The London Fish Exchange

Data / Market Insight / News

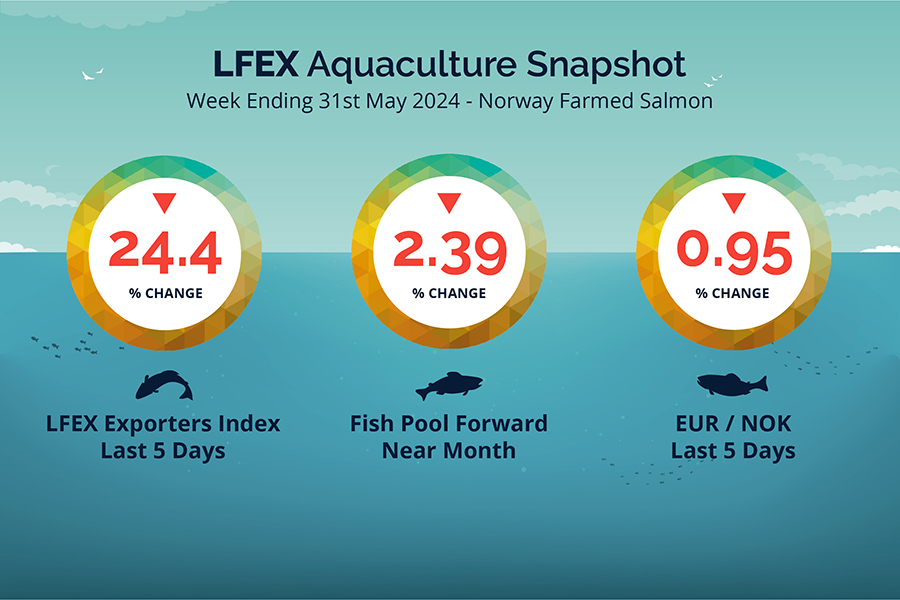

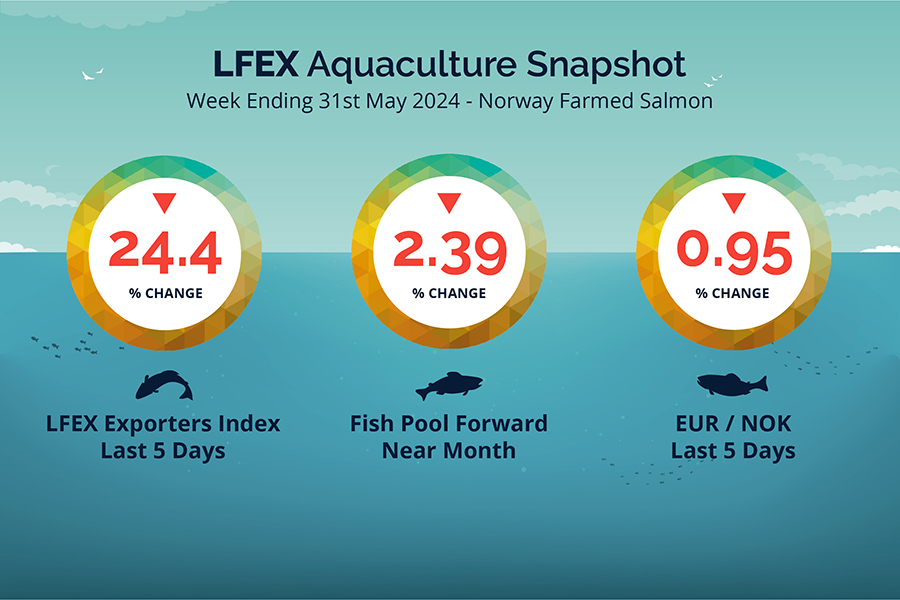

LFEX European Aquaculture Snapshot to 31st May, 2024

|

|

Published: 31st May 2024 This Article was Written by: John Ersser |

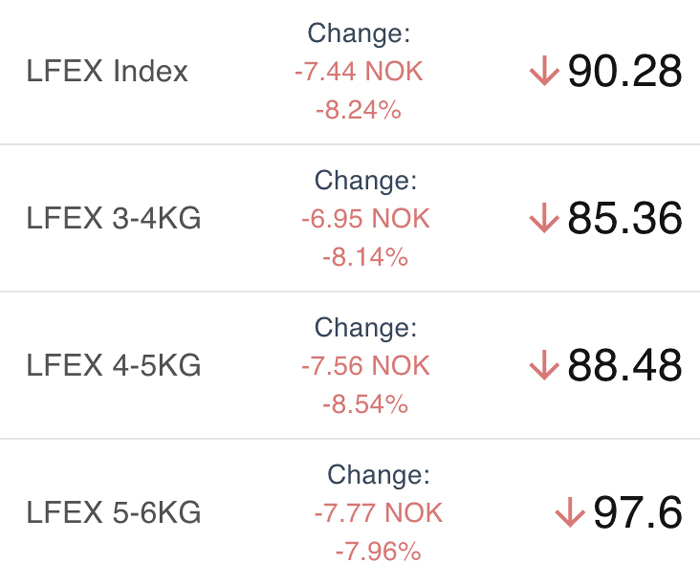

The LFEX Norwegian Exporters Index for Week 22 2024 ended the week down -24.46%, -29.23 NOK to stand at 90.28 NOK (in EUR terms 7.91 / -2.46 / -23.73%) FCA Oslo Week ending Thursday vs previous Thursday.

