Index for Week 32 2024 ended the week FLAT with no change to stand at 74.22 NOK (in EUR terms 6.26 / + 0.03 / +0.51%) FCA Oslo Week ending Thursday vs previous Thursday.

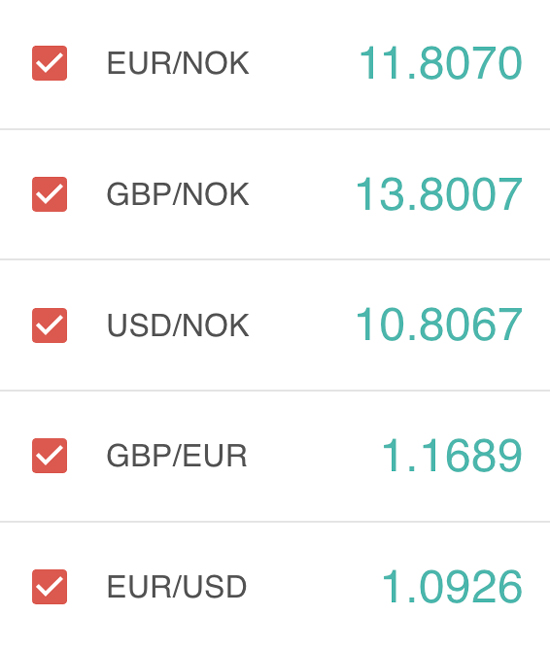

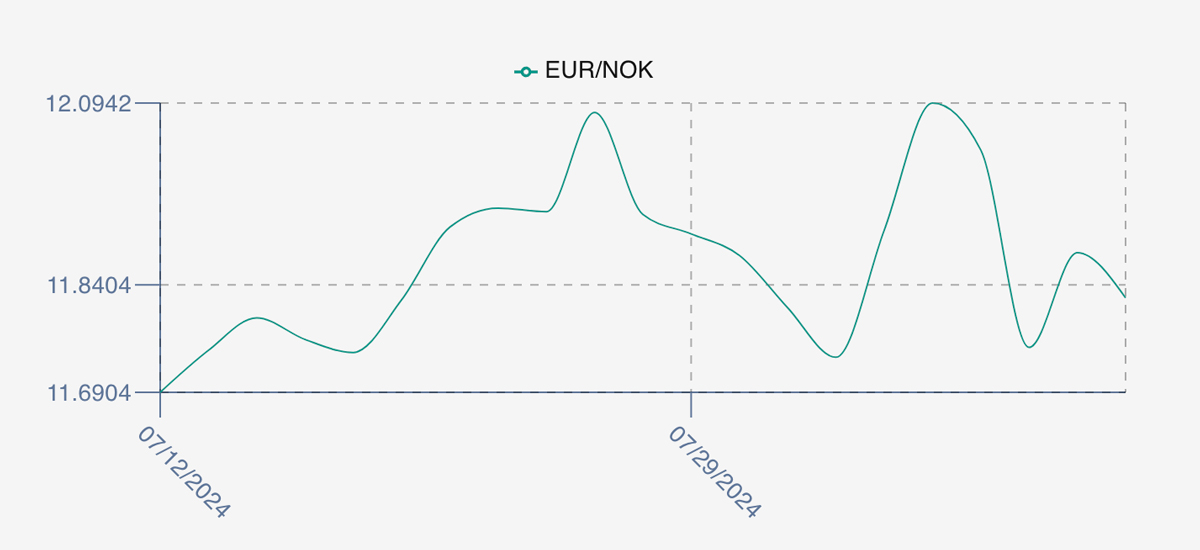

The NOK rate ended down, at 11.85 to the Euro over the period Thursday to Thursday -0.06 NOK or -0.50%. The Fish Pool future August was reported down – 3.50, -4.49% at 74.50 NOK.

