The London Fish Exchange

Data / Market Insight / News

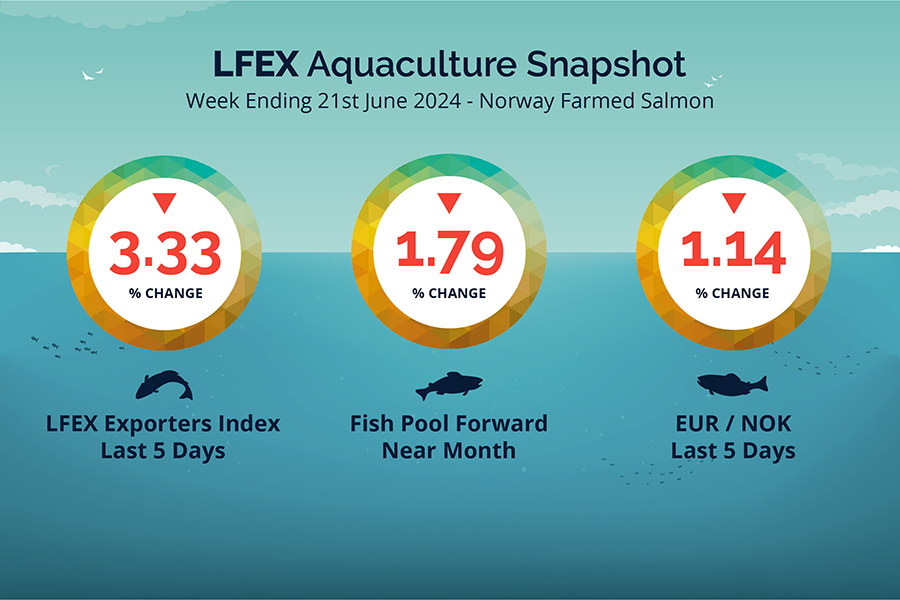

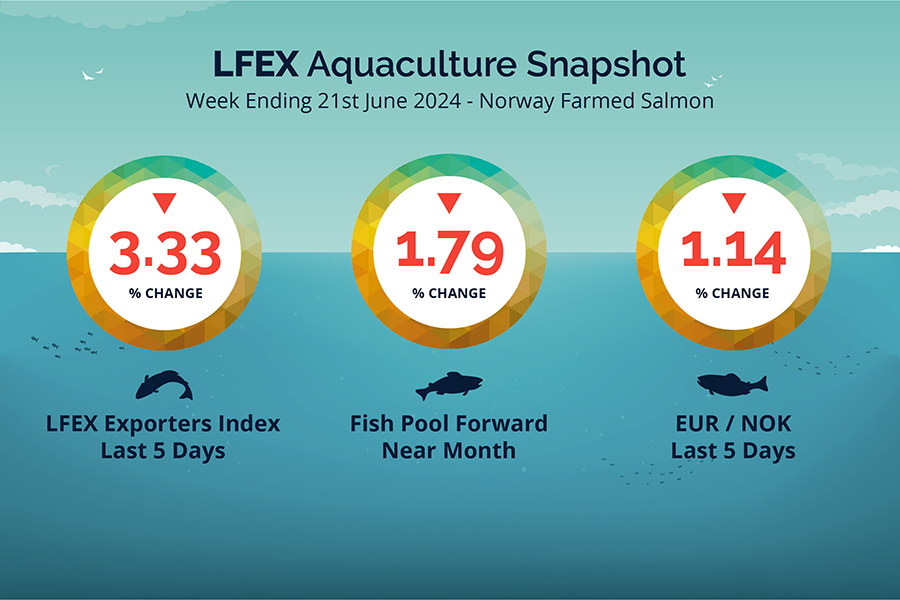

LFEX European Aquaculture Snapshot to 21st June, 2024

|

|

Published: 21st June 2024 This Article was Written by: John Ersser |