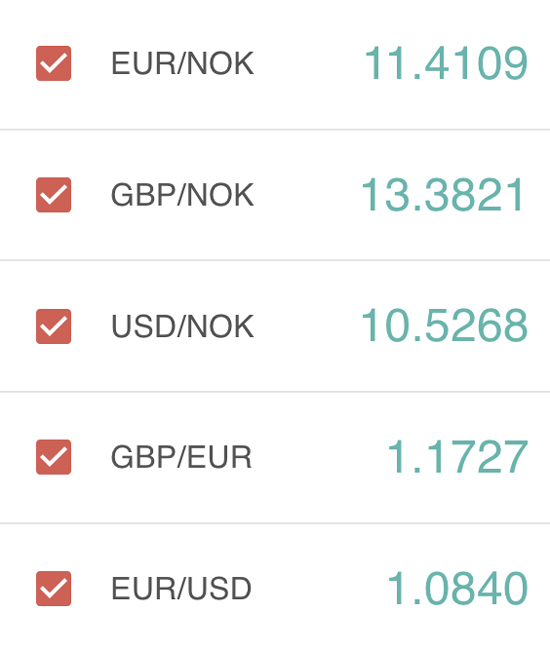

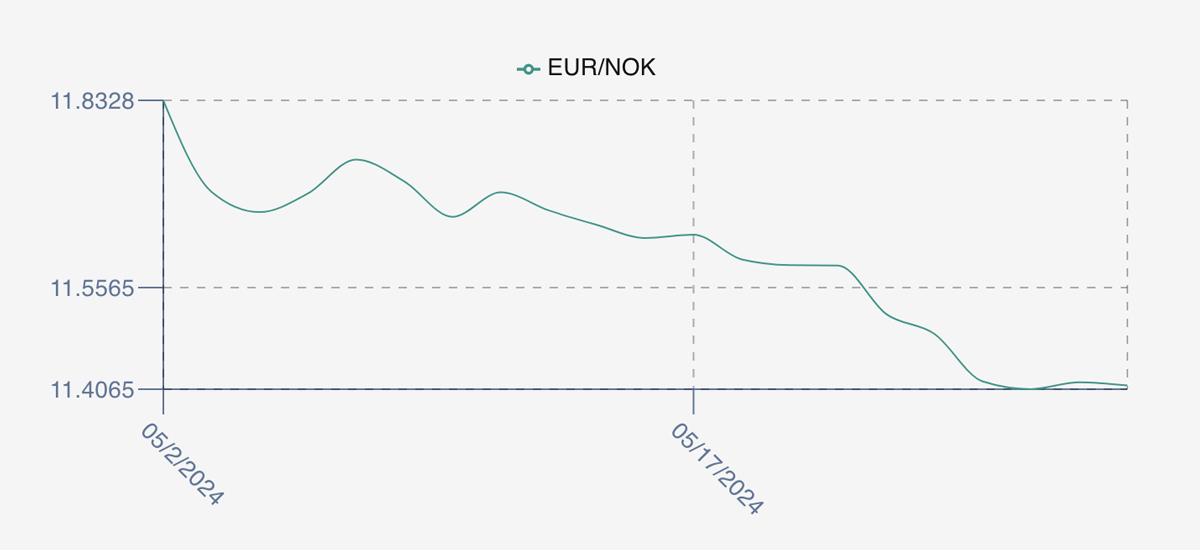

The NOK rate ended down at 11.41 to the Euro over the period Thursday to Thursday -0.11 NOK or -0.95%. The Fish Pool future May was reported down – 3.00, -2.39% at 122.50 NOK with June showing 111.50 NOK a drop of 6 NOK.

