The London Fish Exchange

Data / Market Insight / News

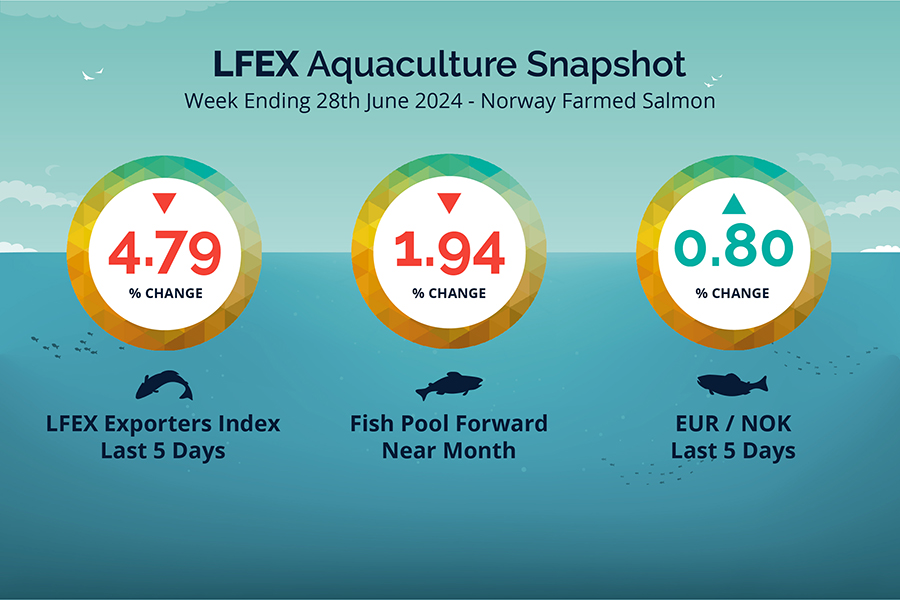

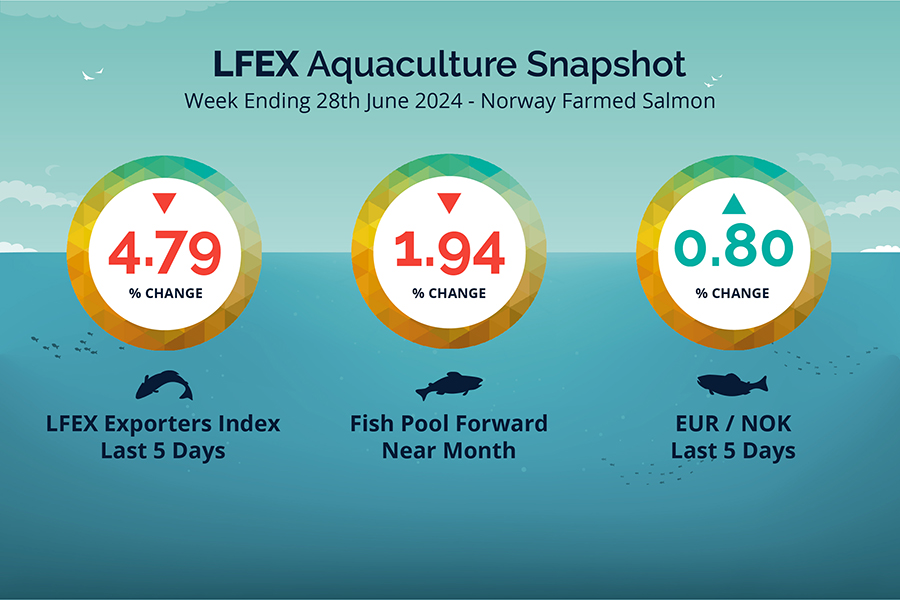

LFEX European Aquaculture Snapshot to 28th June, 2024

|

|

Published: 28th June 2024 This Article was Written by: John Ersser |

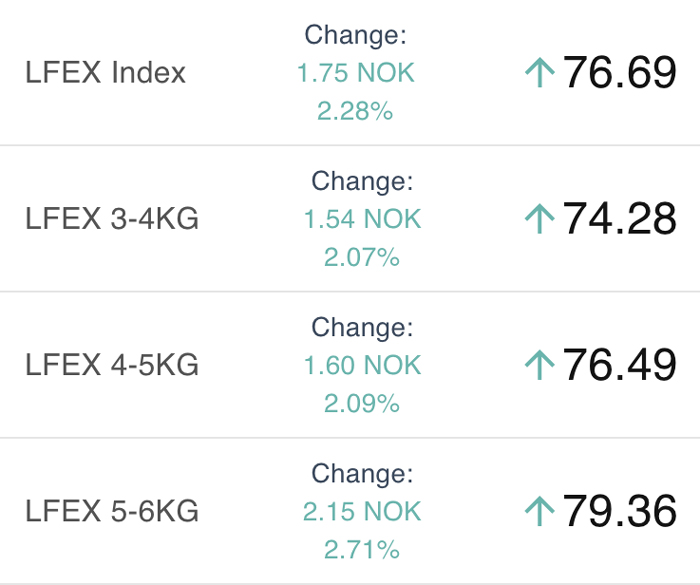

The LFEX Norwegian Exporters Index for Week 26 2024 ended the week down -4.79%, -3.77 