The London Fish Exchange

Data / Market Insight / News

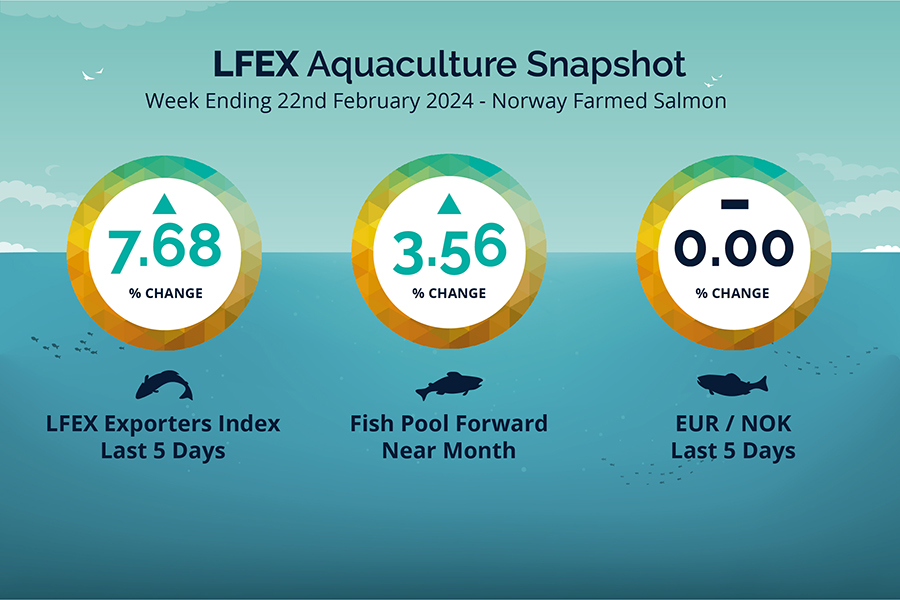

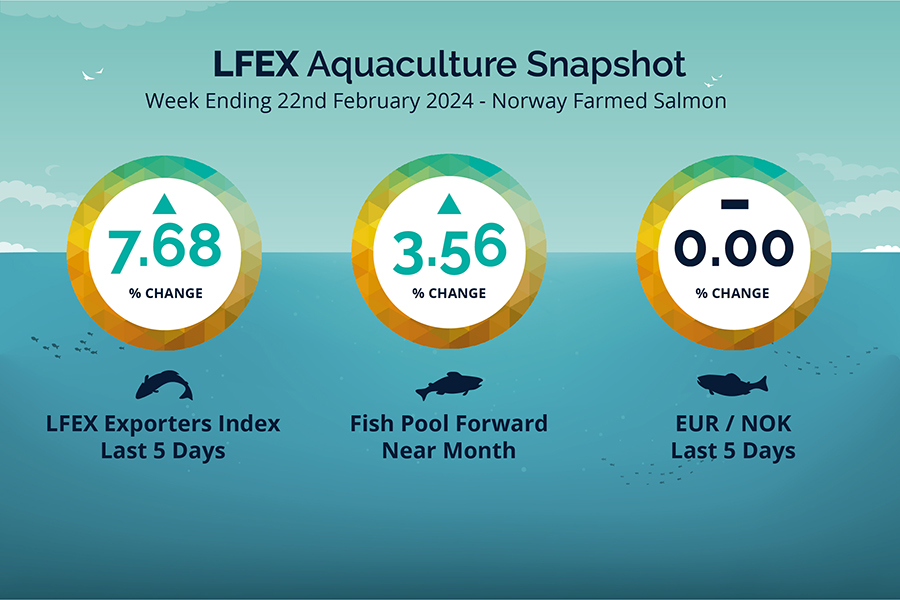

LFEX European Aquaculture Snapshot to 22nd February, 2024

|

|

Published: 23rd February 2024 This Article was Written by: John Ersser |

The LFEX Norwegian Exporters Index for Week 8 2024 ended the week up +7.68%, +8.41 NOK to stand at 117.87 NOK (in EUR terms 10.38 / +0.74 / +7.68%) FCA Oslo Week ending Thursday vs previous Thursday.

The NOK rate ended flat at 11.36 to the Euro over the period Thursday to Thursday exactly no change. The Fish Pool future February was reported up +3.90 NOK, 3.563% at 113.50 NOK.

The index jumped higher last Friday +7.78% at 118.69 as prices surged. Monday saw a further gain to 123.16 NOK and the high of the week. If a level was to be found it was at 121.53 on Tuesday and 121.73 on Wednesday. The week closing out off the higher levels at 117.87. Very low superior fish volumes available and a majority of fish production grade causing the squeeze. The range of biological events and winter wounds all contributing to the lack of volume, although not unusual in itself this time of year, this year is particularly affected. Buyers buy what they need at these levels and no more. Domestic production fish (priced around 70 -75 NOK) are being processed in Norway into VAP although there are rumours of whole production fish being offered in back channels.

Reports that a mid-sized producer will stop (heavily reduce) harvesting between weeks 9 and 17, and a number of producers have reduced inventory because of biological / jelly fish issues, combined with large percentage of production quality fish. The question is what does the consumer do at these prices? Cut back, look for alternatives, which makes it difficult for buyers to over commit. If there are fish left over at the end of the week this can push pricing down at the close.

Next week the story is the same of a low volume squeeze, although the consensus seems to be a little bit more volume will be available. Prices are expected to open around the 119 /120 level on Friday, so slightly up on the previous weeks Friday level at 118.69.

By Comparison – trading in week 9 2023 was brutal – a big jump to open, pricing topping at 128 NOK during the week before closing down at 114 NOK.

David Nye’s technical analysis report will be published later next week.

Market Data (Click Each to Expand)

| LFEX Prices | FX Rates | LFEX Indicative Exporter Prices (4 Week) | EUR / NOK FX Rate (4 Week) |

|

Prices Ending 22nd February, 2024 For Friday's Price For Next Week, Offers & Trading Please Register |

Did You Know?

The recent pricing is of course linked to available supply.

We track the volumes coming out of Norway on the platform for you, with Week 7 2024 showing 13,639 tons versus 14,851 for week 7 2023 and 17,933 tons for the equivalent week 7 in 2022 to provide an idea of the supply curve and allow you to make your own judgements based on data.

FAQ’s

Q. Can multiple people from my company use the platform and see the same information?

A. The answer is yes, we can set the system up to be able to see all offers or trades going through the system and allow multiple users access to this information in real-time. This helps build a picture of sales/ purchases and pricing across the business and facilitates teams work and optimisation of the selling / buying process.