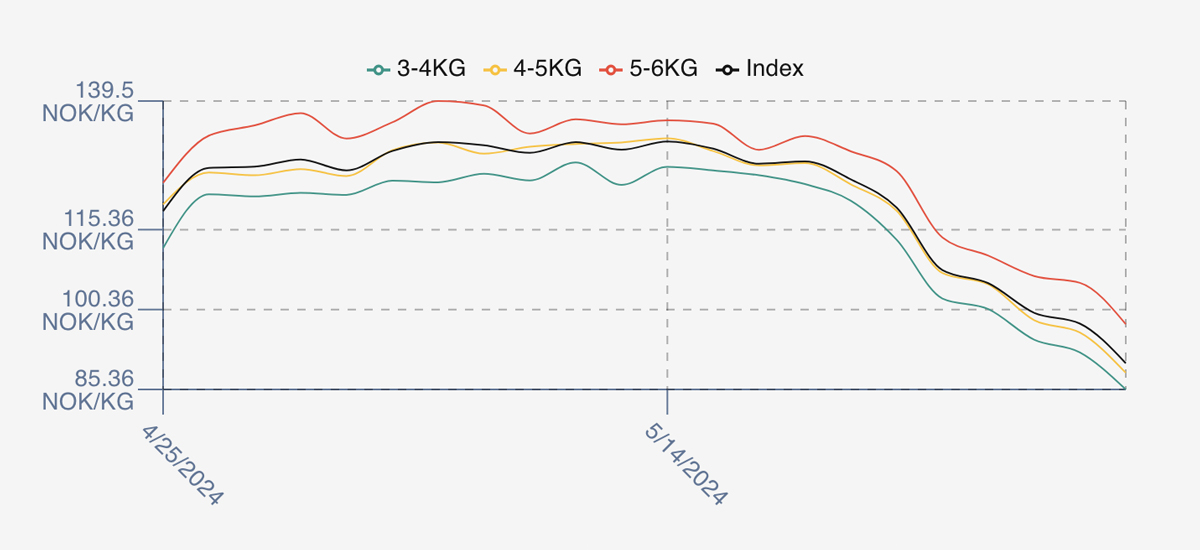

WOW… week 22 2024 is a record-breaking week. If this was a stock price the headlines would read ‘brutal’ as prices crashed in a spectacular fashion. We knew weakness was coming as the market opened at 107.78 NOK itself a 9.82% drop on the previous weeks close of 119.50 NOK – which was the low of the prior week. The ship steadied a little on Monday down at 105.31, but prices continued to capitulate 99.75 and breaking the psychological 100 barrier on Tuesday and Wednesday saw the index register 97.72. The end of the week pricing was pushed down a further 7 NOK to 90.28 and the largest weekly fall in NOK terms. Euro pricing ranged from 10.37 ending down at 7.91 for the week.

The week was of course a story of supply and demand. There were expectations of more harvest, which came through, but more than expected. However, the demand side didn’t show up resulting in the drops seen this week. Having said that, no one on either side of the market foresaw pricing dipping as quickly or as a low as it did this week.

Our comments on pricing volatility in the Did You Know section last week it seems were somewhat prescient. It’s on weeks like this that technology can really help markets, and we repeat it below in case you missed it.

Where does the market go from here? Initially we expect a bounce off of the week ending lows brought about by too many fish in the system. Early indications are around the 92 levels with a wide spread around 13/14 NOK between 3-4’s and 5-6s. Demand remains subdued however. Currently volumes are expected around this weeks’ levels, but more coming through would also impact on pricing.

Volumes

Volume figures for week 21 were lower compared to the same time last year at 12,567 vs 15,492. Volumes in week 22 2023 were 15,666 and 18,299 for week 23 to give some comparison guidance.

Historical Guidance

A year ago, Week 23 2023 prices ended down 10.38 NOK on the week at 106.11 NOK a fall of 8.91%. The EURNOK rate was lower at 11.77.

David Nye’s technical analysis report will be published on Monday.

Market Data (Click Each to Expand)

| LFEX Prices | FX Rates | LFEX Indicative Exporter Prices (4 Week) | EUR / NOK FX Rate (4 Week) |

|

Prices Ending 31st May, 2024 For Friday's Price For Next Week, Offers & Trading Please Register |

Did You Know?

Price volatility is an issue in many markets? Just following the US tech market will give you a good idea of potential price swings.

We saw a large drop in salmon prices in week 24 last year with a 17.7% fall, and this wasn’t a complete anomaly. In July 22 we saw a 17.27% drop in a week and in May 22 we saw a 14.84% drop. The problem is accessing prices during very volatile periods – or price discovery. This is where electronic platforms are very powerful, enabling second by second price updates for market participants in a very efficient manner, allowing both sides of the market a much clearer picture, and the ability to read market direction and react accordingly. One of the many ways technology creates efficiencies for markets.

FAQ’s

Q. I am concerned about beginning the transition from manual to electronic transacting. Is it acceptable to do both?

A. The short answer is of course yes. In fact we recommend that this is how people start. By dipping your toes you learn about the system, what you see and what to expect. You can then build confidence and proactively use the system to get the maximum benefit from it. You can download the orders from the system if you need to into a CSV file, or input data into your existing system in the same way you do a manual trade.