NOK to stand at 74.94 NOK (in EUR terms 6.58 / – 0.39 / -1.94%) FCA Oslo Week ending Thursday vs previous Thursday.

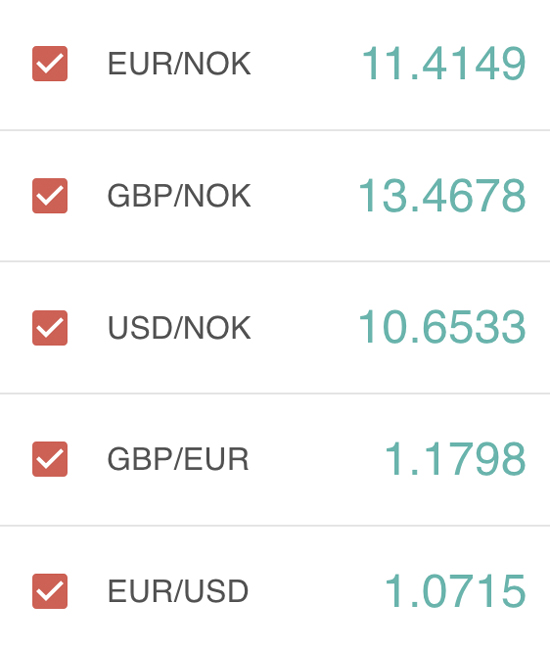

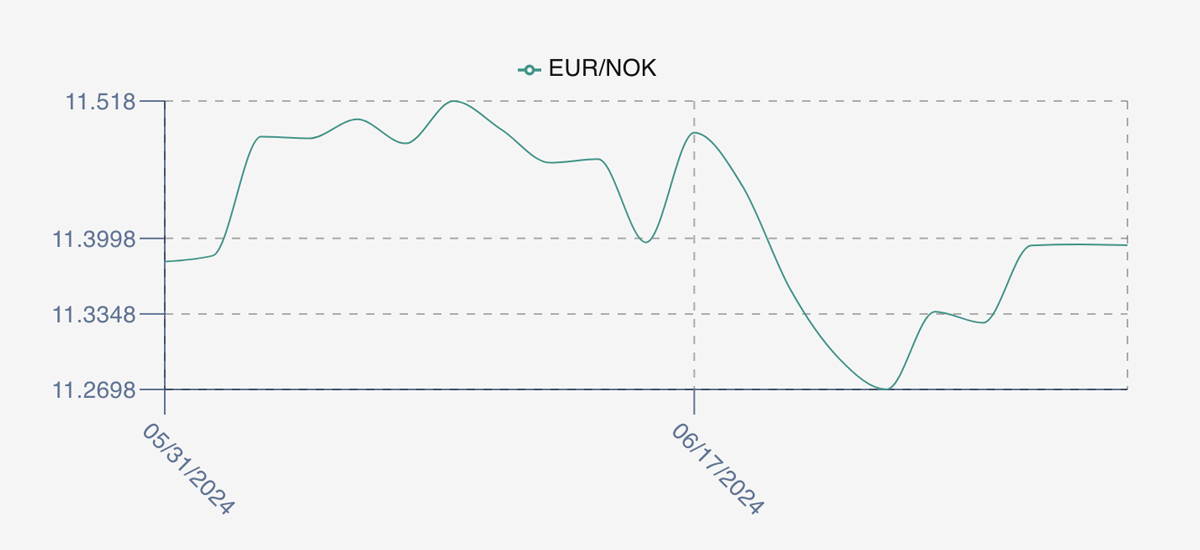

The NOK rate ended up, at 11.39 to the Euro over the period Thursday to Thursday +0.09 NOK or +0.80%. The Fish Pool future June was reported down – 1.60, -1.94% at 80.9 NOK with July showing 83.5 NOK.

