The London Fish Exchange

Data / Market Insight / News

LFEX European Aquaculture Snapshot to 6th June, 2024

|

|

Published: 7th June 2024 This Article was Written by: John Ersser |

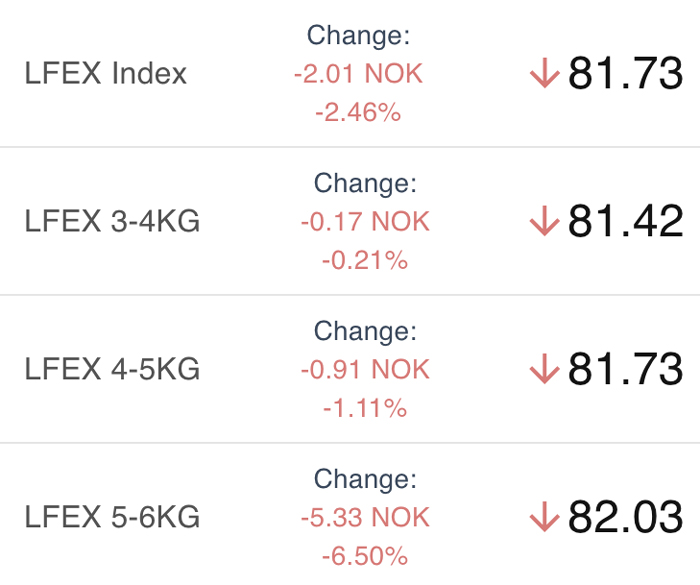

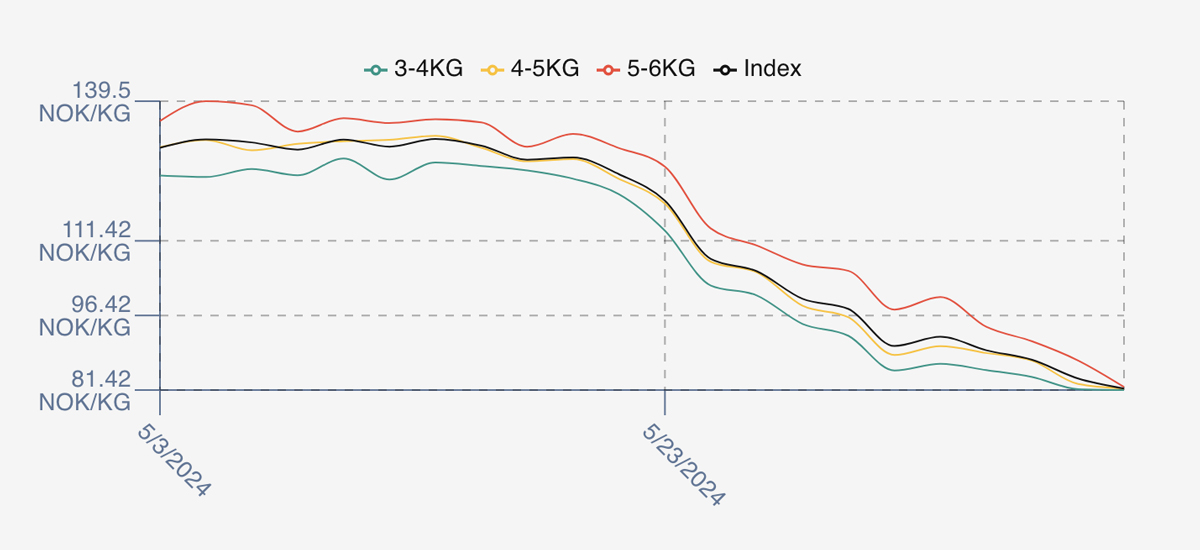

