The London Fish Exchange

Data / Market Insight / News

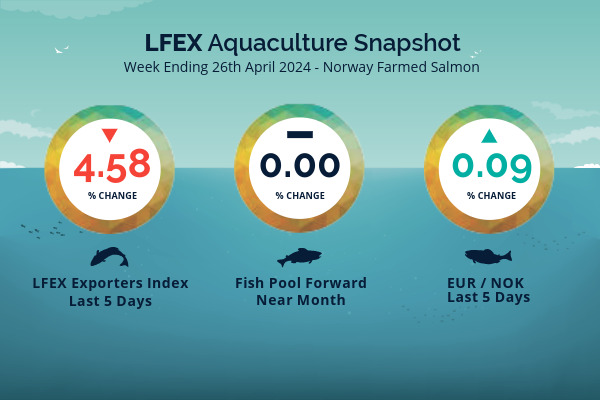

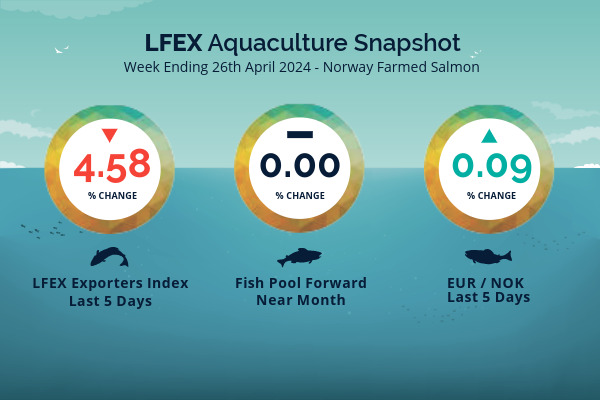

LFEX European Aquaculture Snapshot to 26th April, 2024

|

|

Published: 26th April 2024 This Article was Written by: John Ersser |

The LFEX Norwegian Exporters Index for Week 17 2024 ended the week down -4.58%, -5.71 NOK to stand at 118.83 NOK (in EUR terms 10.12 / -0.50 / -4.67%) FCA Oslo Week ending Thursday vs previous Thursday.

The NOK rate ended up at 11.74 to the Euro over the period Thursday to Thursday +0.01 NOK or +0.09%. The Fish Pool future April was reported flat at 130.50 NOK with May showing 117.0.

A flat-ish week with people away in Barcelona. The market opened lower on Friday at 119.72 a fall of around 4% on the prior weeks. Levels were pretty much maintained during the week, ticking up slightly on the Monday, before softing a little again to close out near starting levels. A bit of a non-week for pricing. The only real debate was how much had been sold early on, versus what was left over that needed to be sold when no-one was around. Differing views, including that maybe too much had been sold early doors, which gave pricing some strength.

Volume figures for week 16 were down on the prior week at 11,766 versus 13,015 tons the week prior. Week 16 2023 saw exports at 16,060 tons. Reportable volumes remained low.

Expectations for better volumes coming through in Q3 and Q4. In the meantime, available volumes remain lower. Next week will still see a higher volume of production fish. Combined with a 4 day week (Labour Day 1st May) means there is a consensus for prices starting higher. Expectations for the index to start around 126 – 127 NOK, but also a softening as the week progresses.

By comparison week 18 2023 prices ended at 112.79 NOK down on a flat week. The EURONOK rate was 11.835 above current levels.

David Nye’s technical analysis report will be published on Monday.

Market Data (Click Each to Expand)

| LFEX Prices | FX Rates | LFEX Indicative Exporter Prices (4 Week) | EUR / NOK FX Rate (4 Week) |

|

Prices Ending 26th April, 2024 For Friday's Price For Next Week, Offers & Trading Please Register |

Did You Know?

The London Fish Exchange Norwegian Exporters Index is updated daily to provide the only independent intraweek pricing movement for the Norwegian salmon market.

It has been running for over three years and is based on offered price indications. When tracked back against other weekly pricing we see that on average the index is around 1% higher than the traded prices that ultimately go through the market – as would be expected, Further, it tracks the traded weekly price volatility very closely, and more specifically provides depth and colour to intraweek pricing and volatility for an excellent insight into intraweek market dynamics.

FAQ’s

Q. After I have executed transactions on the platform can I access documentation from this order?

A. By executing on the platform you have a confirmed transaction between you and your counterparty – a fully electronically documented record of your transaction with all associated details contained in this. These details are immediately available in real-time to both parties and can be accessed whenever required. All history is maintained within the system. Further, a full suite of documentation can then be attached to these records whether it is invoices, specifications, logistics etc making all relevant trade documentation available to both parties the instant they are uploaded / updated.