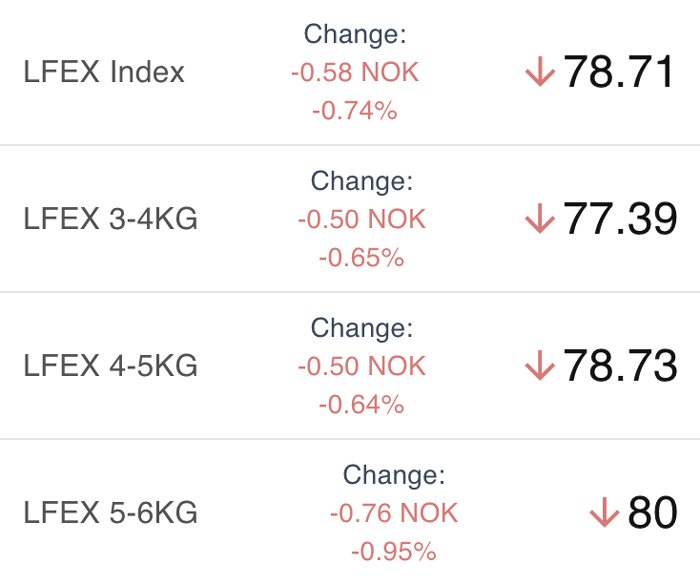

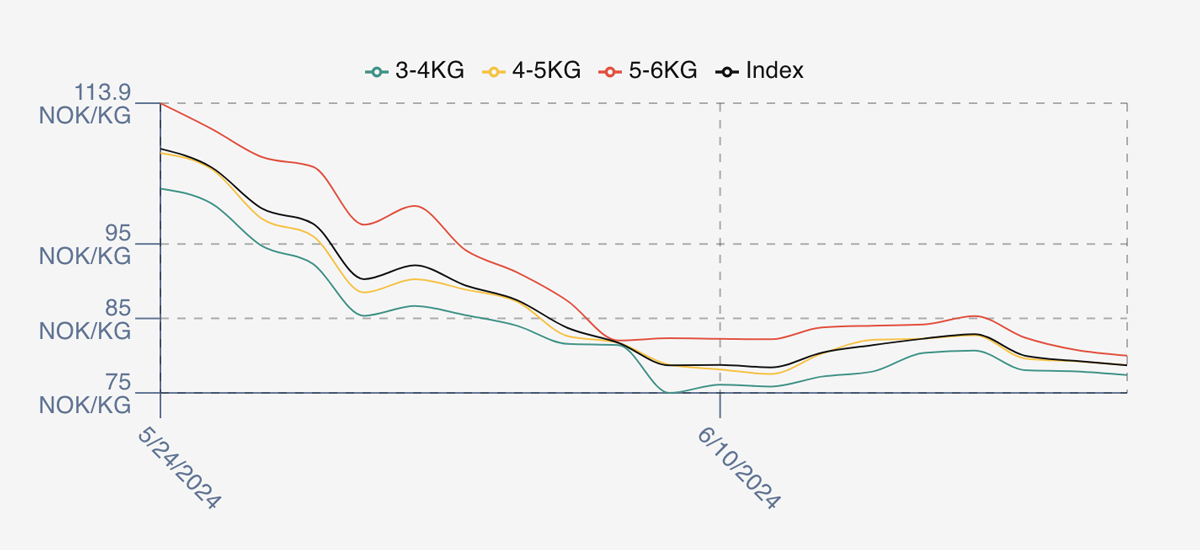

The LFEX Norwegian Exporters Index for Week 25 2024 ended the week down -3.33%, -2.71 NOK to stand at 78.71 NOK (in EUR terms 6.97 / – 0.16 / -2.22%) FCA Oslo Week ending Thursday vs previous Thursday.