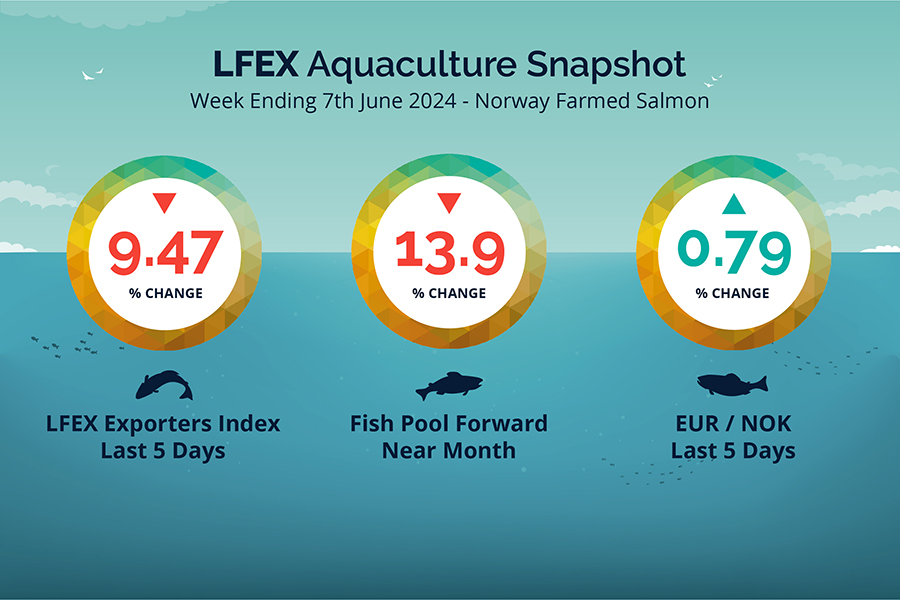

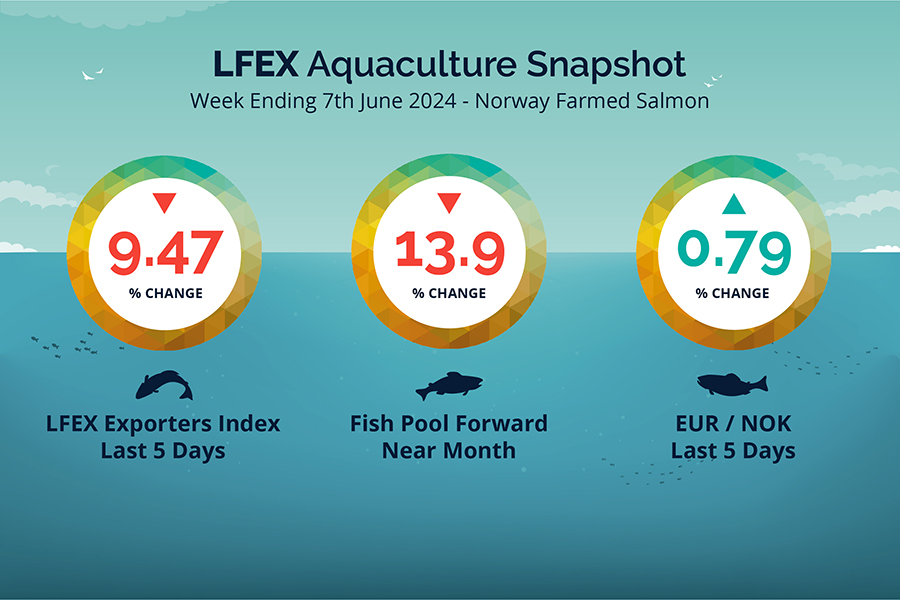

The LFEX Norwegian Exporters Index for Week 23 2024 ended the week down -9.47%, -8.55 NOK to stand at 81.73 NOK (in EUR terms 7.11 / -0.81 / -10.18%) FCA Oslo Week ending Thursday vs previous Thursday.