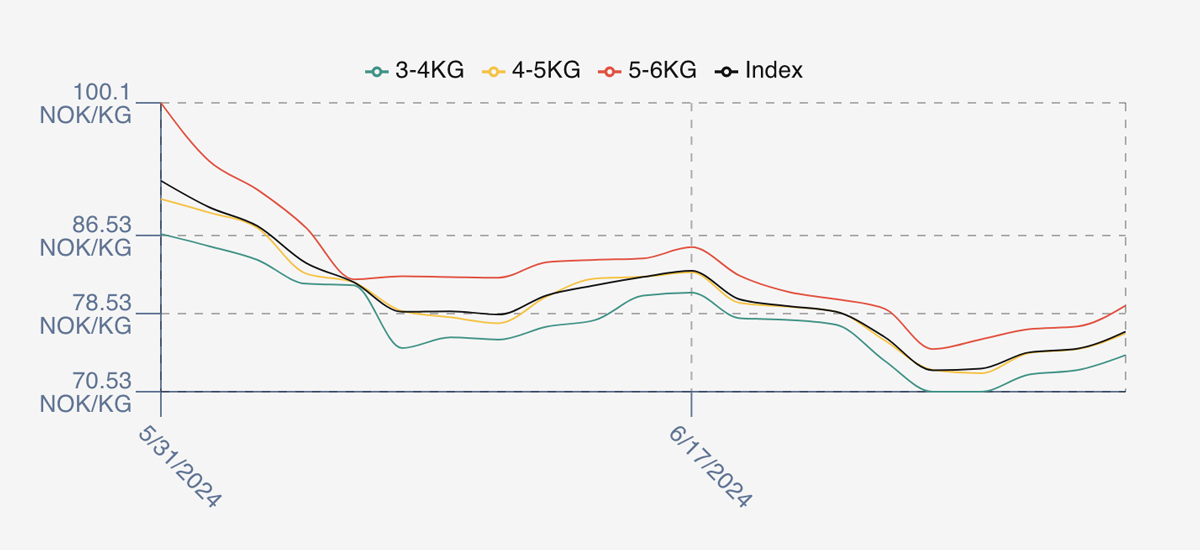

Pricing softened significantly again in the past week. Price discovery was difficult early doors as prices fell further and the market found finding a level difficult. This resulted in an opening level around 76.14 on the Friday from the sellers, but by Monday this had also been pushed down further to a level of 72.73 as buyers got the upper hand. This was the low for the week, and Tuesday followed at a similar level of 72.9. Wednesday saw a pick-up in pricing to 74.56 and closed out at 74.94 for an overall drop on the week. Spreads between 3-4 and 5-6 coming in slightly wider at 5 NOK. Biomass in the water is showing a little increase compared to the similar time of last year and the mix is different with more fish with lower average weight.

Pricing for next week the picture remains complicated. Early price indications for the sellers is around the 76 level as farmers push up prices to start the week. However, there seems to be concerted effort from buyers to trade at lower levels to this. Expectations is probably for offered pricing to come off of these levels early next week. If volume remains strong pricing will be subdued, and buyers aren’t rushing at the moment.

Volumes

Volume figures for week 25 (2024) were 18,125 tons versus 16,792 in 2023. Week 26 in 23 was 17,238 and finally week 27 (coming week) was 19,220 in 2023 to give some comparison guidance.

Historical Price Guidance

A year ago, Week 27 2023 prices ended up 3.06 NOK on the week at 99.24 NOK a rise of 3.18%. The EURNOK rate was lower at 11.64 – there was demand for larger fish pushing pricing higher in the week.

David Nye’s technical analysis report will be published on Monday.

Market Data (Click Each to Expand)

| LFEX Prices | FX Rates | LFEX Indicative Exporter Prices (4 Week) | EUR / NOK FX Rate (4 Week) |

|

Prices Ending 28th June, 2024 For Friday's Price For Next Week, Offers & Trading Please Register |

Did You Know?

The LFEX stores all your previous orders and transactions for immediate access to all your activity on the platform.

It also saves previous orders so that you can quickly and accurately input new orders / RFQ’s without having to constantly key in new order information, and allows constant updating of these orders (price / volume etc) as the market develops, until you trade or end the RFQ.

FAQ’s

Q. Can I manage a sub-set of my client list to show prices or specific requests for prices?

A. Yes the LFEX system flexibility allows users to show interest to one counterpart, all counterparties or a specific group of counterparties that you chose. The system is built to be as flexible as possible, replicating real world processes, but automating them making it much more efficient. So, if you want to quote/target a sub-set of users because of geography / currency / inco terms etc it is easy to do.