Last Week

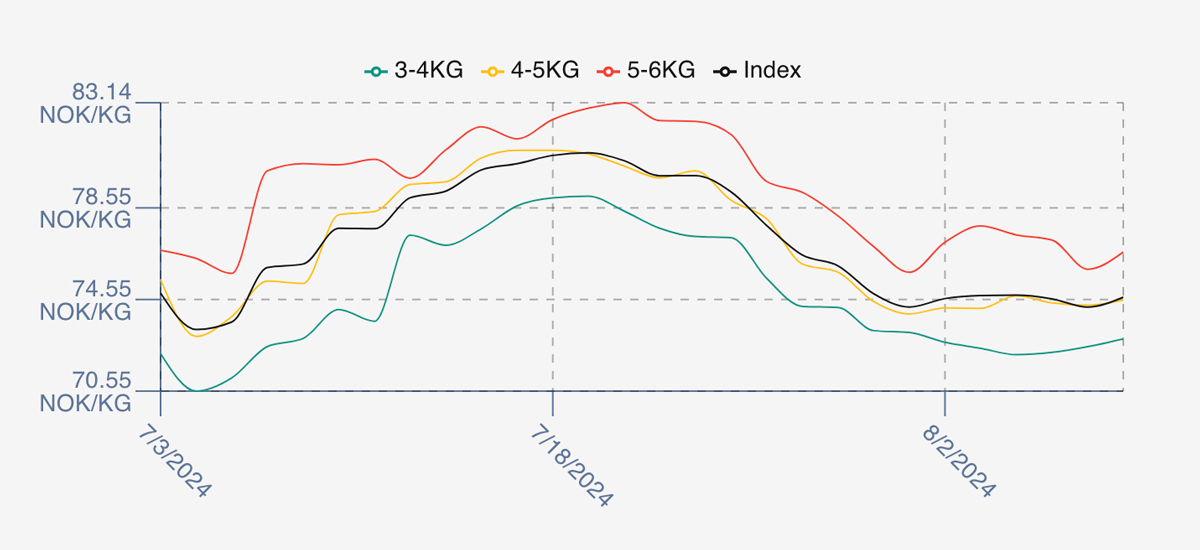

The charts this week look a little like a mill pond, as pricing hardly moved during the week. Pricing opened up +0.50%, +0.37 NOK at 74.59 as compared to the prior weeks close. There was a lot of early talk in the market for good availability of fish, left over fish and summer holiday fatigue, but in the end prices held up, seemingly finding a similar balance all week. If anything, prices edged slightly higher to ‘peak’ at 74.74 on Tuesday as prices rolled off slightly 74.58 Wednesday and 74.22 Thursday for a flat week 74.22.

The FX rate chart by comparison was more camel like, starting at 11.91, peaking at 12.09, dropping to 11.75 before closing out at 11.85. A near 3% range during the week. Global financial markets were very volatile in the past week with concerns over a hard landing for US economy which will have impacted the FX rate.

Spread widened showing around 3.5 NOK 3/4s – 5/6s and so while overall the market was flat, bigger sizes did better especially earlier in the week.

Next Week

Early opening indications from sellers for week 33 are more of the same. Which means we see an indicative starting level for the index at a very slightly stronger at 74.5 levels. There are some holidays coming up this week in Europe (Thursday) which will reduce demand, and the knowledge that pricing generally starts to fall in peak summer.

Volumes

Volume figures for week 31 (2024) were 22,624 tons versus a lower 20,649 in 2023. Volumes for weeks 32 and 33 (2023) were 21,060 and 22,698 respectively for comparison.

Historical Price Guidance for Next Week

A year ago, Week 33 2023 prices ended down -5.49%, -4.17 NOK to stand at 71.82 NOK FCA while the Euro stood at 11.50 and Fishpool August showed 74.0.

David Nye’s technical analysis report will be published on Monday.

Market Data (Click Each to Expand)

| LFEX Prices | FX Rates | LFEX Indicative Exporter Prices (4 Week) | EUR / NOK FX Rate (4 Week) |

|

Prices Ending 9th August, 2024 For Friday's Price For Next Week, Offers & Trading Please Register |

Did You Know?

Provenance, specifications and logistics documentation are supported order by order.

Operational documentation can be added to the platform to allow you to manage the sales, shipping, invoicing and provenance and certifications. Buyers are becoming more demanding of supporting documentation, and this can be made available down to the individual order/trade level or managed and searched on the system for your administrative teams to handle in real-time.

FAQ’s

Q. I tend to trade the same order specifications each week, how can I do this efficiently?

A. No problem. The RFQ is configurable and saved by user. This means that you can set it up perfectly for what you want to trade with your own parameters and at a single click have your own fully populated orders ready to go week in week out. We understand that different users have different requirements, and the system has been designed to cater for everyone’s different choices. We also allow users to configure their LFEX Web workspaces to reflect how they want to operate and use the platform with bespoke and default layouts.