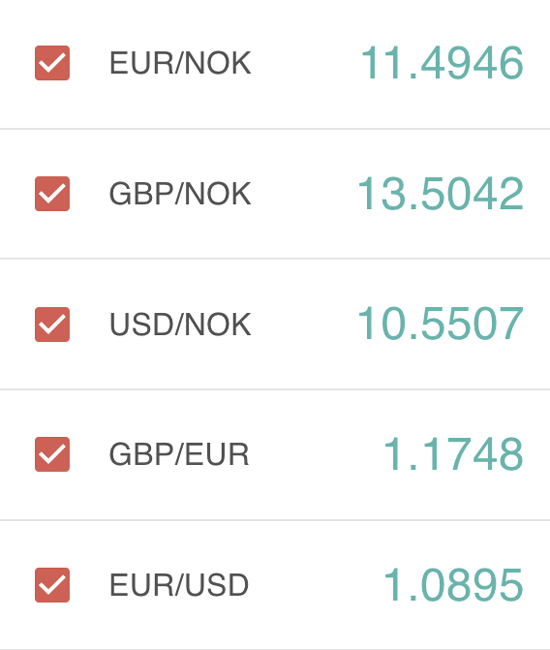

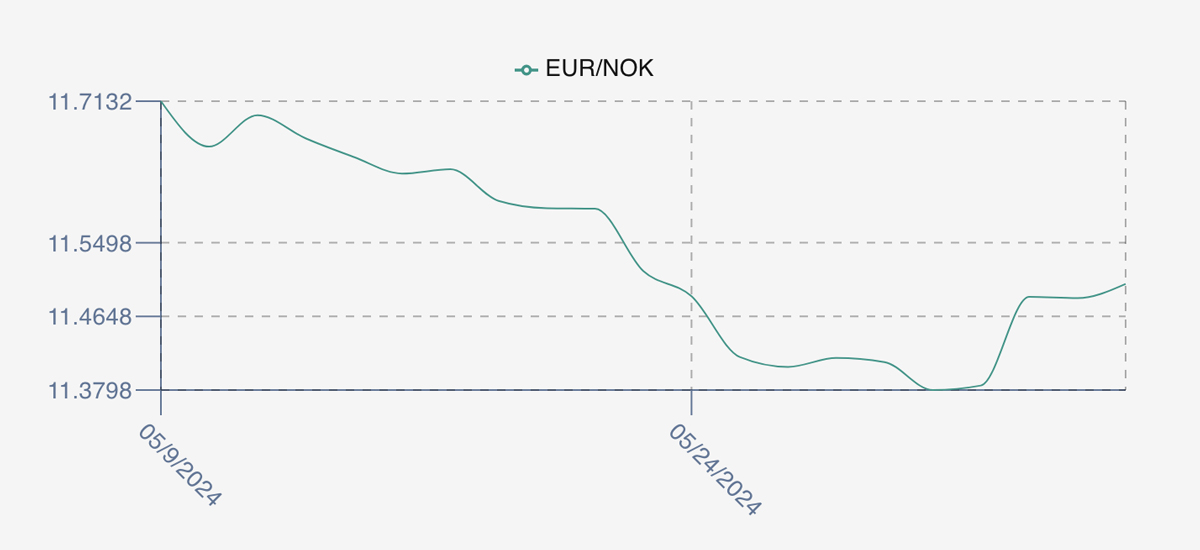

The NOK rate ended up at 11.50 to the Euro over the period Thursday to Thursday +0.09 NOK or +0.79%. The Fish Pool future June was reported down – 15.50, -13.90% at 96.00 NOK.

Following last weeks’ brutal rout in pricing, week 23 came through with further weakness. The initial early week bounce saw prices pushed up 2% to 92.13 NOK levels, which held over the weekend. Monday was back underwater however at 89.42 and lower than the prior week close. This set the pattern for weakness for the rest of the week with prices 2 NOK lower on Tuesday (87.49), accelerating the fall on Wednesday at 83.74 a further near 4 NOK lower, and capping off the week on Thursday a further 2 NOK lower. Spreads between sizes almost evaporated by the end of the week. Prices a long way off prices in the same week last year (106.11).

Again, it is a story of over supply with demand not catching up. Supply has increased as expected with more harvest, there have been some disease issues meaning additional slaughter, and the supply of superior fish is sufficient to cover demand. On the demand side it remains weak, with perhaps buyers not having the orders behind them to support a lot more purchasing. However, at these levels perhaps interest is being generated. Next week pricing looks to open weaker again at 78 – 79 level as supply continues to weigh on the price.

Volumes

Volume figures for week 22 (2024) were 15,060 tons vs 15,666 in 2023. We await formal figures for week 23 just gone. Volumes in week 23 2023 were 18,299 and for the coming week 24, 17,359 tons to give some comparison guidance.

Historical Price Guidance

A year ago, Week 24 2023 prices ended down 18.78 NOK on the week at 87.33 NOK a fall of 17.70%. The EURNOK rate was lower at 11.50. Is the decline running a week early this year?

David Nye’s technical analysis report will be published on Monday.

Market Data (Click Each to Expand)

| LFEX Prices | FX Rates | LFEX Indicative Exporter Prices (4 Week) | EUR / NOK FX Rate (4 Week) |

|

Prices Ending 7th June, 2024 For Friday's Price For Next Week, Offers & Trading Please Register |

Did You Know?

How can you trade a range of specifications on LFEX?

At LFEX we spend a lot of time working closely with both buyers and sellers to capture the different activities of all the participants in the market and continually improve the system. As a consequence we are able to offer a huge range of possibilities and specifications to support all of your business; spot / contract, fresh / frozen, whole / VAP etc.

FAQ’s

Q. How can I optimise my sales in weeks where there may be more volume coming through?

A. Active engagement with as many counterparties as possible will help with distribution. Widening global reach would also help with this, especially if the softness is within a particular market, and funnel volume elsewhere. Proactive updating of pricing and offers will create a sense of movement in the market and spur activity, as well as targeted pricing by clients or geography. Encourage engagement with dialogue on chat and market updates and even get buyers to put up bids to you help build a better market picture.