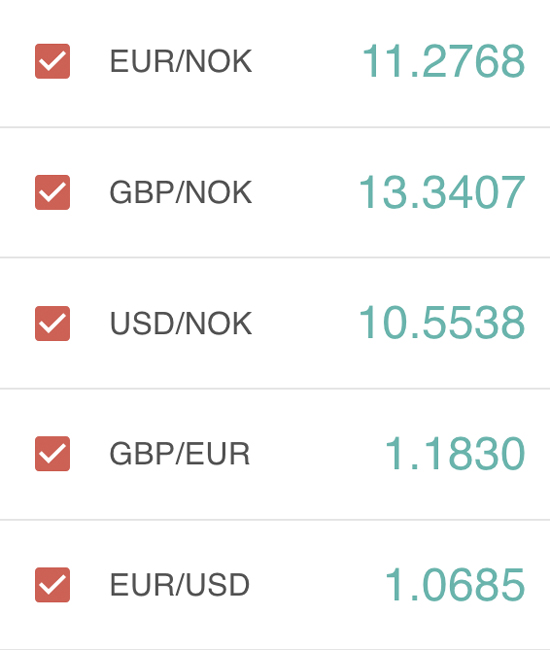

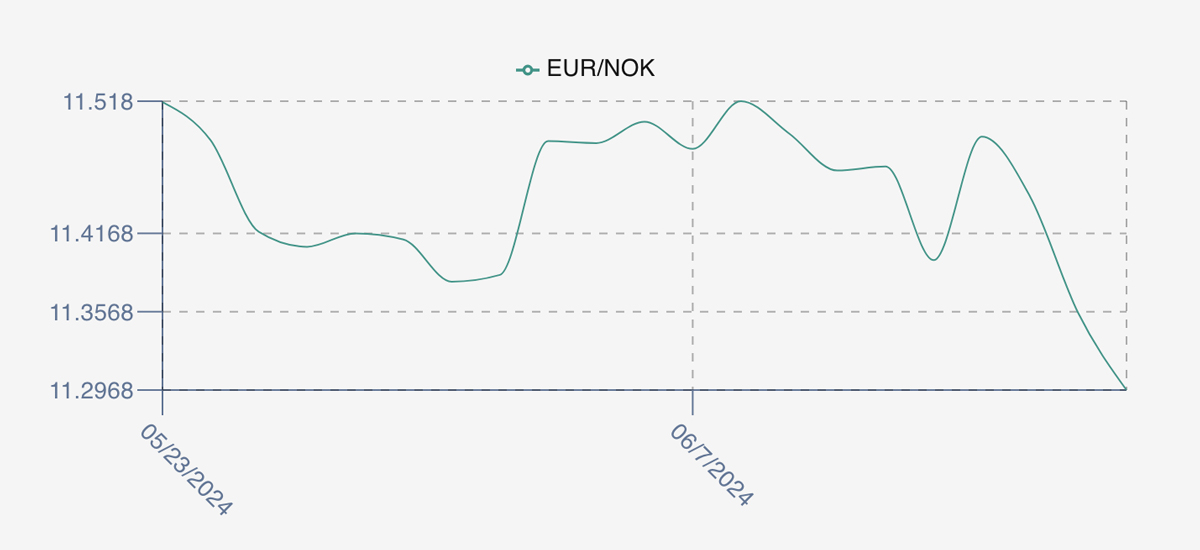

The NOK rate ended down at 11.30 to the Euro over the period Thursday to Thursday -0.13-NOK or -0.1.14%. The Fish Pool future June was reported down – 1.50, -1.79% at 82.5 NOK.

Pricing is finding a stability at around the current market levels as compared the the large drops recently. We noted a pick-up on prices last Friday, as the index edged higher on the slight upward momentum from the previous week. The debate was around more volumes, less production fish, more large size fish coming through and where the appetite lay with the buyers. Sellers looking for 80+, buyers nearer 78. In a sense both sides won in the end this week. Friday opened at 82.28 NOK and held for Monday at 82.9, before weakness crept in, dropping 3 NOK on Tuesday and continuing to soften Wednesday 79.29 and closing at 78.71 as sellers sold off inventory. Spreads between 3-4 and 5-6 less than 3 NOK and 6’s same as 5s.

For next week the picture is quite confused. However, we see the index kicking off lower around the 76 NOK level. Consensus is for the market to open lower as people try and understand where the market is vis a vis volumes and appetite.

Volumes

Volume figures for week 24 (2024) were 16,797 tons. Volumes in the same week ’23 and ’22 were 17,359 and 15,317 respectively. Week 25 in 23 was 16,792 and finally week 26 (coming week) was 17,238 in 2023 to give some comparison guidance.

Historical Price Guidance

A year ago, Week 26 2023 prices ended up 6.82 NOK on the week at 96.18 NOK a rise of 7.63%. The EURNOK rate was higher at 11.75 – there was demand from Asia for bigger fish and prices gapped, along with buying demand pushing pricing higher in the week.

David Nye’s technical analysis report will be published on Monday.

Market Data (Click Each to Expand)

| LFEX Prices | FX Rates | LFEX Indicative Exporter Prices (4 Week) | EUR / NOK FX Rate (4 Week) |

|

Prices Ending 21st June, 2024 For Friday's Price For Next Week, Offers & Trading Please Register |

Did You Know?

You can amend or add to orders transacting on LFEX?

The system allows you to very quickly put up offers / orders within the RFQ service and manage pricing in real-time. The system not only lets you manage order parameters during the sale/purchase process but by single or multiple counterparties. It has been built to replicate your business workflows, is highly flexible and captures your business activity / management perfectly.

FAQ’s

Q. How can I better draw attention to my orders entered on LFEX?

A. An old trading adage says “size opens your eyes”. Yes, a good price is nice at getting attention, but if you are willing and able to move a good volume of product it will capture attention and may help in getting the trade/s completed.